October 3: Citizens Bank International has started “express” internet banking service.…

October 3: Citizens Bank International has started “express” internet banking service.…

September 30: Nepal Investment Bank Limited launched its payment gateway on the occasion of Ghatasthapana on Sunday with the aim of facilitating what the bank said is the safest and most convenient online transactions for debit/credit Visa…

September 30: Kumari Bank Limited convened its 19th Annual General Meeting (AGM) at Naxal Banquet, Kathmandu on September…

September 26: Mega Bank has reached an understanding with Gandaki Bikas Bank for the acquisition of the latter.…

September 25: Prabhu Bank has opened its branch at Kurinar of Ichyakamana Rural Municipality,…

September 20: ICRA Nepal, the first credit rating agency in Nepal, has assigned an issuer rating of ICRA NP issuer rating triple A to Standard Chartered Bank Nepal…

September 11: Laxmi Bank has extended its network to a total of 112 branches with the inauguration of a new branch at Chapagaun in Lalitpur on Tuesday, September…

September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its…

September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its…

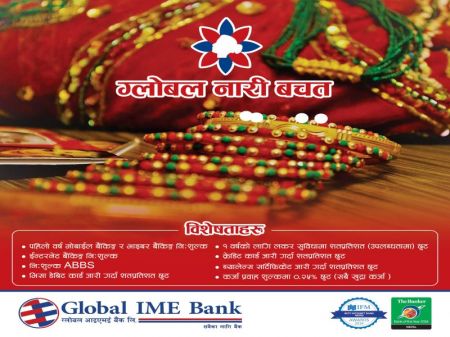

September 4: Global IME Bank has launched a new festive scheme targeting women customers on the occasion of…

June 9: Nepal Investment Bank Ltd (NIBL) organised a blood donation programme to mark the 25th anniversary of its Birgunj branch on Saturday, June…

June 4: Nepal Clearing House Limited (NCHL) has signed an agreement with UKaid’s Sakchyam - Access to Finance Programme (Sakchyam) to “promote connectIPS e-Payments, establish National Payments Interface (NPI) and extend Settlement Guarantee Fund…

June 3: Laxmi Bank in association with F1 Soft has launched a promotion campaign for its digital account opening platform “Ctrl O”.…

May 29: Laxmi Bank has expanded its network with an addition of a branch in Melamchi of Sindhupalchowk…

May 28: Kumari Bank Limited has launched its ATM service en route to at the base of Mt Everest.…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '11511', 'article_category_id' => '218', 'title' => 'Citizens Bank Starts ‘Express’ Internet Banking Services', 'sub_title' => '', 'summary' => 'October 3: Citizens Bank International has started “express” internet banking service. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">October 3: Citizens Bank International has started “express” internet banking service. Under this service, the offers inter-banking cash transaction, payment of electricity, cable and internet bills. Similarly, one can make payment for flight tickets as well through this service.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Prior to this, internet banking of the bank included checking of remittance, payment of utility bills like telephone, internet, mobile, wallet, and credit card among others.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">At present, the bank has been providing its services through 82 branches and 79 ATM counters across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-10-03', 'modified' => '2019-10-03', 'keywords' => '', 'description' => '', 'sortorder' => '11261', 'image' => '20191003011419_aaaadfg.jpg', 'article_date' => '2019-10-03 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 1 => array( 'Article' => array( 'id' => '11495', 'article_category_id' => '218', 'title' => 'NIBL Launches Secure Payment Gateway', 'sub_title' => '', 'summary' => 'September 30: Nepal Investment Bank Limited launched its payment gateway on the occasion of Ghatasthapana on Sunday with the aim of facilitating what the bank said is the safest and most convenient online transactions for debit/credit Visa cardholders.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">September 30: Nepal Investment Bank Limited launched its payment gateway on the occasion of Ghatasthapana on Sunday with the aim of facilitating what the bank said is the safest and most convenient online transactions for debit/credit Visa cardholders.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">According to the bank, the payment gateway facilitates real-time payment transaction by the transfer of information between a merchant's payment portal (website, etc), the acquiring bank, card interchanges like Visa, and the issuing bank.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The bank claimed that the transaction data is protected using a highly secured encryption and other multiple safety features ensuring reliability on the systems for the users. Merchants can now sell goods and services all over the world whereas the cardholders can shop online 24/7 on e-commerce sites for purchasing goods and services securely, the bank said in a statement.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The statement added that NIBL has been aiming to take the Nepalese banking to global standards with the development of a sound, stable and reliable system for which the payment gateway is a big step forward. Further, NIBL has announced a Visa cash-back offer of up to 25 percent for online transactions, valid on select merchants on the occasion of the launch.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">NIBL has been catering to the needs of its customer from 82 branches, 122 ATMs, 15 extension counters, 10 revenue collection counters and 55 branchless banking units across the country. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-30', 'modified' => '2019-09-30', 'keywords' => '', 'description' => '', 'sortorder' => '11245', 'image' => '20190930124855_Clipboard01.jpg', 'article_date' => '2019-09-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 2 => array( 'Article' => array( 'id' => '11494', 'article_category_id' => '218', 'title' => 'Kumari Bank convenes its 19th AGM', 'sub_title' => '', 'summary' => 'September 30: Kumari Bank Limited convened its 19th Annual General Meeting (AGM) at Naxal Banquet, Kathmandu on September 28.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 30: Kumari Bank Limited convened its 19th Annual General Meeting (AGM) at Naxal Banquet, Kathmandu on September 28. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank said in a statement that it issued 10 percent bonus shares and 0.526 percent cash-dividend to offset the levied tax on the issued bonus-dividend for the FY 2075/76 on its total paid-up capital, in favor of its shareholders. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to the bank, its paid-up capital has reached Rs 9.55 billion after issuing the bonus share. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank’s total deposit and total loan have reached Rs 84.40 billion and Rs 76.98 billion respectively as of mid-April 2019. During the review period, the bank said it earned an operating profit of Rs 1.73 billion and net profit of Rs 1.23 billion, respectively. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> The bank has been providing its services with a network of 107 branches, 93 ATMs, three extensions counters and eight branchless banking facilities across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-30', 'modified' => '2019-09-30', 'keywords' => '', 'description' => '', 'sortorder' => '11244', 'image' => '20190930124022_asaa.jpg', 'article_date' => '2019-09-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 3 => array( 'Article' => array( 'id' => '11476', 'article_category_id' => '218', 'title' => 'Mega Bank to Acquire Gandaki Bikas Bank', 'sub_title' => '', 'summary' => 'September 26: Mega Bank has reached an understanding with Gandaki Bikas Bank for the acquisition of the latter. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">September 26: Mega Bank has reached an understanding with Gandaki Bikas Bank for the acquisition of the latter. Chairman of Mega Bank Bhoj Bahadur Shah and Chairman of Gandaki Bikas Bank Sushil Gauchan signed an agreement to this effect amid a function on Wednesday, September 25.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">With this acquisition, Mega Bank will become one of the largest A-class commercial banks of Nepal with an increased capital, business and branches, said the bank’s chairman Shah. He further informed that the two banks will jointly write a letter to the central bank to allow share transaction of Gandaki Bikas Bank.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">After the acquisition, the new entity’s total deposits will increase to 112 billion while the loan provided by the bank will be Rs 98 billion. The bank will have a total of 191 branches after the acquisition.</span></span><strong><u> </u></strong></span></span></p> ', 'published' => true, 'created' => '2019-09-26', 'modified' => '2019-09-26', 'keywords' => '', 'description' => '', 'sortorder' => '11227', 'image' => '20190926122659_aa.jpg', 'article_date' => '2019-09-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 4 => array( 'Article' => array( 'id' => '11464', 'article_category_id' => '218', 'title' => 'Prabhu Bank Opens its Branch at Kurintar', 'sub_title' => '', 'summary' => 'September 25: Prabhu Bank has opened its branch at Kurinar of Ichyakamana Rural Municipality, Chitwan.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 25: Prabhu Bank has opened its branch at Kurinar of Ichyakamana Rural Municipality, Chitwan. Chairperson of the rural municipality Gita Kumari Gurung inaugurated the branch amid a function on Monday, September 23.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank believes the newly opened branch will benefit the locals and entrepreneurs of the area by providing modern banking service.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">At present, the bank has been providing its services through a network of 196 branches, 152 ATM outlets, 19 branchless banking units and 34 extension counters across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-25', 'modified' => '2019-09-25', 'keywords' => '', 'description' => '', 'sortorder' => '11214', 'image' => '20190925085906_PRVU_KUrintar.jpg', 'article_date' => '2019-09-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 5 => array( 'Article' => array( 'id' => '11440', 'article_category_id' => '218', 'title' => 'Standard Chartered gets Triple A Rating', 'sub_title' => '', 'summary' => 'September 20: ICRA Nepal, the first credit rating agency in Nepal, has assigned an issuer rating of ICRA NP issuer rating triple A to Standard Chartered Bank Nepal Limited.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 20: ICRA Nepal, the first credit rating agency in Nepal, has assigned an issuer rating of ICRA NP issuer rating triple A to Standard Chartered Bank Nepal Limited. The bank said in a statement that the rating is considered to have the highest degree of safety regarding timely servicing of financial obligations.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to the bank, such issuers carry the lowest credit risk. The issuer rating is only an opinion on the general creditworthiness of the rated entity and not specific to a particular debt instrument, the statement further said.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">“The rating assignment factors in the bank’s strong parentage (70 percent subsidiary of Standard Chartered Group1 ) along with the existence of a technical services agreement (TSA) with SCB-UK. This ensures strong parental support, the Group’s oversight and deployment of best practices in SCB Nepal’s operations,” the statement said.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The rating is further supported by the bank’s healthy deposit profile with high share of low-cost current and savings accounts (CASA, at 55 percent in mid-July 2019 compared to 43 percent for the industry).</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">This, according to the bank, reflects the lowest cost of funds among private sector players (4.17 percent for FY2019, 6.48 percent for the industry) and hence remains its key competitive strength.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank said ICRA Nepal also takes comfort from the bank’s strong risk management practices and underwriting controls, resulting in superior asset quality indicators with low nonperforming loans (NPLs) of 0.15 percent as of mid-July 2019 .</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank’s established track record (since 1987) and healthy capitalisation profile (capital to risk weighted assets ratio - CRAR of 20% as of mid-July 2019) also support the rating action.</span></span></p> ', 'published' => true, 'created' => '2019-09-20', 'modified' => '2019-09-20', 'keywords' => '', 'description' => '', 'sortorder' => '11190', 'image' => '20190920023137_screen - Copy.jpg', 'article_date' => '2019-09-20 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 6 => array( 'Article' => array( 'id' => '11384', 'article_category_id' => '218', 'title' => 'Laxmi Bank’s 112thBranch in Chapagaun, Lalitpur', 'sub_title' => '', 'summary' => 'September 11: Laxmi Bank has extended its network to a total of 112 branches with the inauguration of a new branch at Chapagaun in Lalitpur on Tuesday, September 10.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">September 11: Laxmi Bank has extended its network to a total of 112 branches with the inauguration of a new branch at Chapagaun in Lalitpur on Tuesday, September 10. According to the bank, this new branch will offer full range of retail banking services including locker service customized to meet the needs of individuals and small businesses.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">With the above new addition, Laxmi Bank’s network now includes 112 branches across 48 districts, two extension counters and four hospital service counters, 136ATMs, 2,500 remittance agents and 58 branchless banking agents spread across the country.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The bank claimed it is rapidly expanding to newer and underserved markets with the aim of fulfilling the growing demand for professional financial services such as innovative saving accounts, term deposits, home and auto loans, small business loans, microfinance, insurance etc. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-11', 'modified' => '2019-09-11', 'keywords' => '', 'description' => '', 'sortorder' => '11134', 'image' => '20190911015537_IMG_20190909_104353.jpg', 'article_date' => '2019-09-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 7 => array( 'Article' => array( 'id' => '11365', 'article_category_id' => '218', 'title' => 'Everest Bank customers to get discount at Hotel Snow Peak', 'sub_title' => '', 'summary' => 'September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement issued by the bank, customers will get a discount of 10 percent on accommodation (all types of rooms) and food and beverages. As per the agreement, the customers will get the discount if they show the debit or credit card of Everest Bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Currently, the bank has been providing its service through a network of 94 branches, 28 revenue collection counters, and 120 ATMs.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-08', 'modified' => '2019-09-08', 'keywords' => '', 'description' => '', 'sortorder' => '11115', 'image' => '20190908025510_everest.jpg', 'article_date' => '2019-09-08 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 8 => array( 'Article' => array( 'id' => '11364', 'article_category_id' => '218', 'title' => 'Everest Bank customers to get discount at Hotel Snow Peak', 'sub_title' => '', 'summary' => 'September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement issued by the bank, customers will get a discount of 10 percent on accommodation (all types of rooms) and food and beverages. As per the agreement, the customers will get the discount if they show the debit or credit card of Everest Bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Currently, the bank has been providing its service through a network of 94 branches, 28 revenue collection counters, and 120 ATMs.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-08', 'modified' => '2019-09-08', 'keywords' => '', 'description' => '', 'sortorder' => '11114', 'image' => '20190908025456_everest.jpg', 'article_date' => '2019-09-08 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 9 => array( 'Article' => array( 'id' => '11345', 'article_category_id' => '218', 'title' => 'Global IME Bank launches New scheme for Women', 'sub_title' => '', 'summary' => 'September 4: Global IME Bank has launched a new festive scheme targeting women customers on the occasion of Teej.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 4: Global IME Bank has launched a new festive scheme targeting women customers on the occasion of Teej.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement released by the company, those who opt to open the Nari Savings account will receive free mobile banking, Viber banking, Internet banking, ABBS, Visa debit and credit card issuance, and locker service for a year.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Additionally, the company claims that the bank will provide a 0.25 percent discount on their loan service charges for customers who already have Nari Savings Account and want to get a loan from the bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The scheme will continue for a month, the statement added.</span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-09-04', 'modified' => '2019-09-04', 'keywords' => '', 'description' => '', 'sortorder' => '11095', 'image' => '20190904024438_fb-nari-bachat-a.jpg', 'article_date' => '2019-09-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 10 => array( 'Article' => array( 'id' => '10866', 'article_category_id' => '218', 'title' => 'NIBL Organises Blood Donation Programme', 'sub_title' => '', 'summary' => 'June 9: Nepal Investment Bank Ltd (NIBL) organised a blood donation programme to mark the 25th anniversary of its Birgunj branch on Saturday, June 8.', 'content' => '<p> June 9: Nepal Investment Bank Ltd (NIBL) organised a blood donation programme to mark the 25<sup>th</sup> anniversary of its Birgunj branch on Saturday, June 8.</p> <p> Altogether 53 people including the bank’s staff donated blood during the programme, said Roshan Bhakta Shrestha, manager of the Birgunj branch.</p> <p> The programme was organised with technical support from Nepal Red Cross Society and Blood Donors Association, said the bank.</p> <p> </p> ', 'published' => true, 'created' => '2019-06-09', 'modified' => '2019-06-09', 'keywords' => '', 'description' => '', 'sortorder' => '10617', 'image' => '20190609034051_IMG_20190608_132704.jpg', 'article_date' => '2019-06-09 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 11 => array( 'Article' => array( 'id' => '10828', 'article_category_id' => '218', 'title' => 'NCHL Signs Partnership Agreement with UKaid Sakchyam Access to Finance', 'sub_title' => '', 'summary' => 'June 4: Nepal Clearing House Limited (NCHL) has signed an agreement with UKaid’s Sakchyam - Access to Finance Programme (Sakchyam) to “promote connectIPS e-Payments, establish National Payments Interface (NPI) and extend Settlement Guarantee Fund (SGF)”.', 'content' => '<p> June 4: Nepal Clearing House Limited (NCHL) has signed an agreement with UKaid’s Sakchyam - Access to Finance Programme (Sakchyam) to “promote connectIPS e-Payments, establish National Payments Interface (NPI) and extend Settlement Guarantee Fund (SGF)”.</p> <p> The partnership was officially announced on June 3 following the signing and exchanging of agreements between Neelesh Man Singh Pradhan, chief executive officer of NCHL and Nirmal Dahal, team leader of Sakchyam.</p> <p> According to a joint statement issued by the signatories, the event was organized in the presence of the executive directors of Nepal Rastra Bank (NRB), other officials of NRB and presidents of Nepal Bankers Association, Development Banks Association and Nepal Financial Institutions Association.</p> <p> The statement further said that the partnership aims to extend payment infrastructure for an integrated mobile and web-based payment services such that it will support in establishing an efficient and reliable digital payment ecosystem in Nepal.</p> <p> The three major ventures of this project include promotion, awareness and training of connectIPS e-Payment system; development and rollout of National Payments Interface (NPI); and extension of Settlement Guarantee Fund (SGF).</p> <p> The above-mentioned ventures will cater to a variety of beneficiary groups, while the collective beneficiaries of the project include bank customers throughout Nepal, banks and financial institutions (BFIs), government/semi-government organizations, large corporates, SMEs, PSP/PSOs, etc.</p> <p> “The project will also support the government’s policy towards creating a digital economy with increased P2P, P2G, G2P, C2B and B2C payments on a countrywide scale,” the statement added.</p> <p> Sakchyam Access to Finance is an UKaid-funded programme as a part of an agreement between the governments of Nepal and the UK. It is being implemented by Louis Berger for DFID Nepal, in partnership with local and international institutions.</p> <p> NCHL is promoted by Nepal Rastra Bank and banks and financial institutions to establish multiple national payments infrastructures of which it has been operating NCHL-ECC, NCHL-IPS and connectIPS e-Payment systems with participation from the majority of the BFIs and few non-bank institutions. </p> <p> </p> ', 'published' => true, 'created' => '2019-06-04', 'modified' => '2019-06-04', 'keywords' => '', 'description' => '', 'sortorder' => '10579', 'image' => '20190604015015_nchl.jpg', 'article_date' => '2019-06-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 12 => array( 'Article' => array( 'id' => '10818', 'article_category_id' => '218', 'title' => 'Laxmi Bank’s Cricket World Cup Offer', 'sub_title' => '', 'summary' => 'June 3: Laxmi Bank in association with F1 Soft has launched a promotion campaign for its digital account opening platform “Ctrl O”. ', 'content' => '<p> June 3: Laxmi Bank in association with F1 Soft has launched a promotion campaign for its digital account opening platform “Ctrl O”. Customers opening savings accounts during the ongoing ICC Cricket World Cup 2019 through the digital platform will be eligible to earn Rs 500 mobile balance top up on first mobile money transaction along with free complete e-banking package, according to the bank. The bank said in a statement that the customers can access the digital application from the bank’s website and will need to visit the branch only once to complete the process.</p> <p> Laxmi Bank said it strongly encourages paperless account opening process supported by a wide range of digital transaction channels.</p> <p> “We expect the World Cup campaign based on Ctrl O digital account opening platform to make a small contribution to a cleaner, greener world,” the statement said, adding that the bank continues to adopt technology, process, and products which result in substantial reduction of its carbon footprint to develop a responsible, sustainable business.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-06-03', 'modified' => '2019-06-03', 'keywords' => '', 'description' => '', 'sortorder' => '10569', 'image' => '20190603010626_laxmi.jpg', 'article_date' => '2019-06-03 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 13 => array( 'Article' => array( 'id' => '10788', 'article_category_id' => '218', 'title' => 'Laxmi Bank Opens Branch in Melamchi', 'sub_title' => '', 'summary' => 'May 29: Laxmi Bank has expanded its network with an addition of a branch in Melamchi of Sindhupalchowk district.', 'content' => '<p> May 29: Laxmi Bank has expanded its network with an addition of a branch in Melamchi of Sindhupalchowk district. Laxmi Bank said in a statement that the newly opened branch is the 106<sup>th</sup> branch of the bank.</p> <p> “This new branch will offer full range of retail banking services customized to meet the needs of individuals and small businesses,” the statement said. </p> <p> With the opening of the new branch, Laxmi Bank’s network now includes 106 branches across 47 districts, two extension counters and four hospital service counters, 128ATMs, 2500 remittance agents and 58 branchless banking agents spread across the country.</p> <p> The bank said it is rapidly expanding to newer and underserved markets with the aim of serving the growing demand for professional financial services such as innovative saving accounts, term deposits, home and auto loans, small business loans, microfinance, insurance etc.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-05-29', 'modified' => '2019-05-29', 'keywords' => '', 'description' => '', 'sortorder' => '10539', 'image' => '20190529040636_laxmi.jpg', 'article_date' => '2019-05-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 14 => array( 'Article' => array( 'id' => '10780', 'article_category_id' => '218', 'title' => 'Kumari Bank Inaugurates ATM in Everest Region', 'sub_title' => '', 'summary' => 'May 28: Kumari Bank Limited has launched its ATM service en route to at the base of Mt Everest. ', 'content' => '<p> May 28: Kumari Bank Limited has launched its ATM service en route to at the base of Mt Everest. Issuing a statement, the bank said that the ATM located at Dingboche of Khumbu Pasang Lhamu Rural Municipality- 4 shall facilitate the mountaineers, tourists as well as the locals in their day-to-day financial transactions at an altitude of 4,410 meters above the sea level.</p> <p> The ATM was jointly inaugurated by Manish Timilsina, deputy general manager of Kumari Bank Limited and Phu Tashi Sherpa, the senior-most citizen of the area.</p> <p> With the launch of this ATM at Dingboche, Solukhumbu, Kumari Bank claimed that it has become the only bank in the country to render its ATM services to the customers from the highest point.</p> <p> “In this context, introduction of this ATM outlet marks the inception of the bank’s stride towards unprecedented heights of banking outreach,” the statement added.</p> <p> The bank has been providing its services across the country via a network of 90 branches, 84 ATMs, three extension counters as well as three branchless banking units. </p> <p> </p> ', 'published' => true, 'created' => '2019-05-28', 'modified' => '2019-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '10531', 'image' => '20190528031335_IMG-20190526-WA0001.jpg', 'article_date' => '2019-05-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '11511', 'article_category_id' => '218', 'title' => 'Citizens Bank Starts ‘Express’ Internet Banking Services', 'sub_title' => '', 'summary' => 'October 3: Citizens Bank International has started “express” internet banking service. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">October 3: Citizens Bank International has started “express” internet banking service. Under this service, the offers inter-banking cash transaction, payment of electricity, cable and internet bills. Similarly, one can make payment for flight tickets as well through this service.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Prior to this, internet banking of the bank included checking of remittance, payment of utility bills like telephone, internet, mobile, wallet, and credit card among others.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">At present, the bank has been providing its services through 82 branches and 79 ATM counters across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-10-03', 'modified' => '2019-10-03', 'keywords' => '', 'description' => '', 'sortorder' => '11261', 'image' => '20191003011419_aaaadfg.jpg', 'article_date' => '2019-10-03 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 1 => array( 'Article' => array( 'id' => '11495', 'article_category_id' => '218', 'title' => 'NIBL Launches Secure Payment Gateway', 'sub_title' => '', 'summary' => 'September 30: Nepal Investment Bank Limited launched its payment gateway on the occasion of Ghatasthapana on Sunday with the aim of facilitating what the bank said is the safest and most convenient online transactions for debit/credit Visa cardholders.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">September 30: Nepal Investment Bank Limited launched its payment gateway on the occasion of Ghatasthapana on Sunday with the aim of facilitating what the bank said is the safest and most convenient online transactions for debit/credit Visa cardholders.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">According to the bank, the payment gateway facilitates real-time payment transaction by the transfer of information between a merchant's payment portal (website, etc), the acquiring bank, card interchanges like Visa, and the issuing bank.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The bank claimed that the transaction data is protected using a highly secured encryption and other multiple safety features ensuring reliability on the systems for the users. Merchants can now sell goods and services all over the world whereas the cardholders can shop online 24/7 on e-commerce sites for purchasing goods and services securely, the bank said in a statement.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The statement added that NIBL has been aiming to take the Nepalese banking to global standards with the development of a sound, stable and reliable system for which the payment gateway is a big step forward. Further, NIBL has announced a Visa cash-back offer of up to 25 percent for online transactions, valid on select merchants on the occasion of the launch.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">NIBL has been catering to the needs of its customer from 82 branches, 122 ATMs, 15 extension counters, 10 revenue collection counters and 55 branchless banking units across the country. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-30', 'modified' => '2019-09-30', 'keywords' => '', 'description' => '', 'sortorder' => '11245', 'image' => '20190930124855_Clipboard01.jpg', 'article_date' => '2019-09-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 2 => array( 'Article' => array( 'id' => '11494', 'article_category_id' => '218', 'title' => 'Kumari Bank convenes its 19th AGM', 'sub_title' => '', 'summary' => 'September 30: Kumari Bank Limited convened its 19th Annual General Meeting (AGM) at Naxal Banquet, Kathmandu on September 28.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 30: Kumari Bank Limited convened its 19th Annual General Meeting (AGM) at Naxal Banquet, Kathmandu on September 28. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank said in a statement that it issued 10 percent bonus shares and 0.526 percent cash-dividend to offset the levied tax on the issued bonus-dividend for the FY 2075/76 on its total paid-up capital, in favor of its shareholders. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to the bank, its paid-up capital has reached Rs 9.55 billion after issuing the bonus share. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank’s total deposit and total loan have reached Rs 84.40 billion and Rs 76.98 billion respectively as of mid-April 2019. During the review period, the bank said it earned an operating profit of Rs 1.73 billion and net profit of Rs 1.23 billion, respectively. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> The bank has been providing its services with a network of 107 branches, 93 ATMs, three extensions counters and eight branchless banking facilities across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-30', 'modified' => '2019-09-30', 'keywords' => '', 'description' => '', 'sortorder' => '11244', 'image' => '20190930124022_asaa.jpg', 'article_date' => '2019-09-30 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 3 => array( 'Article' => array( 'id' => '11476', 'article_category_id' => '218', 'title' => 'Mega Bank to Acquire Gandaki Bikas Bank', 'sub_title' => '', 'summary' => 'September 26: Mega Bank has reached an understanding with Gandaki Bikas Bank for the acquisition of the latter. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">September 26: Mega Bank has reached an understanding with Gandaki Bikas Bank for the acquisition of the latter. Chairman of Mega Bank Bhoj Bahadur Shah and Chairman of Gandaki Bikas Bank Sushil Gauchan signed an agreement to this effect amid a function on Wednesday, September 25.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">With this acquisition, Mega Bank will become one of the largest A-class commercial banks of Nepal with an increased capital, business and branches, said the bank’s chairman Shah. He further informed that the two banks will jointly write a letter to the central bank to allow share transaction of Gandaki Bikas Bank.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">After the acquisition, the new entity’s total deposits will increase to 112 billion while the loan provided by the bank will be Rs 98 billion. The bank will have a total of 191 branches after the acquisition.</span></span><strong><u> </u></strong></span></span></p> ', 'published' => true, 'created' => '2019-09-26', 'modified' => '2019-09-26', 'keywords' => '', 'description' => '', 'sortorder' => '11227', 'image' => '20190926122659_aa.jpg', 'article_date' => '2019-09-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 4 => array( 'Article' => array( 'id' => '11464', 'article_category_id' => '218', 'title' => 'Prabhu Bank Opens its Branch at Kurintar', 'sub_title' => '', 'summary' => 'September 25: Prabhu Bank has opened its branch at Kurinar of Ichyakamana Rural Municipality, Chitwan.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 25: Prabhu Bank has opened its branch at Kurinar of Ichyakamana Rural Municipality, Chitwan. Chairperson of the rural municipality Gita Kumari Gurung inaugurated the branch amid a function on Monday, September 23.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank believes the newly opened branch will benefit the locals and entrepreneurs of the area by providing modern banking service.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">At present, the bank has been providing its services through a network of 196 branches, 152 ATM outlets, 19 branchless banking units and 34 extension counters across the country.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-25', 'modified' => '2019-09-25', 'keywords' => '', 'description' => '', 'sortorder' => '11214', 'image' => '20190925085906_PRVU_KUrintar.jpg', 'article_date' => '2019-09-25 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 5 => array( 'Article' => array( 'id' => '11440', 'article_category_id' => '218', 'title' => 'Standard Chartered gets Triple A Rating', 'sub_title' => '', 'summary' => 'September 20: ICRA Nepal, the first credit rating agency in Nepal, has assigned an issuer rating of ICRA NP issuer rating triple A to Standard Chartered Bank Nepal Limited.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 20: ICRA Nepal, the first credit rating agency in Nepal, has assigned an issuer rating of ICRA NP issuer rating triple A to Standard Chartered Bank Nepal Limited. The bank said in a statement that the rating is considered to have the highest degree of safety regarding timely servicing of financial obligations.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to the bank, such issuers carry the lowest credit risk. The issuer rating is only an opinion on the general creditworthiness of the rated entity and not specific to a particular debt instrument, the statement further said.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">“The rating assignment factors in the bank’s strong parentage (70 percent subsidiary of Standard Chartered Group1 ) along with the existence of a technical services agreement (TSA) with SCB-UK. This ensures strong parental support, the Group’s oversight and deployment of best practices in SCB Nepal’s operations,” the statement said.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The rating is further supported by the bank’s healthy deposit profile with high share of low-cost current and savings accounts (CASA, at 55 percent in mid-July 2019 compared to 43 percent for the industry).</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">This, according to the bank, reflects the lowest cost of funds among private sector players (4.17 percent for FY2019, 6.48 percent for the industry) and hence remains its key competitive strength.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank said ICRA Nepal also takes comfort from the bank’s strong risk management practices and underwriting controls, resulting in superior asset quality indicators with low nonperforming loans (NPLs) of 0.15 percent as of mid-July 2019 .</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The bank’s established track record (since 1987) and healthy capitalisation profile (capital to risk weighted assets ratio - CRAR of 20% as of mid-July 2019) also support the rating action.</span></span></p> ', 'published' => true, 'created' => '2019-09-20', 'modified' => '2019-09-20', 'keywords' => '', 'description' => '', 'sortorder' => '11190', 'image' => '20190920023137_screen - Copy.jpg', 'article_date' => '2019-09-20 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 6 => array( 'Article' => array( 'id' => '11384', 'article_category_id' => '218', 'title' => 'Laxmi Bank’s 112thBranch in Chapagaun, Lalitpur', 'sub_title' => '', 'summary' => 'September 11: Laxmi Bank has extended its network to a total of 112 branches with the inauguration of a new branch at Chapagaun in Lalitpur on Tuesday, September 10.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">September 11: Laxmi Bank has extended its network to a total of 112 branches with the inauguration of a new branch at Chapagaun in Lalitpur on Tuesday, September 10. According to the bank, this new branch will offer full range of retail banking services including locker service customized to meet the needs of individuals and small businesses.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">With the above new addition, Laxmi Bank’s network now includes 112 branches across 48 districts, two extension counters and four hospital service counters, 136ATMs, 2,500 remittance agents and 58 branchless banking agents spread across the country.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif">The bank claimed it is rapidly expanding to newer and underserved markets with the aim of fulfilling the growing demand for professional financial services such as innovative saving accounts, term deposits, home and auto loans, small business loans, microfinance, insurance etc. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-11', 'modified' => '2019-09-11', 'keywords' => '', 'description' => '', 'sortorder' => '11134', 'image' => '20190911015537_IMG_20190909_104353.jpg', 'article_date' => '2019-09-11 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 7 => array( 'Article' => array( 'id' => '11365', 'article_category_id' => '218', 'title' => 'Everest Bank customers to get discount at Hotel Snow Peak', 'sub_title' => '', 'summary' => 'September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement issued by the bank, customers will get a discount of 10 percent on accommodation (all types of rooms) and food and beverages. As per the agreement, the customers will get the discount if they show the debit or credit card of Everest Bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Currently, the bank has been providing its service through a network of 94 branches, 28 revenue collection counters, and 120 ATMs.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-08', 'modified' => '2019-09-08', 'keywords' => '', 'description' => '', 'sortorder' => '11115', 'image' => '20190908025510_everest.jpg', 'article_date' => '2019-09-08 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 8 => array( 'Article' => array( 'id' => '11364', 'article_category_id' => '218', 'title' => 'Everest Bank customers to get discount at Hotel Snow Peak', 'sub_title' => '', 'summary' => 'September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 8: Everest Bank Limited has partnered up with Hotel Snow Peak, Pokhara to provide discounts/special packages to its customers.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement issued by the bank, customers will get a discount of 10 percent on accommodation (all types of rooms) and food and beverages. As per the agreement, the customers will get the discount if they show the debit or credit card of Everest Bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Currently, the bank has been providing its service through a network of 94 branches, 28 revenue collection counters, and 120 ATMs.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2019-09-08', 'modified' => '2019-09-08', 'keywords' => '', 'description' => '', 'sortorder' => '11114', 'image' => '20190908025456_everest.jpg', 'article_date' => '2019-09-08 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 9 => array( 'Article' => array( 'id' => '11345', 'article_category_id' => '218', 'title' => 'Global IME Bank launches New scheme for Women', 'sub_title' => '', 'summary' => 'September 4: Global IME Bank has launched a new festive scheme targeting women customers on the occasion of Teej.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">September 4: Global IME Bank has launched a new festive scheme targeting women customers on the occasion of Teej.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">According to a press statement released by the company, those who opt to open the Nari Savings account will receive free mobile banking, Viber banking, Internet banking, ABBS, Visa debit and credit card issuance, and locker service for a year.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">Additionally, the company claims that the bank will provide a 0.25 percent discount on their loan service charges for customers who already have Nari Savings Account and want to get a loan from the bank.</span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif">The scheme will continue for a month, the statement added.</span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-09-04', 'modified' => '2019-09-04', 'keywords' => '', 'description' => '', 'sortorder' => '11095', 'image' => '20190904024438_fb-nari-bachat-a.jpg', 'article_date' => '2019-09-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 10 => array( 'Article' => array( 'id' => '10866', 'article_category_id' => '218', 'title' => 'NIBL Organises Blood Donation Programme', 'sub_title' => '', 'summary' => 'June 9: Nepal Investment Bank Ltd (NIBL) organised a blood donation programme to mark the 25th anniversary of its Birgunj branch on Saturday, June 8.', 'content' => '<p> June 9: Nepal Investment Bank Ltd (NIBL) organised a blood donation programme to mark the 25<sup>th</sup> anniversary of its Birgunj branch on Saturday, June 8.</p> <p> Altogether 53 people including the bank’s staff donated blood during the programme, said Roshan Bhakta Shrestha, manager of the Birgunj branch.</p> <p> The programme was organised with technical support from Nepal Red Cross Society and Blood Donors Association, said the bank.</p> <p> </p> ', 'published' => true, 'created' => '2019-06-09', 'modified' => '2019-06-09', 'keywords' => '', 'description' => '', 'sortorder' => '10617', 'image' => '20190609034051_IMG_20190608_132704.jpg', 'article_date' => '2019-06-09 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 11 => array( 'Article' => array( 'id' => '10828', 'article_category_id' => '218', 'title' => 'NCHL Signs Partnership Agreement with UKaid Sakchyam Access to Finance', 'sub_title' => '', 'summary' => 'June 4: Nepal Clearing House Limited (NCHL) has signed an agreement with UKaid’s Sakchyam - Access to Finance Programme (Sakchyam) to “promote connectIPS e-Payments, establish National Payments Interface (NPI) and extend Settlement Guarantee Fund (SGF)”.', 'content' => '<p> June 4: Nepal Clearing House Limited (NCHL) has signed an agreement with UKaid’s Sakchyam - Access to Finance Programme (Sakchyam) to “promote connectIPS e-Payments, establish National Payments Interface (NPI) and extend Settlement Guarantee Fund (SGF)”.</p> <p> The partnership was officially announced on June 3 following the signing and exchanging of agreements between Neelesh Man Singh Pradhan, chief executive officer of NCHL and Nirmal Dahal, team leader of Sakchyam.</p> <p> According to a joint statement issued by the signatories, the event was organized in the presence of the executive directors of Nepal Rastra Bank (NRB), other officials of NRB and presidents of Nepal Bankers Association, Development Banks Association and Nepal Financial Institutions Association.</p> <p> The statement further said that the partnership aims to extend payment infrastructure for an integrated mobile and web-based payment services such that it will support in establishing an efficient and reliable digital payment ecosystem in Nepal.</p> <p> The three major ventures of this project include promotion, awareness and training of connectIPS e-Payment system; development and rollout of National Payments Interface (NPI); and extension of Settlement Guarantee Fund (SGF).</p> <p> The above-mentioned ventures will cater to a variety of beneficiary groups, while the collective beneficiaries of the project include bank customers throughout Nepal, banks and financial institutions (BFIs), government/semi-government organizations, large corporates, SMEs, PSP/PSOs, etc.</p> <p> “The project will also support the government’s policy towards creating a digital economy with increased P2P, P2G, G2P, C2B and B2C payments on a countrywide scale,” the statement added.</p> <p> Sakchyam Access to Finance is an UKaid-funded programme as a part of an agreement between the governments of Nepal and the UK. It is being implemented by Louis Berger for DFID Nepal, in partnership with local and international institutions.</p> <p> NCHL is promoted by Nepal Rastra Bank and banks and financial institutions to establish multiple national payments infrastructures of which it has been operating NCHL-ECC, NCHL-IPS and connectIPS e-Payment systems with participation from the majority of the BFIs and few non-bank institutions. </p> <p> </p> ', 'published' => true, 'created' => '2019-06-04', 'modified' => '2019-06-04', 'keywords' => '', 'description' => '', 'sortorder' => '10579', 'image' => '20190604015015_nchl.jpg', 'article_date' => '2019-06-04 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 12 => array( 'Article' => array( 'id' => '10818', 'article_category_id' => '218', 'title' => 'Laxmi Bank’s Cricket World Cup Offer', 'sub_title' => '', 'summary' => 'June 3: Laxmi Bank in association with F1 Soft has launched a promotion campaign for its digital account opening platform “Ctrl O”. ', 'content' => '<p> June 3: Laxmi Bank in association with F1 Soft has launched a promotion campaign for its digital account opening platform “Ctrl O”. Customers opening savings accounts during the ongoing ICC Cricket World Cup 2019 through the digital platform will be eligible to earn Rs 500 mobile balance top up on first mobile money transaction along with free complete e-banking package, according to the bank. The bank said in a statement that the customers can access the digital application from the bank’s website and will need to visit the branch only once to complete the process.</p> <p> Laxmi Bank said it strongly encourages paperless account opening process supported by a wide range of digital transaction channels.</p> <p> “We expect the World Cup campaign based on Ctrl O digital account opening platform to make a small contribution to a cleaner, greener world,” the statement said, adding that the bank continues to adopt technology, process, and products which result in substantial reduction of its carbon footprint to develop a responsible, sustainable business.</p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-06-03', 'modified' => '2019-06-03', 'keywords' => '', 'description' => '', 'sortorder' => '10569', 'image' => '20190603010626_laxmi.jpg', 'article_date' => '2019-06-03 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 13 => array( 'Article' => array( 'id' => '10788', 'article_category_id' => '218', 'title' => 'Laxmi Bank Opens Branch in Melamchi', 'sub_title' => '', 'summary' => 'May 29: Laxmi Bank has expanded its network with an addition of a branch in Melamchi of Sindhupalchowk district.', 'content' => '<p> May 29: Laxmi Bank has expanded its network with an addition of a branch in Melamchi of Sindhupalchowk district. Laxmi Bank said in a statement that the newly opened branch is the 106<sup>th</sup> branch of the bank.</p> <p> “This new branch will offer full range of retail banking services customized to meet the needs of individuals and small businesses,” the statement said. </p> <p> With the opening of the new branch, Laxmi Bank’s network now includes 106 branches across 47 districts, two extension counters and four hospital service counters, 128ATMs, 2500 remittance agents and 58 branchless banking agents spread across the country.</p> <p> The bank said it is rapidly expanding to newer and underserved markets with the aim of serving the growing demand for professional financial services such as innovative saving accounts, term deposits, home and auto loans, small business loans, microfinance, insurance etc.</p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2019-05-29', 'modified' => '2019-05-29', 'keywords' => '', 'description' => '', 'sortorder' => '10539', 'image' => '20190529040636_laxmi.jpg', 'article_date' => '2019-05-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ), (int) 14 => array( 'Article' => array( 'id' => '10780', 'article_category_id' => '218', 'title' => 'Kumari Bank Inaugurates ATM in Everest Region', 'sub_title' => '', 'summary' => 'May 28: Kumari Bank Limited has launched its ATM service en route to at the base of Mt Everest. ', 'content' => '<p> May 28: Kumari Bank Limited has launched its ATM service en route to at the base of Mt Everest. Issuing a statement, the bank said that the ATM located at Dingboche of Khumbu Pasang Lhamu Rural Municipality- 4 shall facilitate the mountaineers, tourists as well as the locals in their day-to-day financial transactions at an altitude of 4,410 meters above the sea level.</p> <p> The ATM was jointly inaugurated by Manish Timilsina, deputy general manager of Kumari Bank Limited and Phu Tashi Sherpa, the senior-most citizen of the area.</p> <p> With the launch of this ATM at Dingboche, Solukhumbu, Kumari Bank claimed that it has become the only bank in the country to render its ATM services to the customers from the highest point.</p> <p> “In this context, introduction of this ATM outlet marks the inception of the bank’s stride towards unprecedented heights of banking outreach,” the statement added.</p> <p> The bank has been providing its services across the country via a network of 90 branches, 84 ATMs, three extension counters as well as three branchless banking units. </p> <p> </p> ', 'published' => true, 'created' => '2019-05-28', 'modified' => '2019-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '10531', 'image' => '20190528031335_IMG-20190526-WA0001.jpg', 'article_date' => '2019-05-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '20' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117