January 31: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the…

January 31: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the…

January 4: Muktinath Bikas Bank has entered its 16th year of operation. On the occasion of its anniversary, the bank inaugurated 32 branch offices at once from the central office…

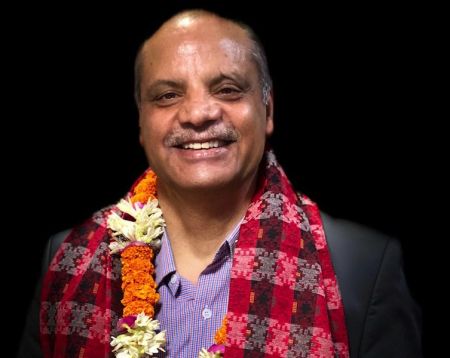

January 2: Standard Chartered Bank has appointed Gorakh Rana as the bank’s Deputy CEO effective from January 1,…

December 17: The third Annual General Meeting (AGM) of Nepal Infrastructure Bank Limited passed the report of the Board of Directors of the Fiscal Year 2077/78 and the financial statements unanimously amid a programme held on December…

July 28: Panchkhal Municipality has signed a Memorandum of Understanding (MoU) with the Nepal Infrastructure Bank Limited (NIFRA) to move ahead with the development, construction and implementation of well-equipped urban infrastructure in the municipality through public private…

Bank of Kathmandu Ltd and Ingwa Hydropower Limited have signed a loan agreement for the Upper Ingwa Hydropower Project.…

Standard Chartered Bank Nepal Limited has been awarded with “Excellence in Learning and…

January 12: Laxmi Bank has signed a MOU with Thulung Dudhkoshi Rural Municipality of Solukhumbu to extend concessional loans at subsidized rates to various entrepreneurs, firms, companies, as well as cooperatives under recommendation and facilitation of the rural municipality.…

January 5: Nepal Infrastructure Bank Limited (NIFRA) has appointed NIBL Ace Capital Limited as its issue manager for the IPO issuance.…

December 4: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the…

December 4: NMB Bank has been awarded with the prestigious "Bank of the Year-2020'' award by London-based The Banker, a British international monthly financial affairs publication owned by The Financial…

October 8: Nabil Bank has appointed Upendra Poudyal as the bank’s chairman effective from October 6.…

September 28: Nabil Bank has announced the launch of Nabil Fone Loan service.…

September 22: NMB Bank has claimed to be the ‘first bank in Nepal’ to issue Corporate Credit Card.…

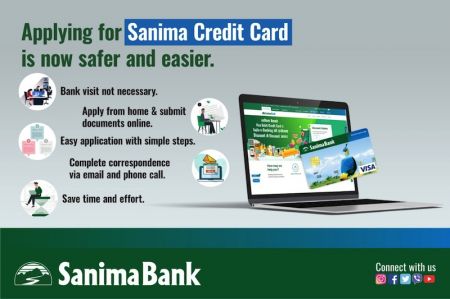

September 22: Sanima Bank has launched online credit card facility to its “valued” customers considering the safety…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '14703', 'article_category_id' => '218', 'title' => 'Standard Chartered gets AAA Rating for 3rd Consecutive Year', 'sub_title' => '', 'summary' => 'January 31: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the country.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">January 31: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the country.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The rating is considered to have the highest degree of safety regarding the timely servicing of financial obligations, the bank said in a statement. Such issuers carry the lowest credit risk.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the bank, this is the third year in a row that the Standard Chartered Nepal has received the coveted rating.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">"The rating reaffirmation factors in the bank's strong financial profile as reflected in robust capitalisation and a healthy asset quality despite the impact of COVID-19. The bank reported a capital to risk weighted assets ratio of 16.09 per cent and tier-I of 14.46 per cent as of mid-October 2021, remaining much comfortable against minimum regulatory requirement of 11 per cent and seven per cent, respectively,” ICRA Nepal said in a statement.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-01', 'modified' => '2022-02-01', 'keywords' => '', 'description' => '', 'sortorder' => '14446', 'image' => '20220201063136_20201204021109_My Effect.jpg', 'article_date' => '2022-02-01 18:30:34', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '14597', 'article_category_id' => '218', 'title' => 'Muktinath Bikas Bank opens 32 branch offices at once', 'sub_title' => '', 'summary' => 'January 4: Muktinath Bikas Bank has entered its 16th year of operation. On the occasion of its anniversary, the bank inaugurated 32 branch offices at once from the central office digitally.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">January 4: Muktinath Bikas Bank has entered its 16</span><sup><span style="font-family:"Times New Roman","serif"">th</span></sup><span style="font-family:"Times New Roman","serif""> year of operation. On the occasion of its anniversary, the bank inaugurated 32 branch offices at once from the central office digitally.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The bank has added four branches in Province 1, three branches in Province 2, thirteen branches in Bagmati Province, two branches in Gandaki Province, five branches in Lumbini Province and two branches in Far-Western Province. The chairperson of the bank, Bharatraj Dhakal inaugurated the new branch offices.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Chairperson Dhakal informed that Muktinath Bikas Bank has been providing modern banking facilities alongside contributing to the economy of the country through different financial and non-financial services. Current directors, former directors, founding shareholders and senior officials of the bank, and branch managers were present at the inauguration ceremony.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The bank informed that it organized various programs under corporate social responsibilities in the regional and branch offices of all the seven states. The bank distributed stationery and furniture to schools, food and clothes to various orphanages and old age homes, dustbin to various places, and conducted financial literacy and digital banking literacy programs. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The bank stated that the regional offices and central offices organized blood donation programs on the occasion. To encourage digital transactions, the bank's ATM card can be used to withdraw money free of charge from any other bank's ATM connected to the Visa network across Nepal.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-01-04', 'modified' => '2022-01-04', 'keywords' => '', 'description' => '', 'sortorder' => '14340', 'image' => '20220104030943_MNBBL_16.jpg', 'article_date' => '2022-01-04 15:07:49', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '14582', 'article_category_id' => '218', 'title' => 'Standard Chartered Bank appoints Gorakh Rana as Deputy CEO ', 'sub_title' => '', 'summary' => 'January 2: Standard Chartered Bank has appointed Gorakh Rana as the bank’s Deputy CEO effective from January 1, 2022.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">January 2: Standard Chartered Bank has appointed Gorakh Rana as the bank’s Deputy CEO effective from January 1, 2022.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to a statement issued by the bank, Rana has banking experience spanning over 27 years with a deep knowledge of Nepal’s banking industry. Rana has been representing Standard Chartered in several industries and regulatory forums.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">He started his career through retail banking in 1994 and has served in positions ranging from relationship manager, senior credit manager, head of client coverage and head of global banking and commercial banking.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Besides the post of deputy CEO, Rana is still the head of customer liaison, corporate, commercial and institutional banking in Nepal, according to a statement issued by the bank.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-01-02', 'modified' => '2022-01-02', 'keywords' => '', 'description' => '', 'sortorder' => '14325', 'image' => '20220102022916_1640956166.jpg', 'article_date' => '2022-01-02 14:28:13', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '14496', 'article_category_id' => '218', 'title' => 'NIFRA Annual General Meeting Passes Financial Reports', 'sub_title' => '', 'summary' => 'December 17: The third Annual General Meeting (AGM) of Nepal Infrastructure Bank Limited passed the report of the Board of Directors of the Fiscal Year 2077/78 and the financial statements unanimously amid a programme held on December 15.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">December 17: The third Annual General Meeting (AGM) of Nepal Infrastructure Bank Limited passed the report of the Board of Directors of the Fiscal Year 2077/78 and the financial statements unanimously amid a programme held on December 15. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">As per the financial statements of 2077/78, out of the accumulated profits till the end of the fiscal yuear, a resolution was passed to provide bonus shares equivalent to 8 percent of Rs 20 billion and a 0.2 percent cash dividend.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The AGM also unanimously elected two directors representing the general shareholders. Those elected include Suman Pokharel and Lima Adhikari Acharya.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The meeting was presided by Anuj Agrawal, who is also the Chairman of the Board of Directors of the bank. The general meeting was organized following the health guidelines against Covid-19 infections for the safety of the shareholders. Some shareholders joined the meeting via online portals in order to prevent the Covid-19 risks.</span></span></span></span></p> ', 'published' => true, 'created' => '2021-12-17', 'modified' => '2021-12-17', 'keywords' => '', 'description' => '', 'sortorder' => '14242', 'image' => '20211217122538_NIFRA.jpg', 'article_date' => '2021-12-17 12:24:42', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '13744', 'article_category_id' => '218', 'title' => 'MoU between Panchkhal Municipality and NIFRA ', 'sub_title' => '', 'summary' => 'July 28: Panchkhal Municipality has signed a Memorandum of Understanding (MoU) with the Nepal Infrastructure Bank Limited (NIFRA) to move ahead with the development, construction and implementation of well-equipped urban infrastructure in the municipality through public private partnership. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">July 28: Panchkhal Municipality has signed a Memorandum of Understanding (MoU) with the Nepal Infrastructure Bank Limited (NIFRA) to move ahead with the development, construction and implementation of well-equipped urban infrastructure in the municipality through public private partnership. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">Mayor of Panchkhal municipality Mahesh Kharel and Chief Executive Officer of NIFRA Ram Krishna Khatiwada signed the agreement on Monday, July 26. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Times New Roman","serif"">According to the press statement, with the signing of the agreement, the bank will help the municipality with technical and economic feasibility study required for project development, financial and technical analysis, detailed project report, market sounding of the project, assistance required for selection of consultants and developers and other cooperation required to decide the structure of investment. </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-07-28', 'modified' => '2021-07-28', 'keywords' => '', 'description' => '', 'sortorder' => '13489', 'image' => '20210728030514_mou (1).jpg', 'article_date' => '2021-07-28 15:04:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '13553', 'article_category_id' => '218', 'title' => 'Bank of Kathmandu to Finance Upper Ingwa Hydropower Project', 'sub_title' => '', 'summary' => 'Bank of Kathmandu Ltd and Ingwa Hydropower Limited have signed a loan agreement for the Upper Ingwa Hydropower Project. ', 'content' => '<p>June 18: Bank of Kathmandu Ltd and Ingwa Hydropower Limited have signed a loan agreement for the Upper Ingwa Hydropower Project.</p> <p>Issuing a statement, the commercial bank said that it was providing 75 percent in loans to develop the 9.7 MW hydropower project with an estimated cost of Rs 1.95 billion.</p> <p>BoK is the sole lender of the project, according to the statement. The remaining 25 percent will be the equity investment of the hydropower company. The hydropower project is being constructed at Yangwarak Rural Municipality in Panchthar and Sidhingba Rural Municipality in Taplejung. “The bank believes that its financing will help in completing the hydropower project in time,” read the statement.</p> <p>According to the statement, the bank has financed 37 energy projects in Nepal including solar and hydropower projects. </p> ', 'published' => true, 'created' => '2021-06-18', 'modified' => '2021-06-18', 'keywords' => '', 'description' => '', 'sortorder' => '13298', 'image' => '20210618090338_Hydropower.jpg', 'article_date' => '2021-06-18 21:00:16', 'homepage' => true, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => true, 'user_id' => '35' ) ), (int) 6 => array( 'Article' => array( 'id' => '13223', 'article_category_id' => '218', 'title' => 'Standard Chartered Bank Nepal awarded with “Excellence in Learning and Development”', 'sub_title' => '', 'summary' => 'Standard Chartered Bank Nepal Limited has been awarded with “Excellence in Learning and Development”.', 'content' => '<p>MARCH 30:<br /> Standard Chartered Bank Nepal Limited has been awarded with “Excellence in Learning and Development”. Issuing a statement last Friday, the commercial bank said that the award was presented at the HR Meet 2021 organized by Growth Sellers, an independent HR consulting firm.<br /> “The award was presented to the Bank in the recognition of its effort to consistently develop the skill sets of its employees and for providing the necessary motivation to grow,” read the statement. According to the statement, the award winners in various categories were decided by an esteemed jury consisting of veteran personalities from the HR domain of Nepal.<br /> On the first day of the event, Anirvan Ghosh Dastidar, CEO Standard Chartered Bank Nepal Limited, was keynote speaker, where he shared his views on “HR as strategic partner - changing the way we work.”</p> <p> </p> ', 'published' => true, 'created' => '2021-03-30', 'modified' => '2021-03-30', 'keywords' => '', 'description' => '', 'sortorder' => '12969', 'image' => '20210330125812_Standard_Chartered.jpg', 'article_date' => '2021-03-30 12:57:01', 'homepage' => true, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => false, 'user_id' => '35' ) ), (int) 7 => array( 'Article' => array( 'id' => '12928', 'article_category_id' => '218', 'title' => 'Laxmi Bank to Provide Concessional Loan to People of Solukhumbu Village', 'sub_title' => '', 'summary' => 'January 12: Laxmi Bank has signed a MOU with Thulung Dudhkoshi Rural Municipality of Solukhumbu to extend concessional loans at subsidized rates to various entrepreneurs, firms, companies, as well as cooperatives under recommendation and facilitation of the rural municipality. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-family:Cambria">January 12: Laxmi Bank has signed a MOU with Thulung Dudhkoshi Rural Municipality of Solukhumbu to extend concessional loans at subsidized rates to various entrepreneurs, firms, companies, as well as cooperatives under recommendation and facilitation of the rural municipality. </span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-family:Cambria"> Dipesh Amatya, chief of the Retail Financial Services of Laxmi Bank, and chairperson of the rural municipality Ashim Rai signed the agreement on behalf of their respective organisations amid a recent function. </span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-family:Cambria">Ajaya Bikram Shah, CEO of Laxmi Bank, expressed the bank’s readiness to finance enterprising activities in various potential sectors of the rural municipality like agriculture, tourism, hospitality, reads a statement issued by the bank. </span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-family:Cambria">The agreement is expected to promote entrepreneurship and self-employment to ultimately help create economically self-dependent rural municipality, the statement added. </span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2021-01-12', 'modified' => '2021-01-12', 'keywords' => '', 'description' => '', 'sortorder' => '12675', 'image' => '20210112025133_IMG - PR.jpg', 'article_date' => '2021-01-12 14:50:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '12898', 'article_category_id' => '218', 'title' => 'NIFRA to Issue IPO from January 15', 'sub_title' => '', 'summary' => 'January 5: Nepal Infrastructure Bank Limited (NIFRA) has appointed NIBL Ace Capital Limited as its issue manager for the IPO issuance. ', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri">January 5: Nepal Infrastructure Bank Limited (NIFRA) has appointed NIBL Ace Capital Limited as its issue manager for the IPO issuance. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri">The bank said in a statement that it is issuing IPO of 40 percent of its issued capital i.e. 80 million units worth Rs 8 billion. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri">The bank will be issuing its IPO from January 15 to 19. The bank claimed that it is the biggest IPO in the history of Nepal’s capital market.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri">NIFRA said its paid-up capital will be Rs 20 billion after the issuance of IPO. Out of the total paid-up capital of the bank, Rs 12 billion has been collected from the promoter shareholders while Rs 8 billion will be collected from the issuance of IPO.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri">Nepal Infrastructure Bank Limited (NIFRA) has been set up by Banks and Financial Institutions (BFIs), Life and Non-life Insurance companies and other leading entities of the private sector in joint participation with the Government of Nepal. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2021-01-05', 'modified' => '2021-01-05', 'keywords' => '', 'description' => '', 'sortorder' => '12645', 'image' => '20210105042837_20190101042956_IPO.jpg', 'article_date' => '2021-01-05 16:28:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '12757', 'article_category_id' => '218', 'title' => 'Standard Chartered Bank Nepal reaffirmed with AAA Rating', 'sub_title' => '', 'summary' => 'December 4: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the country.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">December 4: Standard Chartered Bank Nepal has said that the bank has been reaffirmed with the issuer rating of AAA by ICRA Nepal, the first credit rating agency of the country.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">The rating is considered to have the highest degree of safety regarding the timely servicing of financial obligations, the bank said in a statement. Such issuers carry the lowest credit risk. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">According to the bank, this is the second year in a row that the Standard Chartered Nepal has received the coveted rating.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">“The rating reaffirmation continues to derive comfort from the bank’s established track record (operating since 1987) and robust risk management and underwriting practices, which are reflected in its ability to maintain a strong asset quality in recent quarters despite the impact of the Covid-19 pandemic,” ICRA Nepal stated.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">CEO of Standard Chartered Nepal, Anirvan Ghosh Dastidar said, “The reaffirmation of AAA rating is validation of our commitment towards our clients and all our stakeholders. We thank everyone for making this possible.”</span></span></span></span></p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-12-04', 'modified' => '2020-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '12504', 'image' => '20201204021109_My Effect.jpg', 'article_date' => '2020-12-04 14:09:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '12754', 'article_category_id' => '218', 'title' => 'NMB Bank Bags Bank of the Year 2020 Award', 'sub_title' => '', 'summary' => 'December 4: NMB Bank has been awarded with the prestigious "Bank of the Year-2020'' award by London-based The Banker, a British international monthly financial affairs publication owned by The Financial Times.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">December 4: NMB Bank has been awarded with the prestigious "Bank of the Year-2020'' award by London-based The Banker, a British international monthly financial affairs publication owned by The Financial Times.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">NMB Bank said in a statement that this is the third time the bank has won the award in four years.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">“The bank has had a remarkable growth trajectory evidently reflected in the growth in its balance sheet size and its balanced network expansion that covers urban-semi urban and rural corners of the country,” said the statement, adding, “NMB has positioned itself as the bank that does things differently and translated the same in its core focus areas Renewable Energy, Agriculture, MSMEs/SMEs, and Digitization.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">The bank further said its drive to promote Sustainable Value Based Banking in allegiance to its membership of the Global Alliance for Banking on Value has seen the bank achieve international membership including that of the steering committee member of Partnership for Carbon Accounting Financials (PCAF). Joining a league of international banks like ABN Amro and Morgan Stanley amongst others are some of the achievements of the bank. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">NMB claimed that it is also one of the leading banks to implement Environmental and Social Risk Management Policy that seeks to mitigate environment and social risks caused by businesses.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">The statement further said that the winners of the Bank of the Year award are judged on the basis of their ability to deliver returns to shareholders, bank’s financial performance, shareholders’ value, customers’ initiative, amongst others parameters. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial">“We are delighted to have won the award for the third time in 4 years. It is a testament to the hard work and dedication of our staff, the trust bestowed on us by our customers, regulators, the guidance of the NMB Board and support from all stakeholders,” the statement added.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:Arial"> The bank further said that their efforts during Covid-19 to ensure the customers receive uninterrupted services through “digital and omnichannel platforms” have set industry standards.</span></span></span></span></p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-12-04', 'modified' => '2020-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '12501', 'image' => '20201204111416_My Effect.jpg', 'article_date' => '2020-12-04 11:09:13', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '12569', 'article_category_id' => '218', 'title' => 'Nabil Bank Appoints Upendra Poudyal as its new Chairman', 'sub_title' => '', 'summary' => 'October 8: Nabil Bank has appointed Upendra Poudyal as the bank’s chairman effective from October 6. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">October 8: Nabil Bank has appointed Upendra Poudyal as the bank’s chairman effective from October 6. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">Nabil Bank said in a statement that Poudyal has been serving as the director of the bank since 1st December 2017. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">Poudyal will take the place of outgoing chairman Shambhu Prasad Poudyal, who completed his four-year term on October 3, 2020.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">The current chairman started his banking career in 1986 when he joined Nepal Grindlays Bank.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book""> He later engaged himself in NMB Finance and led the company as CEO, says the statement. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">“He played crucial role in upgrading NMB Finance to a commercial bank and served as CEO of the NMB Bank till 2017. Poudyal is an established leader in the banking sector of Nepal with experience of more than 30 years as a successful banker and former president of Nepal Banker’s Association,” the statement added.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"> Poudyal also represents the Asia pacific region of the Global Alliance for Banking on Values (GABV), with its headquarters in the Netherlands. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri">GABV is a network of banking leaders from around the world committed to advancing positive change in the banking sector. According to the statement, the collective goal of GABV is to change the banking system so that it is more transparent, and supports economic, social and environmental sustainability.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri"><span style="font-family:"Futura LT Book"">Nabil Bank further said it is confident that bank will progress to new heights of success under the able leadership of Poudyal as its chairman.</span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12316', 'image' => '20201008110910_CM Nabil.jpg', 'article_date' => '2020-10-08 11:08:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '12529', 'article_category_id' => '218', 'title' => 'Nabil Bank Launches Nabil Fone Loan Service', 'sub_title' => '', 'summary' => 'September 28: Nabil Bank has announced the launch of Nabil Fone Loan service. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">September 28: Nabil Bank has announced the launch of Nabil Fone</span></span> <span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Loan service. According to the bank, </span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Nabil Fone</span></span> <span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Loan is an innovative digital lending service which provides small short term pre-approved loans to individual customers instantly through bank’s mobile banking platform and by the use of Virtual Credit Card.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">“The solution is designed on existing mobile banking platform of the bank backed by virtual credit card</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">.</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> With this service, eligible customers can instantly apply for virtual credit card loan using banks’ mobile banking and avail short term loan up to Rs 100,000 in minutes.</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> Bank has partnered with F1 Soft International Pvt. Ltd. for the technology,” reads a statement issued by the bank. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">In the first phase, this service shall be extended to those customers who are maintaining salary/payroll account with</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> bank. In future, the bank plans to extend the service to other segments of customers as well. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">CEO of Nabil</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> Bank,</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> Anil Keshary </span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Shah, </span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">stated that he is confident to win satisfaction of the customers due to its “amazing features” like hassle free, collateral free, paperless and immediate deposit of the loan amount without having to visit branches to apply for the loan. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Shah further added that </span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">it is for the first time in Nepalese banking industry that customers are getting instant loan using the banking app without having to submit any physical documentation.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">Nabil Bank is a leading bank in the digital banking industry in Nepal. It has 119 branches and 18</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book"">5</span></span><span style="font-size:14.0pt"><span style="font-family:"Futura LT Book""> ATM network all over the country. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-09-28', 'modified' => '2020-09-28', 'keywords' => '', 'description' => '', 'sortorder' => '12276', 'image' => '20200928055910_Ad Design_Nabil Fone Loan.jpg', 'article_date' => '2020-09-28 17:57:58', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '12504', 'article_category_id' => '218', 'title' => 'NMB Bank launches Corporate Credit Card ', 'sub_title' => '', 'summary' => 'September 22: NMB Bank has claimed to be the ‘first bank in Nepal’ to issue Corporate Credit Card. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">September 22: NMB Bank has claimed to be the ‘first bank in Nepal’ to issue Corporate Credit Card. The bank said in a statement that it has launched NMB Bank VISA Corporate Credit Card, which shall be issued upon request to business organizations/corporate houses. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">The card is to be primarily used to manage business related expenses of staff ranging from business promotion, training, client engagement, marketing and other related expenses of a business entity. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">Multiple cards can be issued to individuals of the same organization with varying credit limits, reads the statement. The credit limit per organization shall be determined on the requirement of the organization.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">“NMB Bank VISA Corporate Credit Card is a fresh offering in the market and we are certain that it will enable our customers in corporate and business organizations in managing their business related expenses better. Enhancing customer experience through creation of value proposition in our products is at the core of our objective and we will continue to explore avenues to enhance our brand experience,” reads the statement issued by the bank.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-09-22', 'modified' => '2020-09-22', 'keywords' => '', 'description' => '', 'sortorder' => '12251', 'image' => '20200922043054_afadsf.jpg', 'article_date' => '2020-09-22 16:30:13', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '12503', 'article_category_id' => '218', 'title' => 'Online Application for Sanima Credit Card now Available', 'sub_title' => '', 'summary' => 'September 22: Sanima Bank has launched online credit card facility to its “valued” customers considering the safety issues.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">September 22: Sanima Bank has launched online credit card facility to its “valued” customers considering the safety issues.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">Customers can easily fill up the form by clicking "Apply Credit Card Online" icon on official website of Sanima Bank (www.sanimabank.com) without any hassle, reads a statement issued by the bank. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">The bank informed that customers shall be informed about approval status of credit card through email or phone call. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">Customers can apply for the credit card from anywhere and anytime, the statement further says. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">This facility has been officially launched on September 22.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">“Customers will get credit limit for a certain period of time and will also get discounts from various partner merchants. Beside that, credit card holders will have option to convert purchased bill into Equated Monthly Installments (EMI),” the statement further reads. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">Sanima Bank said it has been launching latest digital products for its customers in order to enhance digital experience in financial services. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">Sanima Bank has been providing banking service through 82 branches, 15 extension counters and 81 ATM terminals.</span></span></span></span></p> ', 'published' => true, 'created' => '2020-09-22', 'modified' => '2020-09-22', 'keywords' => '', 'description' => '', 'sortorder' => '12250', 'image' => '20200922041938_IMG-20200916-WA0015.jpg', 'article_date' => '2020-09-22 16:18:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117