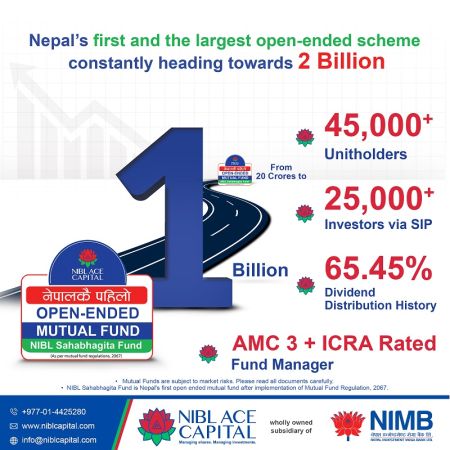

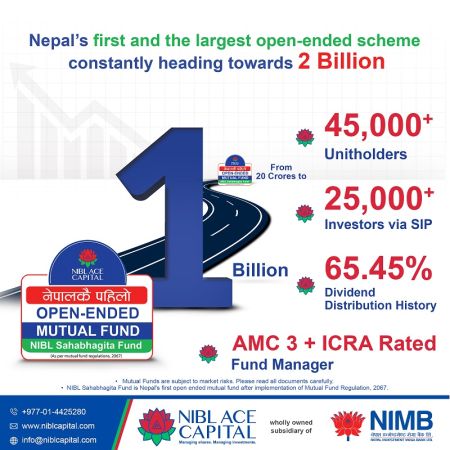

January 19: Securities Board of Nepal (SEBON) has approved the proposal of Nepal Investment Mega Bank Limited (NIMBL) to increase the size of NIBL Sahabhagita Fund, which the bank claims to be Nepal’s first open-ended mutual fund scheme, to Rs 2…

January 19: Securities Board of Nepal (SEBON) has approved the proposal of Nepal Investment Mega Bank Limited (NIMBL) to increase the size of NIBL Sahabhagita Fund, which the bank claims to be Nepal’s first open-ended mutual fund scheme, to Rs 2…

Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from…

Just two-and-a-half- month after it came into effect, Nepal Rastra Bank has revised ‘Working Capital Loan Guideline-2079’. NRB took the decision to this effect at the directive of Prime Minister Pushpa Kamal…

At a time when talk of liquidity crunch is doing round, various statistics show that state of liquidity has improved in the banking…

commercial banks, development banks and finance companies have decided to keep the interest rate on deposits stable for the next month of mid-December to mid-January 2023. …

December 9: Nepal Rastra Bank’s policy to lower the spread rate of banks has caused the profit of a dozen banks to…

November 1: Bank of Kathmandu (BOK) has announced cash-back offer even after the festive…

October 21: Everest Bank celebrated its 28th anniversary by organising a special program on Wednesday.…

September 28: NMB Bank has launched discounts and cash back offers for customers using credit and debit cards and mobile banking…

July 1: Nabil Bank completed one year of “Nabil Sustainable Banking” campaign on Wednesday.…

April 29: ICRA Nepal has upgraded the issuer rating of NMB Bank Limited (NMB), indicating an adequate degree of safety regarding the timely servicing of financial…

April 28: Experts and stakeholders have backed the concept of Nepal Rastra Bank (NRB) to reduce the number of banks and financial institutions, suggesting that the existing number of commercial banks have to be reduced by…

There was a time when the private sector used to be described as a sector that focuses solely on profit…

April 11: The Nepal Bankers' Association (NBA), an umbrella body of chief executive officers of commercial banks, has decided not to issue letters of credit for the import of luxurious goods except in case of extremely needed…

March 21: Managing Director of Bangladesh-based Grameen Trust, Sir A Hai Khan, inaugurated the Pokhara branch of Rastra Utthan Laghubitta Bittiya Sansthan Limited established in honor of Father of Microfinance Professor Mohammed Yunus, chairman of Grameen Trust,…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '16791', 'article_category_id' => '218', 'title' => 'SEBON Gives Green Signal to Increase the Size of NIBL Sahabhagita Fund to Rs 2 Billion', 'sub_title' => '', 'summary' => 'January 19: Securities Board of Nepal (SEBON) has approved the proposal of Nepal Investment Mega Bank Limited (NIMBL) to increase the size of NIBL Sahabhagita Fund, which the bank claims to be Nepal’s first open-ended mutual fund scheme, to Rs 2 billion.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">January 19: Securities Board of Nepal (SEBON) has approved the proposal of Nepal Investment Mega Bank Limited (NIMBL) to increase the size of NIBL Sahabhagita Fund, which the bank claims to be Nepal’s first open-ended mutual fund scheme, to Rs 2 billion.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The scheme, which is operated under NIBL Mutual Fund, was first launched in 2019 with a size of Rs 200 million and has since grown to a milestone size of Rs 1 billion, NIMBL said in a statement.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Considering the high demand of investors, NIBL Ace Capital approached SEBON to increase the size of the scheme to Rs 2 Billion and gained approval from SEBON on January 1, the bank said in the statement published recently.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Considering the developing capital market of Nepal, growing mutual fund industry and increasing investor in mutual fund and being Nepal's first open-ended scheme, this scheme has been successful in giving reasonable returns to its unit holders since the first year of its operation.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Under this scheme, a total of 65.45 percent dividends have been distributed in three years of successful operations with an average annual return of 21.81 percent, added the statement.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The bank claimed that this scheme has so far yielded the highest returns compared to other open-ended mutual fund schemes. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Investors who want to invest in this scheme can invest by submitting duly filled forms available at all the branch offices of NIMB and NIBL Ace Capital and distribution agents. They can also apply online by visiting the website (www.niblcapital.com) of NIBL Ace capital.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Investors can participate in a Dividend Re-Investment Plan as well which eliminates constant logistical hassles and ensures investors don’t miss out an investment opportunity. With skilled and experienced fund managers, the scheme that started with a size of Rs 200 million and was able to a gain significant participation of investors due to its lucrative returns, and as of now it is has crossed a size of more than Rs 1 billion, added the statement.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">This has made the scheme the largest ever open-ended scheme in the capital market of Nepal, the statement further said.</span></span></p> ', 'published' => true, 'created' => '2023-01-19', 'modified' => '2023-01-19', 'keywords' => '', 'description' => '', 'sortorder' => '16532', 'image' => '20230119050140_NIBL_OneBillion.jpg', 'article_date' => '2023-01-19 17:00:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '16697', 'article_category_id' => '218', 'title' => 'Global IME and Bank of Kathmandu Commence Integrated Transactions ', 'sub_title' => '', 'summary' => 'Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from Monday.', 'content' => '<p><br /> January 9: Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from Monday.</p> <p>Prime Minister Pushpa Kamal Dahal inaugurated the joint transactions at a ceremony organized in Kathmandu on Monday. <br /> The integrated transaction will be carried out under the name “Global IME Bank Limited”. </p> <p>Following the merger, the bank's total capital has reached Rs 57 billion, paid-up capital has reached Rs 35.77 billion with total deposits of Rs 408 billion and loans of Rs 376 billion.</p> <p>The merged bank will comprise five boards of members from Global IME and two from Bank of Kathmandu. </p> <p>Ratna Raj Bajracharya will be the CEO of the bank. The bank will have 365 branches, 367 ATMs, 286 branchless banking services, and three contact offices in foreign countries. </p> <p><br /> </p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16438', 'image' => '20230109062616_collage (40).jpg', 'article_date' => '2023-01-09 18:23:41', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 2 => array( 'Article' => array( 'id' => '16665', 'article_category_id' => '218', 'title' => 'NRB Revises Working Capital Loan Guideline-2079 ', 'sub_title' => '', 'summary' => 'Just two-and-a-half- month after it came into effect, Nepal Rastra Bank has revised ‘Working Capital Loan Guideline-2079’. NRB took the decision to this effect at the directive of Prime Minister Pushpa Kamal Dahal.', 'content' => '<p> </p> <p>January 4: Just two-and-a-half- month after it came into effect, Nepal Rastra Bank has revised ‘Working Capital Loan Guideline-2079’. <br /> NRB took the decision to this effect at the directive of Prime Minister Pushpa Kamal Dahal. </p> <p>Ever since Pushpa Kamal Dahal was appointed as Prime Minister, different umbrella organizations of businesses had been lobbying him to revise the new rule of working capital loan.</p> <p>On Wednesday morning, Prime Minister Dahal had held meeting with Finance Minister Bishnu Prasad Poudel and Nepal Rastra Bank’s Governor Maha Prasad Adhikari regarding the same matter. </p> <p>In a virtual press meet, the Nepal Rastra Bank had notified revisions made in connection with the rule of working capital loan. <br /> Since the introduction of the working capital loan guideline by the NRB for financial discipline and stability, industrialists, entrepreneurs and traders had been protesting against it. </p> <p>With the revisions, NRB will not implement the provisions to provide loan based on current assets and annual turnover amount only. Businessmen that have borrowed more than the limit can repay the debt in five installments by Ashad 2082. </p> <p>While determining the limit of periodic loans for working capital purposes, at least 3 years of estimated financial statements and at least 3 years of audited statements should be analyzed in accordance with working capital loan policy.</p> <p>The new rule came into implementation from October 18, 2022. </p> <p>Working capital loan is provided to the firms, organizations and companies to cover their short-term operational needs.</p> <p>Earlier, Nepal Rastra Bank officials had been defending the new rule of working capital loan saying that businessmen and entrepreneurs were using the loan to invest in the stock market and real estate. </p> <p>NRB Governor Maha Prasad Adhikari was reluctant even to hear the word revision of the rule of working capital loan during Sher Bahadur Deuba-led government’s tenure.</p> <p>After CPN-UML bagged the Ministry of Finance, Adhikari revised the provisions related to the working capital loan on the ninth day of the formation of the new government. </p> ', 'published' => true, 'created' => '2023-01-04', 'modified' => '2023-01-04', 'keywords' => '', 'description' => '', 'sortorder' => '16406', 'image' => '20230104050250_collage (26).jpg', 'article_date' => '2023-01-04 16:50:48', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 3 => array( 'Article' => array( 'id' => '16570', 'article_category_id' => '218', 'title' => 'State of Liquidity Easing in Banking System ', 'sub_title' => '', 'summary' => ' At a time when talk of liquidity crunch is doing round, various statistics show that state of liquidity has improved in the banking system. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">December 20 : At a time when talk of liquidity crunch is doing round, various statistics show that state of liquidity has improved in the banking system.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Banks had started facing scarcity of loanable fund since the beginning of the last fiscal year. Rise in remittance inflow and return of the money to the banking channels after the festival and general have led to the increase of deposits, improving state of liquidity in the banking system.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">As per the data made public by Nepal Rastra Bank on Sunday, banks and financial institutions have collected total of deposits of Rs 5254 billion. Out of it, commercial banks have accumulated deposits of Rs 4629 billion while development banks have deposits of Rs 625 billion.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The total credit flow of the banks and financial institutions as of December 18 is 4759 billion. Commercial banks’ lending stands at Rs 4213 billion while the lending of development banks and finance companies stands at Rs 546 billion.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to Nepal Rastra Bank, Credit Deposit Ratio (CD Ratio) of banks and financial institutions stands at 85.86 per cent</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Banks can provide loan up to 90 per cent of CD ratio. Given this provision, banks and financial institutions have capacity to increase credit flow of more than Rs 226 billion, said former banker Parsuram Kunwar Kshetri. “Even if a large sum of liquidity goes to the government coffers by the end of current month, banking system will still have one liquidity of one trillion,” Kshetri claimed.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">When asked banks would face liquidity crunch at the end of second quarters of the current fiscal due to tax, internal loan collection by the government and reduction of local levels’ budget from deposits, Ksherti said, “After reducing all of these, banking system will have one trillion left. They will have the capacity to flow credit of Rs 1000 billion.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Since the deposit is increasing in the banking system, banks will have to slash interest rates from next month if conditions remain unchanged, according to Kshetri.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Banks will lose deposits of Rs 31 billion after the end of the second quarters as they can calculate only 50 per cent money of the local levels as deposits. They are calculating 80 per cent of the local levels’ budget as deposits right now. Around Rs 45 billion will go into the government coffers as tax.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">A report published by Nepal Rastra Bank has shown that financial indicators such as remittance inflow, foreign currency reserve and balance of payment have improved. Remittance inflow increased by 20.4 per cent between mid-October to mid-November. The country received more than Rs 96 billion remittance during the same period.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Data published by Nepal Bankers’ Association show that commercial banks’ deposit increased by 57.22 billion between mid-November and mid-December. Deposits grew by Rs 22 billion in the last week of Mangshir.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Despite rise in deposits, credit flow of the banks is sluggish. Commercial banks provided lending of just Rs 2 billion in the month of Mangshir. Up to the end of Mangshir, lending has reached 4224 billion. Due to soaring interest rates, demand for credit has slumped and banks have failed to expand lending, said Kshetri.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Nepal Rastra Bank’s Governor Maha Prasad Adhikari has been saying that financial indicators have improved and liquidity situation is easing. He, however, has cautioned that banks might experience a liquidity crunch at the end of second quarters.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Nepal Bankers’ Association Anil Kumar Upadhyay said that state of liquidity was easing due to rise in remittance inflow and other reasons. “State of CD Ratio has become comfortable. But, liquidity is not going to be easily available. If the deposits continue to rise in the same manner, bank interests will decrease from next month,” Upadhaya added.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Banks have kept the interest rates stable for the current month.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Rastra Bank’s Executive Director Dr Prakash Kumar Shrestha said that state of liquidity is easing but banks are not able to provide credit easily. “There is no space to provide big loan,” Shrestha stated.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-12-20', 'modified' => '2022-12-20', 'keywords' => '', 'description' => '', 'sortorder' => '16310', 'image' => '20221220112656_collage (11).jpg', 'article_date' => '2022-12-20 11:22:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 4 => array( 'Article' => array( 'id' => '16521', 'article_category_id' => '218', 'title' => 'Bank Interest Rates to Remain Stable for Poush ', 'sub_title' => '', 'summary' => 'commercial banks, development banks and finance companies have decided to keep the interest rate on deposits stable for the next month of mid-December to mid-January 2023. ', 'content' => '<p> </p> <p><span style="font-size:18px">December 14: At a time when industrialists and entrepreneurs have been protesting against the banks and financial institutions’ increased interest rates on lending, commercial banks, development banks and finance companies have decided to keep the interest rate on deposits stable for the next month of mid-December to mid-January 2023. </span></p> <p> </p> <p><span style="font-size:18px">Nepal Bankers’ Association Chairman Anil Kumar Upadhaya said that the association had decided to give continuity to the existing interest rates which the banks have enforced for the last two months. </span></p> <p> </p> <p><span style="font-size:18px">With the decision, interest rate of 12.133 per cent per annum on fixed deposits to individual depositors will be maintained for the next month. Similarly, an interest rate of 10.133 per annum on fixed deposits to institutional depositors will be given continuity for the next month as well. </span></p> <p><span style="font-size:18px">Development banks and finance companies have also decided to keep the interest rate unchanged for the next month of mid-December to mid-January. </span></p> <p><span style="font-size:18px">Development Bankers’ Association had fixed the interest rate of 12.85 per cent on fixed deposit by reducing it by 0.15 per cent for the current month. </span></p> <p> </p> <p><span style="font-size:18px">Likewise, finance companies have been offering an interest rate of 13 per cent on 3-months’ fixed deposit and 13.30 per on 1 year’s fixed deposits for the existing month. </span></p> <p> </p> <p><span style="font-size:18px">As per the Nepal Rastra Bank’s directives, banks and financial institutions have to publish interest rate they wish to enforce every month before the beginning of new month. </span><br /> </p> <p><span style="font-size:18px">Banks can increase their interest only by 10 per cent at a time. But, citing liquidity crunch, umbrella organizations of banks and financial institutions have been controlling interest rate to ward off unhealthy competition. </span></p> <p> </p> ', 'published' => true, 'created' => '2022-12-14', 'modified' => '2022-12-14', 'keywords' => '', 'description' => '', 'sortorder' => '16262', 'image' => '20221214063849_collage (6).jpg', 'article_date' => '2022-12-14 06:34:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 5 => array( 'Article' => array( 'id' => '16490', 'article_category_id' => '218', 'title' => 'Profit of Over a Dozen Banks Likely to Shrink due to the Reduction in Spread Rate', 'sub_title' => '', 'summary' => 'December 9: Nepal Rastra Bank’s policy to lower the spread rate of banks has caused the profit of a dozen banks to shrink.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">December 9: Nepal Rastra Bank’s policy to lower the spread rate of banks has caused the profit of a dozen banks to shrink.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The central bank had decided to reduce the spread rate of commercial banks from 4.4 percent to 4 percent through the first quarterly review of the monetary policy of the current fiscal year. Likewise, the NRB had also recued the spread rate of development banks and finance companies from 5 percent to 4.6 percent.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the data published by the commercial banks, a total of 14 commercial banks will witness a decline in profit because their spread rate was more than 4 percent as of mid-October this year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Among the 26 commercial banks of Nepal, NIC Asia Bank had the highest spread rate of 4.39 percent while Nepal Bank Limited had the lowest spread rate of 33.66 percent.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Spread rate is the difference between the interest rate a bank pays to depositors and the interest rate it receives from loans to consumers. As the main source of income of banks is interest, their income is likely to shrink if the spread rate is reduced. Therefore, the banks have to look for alternative source of income if they are to maintain the same level of profit.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“The average spread rate of banks is around 4 percent. The monetary policy will only affect a handful of banks,” said Anil Kumar Upadhyay, chairman of Nepal Bankers Association.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">He said that the commercial banks will take a decision to reduce the interest on deposits only after the central bank implements the revised provision of the monetary policy.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Former banker Analraj Bhattarai says that the banks facing liquidity crisis will have immediate impact due to the central bank’s decision but there won’t be any long-term implications. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“The banks having high spread rate will feel immediate impact but they can make up for the loss in the long term through other source of income,” said Bhattarai.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-12-09', 'modified' => '2022-12-09', 'keywords' => '', 'description' => '', 'sortorder' => '16231', 'image' => '20221209034132_Banks - Copy.jpg', 'article_date' => '2022-12-09 15:40:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '16228', 'article_category_id' => '218', 'title' => 'BOK Cash-Back Offer Continues after Tihar', 'sub_title' => '', 'summary' => 'November 1: Bank of Kathmandu (BOK) has announced cash-back offer even after the festive season.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">November 1: Bank of Kathmandu (BOK) has announced cash-back offer even after the festive season. The bank announced the scheme previously, aiming to facilitate the purchase of necessary goods to its customers during the festivals of Dashain, Tihar, Nepali New Year 1143 and Chhath. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to the scheme, customers will get up to 25 percent cash back when scanning the QR code from mobile banking and making online payment. Under the scheme, the customer who transacts for the first time through mobile banking of the bank will get 25 percent of the first transaction amount or up to 150 rupees. The cash back scheme has been extended till November 6.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-11-01', 'modified' => '2022-11-01', 'keywords' => '', 'description' => '', 'sortorder' => '15970', 'image' => '20221101064623_BoKtopup_20200226110816.jpg', 'article_date' => '2022-11-01 18:45:43', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '16193', 'article_category_id' => '218', 'title' => 'Everest Bank Marks its 28th Anniversary', 'sub_title' => '', 'summary' => 'October 21: Everest Bank celebrated its 28th anniversary by organising a special program on Wednesday. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">October 21: Everest Bank celebrated its 28th anniversary by organising a special program on Wednesday. On the occasion, the bank organized various programmes including tree plantation under the bank’s corporate social responsibility. More than 200 employees and customers of the bank were present on the occasion at the head office. During the programme, the bank also honored 10 employees who completed 25 years of service.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The bank financially helped Dr. Ram Prasad Pokhrel of the Eye Hospital, Dhankuta under Nepal Netra Jyoti Sangh with Rs 480,250, to purchase an eye examination machine under the bank’s corporate social responsibility. The bank's Chief Executive Officer Sudesh Khaling handed over the check to the board member of Nepal Netra Jyoti Sangh, Dron Guragai during the programme.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Also, the bank entered into an agreement with Godavari Municipality Ward No. 3 for the construction of a solar passenger waiting room at Taikhel in Lalitpur. Deputy Chief Executive Officer Bijay Kumar Sharma on behalf of the bank and President Sanu Raja Ghimire on behalf of the ward office signed the agreement.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-10-21', 'modified' => '2022-10-21', 'keywords' => '', 'description' => '', 'sortorder' => '15934', 'image' => '20221021013240_everest.jpg', 'article_date' => '2022-10-21 13:31:59', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '16090', 'article_category_id' => '218', 'title' => 'NMB Bank Announces Cash Back Offer', 'sub_title' => '', 'summary' => 'September 28: NMB Bank has launched discounts and cash back offers for customers using credit and debit cards and mobile banking services.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">September 28: NMB Bank has launched discounts and cash back offers for customers using credit and debit cards and mobile banking services. The bank has collaborated with various stores and brands to provide cash back and discounts for the festive season.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The bank’s customers can get discount up to Rs 2000 on the occasion of Dashain and Tihar. The offer of the bank has already come into effect from September 26. Debit card users can get cash back up to 10 percent or Rs 300 for electronic transactions. Similarly, credit card users can get cash back up to 20 percent or Rs 500.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Also, customers will get 3 percent instant cash back on NTC/Ncell topup from the bank's app. In addition, customers can get cash back up to 10 percent or Rs 200 for QR payment made from the app.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-09-28', 'modified' => '2022-09-28', 'keywords' => '', 'description' => '', 'sortorder' => '15831', 'image' => '20220928040757_NMB.jpg', 'article_date' => '2022-09-28 16:07:16', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '15541', 'article_category_id' => '218', 'title' => 'Nabil Bank Completes One Year of Sustainable Banking', 'sub_title' => '', 'summary' => 'July 1: Nabil Bank completed one year of “Nabil Sustainable Banking” campaign on Wednesday. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">July 1: Nabil Bank completed one year of “Nabil Sustainable Banking” campaign on Wednesday. The bank had started the campaign with the objective of providing financial access to rural areas and ensuring financial literacy.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The bank informed that it will celebrate this achievement by organizing “Nabil Green Week”. The bank claimed that one year of sustainable banking has been satisfactory. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">A statement issued by the bank said, “We claim that Nabil Sustainable Banking has been established as an innovative approach not only in Nabil Bank but in the entire banking sector of Nepal.”</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The bank had started sustainable banking by investing in hydropower, providing soft loans and working in the social and environmental sectors. On the occasion of Nabil Sustainable Banking's anniversary and National Paddy Day, the bank started celebrating “Nabil Green Week” from Wednesday.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-07-01', 'modified' => '2022-07-01', 'keywords' => '', 'description' => '', 'sortorder' => '15283', 'image' => '20220701032746_Kishan-Karja_600x600.jpg', 'article_date' => '2022-07-01 15:27:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '15189', 'article_category_id' => '218', 'title' => 'ICRA Nepal upgrades NMB bank's issuer rating ', 'sub_title' => '', 'summary' => 'April 29: ICRA Nepal has upgraded the issuer rating of NMB Bank Limited (NMB), indicating an adequate degree of safety regarding the timely servicing of financial obligations. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">April 29: ICRA Nepal has upgraded the issuer rating of NMB Bank Limited (NMB), indicating an adequate degree of safety regarding the timely servicing of financial obligations. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Such issuers carry low credit risk, NMB said in a press statement. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">ICRA Nepal Limited is the first credit rating agency of Nepal and licensed by the Securities Board of Nepal (SEBON). It is a subsidiary of ICRA Limited of India. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The rating upgrade indicates the bank’s ability to successfully consolidate its business following a series of mergers/acquisitions, as reflected in the recent improvement in asset quality and delinquencies. The upgrade is a testament to the bank’s exemplary track record and improvement in overall performance even when the economy is reeling under the impact of COVID- 19 pandemic, the statement added. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">‘The Banker Magazine’ of The Financial Times, London, has awarded NMB Bank with the prestigious Bank of the Year Asia 2021 award. The bank has also been awarded with Bank of the Year in 2017, 2018, 2020 and 2021. NMB Bank is currently providing its services through 201 branches, 138 ATMs and 11 extension counters. </span><br /> </span></span></p> ', 'published' => true, 'created' => '2022-04-29', 'modified' => '2022-04-29', 'keywords' => '', 'description' => '', 'sortorder' => '14931', 'image' => '20220429012340_20150811023459_cf(8) (1).jpg', 'article_date' => '2022-04-29 13:20:20', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '15180', 'article_category_id' => '218', 'title' => ''15 Commercial Banks Enough for the Country'', 'sub_title' => '', 'summary' => 'April 28: Experts and stakeholders have backed the concept of Nepal Rastra Bank (NRB) to reduce the number of banks and financial institutions, suggesting that the existing number of commercial banks have to be reduced by half.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">April 28: Experts and stakeholders have backed the concept of Nepal Rastra Bank (NRB) to reduce the number of banks and financial institutions, suggesting that the existing number of commercial banks have to be reduced by half.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In the survey conducted by the central bank, the participants remarked that the number of banks in Nepal is high based on the size of economy, per capita income and the population and suggested that the number should be reduced.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The NRB conducted the study for the first time after a decade of introduction its merger and acquisition policy. Suggestions for the study were collected through questionnaires from 140 people associated with banks and financial institutions including the chief executive officers (CEO), assistant chief executive officers, acting chief executive officers, chairmen, directors, senior staff and 90 experts and 230 people.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Fifty percent of the respondents suggested that the number of commercial banks should be between 11 to 15. Similarly, 20 percent suggested 5 to 10 banks, 15 percent suggested 16 to 20 banks and the remaining 15 percent suggested 20 to 25 banks were appropriate. Currently, 27 commercial banks are in operation in Nepal</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">NRB spokesperson Gunakar Bhatta said that the study has shown the market's view on the number of banks. “It does not mean that the number of banks must be limited to 15,” he said.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Although the number of development banks and finance companies have declined significantly after the NRB introduced merger and acquisition policy, the number of commercial banks declined minimally. According to the NRB, so far 239 banks and financial institutions participated in the merger and acquisition process and then got limited to 62. A total of 177 licenses were revoked. However, out of 32 commercial banks licensed by NRB, only five merged. Recently, an agreement was reached for the merger of Himalayan and Nepal Investment Bank. The merger process of Nabil and Nepal Bangladesh Bank is also underway.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Eighty-four percent of participants from banks and financial institutions and 78 percent from experts suggested reducing the number only by giving discounts and facilities for mergers. According to the report, 57 percent of the participants suggested that the number of banks could be reduced through incentives, 20 percent through forced merger and 17 percent through voluntary capital increase. Similarly, 61 percent of the participants said that the merger would be effective if the policy of merging the weak with the strong organization was adopted.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Through the merger policy, NRB has been providing policy concessions to the merging banks and financial institutions including cooling off period, priority sector loans, and CCD. Similarly, the government has also been giving income tax exemption.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Most of the respondents said that the merger policy taken by NRB has had a positive impact on banks and financial institutions. Seventy nine percent respondents said the merger increased the bank's risk-bearing capacity, 67 percent said it increased their investment capacity and 52 percent said it increased their operating capacity.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Majority of the participants in the study suggested removing the existing classification of banks and financial institutions and moving to universal banking. Of those surveyed, 34 percent suggested moving to universal banking, 31 percent maintaining the current system and 27 percent moving to a specialized banking system.</span></span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-04-28', 'modified' => '2022-04-28', 'keywords' => '', 'description' => '', 'sortorder' => '14922', 'image' => '20220428115632_Banks - Copy.jpg', 'article_date' => '2022-04-28 11:55:22', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '15159', 'article_category_id' => '218', 'title' => 'Nabil Bank Aims to Promote Social Entrepreneurship for Social Transformation', 'sub_title' => '', 'summary' => 'There was a time when the private sector used to be described as a sector that focuses solely on profit making.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">There was a time when the private sector used to be described as a sector that focuses solely on profit making. Lately, the private sector is being considered globally as an important stakeholder in solving social problems as well. We can see instances of private sector enterprises and entrepreneurs involved in several social works in various countries in addition to their commercial success. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">In the mid-90s, the European corporate sector initiated collective campaigns to address the issues of unemployment and exclusion under the banner of Corporate Social Responsibility (CSR) in response to the request made by the President of the European Union. As part of the campaign, a commission was formed in 2000 and it worked to make the CSR campaign wider, more systematic, and participatory. Various universities were brought on board as partner institutions for the purpose. This made a positive contribution to the society, the private sector, and the national economy. Now, CSR activities undertaken in European countries are considered exemplary across the world.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Lately, the participation of the private sector has been expanding in various sectors of the society. CSR activities have been carried out as charity and as a host of activities contributing to the upliftment of society. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank is one of the leading institutions that has been carrying out various activities to develop social entrepreneurship and sustainable banking, which have emerged as different campaigns in the banking sector of the country. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">Nabil School of Social Entrepreneurship</span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank insists that its recently-launched Nabil School of Social Entrepreneurship (Nabil SSE) is a different and new type of non-profit initiative which aims to expand social entrepreneurship nationwide. Under this initiative, the bank has started a Fellowship Programme commencing from the third week of March 2022. Under this programme, a public call was made to submit concepts on social entrepreneurship. From among 350 applicants, 20 of the most competitive applicants were selected, who are now being trained on social entrepreneurship for a year free of cost. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">According to Nabil Bank, this programme aims to link Nepal’s higher education with the country’s most prominent private-sector bank in order to create successful social entrepreneurs. Under this campaign, Nabil Bank said it is starting another Certificate Level Programme in all seven provinces of the country. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil SSE – Certificate Level Programme</span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank informed that a curriculum is being prepared in coordination with various colleges from all seven provinces. Under this programme, an ambitious target of creating 700 entrepreneurs - 100 in each province, has been set. Nabil Bank has also set up an office in partnership with the Faculty of Management under Tribhuvan University to make this campaign systematic, sustainable, and institutionalized. The main objective of Nabil’s move to promote social entrepreneurship is to contribute to social transformation through the development of social entrepreneurship and to address social problems. This move of the bank aims to identify new ideas on social entrepreneurship from the community level and attract investment to materialize the idea into practices.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil SSE also aims to run social campaigns to develop new ideas, the bank further said adding, “With its own investment, Nabil SSE aims to develop social entrepreneurs and establish a tradition of solving social problems through social entrepreneurship.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank said it has been involved in social work since a long time along with its commercial success. Nabil Bank claimed that it contributed Rs 60 billion to the government’s COVID-19 relief fund in 2020 and also helped establish an oxygen plant at Bir Hospital at a time when the entire nation was suffering from shortage of oxygen during the pandemic. Nabil Bank has been contributing to the society through such types of CSR interventions. But now, the bank says it has moved ahead with a new model of social service through social entrepreneurship development. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">It is a novel initiative in the banking sector. The bank believes that the success of this endeavor will help establish a new culture of entrepreneurship development in the country and in turn, solve social problems.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">Sustainable Banking: A Distinct Initiative </span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">“Sustainable Banking is a new identity of Nabil Bank,” says the bank. The bank has set up a new unit ‘Sustainable Banking’ and has carried out model work at several places in the country. The bank announced the programme regarding Sustainable Banking, which aims to enable excluded classes to receive loans at cheaper rates for their enterprises. This will contribute to developing an inclusive economy in the country.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">For this purpose, the bank says it has been investing in sustainable business development in coordination with various state agencies and development stakeholders. The bank aims to provide services to people deprived of access to finance, and to promote entrepreneurship in remote villages through sustainable banking initiatives. The bank has also been working on promoting micro-enterprises by aligning its works with the Sustainable Development Goals (SDGs) set by the United Nations. Under the Sustainable Banking initiative, a farmer can get a loan up to Rs 1.50 million personally, up to Rs 2.50 million institutionally, and up to Rs 500,000 collectively as a group, according to the bank.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Under the Nabil Entrepreneurship Credit Scheme, people aged 18-60 years can get loans in the range of Rs 100,000 to Rs 10 million. Dozens of people have already started new businesses by availing loans from Nabil Bank under this scheme. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">However, the scope of Nabil Bank’s Sustainable Banking is much larger. The bank has expanded financing under this scheme to achieve the SDGs. It has also commenced maintaining an account of carbon emissions to examine how the enterprises financed by the bank have contributed to reduce carbon dioxide emission. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">The bank says it has been expanding its credits in areas of renewable energy in coordination with the Alternative Energy Promotion Centre. It is the bank’s initiative to minimize the impact of climate change in the country by supporting development of micro hydro projects and other sources of renewable energy. Nabil Bank is also a member of the UK-based Partnership for Carbon Accounting Financials (PCAF), an institution that helps in keeping accounts of the contribution of the bank’s financing in the areas of climate and environment. Nabil Bank informed that it will also work in the area of carbon financing through this agency. The bank has also started a ‘Remit Forestation’ programme to highlight the contribution of remittances sent by Nepali migrant workers. This banking initiative is expected to help promote the spirit of sustainable development and minimize the impact of climate change. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt"><span style="font-family:"Arial","sans-serif"">Social Entrepreneurship for Achieving National Goals </span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">The United Nations has already endorsed a proposal of graduating Nepal into a developing country from a least developed country in 2026. There are three criteria for graduation—per capita Gross National Income (GNI), Human Assets Index (HAI), and Economic Vulnerability Index (EVI). Nepal is yet to meet the criteria related to per capita GNI. In order to graduate into a developing country, an LDC should have per capita GNI of at least $1,230 but presently, it is tentatively $1,100 in the case of Nepal. The country is facing an additional challenge of meeting the GNI criterion because of the impact of the COVID-19 on people’s earnings, the bank further said. Therefore, it is not possible to meet the GNI target without the growth of economic activities through the development of new enterprises. “We need to take steps that help the State achieve sustainable and inclusive economic development,” said the bank.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Poverty alleviation, employment generation, and economic equality are the important pillars for national development, according to the Sustainable Development Goals (SDG). This is in line with the country’s 15th periodic plan (2019-20—2023-24) and 25-year Long-Term Vision Paper. The 8<sup>th</sup> Sustainable Development Goal emphasizes on enhancing people’s access to Banks and Financial Institutions for creating sustainable employment and promoting economic activities. According to the bank, the goal focuses on the need for enhancing the capacity of financial institutions as well as expanding their services. The new endeavors initiated by Nabil Bank for social entrepreneurship development and Sustainable Banking are aligned with the country’s national development goals and objectives. Nabil Bank informed that it has proactively taken initiatives in the banking sector, which has also inspired others to do the same to help achieve common national development goals. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:14.0pt"><span style="font-family:"Arial","sans-serif"">Encouragement to Develop Small Enterprises</span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">As per the government’s statistics, more than 18 percent of the population are living below the poverty line. Furthermore, the COVID-19 pandemic is estimated to have pushed more people under the poverty line. Unemployment rate in the country is over 11 percent. “Our national plan and SDGs have called for addressing these problems along with many other social issues through partnerships and coordinated efforts.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank informed that it has adopted the policy of processing loans for Small and Medium Enterprises (SMEs) as quickly as possible to help promote such enterprises. It is part of the bank’s belief that inclusive banking is essential to promote an inclusive economy. The bank has forged partnerships with various agencies for this purpose. For instance, the bank has started a new banking access programme in coordination with the United Nations Capital Development Fund (UNCDF) to connect youth and women entrepreneurs with the banking service. Under this scheme, the bank expects hundreds of thousands of women and youth entrepreneurs to be connected, thereby contributing to promote inclusive banking and economic development. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank said it has also forged a partnership with Daraz, an online shopping site under which, the bank has started providing credits to small businesses as per the recommendation of Daraz. The bank has also been extending credit in the agriculture sector and helped develop </span></span><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">farming technology in the sector in coordination with various institutions and companies. In addition to this, the bank is also promoting gender equality by extending credit to women entrepreneurs based on the recommendation of the Federation of Women Entrepreneurs Associations of Nepal. These endeavors have emerged as win-win situations for both borrowers and the bank as they helped new people to engage in businesses and helped the bank diversify its investment portfolio.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">These are some of the instances whereby Nabil Bank has not confined its job to banking business alone, but has also been engaged in running social and economic campaigns. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">As Nepal's first private sector bank, Nabil Bank has continued to remain the leading bank in the country. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">“Its focus on inclusive banking to promote economic development and development of enterprises, along with its emphasis on increasing people’s access to finance have enhanced the bank’s public image too. The new endeavors of Nabil Bank are also expected to inspire other banks to follow suit.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">The bank says that the areas where Nabil Bank is expanding credit could be the areas where other banks can also find opportunities to expand their credit in the future. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nabil Bank believes that the wider programmes that the bank launched in coordination with the government, development partners, business enterprises, and professional organizations could stimulate other banks to find new areas of investments and ways to expand investment in social entrepreneurship. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">“The multi-stakeholder partnership including universities, national and international agencies, has contributed to explore innovations in the banking sector, which has separated Nabil from the remaining banking institutions of the nation.” </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-04-24', 'modified' => '2022-04-24', 'keywords' => '', 'description' => '', 'sortorder' => '14901', 'image' => '20220424062828_Nabil.jpg', 'article_date' => '2022-04-24 18:26:37', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '15079', 'article_category_id' => '218', 'title' => 'NBA Decides not to Issue LCs for importing Luxurious Goods', 'sub_title' => '', 'summary' => 'April 11: The Nepal Bankers' Association (NBA), an umbrella body of chief executive officers of commercial banks, has decided not to issue letters of credit for the import of luxurious goods except in case of extremely needed ones.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">April 11: The Nepal Bankers' Association (NBA), an umbrella body of chief executive officers of commercial banks, has decided not to issue letters of credit for the import of luxurious goods except in case of extremely needed ones. The association's meeting on Sunday took a decision to this effect. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The banks have agreed not to open LCs to import luxurious goods like vehicles, gold, silver as well as sugar, chewing gum, dry foods, furniture, cigarettes, alcohol, perfume and mobile phones among others.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">According to chief executive officer of the Nepal Bank Limited, Krishna Bahadur Adhikari, who is also a member of NBA's executive committee, the commercial banks took such decision following a directive from the Nepal Rastra Bank. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Earlier, the central bank in a bid to stop the outflow of the country's depleting foreign exchange reserves had imposed 50 to 100 percent cash margin on the imports of 47 different goods. Likewise, the central bank had recently summoned the CEOs of all 27 commercial banks and unofficially directed them to halt LC to import luxurious goods including vehicles. </span><span style="font-family:"Arial Unicode MS","sans-serif""> -- RSS </span><br /> </span></span></p> ', 'published' => true, 'created' => '2022-04-11', 'modified' => '2022-04-11', 'keywords' => '', 'description' => '', 'sortorder' => '14821', 'image' => '20220411081524_LC.jpg', 'article_date' => '2022-04-11 08:14:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '14966', 'article_category_id' => '218', 'title' => 'MD of Grameen Trust Inaugurates Branch Office in Pokhara', 'sub_title' => '', 'summary' => 'March 21: Managing Director of Bangladesh-based Grameen Trust, Sir A Hai Khan, inaugurated the Pokhara branch of Rastra Utthan Laghubitta Bittiya Sansthan Limited established in honor of Father of Microfinance Professor Mohammed Yunus, chairman of Grameen Trust, Bangladesh.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">March 21: Managing Director of Bangladesh-based Grameen Trust, Sir A Hai Khan, inaugurated the Pokhara branch of Rastra Utthan Laghubitta Bittiya Sansthan Limited established in honor of Father of Microfinance Professor Mohammed Yunus, chairman of Grameen Trust, Bangladesh.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">According to a statement issued by the microfinance company, the visiting MD from Bangladesh inaugurated the branch amid a recent function at Chaauthe, Pokhara - 14.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The program was chaired by Pokhara Metropolitan City ward-14 Chairman Prem Karki and was also attended by Dr Ram Sharan Kharel, chief of Nepal Rastra Bank’s Gandaki Provincial Office.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">During the occasion, Grameen Trust’s MD Khan elaborated about the decades old relation of the trust with Nepal Rural Development Organisation (NeRuDO), the main promoter of Rastriya Utthan Laghubitta Bittiya Sansthan Limited (RULBSl) and assured of all support to RULBSL. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Addressing the function as special guest, Dr Kharel, the NRB chief of Gandaki Province, appreciated the role of RULBSL for the uplifting the deprived sector in collaboration with Grameen Trust. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Sudhir Lohani, executive director of RULBSL, shed light about the plans and programmes of the Pokhara branch with collaboration with Grameen Trust.</span></span></span></p> ', 'published' => true, 'created' => '2022-03-21', 'modified' => '2022-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '14708', 'image' => '20220321054539_Grameen trust.jpg', 'article_date' => '2022-03-21 17:44:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117