Extreme cold triggered by the cold wave for the past one week has thrown normal life out of gear in some districts of…

Extreme cold triggered by the cold wave for the past one week has thrown normal life out of gear in some districts of…

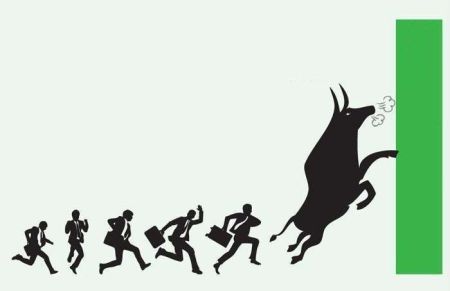

January 10: The stock market, which was in a continuous decline, rose above 2200 points with the formation of a new…

January 10: After the situation of investable capital in banks and financial institutions has eased, the interest rate of the government's short-term treasury bills has come down to its lowest point in the current fiscal…

Chitwan Festival kicked off on the banks of Narayani River on…

Prime Minister Pushpa Kamal Dahal on Tuesday said the government will work to reform the capital market to boost up the confidence of the private sector and…

January 10: Laxmi Bank has reached a preliminary understanding with Sunrise Bank for a…

January 10: The number of commercial banks in Nepal was 32 by mid-June 2012.…

January 10: The government has unveiled a 21-point policy priorities and common minimum program (CMP) without securing source of funding. This has added extra burden to the state…

Once famous for sweet apples, Helambu, a tourist site, is waiting for domestic and foreign tourists in…

January 9: The government has made public its common minimum program (CMP) that outlines its priorities as well as the tasks that will be executed during its term in…

January 9: Nepal Telecommunications Authority (NTA) has directed internet service providers (ISPs) to restrict websites and Apps relating to crypto transactions, hyper networking and online…

Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from…

January 9: Former finance minister and former governor of Nepal Rastra Bank Yuba Raj Khatiwada has said that it is necessary for banks and financial institutions to increase the quality rather than the size of loans.…

With a cut in the price of aviation fuel, Airlines Operators’ Association of Nepal has slashed the fare for domestic…

January 9: Data shows that Nepal spends more than Rs 2 billion annually for importing dairy products.…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '16708', 'article_category_id' => '1', 'title' => 'Biting Cold Throws Life Out of Gear in Tarai ', 'sub_title' => '', 'summary' => ' Extreme cold triggered by the cold wave for the past one week has thrown normal life out of gear in some districts of Tarai. ', 'content' => '<p> </p> <p><br /> <span style="font-size:18px">January 11: Extreme cold triggered by the cold wave for the past one week has thrown normal life out of gear in some districts of Tarai. </span></p> <p><span style="font-size:18px">Freezing cold has hit normal life very hard in Siraha, Saptari, Rautahat. The maximum cold was felt of this year in Saptari on Tuesday. Thick fog and cold breeze have made everyday life hard. </span></p> <p><span style="font-size:18px">Streets wear deserted looks as people hardly venture out of their homes throughout the day. <br /> Meanwhile, patients of asthma, diarrhoea, and common cold have increased at hospitals and health centers in the district. </span></p> <p><span style="font-size:18px">With the falling mercury, locals can be spotted burning firewood to keep themselves warms in the public places., such as streets. </span></p> <p><span style="font-size:18px">Biting cold has hit people from impoverished families such as Dom and Musahar and daily wage earners the most.<br /> Freezing cold has stopped daily wage earners from going to work. This has made them difficult to make their ends meet, according to Biraju Sada of Tilathi Koiladi Rural Municipality-4.</span></p> <p><span style="font-size:18px">Satya Narayan Mukhiya of Chhinnamasta Rural Municipality-3, Saptari complained that unbearable cold had hit normal life very hard. </span></p> <p><span style="font-size:18px">“We don’t have warm clothes to wear. On the other hand, extreme cold has made it tough to make ends meet”, bemoaned Mukhiya.</span></p> <p><span style="font-size:18px">Poor and marginalized people from backward communities are relying on firewood collected from the village to avoid coldness. </span></p> <p><span style="font-size:18px">“We make fire with firewood and keep ourselves warm,” said Hari Narayan Sada from Saptari headquarters Rajbiraj. </span></p> <p><br /> </p> ', 'published' => true, 'created' => '2023-01-11', 'modified' => '2023-01-11', 'keywords' => '', 'description' => '', 'sortorder' => '16449', 'image' => '20230111062034_Cold-wave 11.jpg', 'article_date' => '2023-01-11 06:10:34', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 1 => array( 'Article' => array( 'id' => '16707', 'article_category_id' => '1', 'title' => 'Stock Market Shows Signs of Bullish Trend', 'sub_title' => '', 'summary' => 'January 10: The stock market, which was in a continuous decline, rose above 2200 points with the formation of a new government.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 10: The stock market, which was in a continuous decline, rose above 2200 points with the formation of a new government. Many have assessed that the market, which has increased with the policy changes from the government, has now returned to a bullish trend despite closing below 2200 points on Tuesday.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">In recent days, the market has been increasing by an average of 50/60 points daily although it fell by 21 points on Tuesday. The daily turnover has also reached Rs 4/5 billion. In the last 12 days, the stock market index NEPSE has increased by 345 points. It is an increase by 18.45 per cent.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The morale of investors was boosted after Bishnu Paudel got the responsibility of the Finance Ministry in the new government led by CPN (Maoist Center) Chairman Pushpa Kamal Dahal. The policy changes made by the Nepal Rastra Bank are also supporting the market.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Nayan Bastola, secretary general of the Share Investors Pressure Group, said that there is a possibility that the market will break the record of 3200. He said that if you look at the current market trend, there are signs that it has returned to a bullish trend.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Sabir Bade Shrestha, Chief Executive Officer (CEO) of CBIL Capital, shared that the current stock market is progressing according to policy developments. Shrestha said that the formation of the new government has created a positive atmosphere due to the policies of the NRB and the Ministry of Finance.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Shrestha believes that the prime minister taking the vote of confidence in the Parliament on Tuesday will further increase the morale in the market. In addition, he claimed that the market will boost further after banks and financial institutions reduce interest rates.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Shrestha said that there is less possibility of daily trading of 20/22 billion shares as in the past because the NRB has made it difficult for banks to invest in the stock market.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The share market climbed to 2211 points on Monday with an increase of about 400 points (396 points) before falling marginally to 2190 points on Monday. It is an increase of about 22 per cent.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">When the market increases by 20 per cent, it is taken as a bullish trend, and when it decreases by 20 per cent, it is considered as a bearish trend.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Some analysts interpret it as a bullish trend if the stock market goes up for many days and falls only for a few days. That is, even if there is a bullish trend in the market for 3/4 days and a bearish trend for 1/2 days, the overall market is rising during this time. The market decreased only 3 out of 11 days.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Similarly, the continuous increase in share prices of companies whose financial conditions are weak is interpreted as the market moving into a bullish trend. Recently, the increase in group indicators, including finance and hydropower, also confirms it.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16448', 'image' => '20230110055823_20221227112853_20160613011604_20160613100022_fdsk;slk.jpg', 'article_date' => '2023-01-10 17:57:43', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '16706', 'article_category_id' => '1', 'title' => 'Interest Rate of Treasury Bills Lowest in a Year', 'sub_title' => '', 'summary' => 'January 10: After the situation of investable capital in banks and financial institutions has eased, the interest rate of the government's short-term treasury bills has come down to its lowest point in the current fiscal year.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 10: After the situation of investable capital in banks and financial institutions has eased, the interest rate of the government's short-term treasury bills has come down to its lowest point in the current fiscal year. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">On Monday, Nepal Rastra Bank (NRB) called for bids to renew treasury bills of Rs 16 billion including T-bills of Rs 2 billion for 28 days, Rs 8 billion for 91 days and Rs 6 billion for 364 days. During the auction, the central bank received applications more than the total worth of T-bills while the interest rate dropped to the lowest point.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">For the 28-day treasury bills worth Rs 2 billion auctioned on Monday, the bid was Rs 10.59 billion more than the T-bills auctioned. The interest rate of the treasury bills remained at 7.93 percent. Last week, the interest on the 28-day treasury bills was maintained at 9.16 percent.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The central bank received bids for the 91-day treasury that exceeded the quotation of Rs 8 billion by Rs 5.52 billion. NRB said that the interest rate of the treasury bills also decreased by about 1 percentage point compared to the previous week and stood at 10.6 percent. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">NRB had issued a repo for a period of 45 days on December 29. The average interest rate was maintained at 5.099 percent in the repo. As the liquidity in the market eased due to repo, the banks auctioned for more T-bills than the quotation of the central bank.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Likewise, the government has extended the period for commercial banks to calculate 80 percent of the local level's amount as deposits till mid-July. By Sunday, deposits in banks and financial institutions have reached Rs 5300 billion. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The disbursement of loans also increased by Rs 3 billion to Rs 4700 billion. Along with the increase in deposits, the CD ratio of banks also decreased from 86.44 to 86.40 percent. NRB informed that the inter-bank interest rate also decreased to 6.26 percent.</span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16447', 'image' => '20230110053333_Nepal_Rastra_Bank2 2.jpg', 'article_date' => '2023-01-10 17:32:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '16705', 'article_category_id' => '1', 'title' => 'Chitwan Festival Kicks Off ', 'sub_title' => '', 'summary' => 'Chitwan Festival kicked off on the banks of Narayani River on Monday.', 'content' => '<p><span style="font-size:18px">January 9: Chitwan Festival kicked off on the banks of Narayani River on Monday.</span></p> <p><span style="font-size:18px">Outgoing Minister for Industry, Commerce and Supplies of Bagmati Province, Milan Babu Shrestha, inaugurated the Festival amidst a programme. </span></p> <p><span style="font-size:18px">On the occasion, Mayor of Bharatpur Metropolitan City, Renu Dahal, said the Festival would contribute to the overall development of the district.</span></p> <p><span style="font-size:18px">“The festival will help foster economic activities,” she hoped.</span></p> <p><span style="font-size:18px">Similarly, Vice President of The Federation of Nepalese Chamber of Commerce and Industries(FNCCI) Dinesh Shrestha, said that that liquidity crisis seen in the banking system was causing concern to the industries and entrepreneurship. </span></p> <p><span style="font-size:18px">"Government must pay heed to the liquidity problem," he stressed, arguing that policy level instability was eroding investment climate in Nepal. </span></p> <p><span style="font-size:18px">The Festival will run till January 18, according to Chairman of FNCCI Chitwan chapter, Chun Narayan Shrestha. <br /> The Festival has several stalls including the agricultural products, autos, 'made in Nepal', electronics and IT. </span></p> <p><span style="font-size:18px">The festival is focused to promote indigenous products of Chitwan such as mustard oil and apiary for socioeconomic and cultural transformation of the district this time around. </span><br /> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16446', 'image' => '20230110052046_collage (43).jpg', 'article_date' => '2023-01-10 17:17:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 4 => array( 'Article' => array( 'id' => '16704', 'article_category_id' => '230', 'title' => 'Government will Work to Reform Capital Market, says Prime Minister Dahal ', 'sub_title' => '', 'summary' => 'Prime Minister Pushpa Kamal Dahal on Tuesday said the government will work to reform the capital market to boost up the confidence of the private sector and investors.', 'content' => '<p><span style="font-size:20px">January 10: Prime Minister Pushpa Kamal Dahal on Tuesday said the government will work to reform the capital market to boost up the confidence of the private sector and investors.</span></p> <p><span style="font-size:20px">While speaking at the meeting of the House of Representatives on Tuesday to solicit vote of confidence, Prime Minister Dahal reiterated his government will prioritise capital market and do the needful to reform it. </span></p> <p><span style="font-size:20px">Dahal pledged to work to maintain closer coordination and collaboration among economic and monetary institutions, cooperatives, insurance companies and private enterprises apart from the capital market. </span></p> <p><span style="font-size:20px">Dahal also stressed the need to reform policies and procedures to attract investment from the private sector. “The government will do the necessary work to bring in policy-level, institutional and procedural reforms in order to promote and boost private sector’s investment”, Dahal added.</span></p> <p><span style="font-size:20px">Dahal informed that the government would use financial and monetary tools to address the liquidity crisis prevalent in the banking system. </span><br /> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16445', 'image' => '20230110044725_collage (41).jpg', 'article_date' => '2023-01-10 16:41:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 5 => array( 'Article' => array( 'id' => '16703', 'article_category_id' => '1', 'title' => 'Laxmi Bank and Sunrise Bank sign Preliminary Agreement for Merger', 'sub_title' => '', 'summary' => 'January 10: Laxmi Bank has reached a preliminary understanding with Sunrise Bank for a merger.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 10: Laxmi Bank has reached a preliminary understanding with Sunrise Bank for a merger.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Raman Nepal, chairman of Laxmi Bank and Motilal Dugar, chairman of Sunrise Bank, signed the preliminary agreement regarding the merger of the two banks on Monday.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Members of the board of directors, shareholders, chief executive officers and other high-ranking officials of both the banks were present during the signing ceremony. The two banks have also formed a joint merger committee to take the merger process forward.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The joint merger committee comprises of directors Dr Manish Thapa and Swati Rungata on behalf of Laxmi Bank and directors Sharda Sharma and Deepak Nepal on behalf of Sunrise Bank.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">As per the information shared by the banks, auditors will also be appointed for a detailed 'due diligence audit' of both the banks. The merger process will formally start after receiving the in-principle approval from Nepal Rastra Bank for the merger and will be completed within the current fiscal year.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16444', 'image' => '20230110024256_merger.jpg', 'article_date' => '2023-01-10 14:42:22', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '16702', 'article_category_id' => '1', 'title' => 'Number of Commercial Banks Drops by Ten in a Decade', 'sub_title' => '', 'summary' => 'January 10: The number of commercial banks in Nepal was 32 by mid-June 2012. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 10: The number of commercial banks in Nepal was 32 by mid-June 2012</span><span style="font-family:"Times New Roman","serif"">. </span><span style="font-family:"Arial","sans-serif"">According to Nepal Rastra Bank (NRB), that number dropped to 22 in the last ten years, ceasing the existence of 10 commercial banks. Two more banks are merging with each other in the February. According to the 'big merger' policy taken by NRB, some other banks are also taking initiatives to merge with each other.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">In the beginning of the current fiscal year (FY), only eight banks went through the merger/acquisition process resulting in the establishment of four new entities. Kumari Bank and Nepal Credit & Commerce (NCC) Bank have merged with each other and are doing integrated business under the name of 'Kumari Bank Limited' since January 1</span><span style="font-family:"Times New Roman","serif"">. </span><span style="font-family:"Arial","sans-serif"">After the merger of Global IME Bank and Bank of Kathmandu, the integrated business is starting from January 9 under the name of Global IME Bank Limited.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Likewise, Prabhu Bank Limited acquired Century Commercial Bank and started integrated business under the name of 'Prabhu Bank Limited' from January 10. Mega Bank and Nepal Investment Bank have merged and will be doing integrated business under the name of 'Nepal Investment Mega Bank Limited' from January 11. Even though Himalayan Bank agreed to acquire Civil Bank Limited, the integrated business has not yet started. Both the banks have called the annual general meeting on January 12. They are ready to do integrated business within February.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Nabil Bank Limited has already started integrated business by acquiring Nepal Bangladesh Bank. Similarly, Global IME Bank merged with Commerce and Test Bank in March 2013 and Janata Bank in December 2019</span><span style="font-family:"Times New Roman","serif"">. </span><span style="font-family:"Arial","sans-serif"">In June 2013, NIC Bank and Bank of Asia merged to become NIC Asia Bank. Prabhu Bank merged with Kist Bank in August 2014 and Grand Bank in February 2015</span><span style="font-family:"Times New Roman","serif"">.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">In April 2012, the number of banks and financial institutions in Nepal was as high as 220</span><span style="font-family:"Times New Roman","serif"">. </span><span style="font-family:"Arial","sans-serif"">At that time, 32 commercial banks, 88 development banks, 77 finance companies and 23 microfinance companies were operating. In recent years, NRB has adopted a policy of reducing the number of banks and financial institutions. The study report titled 'Optimum Number of Banks and Financial Intuition in Nepal' published by NRB in April 2022 showed that 11 to 15 commercial banks are suitable for Nepal.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">There are three main objectives behind NRB’s policy of merging banks and financial institutions, said the spokesperson of NRB, Dr Gunakar Bhatta. First, by increasing the capital, the organization will be strengthened, secondly, the operating expenses will be reduced and thirdly, unhealthy competition will be reduced. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">“By increasing the bank's paid-up capital and making it a strong institution, they can invest in big projects, instead of having separate board of directors or management in many banks. When there is a single bank, the number of such banks will decrease and the operating expenses will be reduced, the unhealthy competition will be reduced and the quality of the financial situation will improve,” said Bhatta.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">NRB has been saying that the capital of banks and financial institutions should be increased to strengthen financial stability. Looking at the situation after the Asian economic crisis of 1997-98 and the global economic recession of 2007-2008, the debate about having a ‘few but strong' banks was started. According to NRB, the number of banks and financial institutions should be reduced by looking at various conditions including the use of technology.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Similarly, through the process of merger or acquisition, the capital base of banks and financial institutions will be expanded and the ability to bear risk will increase. The policy of NRB is to create a small number of strong and capable banks instead of a large number of institutions with a small capital base.</span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Former President of Nepal Bankers Association, Bhuwan Dahal says that NRB should focus on the regulatory role rather than providing incentives for mergers and acquisitions of banks and financial institutions. He said that in order to reduce the number of commercial banks in Nepal, their managerial aspects and institutional governance should be focused.</span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16443', 'image' => '20230110012110_Banks.jpg', 'article_date' => '2023-01-10 13:20:20', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '16701', 'article_category_id' => '1', 'title' => 'Government Announces 21-Point Programme without Securing Source of Funding', 'sub_title' => '', 'summary' => 'January 10: The government has unveiled a 21-point policy priorities and common minimum program (CMP) without securing source of funding. This has added extra burden to the state coffers.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">BIJAY DAMASE<br /> January 10: The government has unveiled a 21-point policy priorities and common minimum program (CMP) without securing source of funding. This has added extra burden to the state coffers. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The CMP has provision such as providing social security allowance to the people at 60 years and to provide monthly allowance of Rs 1500 to menstruating women. However, there isn’t any source of funding for these provisions and will only add extra responsibility to the shoulders of the government.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The CMP prepared by a task force headed by Deputy Prime Minister and Minister for Finance Bishnu Poudel was unveiled amid a programme at the Office of the Prime Minister and Council of Ministers on Monday. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">While announcing the programme, DPM Poudel said that a total of 6 million people including elderly citizens, Dalits, single women, people with disabilities, indigenous groups that are on the verge of extinction will get social security allowances within the next five years.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Similarly, all the women of menstruating age will get Rs 1500 annually to purchase sanitary pads. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The government has also adopted a policy to investigate cases of corruption irrespective of the statute of limitation. The CPM has stated that the government will investigate cases of corruption and abuse of authority. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The government also announced to revive the economy by implementing the industrial, financial and monetary policy in a coordinated way in order to address the problems seen in the decline in industrial productivity, liquidity crisis in the banking system, high interest rate, increasing trade deficit, low capital expenditure, declining revenue collection, pressure on foreign exchange reserves and a drop in the share market.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Likewise, the common minimum programme of the government has also provisions to give to manufacturing industries that produce food, footwear, medicines, cement among other products within Nepal. In order to promote these industries, the government has announced to provide subsidies on tax, electricity tariff and loans to the private sector. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The government, through the common minimum programme, also plans to reduce trade deficit and discourage imports while there are plans to increase productivity of the goods for domestic consumption and improve the quality and standard of exportable items to promote exports. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">There are also plans to revitalize the state-owned industries that are currently shut through public private partnership. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The new government also plans to step up infrastructure development for industries. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Another provision in the CMP is the concept of ‘time card’ for giving all types of permission to the industries from the starting point during the registration itself.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">DPM Poudel also said that all kinds of problems related to the citizenship issue will be sorted out within six months. According to Poudel, the government is planning to reduce the expenses for purchase of vehicles and operating cost of office. He also made it clear that the federal and provincial governments will not open new bodies unless there is an exceptional situation. This is expected to reduce government expenses.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The Public Expenditure Review Commission formed by the government has stated that most of the government spending is incurred in day-to-day operations despite repeated pledges by successive governments to cut the current expenditure. The capital expenditure of the government is still quite high at present. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The data of the Ministry of Finance shows that the government has failed to manage financial resources to meet the capital expenses of late. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Therefore the government plans to issue ‘time cards’ to speed up government works.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The government said that the use of time card will remove the compulsion for the service seekers to stay in long queue.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Another priority area of the government will be digitalization of government services.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">At present, people have to stay in long queues making driving license, passport and citizenship. In this context, the government expects to end such problem through the use of digital technology and time card.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The government has also set an ambitious plan of attaining 100 percent literacy rate in the next two years and to increase the standard of education in Nepal.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The CMP also has plans to improve the health sector while the the existing laws will be amended to make them labour-friendly, said DPM Poudel.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The CMP has also a vision to modernize the agriculture sector while it emphasized to take necessary measures so that no person will be compelled to live on the streets. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The concept of establishing a land bank, facilitating procurement of fertilizers, fixing of support prices, energy development among others will also be prioritized by the government, said DPM Poudel.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16442', 'image' => '20230110114205_PRO_KTM_PRACHANDA_SPEECH.jpg', 'article_date' => '2023-01-10 11:41:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '16699', 'article_category_id' => '239', 'title' => 'Helambu Waiting to Welcome Tourists ', 'sub_title' => '', 'summary' => 'Once famous for sweet apples, Helambu, a tourist site, is waiting for domestic and foreign tourists in Sindhupalchowk.', 'content' => '<p><br /> <span style="font-size:20px">January 9: Once famous for sweet apples, Helambu, a tourist site, is waiting for domestic and foreign tourists in Sindhupalchowk.</span></p> <p><span style="font-size:20px">Following the spread of the COVID-19, tourist arrival had dropped drastically. <br /> With most of the countries opening their borders and restrictions, Helambu is waiting for the visitors to come.</span></p> <p><span style="font-size:20px">Helambu has built attractive hotels and guesthouses with local resources. The tourist site is home to Langtang National Park, Melamchi khola’s water fall, topographical diversity, delicacies made from local products. </span></p> <p><span style="font-size:20px">“Gumbas, Melmchi Great Trail, Palchowk Temple and Holmo Community’s cultures are major attractions of the Helambu”, said Chairman Nima Gyaljen Sherpa of Helambu Rural Municipality. </span></p> <p><span style="font-size:20px">Captivating statute of Guru Renpoche constructed at the entrance of Helambu and Great Trail have started luring tourists, according to Sherpa. </span></p> <p><span style="font-size:20px">Apples are not available in Helambu at the moment. “Apples have stopped growing at Sermanath, Chhimi, Nakate, and Tarkeghyang villages”, said a local Karma Tokpe Lama. </span><br /> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16441', 'image' => '20230110072035_collage (26).jpg', 'article_date' => '2023-01-10 07:14:29', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 9 => array( 'Article' => array( 'id' => '16700', 'article_category_id' => '1', 'title' => 'Government Unveils Common Minimum Program', 'sub_title' => '', 'summary' => 'January 9: The government has made public its common minimum program (CMP) that outlines its priorities as well as the tasks that will be executed during its term in office. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">January 10: The government has made public its common minimum program (CMP) that outlines its priorities as well as the tasks that will be executed during its term in office. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The common minimum program was unveiled in the presence of Prime Minister Pushpa Kamal Dahal at a program held at the Office of the Prime Minister and Council of Ministers on Monday. The document brings together the policy priorities and programs of the ruling parties. The CMP was developed by a task force formed by the coalition partners. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Prime Minister Dahal has instructed all the secretaries to devise action plans within a month to implement the common minimum program of the government. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Directing the secretaries on Monday, PM Dahal expressed his commitment to firmly enforce the common minimum program once his government obtains the vote of confidence from parliament. PM Dahal is scheduled take a vote of confidence from the parliament on Tuesday. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Stating that the common minimum program is the base for unity among the coalition partners, PM Dahal shared that the programs of the ruling parties contained all issues ranging from socio-economic, education, health, employment and foreign policy among others. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">PM Dahal viewed that the common minimum program has outlined the tasks and priorities of the government to reflect how the government plans to advance. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">On a different note, PM Dahal claimed that the national economy and politics were not in a difficult situation in reality as it has been portrayed. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Dahal expressed his confidence that massive change could be brought about in the country if all political parties move ahead in unison and with firm determination. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">"Political stability and prosperity are only possible by honest efforts from one and all." -- RSS</span></span></span><br /> </p> ', 'published' => true, 'created' => '2023-01-10', 'modified' => '2023-01-10', 'keywords' => '', 'description' => '', 'sortorder' => '16440', 'image' => '20230110103832_PRO_KTM_PRACHANDA_OLI - Copy.jpg', 'article_date' => '2023-01-10 10:37:34', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '16698', 'article_category_id' => '1', 'title' => 'NTA Directs Internet Service Providers to Restrict Crypto-Related Websites, Apps ', 'sub_title' => '', 'summary' => 'January 9: Nepal Telecommunications Authority (NTA) has directed internet service providers (ISPs) to restrict websites and Apps relating to crypto transactions, hyper networking and online betting. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">January 9: Nepal Telecommunications Authority (NTA) has directed internet service providers (ISPs) to restrict websites and Apps relating to crypto transactions, hyper networking and online betting. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Existing laws in Nepal regard crypto transaction, networking and online betting as an illegal act. However, such websites and Apps have been running unabated by taking advantages of technological advancement despite government’s ban on such acts. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Issuing a notice on Sunday, the NTA said it renewed the directive as the internet service providers turned a deaf ear to end the transaction of crypto currency transaction, hyper networking, online betting which are not only illegal acts but also linked to financial crime. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">NTA’s spokesperson Santosh Poudel shared this was the second time that such a directive was given to the internet service providers. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The NTA said that the ISPs failing to abide by the government circulation will face the music. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16439', 'image' => '20230109081135_b.jpg', 'article_date' => '2023-01-09 20:11:06', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '16697', 'article_category_id' => '218', 'title' => 'Global IME and Bank of Kathmandu Commence Integrated Transactions ', 'sub_title' => '', 'summary' => 'Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from Monday.', 'content' => '<p><br /> January 9: Following the successful merger between Global IME Bank and Bank of Kathmandu, the two banks have started an integrated transaction from Monday.</p> <p>Prime Minister Pushpa Kamal Dahal inaugurated the joint transactions at a ceremony organized in Kathmandu on Monday. <br /> The integrated transaction will be carried out under the name “Global IME Bank Limited”. </p> <p>Following the merger, the bank's total capital has reached Rs 57 billion, paid-up capital has reached Rs 35.77 billion with total deposits of Rs 408 billion and loans of Rs 376 billion.</p> <p>The merged bank will comprise five boards of members from Global IME and two from Bank of Kathmandu. </p> <p>Ratna Raj Bajracharya will be the CEO of the bank. The bank will have 365 branches, 367 ATMs, 286 branchless banking services, and three contact offices in foreign countries. </p> <p><br /> </p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16438', 'image' => '20230109062616_collage (40).jpg', 'article_date' => '2023-01-09 18:23:41', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 12 => array( 'Article' => array( 'id' => '16696', 'article_category_id' => '1', 'title' => 'Focus on Quality of Loan Instead of its Size: Yuba Raj Khatiwada', 'sub_title' => '', 'summary' => 'January 9: Former finance minister and former governor of Nepal Rastra Bank Yuba Raj Khatiwada has said that it is necessary for banks and financial institutions to increase the quality rather than the size of loans. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 9: Former finance minister and former governor of Nepal Rastra Bank Yuba Raj Khatiwada has said that it is necessary for banks and financial institutions to increase the quality rather than the size of loans. Addressing the 3rd annual general meeting of Confederation of Banks and Financial Institutions of Nepal on Sunday, former finance minister Khatiwada suggested banks to increase the quality of loans arguing that there may be risks when they increase the size of loans.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">He said that although the electronic sector has benefited from the capital increase of the banks, the agricultural sector is yet to benefit. Stating that the size of loans issued by banks and financial institutions is equal to the size of the economy, he said that the increase in the size of the loan indicates an economic crisis in the financial system. He also said that the financial system of the country has taken a big leap recently.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Former finance minister Khatiwada also remarked that he has an increased confidence that the deposits in banks will not sink. He mentioned that the use of information technology in the entire financial sector, including the banking and capital market, has increased rapidly, and the central bank will also undertake its works electronically.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16437', 'image' => '20230109054849_1673175063.jpg', 'article_date' => '2023-01-09 17:48:10', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '16695', 'article_category_id' => '228', 'title' => 'Fare For Domestic Flights Drops ', 'sub_title' => '', 'summary' => ' With a cut in the price of aviation fuel, Airlines Operators’ Association of Nepal has slashed the fare for domestic flights.', 'content' => '<p> </p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">January 9: With a cut in the price of aviation fuel, Airlines Operators’ Association of Nepal has slashed the fare of domestic flights.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Issuing a press statement on Monday, the association slashed the price of domestic flights from Rs 100 to Rs 900 effective from January 11.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">According to the association, fare from Kathmandu to Dhangadhi has decreased by Rs 885. The maximum fare along the route is Rs 16,140. Fare in the mountain flight from Kathmandu has dropped by Rs 685. The maximum fare for the mountain flight from Kathmandu is Rs 14,205.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">As per the revised fare for the domestic flights, flights from Kathmandu to Bhadrapur, Kathmandu to Biratnagar and Kathmandu to Janakpur have become cheaper by Rs 600, Rs 485, and 260 respectively. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Likewise, Kathmandu-Bharatpur, and Kathmandu-Pokhara routes have seen a drop of Rs 320 and Rs 410 in fare respectively.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">Nepal Oil Corporation had slashed the prices of petroleum products including aviation fuel effective from 12 pm Sunday night. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Arial","sans-serif"">NOC had cut the price of domestic aviation fuel by Rs 20 per liter. With the price adjustment, the price of domestic aviation fuel stands at Rs 170 per liter. </span></span></span></span></p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16436', 'image' => '20230109053530_50126_1534486336.jpg', 'article_date' => '2023-01-09 16:26:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 14 => array( 'Article' => array( 'id' => '16694', 'article_category_id' => '1', 'title' => 'Nepal Spends Rs 2 Billion Annually on Import of Dairy Products ', 'sub_title' => '', 'summary' => 'January 9: Data shows that Nepal spends more than Rs 2 billion annually for importing dairy products. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Pratikshya Kandel</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">January 9: Data shows that Nepal spends more than Rs 2 billion annually for importing dairy products. The records of the Department of Customs in the last five years show that Nepal has been spending at least Rs 1.80 billion to 2.60 billion for the import of dairy products each year. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Although the government has announced to make the country self-sufficient in dairy products, imports are increasing instead of decreasing. Dairy products worth more than Rs 1 billion have been imported into Nepal in the first five months of the current fiscal year. In these five months, Rs 1.6 billion has gone out for the import of 2.48 million litres of dairy products. This is 18 per cent more than the same period last year. From mid-July to mid-December last year, Rs 90.21 million was spent for the import of 1.92 million litres of dairy products.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">According to the data of the Department of Customs, Nepal imported skimmed milk, processed milk, butter, cream, cheese and other milk products during the review period. Out of the imported items, the highest amount of milk products imported was baby milk worth Rs 2888 million, baby food made from milk worth Rs 2111 million, powdered milk worth Rs 1759 million and cheese worth Rs 1241 million.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Nepal imports dairy products mainly from India, Germany, South Korea, Denmark, the UK, America, Belgium, China, Japan, Qatar and other countries. The data from the Department of Customs show that Nepal has imported dairy products worth more than Rs 11.84 billion in the last five and a half years.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Raj Kumar Dahal, president of the Dairy Industry Association, said that the import of dairy products is increasing as domestic production is not sufficient to meet the demand. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">"There is still a shortage of 3,000 metric tons of milk in our market. Our domestic production is only 24,000 metric tons,'' he told Ne Business Age, “The amount of milk we need is 27,000 to 28,000 metric tons.” </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Dahal said that since it is the milk production season, and should be the time to stock milk, domestic production is not enough to meet the demand.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">"Now, if 200,000 to 300,000 litres of extra milk were available, converting it would be enough to meet the demand for three to four months," Dahal said, adding, "But now, during the peak season of stocking milk, not even 50 litres are left daily."</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">He said that even though domestically produced milk is exported abroad, milk is not available to meet the domestic demand. According to the Department of Customs, Nepal exports food made from milk for dogs and cats, including Churpi (hardened cheese), worth Rs 3 billion annually. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Dahal said that more than 30 million litres of milk are consumed for preparing hardened cheese. Last year, 1,744,500 kgs of dog and cat food were exported from Nepal fetching Rs 2.92 billion of foreign currency through export. The average price of hardened cheese was Rs 1,670 per kg. Even in the five months of the current fiscal year, a total of 594,000 kilos of dog and cat food worth Rs 1.1 billion has been exported from Nepal. Its average price is around Rs 1,900 per kg.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-01-09', 'modified' => '2023-01-09', 'keywords' => '', 'description' => '', 'sortorder' => '16435', 'image' => '20230109014440_1673219740.Clipboard11.jpg', 'article_date' => '2023-01-09 13:44:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117