March 22: The head of the IMF called for countries to "preserve and strengthen" the independence of central banks in order to ensure price stability and support long-term economic…

March 22: The head of the IMF called for countries to "preserve and strengthen" the independence of central banks in order to ensure price stability and support long-term economic…

March 21: The World Happiness Report 2024 released on Wednesday has put Nepal in the 93rd position out of 143 countries included in the…

March 22: The eighth edition of the Newbiz Business Conclave and Awards is all set to kick off in the capital amid a grand function today…

The Nepal Stock Exchange (NEPSE) Index continued its downward trajectory, experiencing a loss of 15.37 points or 0.74%, closing at 2048.57 points on…

March 20: Parliamentarians have drawn the attention of the government towards the need of declaring a special situation and taking urgent measures for minimizing the increasing road accidents in the country.…

March 21: The Russian government has shown interest to invest in Nepal’s hydropower sector and chemical fertilizer plant.…

March 21: The Central Bureau of Investigation (CIB) has recorded a statement from the member of the House of Representatives, Binod Chaudhary, who is also a central member of the Nepali Congress, in a case of land embezzlement of the Bansbari Leather and Shoe Factory.…

March 21: The price of gold has set a new record on…

March 21: Rainfall is likely to occur in different parts of the country, including the Kathmandu Valley today due to the influence of the western low pressure system and the low pressure system around Bihar state of India.…

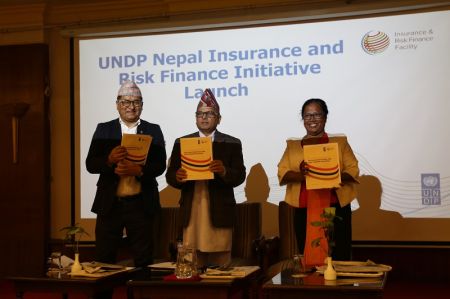

March 20: The United Nations Development Programme (UNDP) Nepal has launched the Insurance and Risk Finance Initiative for Nepal as a part of UNDP's global…

March 20: Finance Minister Barshaman Pun has said that the principles and priorities of the Appropriation Bill for the upcoming fiscal year 2024/25 shall be revised on the basis of necessity and also taking into consideration the Common Minimum Resolution adopted by the ruling…

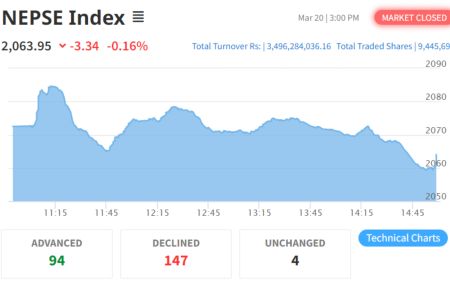

The Nepal Stock Exchange (NEPSE) Index witnessed a minimal loss of 3.34 points or 0.16%, closing at 2063.95 on the fourth trading day of the week on…

March 20: The Bank of Japan announced a seismic change in direction on Tuesday, hiking interest rates for the first time in 17…

March 20: The operating income of Buddha Air, a leading private sector airlines company of Nepal, has increased by three folds compared to the two fiscal years affected by the Covid-19…

March 20: One hundred and thirty-seven cottage and small industries have closed down in Kailali district due to the shortage of raw…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '20545', 'article_category_id' => '1', 'title' => 'IMF Chief says Countries 'must' Strengthen Central Bank Independence', 'sub_title' => '', 'summary' => 'March 22: The head of the IMF called for countries to "preserve and strengthen" the independence of central banks in order to ensure price stability and support long-term economic growth.', 'content' => '<p><span style="font-size:18px">March 22: The head of the IMF called for countries to "preserve and strengthen" the independence of central banks in order to ensure price stability and support long-term economic growth.</span></p> <p><span style="font-size:18px">In recent decades, many countries around the world have increased the autonomy of central banks, tasking them with fighting inflation and restoring stable prices. These actions have proven critical to the recent success many countries have had in fighting post-pandemic surges in inflation around the globe, International Monetary Fund managing director Kristalina Georgieva wrote in a blog post published Thursday.</span></p> <p><span style="font-size:18px">"Central bank independence matters for price stability -- and price stability matters for consistent long-term growth," she said. "Financial stability benefits the whole economy and reduces the risk that the central bank becomes reluctant to raise interest rates for fear of causing a financial meltdown," she added. </span></p> <p><span style="font-size:18px">Georgieva contrasted the years since the Covid-19 pandemic with the high inflationary period of the 1970s, arguing that a lack of central bank independence at that time meant politicians were often pressured to take actions that undermined price stability.</span></p> <p><span style="font-size:18px">"When central banks and governments each play their roles, we have seen better control of inflation, better outcomes in growth and employment, and lower financial stability risks," she said. "With such high stakes, we must preserve and strengthen central bank independence," she added. – AFP/RSS</span></p> ', 'published' => true, 'created' => '2024-03-22', 'modified' => '2024-03-22', 'keywords' => '', 'description' => '', 'sortorder' => '20272', 'image' => '20240322115750_41_2023-638383278984545533-454.jpg', 'article_date' => '2024-03-22 11:56:19', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '20544', 'article_category_id' => '1', 'title' => 'Nepal Ranks 93rd in World Happiness Index ', 'sub_title' => '', 'summary' => 'March 21: The World Happiness Report 2024 released on Wednesday has put Nepal in the 93rd position out of 143 countries included in the list.', 'content' => '<p><span style="font-size:16px">March 21: The World Happiness Report 2024 released on Wednesday has put Nepal in the 93rd position out of 143 countries included in the list. </span></p> <p><span style="font-size:16px">Finland ranks first with the highest score in the list for the seven consecutive years. </span></p> <p><span style="font-size:16px">"The top 10 countries have remained much the same since before COVID. Finland is still in top, with Denmark now very close, and all five Nordic countries in the top 10,” states the report prepared in partnership of Gallup, the Oxford Wellbeing Research Centre and the UN Sustainable Development Solutions Network. </span></p> <p><span style="font-size:16px">The report noted that there have been some changes in the rankings below the top 10, with the transition countries of Eastern Europe rising in happiness index (especially Chechnya, Lithuania and Slovenia). The United States and Germany have fallen to 23 and 24 in the rankings, added the report. </span></p> <p><span style="font-size:16px">The report stated that life satisfaction drops gradually from childhood through adolescence and into adulthood in most countries. Globally, young people aged 15-24 still report higher life satisfaction than older adults. </span></p> <p><span style="font-size:16px">"But this gap is narrowing in Western Europe and recently reversed in North America due to falling life satisfaction among the young. Conversely, in Sub-Saharan Africa life satisfaction has increased among the young." Overall, globally, young people aged 15-24 experienced improved life-satisfaction between 2006 and 2019, and stable life satisfaction since then. -- RSS</span></p> ', 'published' => true, 'created' => '2024-03-22', 'modified' => '2024-03-22', 'keywords' => '', 'description' => '', 'sortorder' => '20271', 'image' => '20240322111548_rewire-brain-for-joy-GettyImages-1473951447-94f61eb940fb4adf8c2c140d64f158d1.jpg', 'article_date' => '2024-03-22 11:12:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '20543', 'article_category_id' => '1', 'title' => 'Eighth Edition of Newbiz Business Conclave and Awards Today', 'sub_title' => '', 'summary' => 'March 22: The eighth edition of the Newbiz Business Conclave and Awards is all set to kick off in the capital amid a grand function today (Friday).', 'content' => '<p><span style="font-size:18px">March 22: The eighth edition of the Newbiz Business Conclave and Awards is all set to kick off in the capital amid a grand function today (Friday). Asian Paints is the title sponsor of the annual program. </span></p> <p><span style="font-size:18px">Apart from panel discussion, the event will see award distribution in various categories in recognition to the contributions made by the business sector. The panel discussion will delve on the topic of 'Business Opportunities in Difficult Times'. </span></p> <p><span style="font-size:18px">The speakers during the panel discussion will be Amlan Mukherjee, Managing Director of Unilever Nepal Limited, Anand Bagaria, Managing Director of Nimbus Holding Pvt Ltd and Sewa Pathak, Chief Executive Officer of Vianet Communications. The panel discussion will be facilitated by Ranjit Acharya, Chief Executive Officer of Prisma Advertising.</span></p> <p><span style="font-size:18px">Manab Majumdar, Senior Advisor to Federation of Indian Industry and Commerce (FICCI), will give a keynote speech during the program. </span></p> <p><span style="font-size:18px">Under the program, awards will be distributed in 11 different categories, including 10 institutional categories and one lifetime achievement award. According to the organizer, Lifetime Achievement Award will be given to a person who has contributed for a long time in the field of business. </span></p> <p><span style="font-size:18px">Similarly, awards will be distributed under the categories of 'Best Managed Company of the Year', 'Premium Hotel of the Year', 'Best Hospital of the Year', 'Best Managed Commercial Bank of the Year', 'Best Managed Development Bank of the Year', 'Best Managed Finance Company of the Year', 'Best Life Insurance Company of the Year', and 'Best Non-Life Insurance Company of the Year'. According to the organizers, a panel of independent jury comprising experts from various fields have selected the organizations and individuals who will receive the award. </span></p> <p><span style="font-size:18px">The selection was done after a rigorous and phase-wise evaluation. Other sponsors of the event are NIC Asia Bank, Tiago EV, Nabil Bank, National Life Insurance, Rastriya Banijya Bank, Asian Life Insurance, Nepal Insurance Authority, smartphone company MI, NLG Insurance, Prabhu Bank and Sonam Gear. The internet partner of the program is DishHome Fiber Net and the TV partner is Himalaya TV. Vogue Ad and Event Management is in charge of program management.</span></p> ', 'published' => true, 'created' => '2024-03-22', 'modified' => '2024-03-27', 'keywords' => '', 'description' => '', 'sortorder' => '20270', 'image' => '20240322103831_New Biz Awards 2_183405.jpeg', 'article_date' => '2024-03-22 10:36:48', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '20542', 'article_category_id' => '1', 'title' => 'NEPSE Registers Loss of 15.37 Points to Close at 2048.57', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) Index continued its downward trajectory, experiencing a loss of 15.37 points or 0.74%, closing at 2048.57 points on Thursday.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">March 21: The Nepal Stock Exchange (NEPSE) Index continued its downward trajectory, experiencing a loss of 15.37 points or 0.74%, closing at 2048.57 points on Thursday. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">During the today’s trading session, 315 scrips were traded through 52,317 transactions, resulting in a turnover of Rs 4.31 billion, with a total of 18,55,2705 shares changing hands.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Machhapuchhre Bank Promoter Share (MBLPO) dominated the turnover, amounting to Rs 1.21 billion. Meanwhile, Dhaulagiri Laghubitta Bittiya Sanstha Limited (DLBS) witnessed a 10% gain, hitting the positive circuit for the day.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Conversely, Buddha Bhumi Nepal Hydropower Company Limited (BNHC) suffered a 10% loss, closing at a market price of Rs 544 per share.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">In terms of sub-indices, all sectors closed in the red. The Microfinance Index recorded the highest loss at 1.32%, while Manufacturing and Processing experienced the least loss at 0.06%.</span></span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20269', 'image' => '20240321040620_collage (54).jpg', 'article_date' => '2024-03-21 16:05:14', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 4 => array( 'Article' => array( 'id' => '20541', 'article_category_id' => '1', 'title' => 'Lawmakers Tell Govt to Declare 'Special Situation' to Reduce Road Accidents ', 'sub_title' => '', 'summary' => 'March 20: Parliamentarians have drawn the attention of the government towards the need of declaring a special situation and taking urgent measures for minimizing the increasing road accidents in the country. ', 'content' => '<p><span style="font-size:16px">March 20: Parliamentarians have drawn the attention of the government towards the need of declaring a special situation and taking urgent measures for minimizing the increasing road accidents in the country. </span></p> <p><span style="font-size:16px">Speaking during the Urgent Time in the meeting of the National Assembly on Wednesday, they urged the government to pay attention to the issue of road safety. Lawmaker Bimala Ghimire drew the attention of the government towards the escalation in the number of road accidents over the years, calling for making arrangement for providing free medical treatment to the people injured in road accidents.</span></p> <p><span style="font-size:16px">"The increasing number of accidents day by day shows how risky our roadways are. Accidents are increasing due to various factors, including the poor road condition, recklessness driving, operation of old vehicles and heavy traffic," she pointed out and called on the government to carry out the health check of vehicles, improve the roads and provide training to drivers and their helpers. </span></p> <p><span style="font-size:16px">Lawmaker Jayanti Rai urged the government to bring a special plan aimed at mitigating road accidents, saying that road casualties are on an increasing trend. Krishna Bahadur Rokaya also drew the attention of the government on taking urgent steps to reduce road fatalities while Maya Prasad Sharma called on the government to make arrangements for safe road transportation by upgrading the roads. </span></p> <p><span style="font-size:16px">Lawmaker Mohammad Khalid said the loss of lives due to road accidents is staggering and urged government intervention in making road travel safer. Lawmaker Tula Prasad Bishwokarma urged the government to take immediate steps for minimizing road accidents. -- RSS</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20268', 'image' => '20240321014151_20231002025824_20230903105008_blank - Copy.jpg', 'article_date' => '2024-03-21 13:39:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '20539', 'article_category_id' => '1', 'title' => 'Russia Shows Interest in Investing in Nepal’s Hydropower Sector', 'sub_title' => '', 'summary' => 'March 21: The Russian government has shown interest to invest in Nepal’s hydropower sector and chemical fertilizer plant. ', 'content' => '<p><span style="font-size:18px">March 21: The Russian government has shown interest to invest in Nepal’s hydropower sector and chemical fertilizer plant. Russia's ambassador to Nepal, Aleksei Novikov, during a meeting with Finance Minister Bashaman Pun on Wednesday, said Russia was positive towards investing in the hydropower sector and fertilizer plant in Nepal. </span></p> <p><span style="font-size:18px">He said that Nepal, geopolitically, presents a highly potential and positive zone for the Russian investment. He made such remarks during his visit to congratulate newly-appointed Minister Pun at his office after the finance minister requested the Government of Russia to invest in Nepal's hydropower sector and chemical fertilizer industry. </span></p> <p><span style="font-size:18px">During the meeting, Minister Pun assured the Russia's ambassador that the government has guaranteed an international market for consumption of power generated in the country. </span></p> <p><span style="font-size:18px">“Nepal's hydropower sector is a suitable area for investment for the international community," Minister Pun said, adding that the government has adopted a policy to open a chemical fertilizer factory within the country. "If Russia is interested in investing, we are ready to enable an atmosphere towards this end," he said. </span></p> <p><span style="font-size:18px">The minister also urged the Russian ambassador to encourage more investors from his country to join the upcoming Nepal Investment Summit on April 28-29. </span></p> <p><span style="font-size:18px">In response, the ambassador welcomed the Minister's proposal, pledging to talk with investors in Russia about the matter. According to the ambassador, a delegation from the Russian Chamber of Commerce and Industry was supposed to visit Nepal on Thursday to assess the potential areas for investment through the Nepal Investment Summit. </span></p> <p><span style="font-size:18px">The delegation will engage in discussions with government officials, the representatives of Investment Board Nepal and the private sector.</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20267', 'image' => '20240321012728_hydro.jpg', 'article_date' => '2024-03-21 13:25:59', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '20538', 'article_category_id' => '1', 'title' => 'Police Record Statement of Billionaire Chaudhary on Bansbari Land Embezzlement Case', 'sub_title' => '', 'summary' => 'March 21: The Central Bureau of Investigation (CIB) has recorded a statement from the member of the House of Representatives, Binod Chaudhary, who is also a central member of the Nepali Congress, in a case of land embezzlement of the Bansbari Leather and Shoe Factory. ', 'content' => '<p><span style="font-size:18px">March 21: The Central Bureau of Investigation (CIB) has recorded a statement from the member of the House of Representatives, Binod Chaudhary, who is also a central member of the Nepali Congress, in a case of land embezzlement of the Bansbari Leather and Shoe Factory. </span></p> <p><span style="font-size:18px">The police took the statement on Thursday after informing lower house Speaker Devraj Ghimire through the Parliament Secretariat that the CIB has started an investigation against Chaudhary on the suspicion of his involvement in embezzling government land. </span></p> <p><span style="font-size:18px">CIB Chief Shyamlal Gyawali informed RSS that the police took Chaudhary’s statement at the District Public Prosecutor's Office. According to Additional Inspector General of Police Gyawali, Chaudhary’s statement was taken without arresting him as he was not in a position to run away and destroy evidence. </span></p> <p><span style="font-size:18px">Chaudhary made it clear that he was not involved in embezzlement of government land. While leaving the public prosecutor's office after giving the statement on Thursday, MP Choudhary said that he came to the public prosecutor's office to assist the investigation by giving verbal statement to help the police. </span></p> <p><span style="font-size:18px">"Being a responsible politician and entrepreneur, I came to help," Chaudhary said, He expressed regrets over politicizing the issue of Bansbari’s land which according to Chaudhary was of scrap value 42 years when it was privatized under public-private partnership model</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20266', 'image' => '20240321012521_bnd.jpg', 'article_date' => '2024-03-21 13:24:03', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '20536', 'article_category_id' => '1', 'title' => 'Price of Gold Sets another Record, Increases by Rs 2,600 Per Tola', 'sub_title' => '', 'summary' => 'March 21: The price of gold has set a new record on Thursday.', 'content' => '<p><span style="font-size:16px">March 21: The price of gold has set a new record on Thursday. </span></p> <p><span style="font-size:16px">According to the Federation of Nepal Gold and Silver Dealers Association, the price of gold increased by Rs 2,600 per tola (11.66 grams) on Thursday to reach an all-time high record. Gold, which was traded at Rs 125,200 per tola on Wednesday, is being traded at Rs 127,800 per tola on Thursday. </span></p> <p><span style="font-size:16px">Earlier, on March 12, the price of gold had set a record of Rs 126,000 per tola. Within nine days, the price of gold set a new record. </span></p> <p><span style="font-size:16px">The price of silver also reached an all-time high on Thursday. The price of silver, which was traded at Rs 1,520 per tola on Wednesday, increased to Rs 1,555 on Thursday. </span></p> <p><span style="font-size:16px">According to Mani Ratna Shakya, the former president of the Federation of Nepal Gold and Silver Dealers Federation, it is difficult to ascertain the exact reason for the fluctuation of price of gold in recent times. However, he said that there are some factors that influence the price of gold in the market. </span></p> <p><span style="font-size:16px">He remarked that the declining trust of investors in the American dollar, compounded by the ongoing Russia-Ukraine conflict and the Israel-Palestine conflict, is also a contributing factor.</span></p> <p><span style="font-size:16px">"Recently, the credibility of the dollar has decreased. Instead of dollars, other currencies such as Euro and Yuan are being used in foreign trade. As these currencies are not plentiful, they have been paid through gold, it seems that this is also a factor,” he said. </span></p> <p><span style="font-size:16px">He added that the banks lowering the interest rates on deposits has also affected the price of gold. He argued that the investors opted to invest in gold for better return after the banks reduced the interest rates.</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20265', 'image' => '20240321125317_gold newwww.jpg', 'article_date' => '2024-03-21 12:48:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '20540', 'article_category_id' => '1', 'title' => 'Rainfall Likely to Occur in Kathmandu this Afternoon ', 'sub_title' => '', 'summary' => 'March 21: Rainfall is likely to occur in different parts of the country, including the Kathmandu Valley today due to the influence of the western low pressure system and the low pressure system around Bihar state of India. ', 'content' => '<p><span style="font-size:16px">March 21: Rainfall is likely to occur in different parts of the country, including the Kathmandu Valley today due to the influence of the western low pressure system and the low pressure system around Bihar state of India. </span></p> <p><span style="font-size:16px">Meteorologist at the Weather Forecasting Division of the Department of Hydrology and Meteorology, Chiranjibi Bhetwal said the weather is partly cloudy throughout the country, including the Kathmandu Valley. </span></p> <p><span style="font-size:16px">Rain is likely to occur in Koshi, Madhes, Bagmati and Gandaki provinces this afternoon. There is a possibility of rain in Kathmandu today afternoon, he said. Some places in Koshi province are currently receiving sporadic rainfall. </span></p> <p><span style="font-size:16px">According to the division, the influence of the western low pressure system will remain active till Friday and it will have an impact in most parts of the country. </span></p> <p><span style="font-size:16px">Light to moderate rain is likely to occur at a few places of Koshi, Madhes and Bagmati provinces. Light snowfall is likely to occur at one or two places of the high hills and mountainous regions of Koshi, Bagmati and Gandaki provinces. </span></p> <p><span style="font-size:16px">The Weather Forecasting Division said there is a possibility of scattered rain accompanied by thunder and lightning at some places of the hill regions of Koshi, Bagmati and Gandaki provinces tonight. -- RSS</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20263', 'image' => '20240321013545_rsain.jpeg', 'article_date' => '2024-03-21 13:33:17', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '20535', 'article_category_id' => '1', 'title' => 'UNDP Launches Insurance and Risk Finance Initiative for Nepal ', 'sub_title' => '', 'summary' => 'March 20: The United Nations Development Programme (UNDP) Nepal has launched the Insurance and Risk Finance Initiative for Nepal as a part of UNDP's global initiative', 'content' => '<p><span style="font-size:18px">March 20: The United Nations Development Programme (UNDP) Nepal has launched the Insurance and Risk Finance Initiative for Nepal as a part of UNDP's global initiative. The Insurance and Risk Finance Facility (IRFF) is being implemented in over thirty countries. This initiative seeks to prioritize financial resilience by tapping into the benefits of insurance and risk financing mechanisms, the UNDP Nepal stated in a press release. </span></p> <p><span style="font-size:18px"> During the launching event on March 19, Revenue Secretary of the Ministry of Finance (MoF) Dr Ram Prasad Ghimire, Chief Executive Officer of the National Disaster Risk Reduction and Management Authority (NDRRMA) Anil Pokhrel, and UNDP's Resident Representative, Ayshanie Medagangoda-Labé, jointly unveiled the Country Diagnostic Report. </span></p> <p><span style="font-size:18px">The report states that Nepal's disaster landscape is impacted by earthquakes, floods, landslides, and droughts, which collectively have caused almost USD 7 billion in damages from 1980 to 2020. These disasters have affected the country's capacity to build financial resilience in the face of looming disasters. </span></p> <p><span style="font-size:18px">The Government of Nepal has spent Rs 50 billion (USD 0.4 billion) between 2012 and 2020 in disaster response and recovery. The expenditure data indicates that this is not financially sustainable in the long run, which demands the development of risk transfer solutions. The diagnostic report highlighted that Nepal is one of the top ten countries most affected by climate change and is highly vulnerable to floods, landslides, earthquakes, and droughts. </span></p> <p><span style="font-size:18px">The report also showcases that the Government of Nepal is committed to fostering the insurance industry's ability to provide accessible and affordable insurance products, as evidenced by recent legal updates such as the Insurance Act 2079, which contains several microinsurance provisions. </span></p> <p><span style="font-size:18px">While credit-life microinsurance and agriculture insurance offer financial protection to low-income and vulnerable Nepali households, the overall inclusive insurance market is still lagging due to low awareness about insurance and data gaps that prevent insurance companies from offering products that meet the needs of customers. </span></p> <p><span style="font-size:18px">Revenue Secretary Ghimire reiterated the government's commitment to delivering risk finance solutions, mentioning that the government has already initiated the development of a Risk Management Framework. Anil Pokharel, CEO of NDRRMA, highlighted the importance of collaboration between the government, development partners, and the private sector to address increasingly frequent and complex climate and disaster risks. </span></p> <p><span style="font-size:18px">Meanwhile, Ayshanie Medagangoda-Labé, UNDP Resident Representative, stated, "Insurance and risk financing are among the solutions that can contribute to strengthening a comprehensive risk management approach for any country and community. We need to tap into the insurance market opportunities, leaving no one behind." </span></p> <p><span style="font-size:18px">The UNDP’s initiative will work closely with government partners such as the Ministry of Finance, Nepal Insurance Authority and National Disaster Risk Reduction and Management Authority to improve legal and regulatory environment for insurance to be better incorporated in risk management priorities and actions. It will also work with the insurance industry to identify the financial protection needs of vulnerable groups such as women, farmers and businesses and facilitate the offer of customer-centric insurance products. UNDP will work more broadly with other development actors also pushing for financial resilience to further advocate and make the case for insurance as a key ingredient in managing shocks and fast-tracking recovery. -- RSS</span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20262', 'image' => '20240321121243_press_release_.jpg', 'article_date' => '2024-03-21 12:06:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '20534', 'article_category_id' => '1', 'title' => 'Principles and Priorities of Budget will be Revised on Needs Basis: Finance Minister ', 'sub_title' => '', 'summary' => 'March 20: Finance Minister Barshaman Pun has said that the principles and priorities of the Appropriation Bill for the upcoming fiscal year 2024/25 shall be revised on the basis of necessity and also taking into consideration the Common Minimum Resolution adopted by the ruling alliance. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">March 20: Finance Minister Barshaman Pun has said that the principles and priorities of the Appropriation Bill for the upcoming fiscal year 2024/25 shall be revised on the basis of necessity and also taking into consideration the Common Minimum Resolution adopted by the ruling alliance. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Pun also said the good policies contained in the Appropriation Bill for fiscal year 2024/25 presented in parliament by the immediate past Finance Minister Dr Prakash Sharan Mahat would be continued. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The finance minister made such remarks in response to the queries of the National Assembly members on Wednesday during the deliberations on the principles and priorities of the Appropriation Bill for the next fiscal year. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">"In the changed context at present, many parliamentarians had raised the issue of rewriting several of the principles and priorities of the Appropriation Bill, 2081 which the outgoing finance minister had presented in the parliament on behalf the government. The principles and priorities of next year's budget would be set by maintaining a balance and addressing the needs, possibilities and approaches in accordance with the changed context. The government will also take into consideration the need to maintaining stability in the government's policies and giving continuity to the good policies and programmes," he explained. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Finance Minister Pun reiterated that the new periodic plan and budget would be brought with the concept of good governance, social justice and prosperity. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">"The next fiscal year's budget would be aimed at increasing the state's role in the sector of providing basic service of major strategic importance and at establishing social justice by making provisions for quality education, health, employment and social security," he added. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The finance minister insisted that an environment would be created for fully utilizing the capacity of the private and cooperative sectors towards the efficient use of means and resources, production and employment generation. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to him, the government will immediately take steps to address the problems related to the usury practice and cooperatives and microfinance victims. He stressed that the government has the plan of stopping the present exodus of youths to foreign lands and the high unemployment rate by emphasizing on production and productivity growth. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The finance minister also claimed that the capital expenditure will be significantly increased in the next fiscal year since the government has moved ahead the works of some procedural and structural reforms for boosting the capital expenditure. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2024-03-21', 'modified' => '2024-03-21', 'keywords' => '', 'description' => '', 'sortorder' => '20261', 'image' => '20240321110225_budget.jpg', 'article_date' => '2024-03-21 11:01:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '20533', 'article_category_id' => '1', 'title' => 'NEPSE Records Minimal Loss of 3.34 Points to Close at 2063.95', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) Index witnessed a minimal loss of 3.34 points or 0.16%, closing at 2063.95 on the fourth trading day of the week on Wednesday.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">March 20: The Nepal Stock Exchange (NEPSE) Index witnessed a minimal loss of 3.34 points or 0.16%, closing at 2063.95 on the fourth trading day of the week on Wednesday. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">During today’s trading session, as many as 305 scrips were traded on the NEPSE through 60,016 transactions. A total of 9,445,697 shares were traded resulting in a total turnover of Rs 3.49 billion. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Sonapur Minerals and Oil Company (SONA) led the turnover with total transaction of worth Rs 19 crores. Gurkhas Finance Limited (GUFL) and Buddha Bhumi Nepal Hydropower Company (BNHC) each gained 10%, and hit the positive circuit for the day. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Bottlers Nepal (Balaju) Limited (BNL) incurred the highest loss of 9.32%, closing at a market price at Rs 493 per share. </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Regarding sub-indices, Microfinance Index, Mutual Fund Index, NonLife Insurance and Trading Index closed in the green territory, while the remaining sectors landed in the red zone.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Microfinance Index experienced the highest gain of 2.51%, while Manufacturing and Processing suffered the maximum loss at 1.45%.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2024-03-20', 'modified' => '2024-03-20', 'keywords' => '', 'description' => '', 'sortorder' => '20260', 'image' => '20240320054035_collage (53).jpg', 'article_date' => '2024-03-20 17:39:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 12 => array( 'Article' => array( 'id' => '20532', 'article_category_id' => '1', 'title' => 'The Bank of Japan's Experiment ', 'sub_title' => '', 'summary' => 'March 20: The Bank of Japan announced a seismic change in direction on Tuesday, hiking interest rates for the first time in 17 years. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">March 20: The Bank of Japan announced a seismic change in direction on Tuesday, hiking interest rates for the first time in 17 years. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The move represents an unwinding of an ultra-loose -- and maverick -- policy aimed at putting Japan's "lost decades" of stagnation and deflation behind it. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt">'Ambitious goal' </span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The last time the BoJ raised interest rates was in 2007, but its war against deflation began in earnest in 2013 under then-prime minister Shinzo Abe. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">"Abenomics" combined generous government spending and central bank monetary easing. The BoJ spent vast amounts on bonds and other assets to pump liquidity into the system, targeting inflation of two percent that policymakers hoped would fuel growth. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">It was "an extremely ambitious goal" and it did not work right away, said Kazuo Momma, an economist at Mizuho Research and Technologies. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">"Having failed to achieve the target within a committed two-year period, the BoJ had no other choice than to pursue further stimulative measures including the negative interest rate," Momma told AFP. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt">Spur lending </span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The negative interest rate of -0.1 percent -- hiked to between zero and 0.1 percent on Tuesday -- had been in place since 2016, effectively charging banks to keep their money at the Bank of Japan. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The hope was that banks would loan out their capital instead, boosting economic activity. The same year, bank policymakers introduced another measure, which Momma called "even more unconventional": yield curve control. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">That consisted of buying as many or as few 10-year government bonds as necessary to keep their yields steady at zero to stimulate lending in the real economy. On Tuesday, this too was scrapped, along with the purchase of risk assets such as exchange-traded funds (ETFs), with the BoJ saying they had "fulfilled their roles". </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt">Crisis averted? </span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The BoJ's stance has put major pressure on the yen. But some say it met its aims, helping Japan escape deflation while providing better conditions for the BoJ's hoped-for "virtuous cycle" of higher wages and spending. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Overall, the consensus is that the economy would have fared worse without the measures, said Louis Kuijs, chief economist for Asia Pacific at S&P Global Ratings. Due to downward pressure on growth and prices, growth "would have been weaker and significant deflation may have occurred if the BoJ had not eased monetary policy," he told AFP. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt">'Zombie' companies </span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">But Momma said that the policy might also have led to a "lack of fiscal discipline and inefficient allocation of resources through keeping non-viable firms alive". </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">One research company found that the number of "zombie" companies jumped by around a third in Japan after the Covid pandemic. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Monetary easing can also exacerbate social inequality, and "tends to distort financial markets," Kuijs warned. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Some economists, such as former BoJ board member Sayuri Shirai, still think factors including weak consumption make sustained two-percent inflation a long shot. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">"There is no way to justify that two percent is achievable in terms of Japan's inflation environment and wage environment," she said. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:16.0pt">Wasted progress? </span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">If done too aggressively, the risks of moving away from years of monetary easing are high. The BoJ "worries that if it tightens monetary policy, economic growth, wage growth and prices will fall again, wasting the recent progress," Kuijs said. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Moving too quickly could also see a flight of capital from elsewhere into Japan by investors seeking higher returns, potentially destabilising financial markets. "Governor Ueda has stressed that, while there are risks of tightening too late, the risks of tightening too early are larger," Kuijs said. – AFP/RSS</span></span></span></p> ', 'published' => true, 'created' => '2024-03-20', 'modified' => '2024-03-20', 'keywords' => '', 'description' => '', 'sortorder' => '20259', 'image' => '20240320032250_images.jpg', 'article_date' => '2024-03-20 15:22:14', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '20530', 'article_category_id' => '1', 'title' => 'Buddha Air's Operating Income Up by Three Folds', 'sub_title' => '', 'summary' => 'March 20: The operating income of Buddha Air, a leading private sector airlines company of Nepal, has increased by three folds compared to the two fiscal years affected by the Covid-19 pandemic.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">March 20: The operating income of Buddha Air, a leading private sector airlines company of Nepal, has increased by three folds compared to the two fiscal years affected by the Covid-19 pandemic.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">According to the information released by ICRA Nepal, a government recognized rating company, the income of Buddha Air has increased significantly during the last fiscal year. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The airline company, which had an operating income of Rs 4.94 billion in the fiscal year 2076/77 when coronavirus first appeared, has made such an income of Rs 12.16 billion in the fiscal year (FY) 2079/80. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">In addition, the company has made an operating income of Rs 3.83 billion in the first three and a half months of the current fiscal year, according to the unaudited data of the company.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The company has seen a significant improvement in its income after the coronavirus pandemic subsided. The increase in the number of air passengers after coronavirus subsided made a positive contribution to the company's income. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">According to the Tribhuvan International Airport Office, Buddha Air served 25,77,618 passengers in the year 2023. The number of flights operated by Buddha Air is also the highest among domestic airlines companies.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The report prepared by ICRA Nepal mentions that Buddha Air's income increased in FY 2079/80 despite the increase in the price of aviation fuel. According to the report, the company's market share has also increased. The market share is estimated to reach 67 percent in the coming year. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Buddha Air has been operating domestic and international flights (Beneras in India) for the past 27 years. The company has been continuously increasing the number of aircraft. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">According to ICRA Nepal, the operating income of Buddha Air in 2018 was Rs 6.8 billion. In 2019, such income reached Rs 6.80 billion. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">The increase in the company's income has been attributed to the increase in the number of aircraft as well as passengers. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:16.0pt">Buddha Air, which started domestic flights with 18-seat capacity aircraft, currently has 17 aircraft. All of them are ATR. Buddha has 14 ATR 72-500 series with 70 seat capacity and three ATR 42-300 series with 47 seat capacity. The company has been flying to 15 different destinations with its base in Kathmandu.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-03-20', 'modified' => '2024-03-20', 'keywords' => '', 'description' => '', 'sortorder' => '20257', 'image' => '20240320020526_Buddha Air Plane.jpg', 'article_date' => '2024-03-20 14:04:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '20528', 'article_category_id' => '1', 'title' => '137 Small Industries Closed in Kailali due to Shortage of Raw Material', 'sub_title' => '', 'summary' => 'March 20: One hundred and thirty-seven cottage and small industries have closed down in Kailali district due to the shortage of raw materials.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">March 20: One hundred and thirty-seven cottage and small industries have closed down in Kailali district due to the shortage of raw materials. Several of these industries have shut as they could not manage the operation cost while some because their productions could not compete with the market prices. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to the Cottage and Small Industries Office, several of the industries closed after their proprietors left the country for foreign employment. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">However, the registration of women-owned enterprises has notably increased in the district in recent years. This is due to the provision of concessions on the registration fees for women-owned industries. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">So far 15,434 industries have been registered in Kailali and the registration of 137 of them has been annulled. Among the registered industries, 3,194 are production-based, 6488 agriculture-based, two construction, 65 tourism-related, 12 information technology related and 5,673 service-oriented industries. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">These industries have an investment of Rs 25 billion. The Sudurpaschim provincial government has allocated Rs 15 million for implementing the 'One Electoral Constituency, One Industry' programme in the current fiscal year. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The office stated that 9,120 women and 69,611 men are employed in the registered industries. The office collected revenues worth Rs 5,216, 000 in last fiscal year 2022/23 and Rs 10,500,000 as of March 13, in the eight months of the current fiscal year 2023/24. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2024-03-20', 'modified' => '2024-03-20', 'keywords' => '', 'description' => '', 'sortorder' => '20256', 'image' => '20240320125058_20220526052559_service_1543560160.jpg', 'article_date' => '2024-03-20 12:50:27', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117