May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May…

May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May…

April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially…

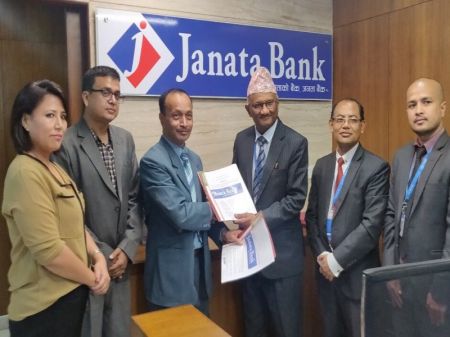

April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance…

April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura…

April 29: NIC Asia Bank Limited has opened 13 new five branches across the…

April 26: NIC Asia Bank has added three new branches to its…

April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers.…

April 24: Prabhu Bank Ltd has started online account opening service for its customers.…

April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu…

April 23: Prabhu Bank Limited has opened a new branch in Balkot,…

April 23: Mahalaxmi Bikas Bank has opened a new branch in…

December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance…

December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across…

December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME…

December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '10600', 'article_category_id' => '218', 'title' => 'NIC Asia Bank’s Cash-Back Offer', 'sub_title' => '', 'summary' => 'May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.', 'content' => '<p> May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.</p> <p> Under this offer, the bank’s customers using debit/credit cards or mobile banking to make payment will get a refund of 10 percent or maximum Rs 1000.</p> <p> According to the bank, this offer is valid for making payment with the card to Daraz online portal, Khalti digital wallet, any other e-payment as well as payment through QR code system.</p> <p> The customers will also get cash-back for top-up on NTC and Ncell network through the bank’s mobile banking app.</p> <p> This offer is valid for one day only, the bank said in a statement.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-05-02', 'modified' => '2019-05-02', 'keywords' => '', 'description' => '', 'sortorder' => '10351', 'image' => '20190502023813_NIC.jpg', 'article_date' => '2019-05-02 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 1 => array( 'Article' => array( 'id' => '10584', 'article_category_id' => '218', 'title' => 'Nabil Bank signs MoU with Play for Deprived Children Nepal', 'sub_title' => '', 'summary' => 'April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.', 'content' => '<p> April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.</p> <p> The bank said in a statement that it has become the banking partner of Nepal Basketball League.</p> <p> Anil Keshary Shah, CEO of the bank and Arun Karki, chairman of Play for Deprived Children Nepal, signed the agreement amid an event organized at Nepal Police Training Camp, Maharajgunj, Kathmandu on Monday. Captains of the men’s and women’s national team Sadhish Pradhan and Sadina Shrestha were also present during the occasion.</p> <p> Nepal Basketball League kicked off on April 28 and the finals will be held on July 22. As informed by the chairman of PDCN, the tournament is going to be the held for 55 days. The top three finishers of the tournament will be awarded with cash prize of Rs 200,000, Rs100,000 and Rs 50,000 respectively.</p> <p> CEO Anil Keshary Shah said, “We are delighted to be the banking partner of the Nepal Basketball League as we are confident that the structure of the tournament will ensure that the game of basketball gains momentum across the nation. Nabil Bank is privileged to be part of the league and looks forward to a truly incredible tournament.”</p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10335', 'image' => '20190430030832_nabil.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 2 => array( 'Article' => array( 'id' => '10583', 'article_category_id' => '218', 'title' => 'Remittance Agreement between Janta Bank and Bhathateni Money Transfer', 'sub_title' => '', 'summary' => 'April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector.', 'content' => '<p> April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector. Parashuram Kunwar, CEO of Janata Bank, and Rajankumar Amatya, managing director of BMT, signed the agreement on behalf of their respective organisations.</p> <p> According to the agreement, both national as well as international remittance sent through BMT can be now received from all 129 branches and 50 branchless banking facilities of the bank.</p> <p> Bhatbhateni Money Transfer Pvt Ltd is being operated by Bhatbhateni Group.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10334', 'image' => '20190430025947_janata.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 3 => array( 'Article' => array( 'id' => '10580', 'article_category_id' => '218', 'title' => 'New Branch of Himalayan Bank', 'sub_title' => '', 'summary' => 'April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.', 'content' => '<p> April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.</p> <p> Chairman of Chededaha Rural Municipality Nar Bahadur Rawat inaugurated the branch amid a recent function. The bank said the new branch will provide modern banking facilities to the general public.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10331', 'image' => '20190430022113_hbl.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 4 => array( 'Article' => array( 'id' => '10569', 'article_category_id' => '218', 'title' => '13 New Branches of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 29: NIC Asia Bank Limited has opened 13 new five branches across the country.', 'content' => '<p> April 29: NIC Asia Bank Limited has opened 13 new five branches across the country. The commercial bank has added seven new branches in Kathmandu valley, one each in Rautahat, Kavre, Kaski and Parsa districts and two in Nuwakot.</p> <p> The bank said the new branches are located in Sitapaila, Shankhamul, Bhainsepati, Baluwater, Thulo Bharyang, Ramkot and Chabhil in Kathmandu. and Gujara Municipality in Rautahat.</p> <p> The bank additionally opened its 24th branchless banking facility in Kanchan Rural Municipality in Rupendehi.</p> <p> The bank has appointed Lal Bahadur Thapa as the representative of the branchless facility in Kanchan Rural Municipality.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-29', 'modified' => '2019-04-29', 'keywords' => '', 'description' => '', 'sortorder' => '10320', 'image' => '20190429022211_WhatsApp Image 2019-04-26 at 11.58.07 AM(1).jpg', 'article_date' => '2019-04-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 5 => array( 'Article' => array( 'id' => '10553', 'article_category_id' => '218', 'title' => 'Three More Branches of NIC Asia', 'sub_title' => '', 'summary' => 'April 26: NIC Asia Bank has added three new branches to its network.', 'content' => '<p> April 26: NIC Asia Bank has added three new branches to its network.</p> <p> The commercial bank said in a statement that it has opened the new branches in Radhe Radhe, Madhapur Thimi and Duwakot of Changunarayan Municipality in Bhaktapur and Jagarnathpur Rural Municipality in Parsa.</p> <p> Amrit Maan Shrestha, chairman of ward number five of Madhyapur Thimi Municipality inaugurated the new branch in Radhe Radhe.</p> <p> Similarly Shiva KC, chairman of ward number two of Changunarayan Municipality inaugurated the new branch in Duwakot and Jalim Miya, chairman of Jagarnathpur Rural Municipality inaugurated the new branch of NIC Asia in Jagarnathpur amid a recent event.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-26', 'modified' => '2019-04-26', 'keywords' => '', 'description' => '', 'sortorder' => '10303', 'image' => '20190426011854_nic.jpg', 'article_date' => '2019-04-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 6 => array( 'Article' => array( 'id' => '10541', 'article_category_id' => '218', 'title' => ' Civil Bank to Resume Card-less Withdrawal from ATM', 'sub_title' => 'Cooperatives and Financial Institutions to benefit from ATM Service', 'summary' => 'April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. ', 'content' => '<p> April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. Hamro Technology Pvt Ltd, a hardware and networking services provider, has signed an agreement with Civil Bank to start the service within a few days.</p> <p> Civil Bank has altogether 68 branches across the country while more than 200 banks, cooperatives and financial institutions are affiliated to Hamro Technology.</p> <p> Following the agreement, customers of the member banks, cooperatives and financial institutions can withdraw cash from any ATM of Civil Bank through ‘card-less’ technology.</p> <p> According to the bank, customers can withdraw amount from Rs 500 to Rs 25,000 at a time for which the bank will charge Rs 25 per transaction. The service is applicable for remittance as well.</p> <p> In order to avail the service, account holders/ customers of the institutions have to send a request about the required amount through mobile banking app of the respective institution. Following the request, a ‘one-time password (OTP)’ number will be received by the customers that needs to be entered in the ATM.</p> <p> Since the OTP is valid just for two hours, the customers need to withdraw their amount within the limited time frame.</p> <p> Bishnu Maharjan, CEO of Hamro Technology, said that the company has resumed the operation of the ‘card-less cash’ technology which was established by Civil Bank in 2013.</p> <p> At present, only few commercial banks and financial companies are providing card-less service from ATMs.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10292', 'image' => '20190424040502_civil.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 7 => array( 'Article' => array( 'id' => '10540', 'article_category_id' => '218', 'title' => 'Prabhu Bank Starts Online Account Opening Service', 'sub_title' => '', 'summary' => 'April 24: Prabhu Bank Ltd has started online account opening service for its customers. ', 'content' => '<p> April 24: Prabhu Bank Ltd has started online account opening service for its customers. Customers can open an account online from any place without visiting bank , reads a statement issued by the bank.</p> <p> According to the statement, one can easily upload details and documents online to open the account. Online account can be opened by clicking the ‘Online A/C Opening’ button on the bank’s website.</p> <p> The statement further says that with this service, customers can save their time and easily open their account with the bank without any hassles.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10291', 'image' => '20190424033750_HOBuilding_small.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 8 => array( 'Article' => array( 'id' => '10532', 'article_category_id' => '218', 'title' => 'Manmaiju Branch of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district.', 'content' => '<p> April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district. The mayor of the municipality, Rameshwar Bohara, and the head of the bank’s sub-provincial office (Province 3) Bikas Kharel jointly inaugurated the branch amid a function on Tuesday, April 23.</p> <p> Kharel said that the bank has been contributing to Nepal Rastra Bank’s aim in providing banking services to rural and remote areas of the country.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10283', 'image' => '20190424011205_nic.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 9 => array( 'Article' => array( 'id' => '10520', 'article_category_id' => '218', 'title' => 'Prabhu opens new branch in Balkot', 'sub_title' => '', 'summary' => 'April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.', 'content' => '<p> April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.</p> <p> The bank in a statement informed that it aims to deliver the latest banking facilities to its customers through the new branch. </p> <p> Mahesh Basnet, member of the federal parliament, inaugurated the new branch of Prabhu Bank amid an official event on April 22, Monday.</p> <p> Ashok Serchan, CEO of Prabhu Bank, said that the branch in Balkot will work hand in hand with the locals of the region and support them for the economic prosperity.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10271', 'image' => '20190423123940_prabhu.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 10 => array( 'Article' => array( 'id' => '10519', 'article_category_id' => '218', 'title' => 'Mahalaxmi Branch now in Koteshwar', 'sub_title' => '', 'summary' => 'April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.', 'content' => '<p> April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.</p> <p> The development bank said in a statement it has opened a new branch in Koteshwar- 32 of Kathmandu Metropolitan City.</p> <p> The new branch was inaugurated amid a recent event in the presence of high ranking officials of the bank.</p> <p> Mahalaxmi Bikas Bank now has 90 branches spread across the country.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10270', 'image' => '20190423123514_maha.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 11 => array( 'Article' => array( 'id' => '9615', 'article_category_id' => '218', 'title' => 'NIC Asia Bank Inks Bancassurance Pact with IME Life Insurance', 'sub_title' => '', 'summary' => 'December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service.', 'content' => '<p>December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service. The bank’s CEO Roshan Kumar Neupane and the insurance company’s CEO Shree Chandra Bhatta signed the agreement amid a function on Tuesday, December 11.</p> <p>Following the agreement, the bank’s customers can avail life insurance service provided by the insurance service through any branch of the bank.</p> <p>Currently, the bank has been providing its service through a network of 270 branches, 285 ATM outlets, 37 extension counters and 20 branchless banking services spread across the country.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9389', 'image' => '20181228025824_Chrysanthemum.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 12 => array( 'Article' => array( 'id' => '9611', 'article_category_id' => '218', 'title' => 'Simplified Microcredit Services to Underserved Population', 'sub_title' => '', 'summary' => 'December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.', 'content' => '<p>December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.</p> <p>CEO of MBL, Suman Sharma, team leader of Sakchyam, Nirmal Dahal and country director of Heifer International Nepal, Shubh Mahato along with other representatives from MBL, Sakchyam and Heifer International Nepal were present during the partnership signing ceremony.</p> <p>According to a joint statement issued by the three organisations, MBL in strategic alliance with UKaid Sakchyam and Heifer International Nepal, will expand access to finance for women entrepreneurs and farmers in order to enhance their economic condition through the ‘Simplified Financial Services for Economic Empowerment of Women’ project.</p> <p>During the program, MBL’s CEO Suman Sharma said that the bank will cater to the financial requirement of rural farmers, small and medium enterprises, other value chain actors and underprivileged group in 14 districts in order to enhance their livelihood ‘through this strategic alliance.</p> <p>The aim of the project is to reach to more than 4,300 farmers, provide savings accounts to more than 3,000 beneficiaries, initiate financial literacy and awareness, maximize branchless banking (BLB) and introduce innovative credit assessment and delivery tools in form of Kishan Credit Card (KCC).</p> <p>Machhapuchchhre Bank is providing its services across Nepal with a network of 86 branches, two extension counters and 39 branchless banking units. The bank has 107 ATMs spread all over the country.</p> <p>Sakchyam is a UKaid-funded access to finance programme implemented by Louis Berger for DFID Nepal while Heifer International is working in Nepal as a sustainable development non-profit leader in smallholder agriculture.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9386', 'image' => '20181228025622_cap.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 13 => array( 'Article' => array( 'id' => '9610', 'article_category_id' => '218', 'title' => 'NB Bank becomes Partner Bank of IME Digital', 'sub_title' => '', 'summary' => 'December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.', 'content' => '<p>December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.</p> <p>Daniel D Shrestha, chief operating officer of IME Digital, and Suresh Devkota, chief operating officer of Nepal Bangladesh Bank, signed the agreement on behalf of their respective organisations.</p> <p>Based on the agreement, Nepal Bangladesh Bank will act as a partner bank of IME Digital and offer services like linking bank accounts, transferring funds to and from customers’ bank accounts to IME Pay wallets for the customers, reads a statement issued by IME Digital Solution.</p> <p>Nepal Bangladesh Bank’s customers will soon be able to avail recharge, payment and money transfer services along with myriad of other online and offsite QR-based merchant payment services of IME Pay.</p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9385', 'image' => '20181212014933_NB.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 14 => array( 'Article' => array( 'id' => '9609', 'article_category_id' => '218', 'title' => 'Nabil Bank Launches QR Payment Service', 'sub_title' => '', 'summary' => 'December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited.', 'content' => '<p>December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited. Nabil Bank said in a statement that it has formed a Quick Response (QR) merchant development alliance with UPI, a leading international payment association, and Rojgari Services, a recruitment solution company.</p> <p>According to the bank, the alliance brings together a pool of expertise in QR payment solution, acquiring/payment services and network development.</p> <p>“Rojgari Services shall develop QR merchant network across the country for Nabil Bank that will enable customers to process payment through their mobile device using QR Code from those merchant touch points,” the statement said.</p> <p>With the UPI QR Code service, Nepali businesses can now sell their products/services electronically in a secure environment, the statement further said. The bank said that Rojgari Services will build the bank’s QR acquiring portfolio with 10,000 merchants over the period of one year. Over the time, Nabil Bank said it expects to deliver enhanced suite of QR payment solution to its customers and merchants.</p> <p>“It's a completely new approach to the typical payment process where the need of physical Point of Sales (POS) terminals can be avoided and no physical contact of the card is required. The QR code conveys the purchase transaction information to the application on the mobile device where the payment is initiated.”</p> <p>Commenting on the agreement, Anil K Khanal, deputy chief executive officer of Nabil Bank, said, “We continue to work towards promoting digital banking and innovative solution as we have been delivering such innovative payment solutions to our customers since long. This partnership will help towards building an ecosystem for QR payment in the country and expand our service offering to the next level.”</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9384', 'image' => '20181212014007_nabil.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '10600', 'article_category_id' => '218', 'title' => 'NIC Asia Bank’s Cash-Back Offer', 'sub_title' => '', 'summary' => 'May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.', 'content' => '<p> May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.</p> <p> Under this offer, the bank’s customers using debit/credit cards or mobile banking to make payment will get a refund of 10 percent or maximum Rs 1000.</p> <p> According to the bank, this offer is valid for making payment with the card to Daraz online portal, Khalti digital wallet, any other e-payment as well as payment through QR code system.</p> <p> The customers will also get cash-back for top-up on NTC and Ncell network through the bank’s mobile banking app.</p> <p> This offer is valid for one day only, the bank said in a statement.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-05-02', 'modified' => '2019-05-02', 'keywords' => '', 'description' => '', 'sortorder' => '10351', 'image' => '20190502023813_NIC.jpg', 'article_date' => '2019-05-02 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 1 => array( 'Article' => array( 'id' => '10584', 'article_category_id' => '218', 'title' => 'Nabil Bank signs MoU with Play for Deprived Children Nepal', 'sub_title' => '', 'summary' => 'April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.', 'content' => '<p> April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.</p> <p> The bank said in a statement that it has become the banking partner of Nepal Basketball League.</p> <p> Anil Keshary Shah, CEO of the bank and Arun Karki, chairman of Play for Deprived Children Nepal, signed the agreement amid an event organized at Nepal Police Training Camp, Maharajgunj, Kathmandu on Monday. Captains of the men’s and women’s national team Sadhish Pradhan and Sadina Shrestha were also present during the occasion.</p> <p> Nepal Basketball League kicked off on April 28 and the finals will be held on July 22. As informed by the chairman of PDCN, the tournament is going to be the held for 55 days. The top three finishers of the tournament will be awarded with cash prize of Rs 200,000, Rs100,000 and Rs 50,000 respectively.</p> <p> CEO Anil Keshary Shah said, “We are delighted to be the banking partner of the Nepal Basketball League as we are confident that the structure of the tournament will ensure that the game of basketball gains momentum across the nation. Nabil Bank is privileged to be part of the league and looks forward to a truly incredible tournament.”</p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10335', 'image' => '20190430030832_nabil.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 2 => array( 'Article' => array( 'id' => '10583', 'article_category_id' => '218', 'title' => 'Remittance Agreement between Janta Bank and Bhathateni Money Transfer', 'sub_title' => '', 'summary' => 'April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector.', 'content' => '<p> April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector. Parashuram Kunwar, CEO of Janata Bank, and Rajankumar Amatya, managing director of BMT, signed the agreement on behalf of their respective organisations.</p> <p> According to the agreement, both national as well as international remittance sent through BMT can be now received from all 129 branches and 50 branchless banking facilities of the bank.</p> <p> Bhatbhateni Money Transfer Pvt Ltd is being operated by Bhatbhateni Group.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10334', 'image' => '20190430025947_janata.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 3 => array( 'Article' => array( 'id' => '10580', 'article_category_id' => '218', 'title' => 'New Branch of Himalayan Bank', 'sub_title' => '', 'summary' => 'April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.', 'content' => '<p> April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.</p> <p> Chairman of Chededaha Rural Municipality Nar Bahadur Rawat inaugurated the branch amid a recent function. The bank said the new branch will provide modern banking facilities to the general public.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10331', 'image' => '20190430022113_hbl.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 4 => array( 'Article' => array( 'id' => '10569', 'article_category_id' => '218', 'title' => '13 New Branches of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 29: NIC Asia Bank Limited has opened 13 new five branches across the country.', 'content' => '<p> April 29: NIC Asia Bank Limited has opened 13 new five branches across the country. The commercial bank has added seven new branches in Kathmandu valley, one each in Rautahat, Kavre, Kaski and Parsa districts and two in Nuwakot.</p> <p> The bank said the new branches are located in Sitapaila, Shankhamul, Bhainsepati, Baluwater, Thulo Bharyang, Ramkot and Chabhil in Kathmandu. and Gujara Municipality in Rautahat.</p> <p> The bank additionally opened its 24th branchless banking facility in Kanchan Rural Municipality in Rupendehi.</p> <p> The bank has appointed Lal Bahadur Thapa as the representative of the branchless facility in Kanchan Rural Municipality.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-29', 'modified' => '2019-04-29', 'keywords' => '', 'description' => '', 'sortorder' => '10320', 'image' => '20190429022211_WhatsApp Image 2019-04-26 at 11.58.07 AM(1).jpg', 'article_date' => '2019-04-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 5 => array( 'Article' => array( 'id' => '10553', 'article_category_id' => '218', 'title' => 'Three More Branches of NIC Asia', 'sub_title' => '', 'summary' => 'April 26: NIC Asia Bank has added three new branches to its network.', 'content' => '<p> April 26: NIC Asia Bank has added three new branches to its network.</p> <p> The commercial bank said in a statement that it has opened the new branches in Radhe Radhe, Madhapur Thimi and Duwakot of Changunarayan Municipality in Bhaktapur and Jagarnathpur Rural Municipality in Parsa.</p> <p> Amrit Maan Shrestha, chairman of ward number five of Madhyapur Thimi Municipality inaugurated the new branch in Radhe Radhe.</p> <p> Similarly Shiva KC, chairman of ward number two of Changunarayan Municipality inaugurated the new branch in Duwakot and Jalim Miya, chairman of Jagarnathpur Rural Municipality inaugurated the new branch of NIC Asia in Jagarnathpur amid a recent event.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-26', 'modified' => '2019-04-26', 'keywords' => '', 'description' => '', 'sortorder' => '10303', 'image' => '20190426011854_nic.jpg', 'article_date' => '2019-04-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 6 => array( 'Article' => array( 'id' => '10541', 'article_category_id' => '218', 'title' => ' Civil Bank to Resume Card-less Withdrawal from ATM', 'sub_title' => 'Cooperatives and Financial Institutions to benefit from ATM Service', 'summary' => 'April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. ', 'content' => '<p> April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. Hamro Technology Pvt Ltd, a hardware and networking services provider, has signed an agreement with Civil Bank to start the service within a few days.</p> <p> Civil Bank has altogether 68 branches across the country while more than 200 banks, cooperatives and financial institutions are affiliated to Hamro Technology.</p> <p> Following the agreement, customers of the member banks, cooperatives and financial institutions can withdraw cash from any ATM of Civil Bank through ‘card-less’ technology.</p> <p> According to the bank, customers can withdraw amount from Rs 500 to Rs 25,000 at a time for which the bank will charge Rs 25 per transaction. The service is applicable for remittance as well.</p> <p> In order to avail the service, account holders/ customers of the institutions have to send a request about the required amount through mobile banking app of the respective institution. Following the request, a ‘one-time password (OTP)’ number will be received by the customers that needs to be entered in the ATM.</p> <p> Since the OTP is valid just for two hours, the customers need to withdraw their amount within the limited time frame.</p> <p> Bishnu Maharjan, CEO of Hamro Technology, said that the company has resumed the operation of the ‘card-less cash’ technology which was established by Civil Bank in 2013.</p> <p> At present, only few commercial banks and financial companies are providing card-less service from ATMs.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10292', 'image' => '20190424040502_civil.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 7 => array( 'Article' => array( 'id' => '10540', 'article_category_id' => '218', 'title' => 'Prabhu Bank Starts Online Account Opening Service', 'sub_title' => '', 'summary' => 'April 24: Prabhu Bank Ltd has started online account opening service for its customers. ', 'content' => '<p> April 24: Prabhu Bank Ltd has started online account opening service for its customers. Customers can open an account online from any place without visiting bank , reads a statement issued by the bank.</p> <p> According to the statement, one can easily upload details and documents online to open the account. Online account can be opened by clicking the ‘Online A/C Opening’ button on the bank’s website.</p> <p> The statement further says that with this service, customers can save their time and easily open their account with the bank without any hassles.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10291', 'image' => '20190424033750_HOBuilding_small.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 8 => array( 'Article' => array( 'id' => '10532', 'article_category_id' => '218', 'title' => 'Manmaiju Branch of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district.', 'content' => '<p> April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district. The mayor of the municipality, Rameshwar Bohara, and the head of the bank’s sub-provincial office (Province 3) Bikas Kharel jointly inaugurated the branch amid a function on Tuesday, April 23.</p> <p> Kharel said that the bank has been contributing to Nepal Rastra Bank’s aim in providing banking services to rural and remote areas of the country.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10283', 'image' => '20190424011205_nic.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 9 => array( 'Article' => array( 'id' => '10520', 'article_category_id' => '218', 'title' => 'Prabhu opens new branch in Balkot', 'sub_title' => '', 'summary' => 'April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.', 'content' => '<p> April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.</p> <p> The bank in a statement informed that it aims to deliver the latest banking facilities to its customers through the new branch. </p> <p> Mahesh Basnet, member of the federal parliament, inaugurated the new branch of Prabhu Bank amid an official event on April 22, Monday.</p> <p> Ashok Serchan, CEO of Prabhu Bank, said that the branch in Balkot will work hand in hand with the locals of the region and support them for the economic prosperity.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10271', 'image' => '20190423123940_prabhu.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 10 => array( 'Article' => array( 'id' => '10519', 'article_category_id' => '218', 'title' => 'Mahalaxmi Branch now in Koteshwar', 'sub_title' => '', 'summary' => 'April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.', 'content' => '<p> April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.</p> <p> The development bank said in a statement it has opened a new branch in Koteshwar- 32 of Kathmandu Metropolitan City.</p> <p> The new branch was inaugurated amid a recent event in the presence of high ranking officials of the bank.</p> <p> Mahalaxmi Bikas Bank now has 90 branches spread across the country.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10270', 'image' => '20190423123514_maha.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 11 => array( 'Article' => array( 'id' => '9615', 'article_category_id' => '218', 'title' => 'NIC Asia Bank Inks Bancassurance Pact with IME Life Insurance', 'sub_title' => '', 'summary' => 'December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service.', 'content' => '<p>December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service. The bank’s CEO Roshan Kumar Neupane and the insurance company’s CEO Shree Chandra Bhatta signed the agreement amid a function on Tuesday, December 11.</p> <p>Following the agreement, the bank’s customers can avail life insurance service provided by the insurance service through any branch of the bank.</p> <p>Currently, the bank has been providing its service through a network of 270 branches, 285 ATM outlets, 37 extension counters and 20 branchless banking services spread across the country.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9389', 'image' => '20181228025824_Chrysanthemum.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 12 => array( 'Article' => array( 'id' => '9611', 'article_category_id' => '218', 'title' => 'Simplified Microcredit Services to Underserved Population', 'sub_title' => '', 'summary' => 'December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.', 'content' => '<p>December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.</p> <p>CEO of MBL, Suman Sharma, team leader of Sakchyam, Nirmal Dahal and country director of Heifer International Nepal, Shubh Mahato along with other representatives from MBL, Sakchyam and Heifer International Nepal were present during the partnership signing ceremony.</p> <p>According to a joint statement issued by the three organisations, MBL in strategic alliance with UKaid Sakchyam and Heifer International Nepal, will expand access to finance for women entrepreneurs and farmers in order to enhance their economic condition through the ‘Simplified Financial Services for Economic Empowerment of Women’ project.</p> <p>During the program, MBL’s CEO Suman Sharma said that the bank will cater to the financial requirement of rural farmers, small and medium enterprises, other value chain actors and underprivileged group in 14 districts in order to enhance their livelihood ‘through this strategic alliance.</p> <p>The aim of the project is to reach to more than 4,300 farmers, provide savings accounts to more than 3,000 beneficiaries, initiate financial literacy and awareness, maximize branchless banking (BLB) and introduce innovative credit assessment and delivery tools in form of Kishan Credit Card (KCC).</p> <p>Machhapuchchhre Bank is providing its services across Nepal with a network of 86 branches, two extension counters and 39 branchless banking units. The bank has 107 ATMs spread all over the country.</p> <p>Sakchyam is a UKaid-funded access to finance programme implemented by Louis Berger for DFID Nepal while Heifer International is working in Nepal as a sustainable development non-profit leader in smallholder agriculture.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9386', 'image' => '20181228025622_cap.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 13 => array( 'Article' => array( 'id' => '9610', 'article_category_id' => '218', 'title' => 'NB Bank becomes Partner Bank of IME Digital', 'sub_title' => '', 'summary' => 'December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.', 'content' => '<p>December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.</p> <p>Daniel D Shrestha, chief operating officer of IME Digital, and Suresh Devkota, chief operating officer of Nepal Bangladesh Bank, signed the agreement on behalf of their respective organisations.</p> <p>Based on the agreement, Nepal Bangladesh Bank will act as a partner bank of IME Digital and offer services like linking bank accounts, transferring funds to and from customers’ bank accounts to IME Pay wallets for the customers, reads a statement issued by IME Digital Solution.</p> <p>Nepal Bangladesh Bank’s customers will soon be able to avail recharge, payment and money transfer services along with myriad of other online and offsite QR-based merchant payment services of IME Pay.</p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9385', 'image' => '20181212014933_NB.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 14 => array( 'Article' => array( 'id' => '9609', 'article_category_id' => '218', 'title' => 'Nabil Bank Launches QR Payment Service', 'sub_title' => '', 'summary' => 'December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited.', 'content' => '<p>December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited. Nabil Bank said in a statement that it has formed a Quick Response (QR) merchant development alliance with UPI, a leading international payment association, and Rojgari Services, a recruitment solution company.</p> <p>According to the bank, the alliance brings together a pool of expertise in QR payment solution, acquiring/payment services and network development.</p> <p>“Rojgari Services shall develop QR merchant network across the country for Nabil Bank that will enable customers to process payment through their mobile device using QR Code from those merchant touch points,” the statement said.</p> <p>With the UPI QR Code service, Nepali businesses can now sell their products/services electronically in a secure environment, the statement further said. The bank said that Rojgari Services will build the bank’s QR acquiring portfolio with 10,000 merchants over the period of one year. Over the time, Nabil Bank said it expects to deliver enhanced suite of QR payment solution to its customers and merchants.</p> <p>“It's a completely new approach to the typical payment process where the need of physical Point of Sales (POS) terminals can be avoided and no physical contact of the card is required. The QR code conveys the purchase transaction information to the application on the mobile device where the payment is initiated.”</p> <p>Commenting on the agreement, Anil K Khanal, deputy chief executive officer of Nabil Bank, said, “We continue to work towards promoting digital banking and innovative solution as we have been delivering such innovative payment solutions to our customers since long. This partnership will help towards building an ecosystem for QR payment in the country and expand our service offering to the next level.”</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9384', 'image' => '20181212014007_nabil.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 133]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/subindexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '10600', 'article_category_id' => '218', 'title' => 'NIC Asia Bank’s Cash-Back Offer', 'sub_title' => '', 'summary' => 'May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.', 'content' => '<p> May 2: NIC Asia Bank has announced cash-back and discount offer on digital payment on the occasion of National Information and Communication Technology Day on Thursday, May 2.</p> <p> Under this offer, the bank’s customers using debit/credit cards or mobile banking to make payment will get a refund of 10 percent or maximum Rs 1000.</p> <p> According to the bank, this offer is valid for making payment with the card to Daraz online portal, Khalti digital wallet, any other e-payment as well as payment through QR code system.</p> <p> The customers will also get cash-back for top-up on NTC and Ncell network through the bank’s mobile banking app.</p> <p> This offer is valid for one day only, the bank said in a statement.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-05-02', 'modified' => '2019-05-02', 'keywords' => '', 'description' => '', 'sortorder' => '10351', 'image' => '20190502023813_NIC.jpg', 'article_date' => '2019-05-02 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 1 => array( 'Article' => array( 'id' => '10584', 'article_category_id' => '218', 'title' => 'Nabil Bank signs MoU with Play for Deprived Children Nepal', 'sub_title' => '', 'summary' => 'April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.', 'content' => '<p> April 30: Nabil Bank has entered into an agreement with Play for Deprived Children Nepal (PDCN) to encourage youths in sports, especially basketball.</p> <p> The bank said in a statement that it has become the banking partner of Nepal Basketball League.</p> <p> Anil Keshary Shah, CEO of the bank and Arun Karki, chairman of Play for Deprived Children Nepal, signed the agreement amid an event organized at Nepal Police Training Camp, Maharajgunj, Kathmandu on Monday. Captains of the men’s and women’s national team Sadhish Pradhan and Sadina Shrestha were also present during the occasion.</p> <p> Nepal Basketball League kicked off on April 28 and the finals will be held on July 22. As informed by the chairman of PDCN, the tournament is going to be the held for 55 days. The top three finishers of the tournament will be awarded with cash prize of Rs 200,000, Rs100,000 and Rs 50,000 respectively.</p> <p> CEO Anil Keshary Shah said, “We are delighted to be the banking partner of the Nepal Basketball League as we are confident that the structure of the tournament will ensure that the game of basketball gains momentum across the nation. Nabil Bank is privileged to be part of the league and looks forward to a truly incredible tournament.”</p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10335', 'image' => '20190430030832_nabil.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 2 => array( 'Article' => array( 'id' => '10583', 'article_category_id' => '218', 'title' => 'Remittance Agreement between Janta Bank and Bhathateni Money Transfer', 'sub_title' => '', 'summary' => 'April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector.', 'content' => '<p> April 30: Janata Bank has signed an agreement with Bhatbhateni Money Transfer (BMT) Pvt Ltd to collaborate in the remittance sector. Parashuram Kunwar, CEO of Janata Bank, and Rajankumar Amatya, managing director of BMT, signed the agreement on behalf of their respective organisations.</p> <p> According to the agreement, both national as well as international remittance sent through BMT can be now received from all 129 branches and 50 branchless banking facilities of the bank.</p> <p> Bhatbhateni Money Transfer Pvt Ltd is being operated by Bhatbhateni Group.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10334', 'image' => '20190430025947_janata.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 3 => array( 'Article' => array( 'id' => '10580', 'article_category_id' => '218', 'title' => 'New Branch of Himalayan Bank', 'sub_title' => '', 'summary' => 'April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.', 'content' => '<p> April 30: Himalayan Bank Limited has opened a new branch in Khaptad Chhededaha Rural Municipalityof Bajura district.</p> <p> Chairman of Chededaha Rural Municipality Nar Bahadur Rawat inaugurated the branch amid a recent function. The bank said the new branch will provide modern banking facilities to the general public.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-30', 'modified' => '2019-04-30', 'keywords' => '', 'description' => '', 'sortorder' => '10331', 'image' => '20190430022113_hbl.jpg', 'article_date' => '2019-04-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 4 => array( 'Article' => array( 'id' => '10569', 'article_category_id' => '218', 'title' => '13 New Branches of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 29: NIC Asia Bank Limited has opened 13 new five branches across the country.', 'content' => '<p> April 29: NIC Asia Bank Limited has opened 13 new five branches across the country. The commercial bank has added seven new branches in Kathmandu valley, one each in Rautahat, Kavre, Kaski and Parsa districts and two in Nuwakot.</p> <p> The bank said the new branches are located in Sitapaila, Shankhamul, Bhainsepati, Baluwater, Thulo Bharyang, Ramkot and Chabhil in Kathmandu. and Gujara Municipality in Rautahat.</p> <p> The bank additionally opened its 24th branchless banking facility in Kanchan Rural Municipality in Rupendehi.</p> <p> The bank has appointed Lal Bahadur Thapa as the representative of the branchless facility in Kanchan Rural Municipality.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-29', 'modified' => '2019-04-29', 'keywords' => '', 'description' => '', 'sortorder' => '10320', 'image' => '20190429022211_WhatsApp Image 2019-04-26 at 11.58.07 AM(1).jpg', 'article_date' => '2019-04-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 5 => array( 'Article' => array( 'id' => '10553', 'article_category_id' => '218', 'title' => 'Three More Branches of NIC Asia', 'sub_title' => '', 'summary' => 'April 26: NIC Asia Bank has added three new branches to its network.', 'content' => '<p> April 26: NIC Asia Bank has added three new branches to its network.</p> <p> The commercial bank said in a statement that it has opened the new branches in Radhe Radhe, Madhapur Thimi and Duwakot of Changunarayan Municipality in Bhaktapur and Jagarnathpur Rural Municipality in Parsa.</p> <p> Amrit Maan Shrestha, chairman of ward number five of Madhyapur Thimi Municipality inaugurated the new branch in Radhe Radhe.</p> <p> Similarly Shiva KC, chairman of ward number two of Changunarayan Municipality inaugurated the new branch in Duwakot and Jalim Miya, chairman of Jagarnathpur Rural Municipality inaugurated the new branch of NIC Asia in Jagarnathpur amid a recent event.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-26', 'modified' => '2019-04-26', 'keywords' => '', 'description' => '', 'sortorder' => '10303', 'image' => '20190426011854_nic.jpg', 'article_date' => '2019-04-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 6 => array( 'Article' => array( 'id' => '10541', 'article_category_id' => '218', 'title' => ' Civil Bank to Resume Card-less Withdrawal from ATM', 'sub_title' => 'Cooperatives and Financial Institutions to benefit from ATM Service', 'summary' => 'April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. ', 'content' => '<p> April 24: Cooperatives and financial institutions are all set to offer ATM service to their customers. Hamro Technology Pvt Ltd, a hardware and networking services provider, has signed an agreement with Civil Bank to start the service within a few days.</p> <p> Civil Bank has altogether 68 branches across the country while more than 200 banks, cooperatives and financial institutions are affiliated to Hamro Technology.</p> <p> Following the agreement, customers of the member banks, cooperatives and financial institutions can withdraw cash from any ATM of Civil Bank through ‘card-less’ technology.</p> <p> According to the bank, customers can withdraw amount from Rs 500 to Rs 25,000 at a time for which the bank will charge Rs 25 per transaction. The service is applicable for remittance as well.</p> <p> In order to avail the service, account holders/ customers of the institutions have to send a request about the required amount through mobile banking app of the respective institution. Following the request, a ‘one-time password (OTP)’ number will be received by the customers that needs to be entered in the ATM.</p> <p> Since the OTP is valid just for two hours, the customers need to withdraw their amount within the limited time frame.</p> <p> Bishnu Maharjan, CEO of Hamro Technology, said that the company has resumed the operation of the ‘card-less cash’ technology which was established by Civil Bank in 2013.</p> <p> At present, only few commercial banks and financial companies are providing card-less service from ATMs.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10292', 'image' => '20190424040502_civil.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 7 => array( 'Article' => array( 'id' => '10540', 'article_category_id' => '218', 'title' => 'Prabhu Bank Starts Online Account Opening Service', 'sub_title' => '', 'summary' => 'April 24: Prabhu Bank Ltd has started online account opening service for its customers. ', 'content' => '<p> April 24: Prabhu Bank Ltd has started online account opening service for its customers. Customers can open an account online from any place without visiting bank , reads a statement issued by the bank.</p> <p> According to the statement, one can easily upload details and documents online to open the account. Online account can be opened by clicking the ‘Online A/C Opening’ button on the bank’s website.</p> <p> The statement further says that with this service, customers can save their time and easily open their account with the bank without any hassles.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10291', 'image' => '20190424033750_HOBuilding_small.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 8 => array( 'Article' => array( 'id' => '10532', 'article_category_id' => '218', 'title' => 'Manmaiju Branch of NIC Asia Bank', 'sub_title' => '', 'summary' => 'April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district.', 'content' => '<p> April 24: NIC Asia Bank has opened a new branch at Manmaiju of Tarkeshwar Municipality-11 in Kathmandu district. The mayor of the municipality, Rameshwar Bohara, and the head of the bank’s sub-provincial office (Province 3) Bikas Kharel jointly inaugurated the branch amid a function on Tuesday, April 23.</p> <p> Kharel said that the bank has been contributing to Nepal Rastra Bank’s aim in providing banking services to rural and remote areas of the country.</p> <p> </p> ', 'published' => true, 'created' => '2019-04-24', 'modified' => '2019-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '10283', 'image' => '20190424011205_nic.jpg', 'article_date' => '2019-04-24 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 9 => array( 'Article' => array( 'id' => '10520', 'article_category_id' => '218', 'title' => 'Prabhu opens new branch in Balkot', 'sub_title' => '', 'summary' => 'April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.', 'content' => '<p> April 23: Prabhu Bank Limited has opened a new branch in Balkot, Bhaktapur.</p> <p> The bank in a statement informed that it aims to deliver the latest banking facilities to its customers through the new branch. </p> <p> Mahesh Basnet, member of the federal parliament, inaugurated the new branch of Prabhu Bank amid an official event on April 22, Monday.</p> <p> Ashok Serchan, CEO of Prabhu Bank, said that the branch in Balkot will work hand in hand with the locals of the region and support them for the economic prosperity.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10271', 'image' => '20190423123940_prabhu.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 10 => array( 'Article' => array( 'id' => '10519', 'article_category_id' => '218', 'title' => 'Mahalaxmi Branch now in Koteshwar', 'sub_title' => '', 'summary' => 'April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.', 'content' => '<p> April 23: Mahalaxmi Bikas Bank has opened a new branch in Kathmandu.</p> <p> The development bank said in a statement it has opened a new branch in Koteshwar- 32 of Kathmandu Metropolitan City.</p> <p> The new branch was inaugurated amid a recent event in the presence of high ranking officials of the bank.</p> <p> Mahalaxmi Bikas Bank now has 90 branches spread across the country.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-04-23', 'modified' => '2019-04-23', 'keywords' => '', 'description' => '', 'sortorder' => '10270', 'image' => '20190423123514_maha.jpg', 'article_date' => '2019-04-23 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 11 => array( 'Article' => array( 'id' => '9615', 'article_category_id' => '218', 'title' => 'NIC Asia Bank Inks Bancassurance Pact with IME Life Insurance', 'sub_title' => '', 'summary' => 'December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service.', 'content' => '<p>December 12: NIC Asia Bank has signed bancassurance agreement with IME Life Insurance to provide its customers with insurance service. The bank’s CEO Roshan Kumar Neupane and the insurance company’s CEO Shree Chandra Bhatta signed the agreement amid a function on Tuesday, December 11.</p> <p>Following the agreement, the bank’s customers can avail life insurance service provided by the insurance service through any branch of the bank.</p> <p>Currently, the bank has been providing its service through a network of 270 branches, 285 ATM outlets, 37 extension counters and 20 branchless banking services spread across the country.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9389', 'image' => '20181228025824_Chrysanthemum.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 12 => array( 'Article' => array( 'id' => '9611', 'article_category_id' => '218', 'title' => 'Simplified Microcredit Services to Underserved Population', 'sub_title' => '', 'summary' => 'December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.', 'content' => '<p>December 12: Machhapuchchhre Bank Limited (MBL), UKaid Sakchyam Access to Finance Programme (Sakchyam) and Heifer international Nepal signed a partnership on Tuesday (December 11) to provide simplified microcredit services to the unserved and underserved population of fourteen districts across Nepal.</p> <p>CEO of MBL, Suman Sharma, team leader of Sakchyam, Nirmal Dahal and country director of Heifer International Nepal, Shubh Mahato along with other representatives from MBL, Sakchyam and Heifer International Nepal were present during the partnership signing ceremony.</p> <p>According to a joint statement issued by the three organisations, MBL in strategic alliance with UKaid Sakchyam and Heifer International Nepal, will expand access to finance for women entrepreneurs and farmers in order to enhance their economic condition through the ‘Simplified Financial Services for Economic Empowerment of Women’ project.</p> <p>During the program, MBL’s CEO Suman Sharma said that the bank will cater to the financial requirement of rural farmers, small and medium enterprises, other value chain actors and underprivileged group in 14 districts in order to enhance their livelihood ‘through this strategic alliance.</p> <p>The aim of the project is to reach to more than 4,300 farmers, provide savings accounts to more than 3,000 beneficiaries, initiate financial literacy and awareness, maximize branchless banking (BLB) and introduce innovative credit assessment and delivery tools in form of Kishan Credit Card (KCC).</p> <p>Machhapuchchhre Bank is providing its services across Nepal with a network of 86 branches, two extension counters and 39 branchless banking units. The bank has 107 ATMs spread all over the country.</p> <p>Sakchyam is a UKaid-funded access to finance programme implemented by Louis Berger for DFID Nepal while Heifer International is working in Nepal as a sustainable development non-profit leader in smallholder agriculture.</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-28', 'keywords' => '', 'description' => '', 'sortorder' => '9386', 'image' => '20181228025622_cap.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 13 => array( 'Article' => array( 'id' => '9610', 'article_category_id' => '218', 'title' => 'NB Bank becomes Partner Bank of IME Digital', 'sub_title' => '', 'summary' => 'December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.', 'content' => '<p>December 12: IME Digital Solution and Nepal Bangladesh Bank have inked an agreement to facilitate customers to avail various mobile financial services offered by IME Digital through its product IME Pay.</p> <p>Daniel D Shrestha, chief operating officer of IME Digital, and Suresh Devkota, chief operating officer of Nepal Bangladesh Bank, signed the agreement on behalf of their respective organisations.</p> <p>Based on the agreement, Nepal Bangladesh Bank will act as a partner bank of IME Digital and offer services like linking bank accounts, transferring funds to and from customers’ bank accounts to IME Pay wallets for the customers, reads a statement issued by IME Digital Solution.</p> <p>Nepal Bangladesh Bank’s customers will soon be able to avail recharge, payment and money transfer services along with myriad of other online and offsite QR-based merchant payment services of IME Pay.</p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9385', 'image' => '20181212014933_NB.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ), (int) 14 => array( 'Article' => array( 'id' => '9609', 'article_category_id' => '218', 'title' => 'Nabil Bank Launches QR Payment Service', 'sub_title' => '', 'summary' => 'December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited.', 'content' => '<p>December 12: Nabil Bank has announced the launch of “QR Code Payment Service” in association with UnionPay International (UPI) and Rojgari Services Private Limited. Nabil Bank said in a statement that it has formed a Quick Response (QR) merchant development alliance with UPI, a leading international payment association, and Rojgari Services, a recruitment solution company.</p> <p>According to the bank, the alliance brings together a pool of expertise in QR payment solution, acquiring/payment services and network development.</p> <p>“Rojgari Services shall develop QR merchant network across the country for Nabil Bank that will enable customers to process payment through their mobile device using QR Code from those merchant touch points,” the statement said.</p> <p>With the UPI QR Code service, Nepali businesses can now sell their products/services electronically in a secure environment, the statement further said. The bank said that Rojgari Services will build the bank’s QR acquiring portfolio with 10,000 merchants over the period of one year. Over the time, Nabil Bank said it expects to deliver enhanced suite of QR payment solution to its customers and merchants.</p> <p>“It's a completely new approach to the typical payment process where the need of physical Point of Sales (POS) terminals can be avoided and no physical contact of the card is required. The QR code conveys the purchase transaction information to the application on the mobile device where the payment is initiated.”</p> <p>Commenting on the agreement, Anil K Khanal, deputy chief executive officer of Nabil Bank, said, “We continue to work towards promoting digital banking and innovative solution as we have been delivering such innovative payment solutions to our customers since long. This partnership will help towards building an ecosystem for QR payment in the country and expand our service offering to the next level.”</p> <p> </p> ', 'published' => true, 'created' => '2018-12-12', 'modified' => '2018-12-12', 'keywords' => '', 'description' => '', 'sortorder' => '9384', 'image' => '20181212014007_nabil.jpg', 'article_date' => '2018-12-12 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '20' ) ) ) $current_user = null $logged_in = false $xml = falseinclude - APP/View/Elements/side_bar.ctp, line 133 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117