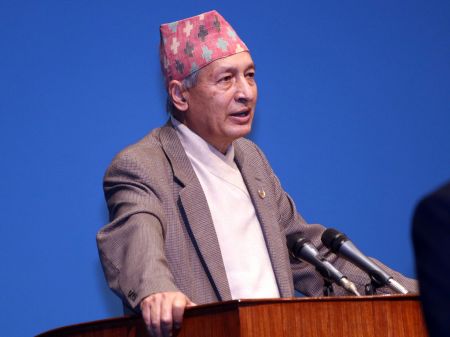

As the Covid-19 pandemic continues to impact every aspect of Nepal’s economy, the government has lowered economic growth projection to 2.3 percent for the current fiscal year.…

As the Covid-19 pandemic continues to impact every aspect of Nepal’s economy, the government has lowered economic growth projection to 2.3 percent for the current fiscal year.…

International Finance Corporation (IFC) has said that it is ready to support Covid-19 pandemic-stricken small and medium enterprises (SMEs) of…

The Asian Development Bank (ADB) has approved a USD 250 million concessional loan to help the Nepal government fund its response to the Covid-19 pandemic, which includes measures to strengthen the country’s public health systems and mitigate the adverse economic and social impacts of the pandemic, particularly on the…

NIC Asia Bank has signed an agreement with the e-commerce app Recharger to provide the customers of the bank 10 percent discount on purchase of items that are used to combat coronavirus contagion.…

The adverse impact of the lockdown imposed by the government since March 24 has started to get reflected in all indicators of Nepal’s foreign trade.…

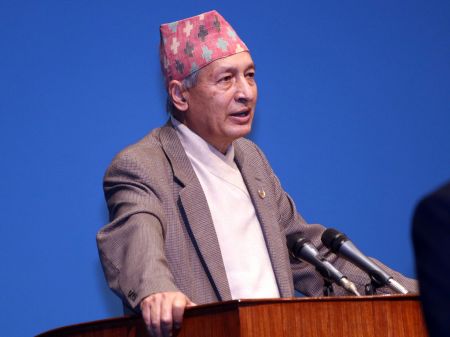

Prime Minister KP Sharma Oli has hinted to ease the ongoing lockdown to resume economic activities in the country.…

Nepali dairy industries have incurred a total loss of around Rs 3 billion in the two months of the ongoing lockdown.…

Development banks have registered higher profit growth than commercial banks in the third quarter of the current fiscal year.…

With risks rising due to the increasing number of coronavirus infected people across the country, the Insurance Board (IB), the insurance sector regulator, has set criteria in the Covid-19 insurance…

With the lockdown imposed by the government going longer than anticipated, many owners of small and medium enterprises (SMEs) have made up their mind to exit from their business.…

Soft drinks maker Coca-Cola has announced a joint intitiave named Waste Worker Emergency Relief Project (WWERP) in association with CREASION, a non-government organization, to provide awareness, safety gears and relief materials for vulnerable waste workers and their families to help protect them from the impacts of coronavirus.…

Warning (2): getimagesize(/var/www/html/newbusinessage.com/app/webroot/img/news/thumbnails/eMT & Valyou[5543].png): failed to open stream: No such file or directory [APP/View/Articles/index.ctp, line 35]Code Context<?phplist($width, $height) = getimagesize(WWW_ROOT.'img'.DS.'news'.DS.'thumbnails'.DS.$article['Article']['image']);$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/index.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '12079', 'article_category_id' => '1', 'title' => 'Govt Lowers Economic Growth Projection to 2.3%', 'sub_title' => '', 'summary' => 'As the Covid-19 pandemic continues to impact every aspect of Nepal’s economy, the government has lowered economic growth projection to 2.3 percent for the current fiscal year. ', 'content' => '<h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">As the Covid-19 pandemic continues to impact every aspect of Nepal’s economy, the government has lowered economic growth projection to 2.3 percent for the current fiscal year. The government in the budget of the current fiscal year had set an ambitious economic growth target of 8.5 percent. Presenting the Economic Survey 2019/20 before the Federal Parliament on May 26, Finance Minister Dr Yuba Raj Khatiwada said that the Covid-19 pandemic is to be blamed for the sharp contraction. The estimation, is however, 0.03 percent higher than the economic growth projection of the Central Bureau of Statistics (CBS). CBS in April 29 estimated 2.27 percent economic growth for the current fiscal year. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">In the Economic Survey report, the government has said that services sector, tourism, hotel industry, manufacturing, transportation, construction, and wholesale and retail trade have been hard hit by the pandemic leading to the country’s dismal economic growth. Unveiling the report, Dr Khatiwada said that Nepali economy, which was growing satisfactorily till February-March (Falgun) headed towards a deeper slump in the ensuing months. According to the Economic Survey 2019/20, the pandemic-induced economic crisis will aggravate unemployment and poverty. Nepal registered average economic growth of 7.3 percent in the last three years. “The Covid-19 pandemic has affected Nepal’s overall economic productivity and supply chain,” stated the report. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government has predicted that tourism sector will decline the most in the current fiscal year due to abrupt halt in global travel and hospitality activities. The growth of the tourism sector, which was 7.3 percent in FY2018/19, will be negative 16.3 percent in the current fiscal year, according to the Economic Survey. Similarly, sectors such as transportation, storage and warehousing, communications, manufacturing, mining and construction will also register negative growth this year. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">According to the Economic Survey, the contribution of agriculture sector to the country’s gross domestic product (GDP) has declined, while the contribution of non-agriculture sector has risen. The government has estimated that the contribution of agriculture sector to GDP will be 27.6 percent, while it will be 72.4 percent for non-agriculture sector. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Despite the steep decline in economic growth, income growth of citizens, however, will increase in the current fiscal year. The survey has forecasted that per capita income of Nepalis will grow by Rs 8,563 to reach to Rs 126,018 (USD 1,058) in FY2019/20. </span></span></span></span></h2> <h2><strong><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Decline in Savings</span></span></span></span></strong></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">According to the survey, savings of Nepalis in FY2019/20 has decreased compared to the last fiscal year. “Consumption will account 81.9 percent of GDP and savings will be 18.1 percent in the current fiscal year,” reads the report. In FY2018/19, the rates of consumption and savings were 79.5 percent of GDP and 20.5 percent, respectively. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Similarly, the survey has also predicted that total investment in the country will decline by 3.4 percent than last year to Rs 1,889.26 billion due to the increase in expenses on preventive measures against the spread of coronavirus deployed by the government and the private sector. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The per capita public debt has reached Rs 39,000 as of 2020 February-March (Falgun) which was Rs 36,000 in the corresponding period of last year. According to Economic Survey, public debt has amounted to Rs 1,139.80 as of February-March, increasing by Rs 91.90 billion in the nine months of the current fiscal year from Rs 1,047.90 billion in June-July of 2019. “Strengthening economy, increase in per capita income and loan re-payment capacity of people, and acceleration in post-quake reconstruction have resulted in decline in foreign grant in development assistance. This has led to the growth of share of debt in GDP,” stated the survey. According to the report, the ratio of internal and external debt has been 38.6 percent and 61.4 percent, respectively. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Economists say that the Economic Survey has shown underlying problems of Nepali economy that have been exacerbated by the pandemic-induced crisis. “The survey has just presented the picture of eight months of the current fiscal year. But the economic momentum was already lethargic before this period,” said Jagdish Chandra Pokharel, former vice chairman of National Planning Commission (NPC), adding “A big trouble arrived in the country after eight months. But the government has failed to measure and evaluate the economic loss incurred by Nepal over the last two months.” He suggested the government to conduct a comprehensive study about the Covid-19 economic impacts so as to focus its efforts in the economic recovery.</span></span></span></span></h2> ', 'published' => true, 'created' => '2020-05-27', 'modified' => '2020-05-27', 'keywords' => '', 'description' => '', 'sortorder' => '11829', 'image' => '20200527122508_Dr Khatiwada.jpg', 'article_date' => '2020-05-27 12:22:11', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 1 => array( 'Article' => array( 'id' => '12078', 'article_category_id' => '1', 'title' => 'IFC to Support Nepal’s SMEs ', 'sub_title' => '', 'summary' => 'International Finance Corporation (IFC) has said that it is ready to support Covid-19 pandemic-stricken small and medium enterprises (SMEs) of Nepal.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">International Finance Corporation (IFC) has said that it is ready to support Covid-19 pandemic-stricken small and medium enterprises (SMEs) of Nepal. Addressing a webinar titled ‘Private Sector Response to Covid-19’ organised by the Society of Economic Journalists-Nepal (SEJON) on May 26, </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Wendy Werner, country manager for Nepal Bangladesh and Bhutan of IFC said that the </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">private sector arm of the World Bank Group will help to reenergize the Nepali private sector affected by the global health emergency and measures taken by the government to stop the spread of coronavirus. “The role of private sector is very important for economic recovery. We will support the SMEs of Nepal affected by the coronavirus,” she said. Werner mentioned that Nepal’s services sectors including tourism collapsed during the beginning of Covid-19 pandemic and that the impacts of the collapse will remain for some time to come. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">“IFC will not only be equity investor for the Nepali private sector but will also play a broader assistive role to help overcome the difficulties,” she said. IFC in mid-March announced a USD 8 billion Covid-19 package to support private companies of developing countries. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif"> IFC has been providing its support to private sector-run banks and financial institutions in Nepal. Werner informed that the country’s SMEs will receive assistance from this year. “SMEs play crucial role in employment generation,” she said. According to Werner, IFC’s investment in Nepal will reach USD 500 million by the end of 2020. “We have targeted to invest USD 1.2 billion in Nepali private sector by 2023,” she said. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-27', 'modified' => '2020-05-27', 'keywords' => '', 'description' => '', 'sortorder' => '11828', 'image' => '20200527101416_IFC.jpg', 'article_date' => '2020-05-27 10:10:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 2 => array( 'Article' => array( 'id' => '12077', 'article_category_id' => '1', 'title' => 'ADB Approves USD 250 million Concessional Loan to Help Nepal Fight Covid-19 ', 'sub_title' => '', 'summary' => 'The Asian Development Bank (ADB) has approved a USD 250 million concessional loan to help the Nepal government fund its response to the Covid-19 pandemic, which includes measures to strengthen the country’s public health systems and mitigate the adverse economic and social impacts of the pandemic, particularly on the poor.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The Asian Development Bank (ADB) has approved a USD 250 million concessional loan to help the Nepal government fund its response to the Covid-19 pandemic, which includes measures to strengthen the country’s public health systems and mitigate the adverse economic and social impacts of the pandemic, particularly on the poor.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The Manila-based lender in a press statement said that the Covid-19 Active Response and Expenditure Support (CARES) Program is funded through the COVID-19 pandemic response option (CPRO) under ADB’s Countercyclical Support Facility. CPRO was established as part of ADB’s <a href="https://www.adb.org/news/adb-triples-covid-19-response-package-20-billion">USD 20 billion expanded assistance</a> for developing member countries’ COVID-19 response, which was announced on 13 April.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">“The CARES Program will support the Nepal government in scaling up its testing capacity to at least 3,000 tests per day and establishing quarantine facilities for at least 200,000 people with separate wards for women and men in all seven provinces. Incentives will be provided for medical and other frontline personnel responding to COVID-19,” reads the statement. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">ADB’s financing will also support the government in extending its social protection program to include distribution of food assistance to the poorest and vulnerable households, provision of employment support to the unemployed poor, especially women, and returning migrant workers. Subsidized lending will be extended to affected micro, small, and medium-sized enterprises, of which at least 30 percent are women-led, with at least half of them from disadvantaged groups.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">“ADB is strongly committed to supporting Nepal at this crucial time. This concessional loan will enable the government to continue its containment measures, extend its social protection program for the poor and vulnerable, and set the stage for an early economic recovery,” the statement quoted ADB President Masatsugu Asakawa as saying. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">ADB informed that it has already provided Nepal a USD 300,000 grant to procure medical supplies, in collaboration with UNICEF. “ADB is working closely with the government and development partners to provide policy advice and develop measures to deal with the social and economic impacts of the pandemic,” reads the statement. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-27', 'modified' => '2020-05-27', 'keywords' => '', 'description' => '', 'sortorder' => '11827', 'image' => '20200527081119_ADB.jpg', 'article_date' => '2020-05-27 08:08:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 3 => array( 'Article' => array( 'id' => '12076', 'article_category_id' => '1', 'title' => 'NIC Asia and Recharger Sign Deal', 'sub_title' => '', 'summary' => 'NIC Asia Bank has signed an agreement with the e-commerce app Recharger to provide the customers of the bank 10 percent discount on purchase of items that are used to combat coronavirus contagion. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">NIC Asia Bank has signed an agreement with the e-commerce app Recharger to provide discount to the customers of the bank on purchase of items that are used to combat coronavirus contagion. Issuing a press statement, the bank said that Recharger app users will get 10 percent cash back on payment of their purchase using NIC Asia’s QR code, debit card and credit card. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">Recharger has been selling items such as face masks, sanitizer, gloves, thermal gun and personal protection kits at affordable price points. According to the press statement, customers of NIC Asia will receive an additional 10 percent discount on purchase of these items through the app for the month of May. The statement claims that Recharger, which has been selling KN95 masks at Rs 175 per unit with free home delivery service, has been selling face masks at price less than international e-commerce platforms such as Alibaba and Amazon. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-26', 'modified' => '2020-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '11826', 'image' => '20200526051930_Reecharger_NIC Asia[5555].jpg', 'article_date' => '2020-05-26 17:15:03', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 4 => array( 'Article' => array( 'id' => '12075', 'article_category_id' => '1', 'title' => 'Slump in Nepal’s Foreign Trade Deepens ', 'sub_title' => '', 'summary' => 'The adverse impact of the lockdown imposed by the government since March 24 has started to get reflected in all indicators of Nepal’s foreign trade. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:18.0pt"><span style="font-family:"Arial",sans-serif">The adverse impact of the lockdown imposed by the government since March 24 has started to get reflected in all indicators of Nepal’s foreign trade. The severe disruption in supply chain has adversely affected Nepal’s imports and exports with both of its largest trading partners India and China. Data published by the Department of Customs (DoC) show that Nepal’s total foreign trade has declined sharply in the 10 months of the current fiscal year 2019/20 compared to the same period of the last fiscal year. As of Baisakh (April-May), the foreign trade has declined by 11.89 percent to Rs 1,172 billion from Rs 1,256.67 billion in the corresponding period of FY2018/19.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:18.0pt"><span style="font-family:"Arial",sans-serif">Official statistics reveal that slump in the country’s imports/exports have further deepened in the April-May compared to previous months. In the review period, foreign trade has decreased to Rs 46 billion which was Rs 62.20 billion in March-April and Rs 130 billion in February-March. In April-May, Nepal’s imports amounted to Rs 42.60 billion and exports totaled Rs 3.24 billion; the figures were Rs 58.29 billion and Rs 3.91 billion in March-April period. Sharp decline in import of petroleum products has contributed to this slump in the country’s foreign trade. Difficulties in transportation along with problems in export and export through customs points are the key reasons for this. For instance, suspension of all international commercial flights, which is in place since March 20 has badly affected Nepal’s exports. Much of the country’s exports are carried out through air cargoes. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:18.0pt"><span style="font-family:"Arial",sans-serif">As per DoC data, import of vegetables, petroleum products, iron/steel, boiler machinery and vehicles has declined the most in April-May, while import of rice and medicine/medical equipment has increased during the review period. Last month, Nepal imported rice worth Rs 4.76 billion which was Rs 3.82 billion in March-April. Meanwhile, import of petroleum products has come down to Rs 8.28 billion in April-May which was Rs 9.19 billion a month earlier. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:18.0pt"><span style="font-family:"Arial",sans-serif">In April-May, Nepal’s imported goods worth Rs 25.04 billion from India while its exports to the southern neighbour amounted to Rs 2.09 billion. Similarly, imports from China totaled Rs 1.98 billion while exports to the northern neighbour were a meagre at Rs 3.7 million. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:18.0pt"><span style="font-family:"Arial",sans-serif">DoC officials are hopeful foreign trade will improve as barriers seen at customs points have gradually eased. Suman Dahal, director general at DoC said that a high-level Rapid Response Team has been working to resolve the issues. According to him Ministry of Finance has been notified about the problems being faced at customs points and the Ministry of Foreign Affairs has expedited its diplomatic initiations to resolve the issues through bilateral talks with India and China. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-26', 'modified' => '2020-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '11825', 'image' => '20200526033859_VKM-Parsa.jpg', 'article_date' => '2020-05-26 15:36:55', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 5 => array( 'Article' => array( 'id' => '12074', 'article_category_id' => '1', 'title' => 'Prime Minster Hints to Ease Lockdown', 'sub_title' => '', 'summary' => 'Prime Minister KP Sharma Oli has hinted to ease the ongoing lockdown to resume economic activities in the country. ', 'content' => '<h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Prime Minister KP Sharma Oli has hinted to ease the ongoing lockdown to resume economic activities in the country. Oli in his address to nation on Monday said that the government will make some changes to ease the situation while being careful to avoid further contagion of coronavirus. According to him, there will be some changes in the modality of lockdown ensuring that the epidemic risks are kept at minimum. The latest remarks by PM Oli signals changes in his approach towards restrictions that are in place since March 24. In his earlier comments, he had prioritised life of Nepalis over the country’s economy. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Oli said that the government will allow resuming further agricultural and industrial activities ensuring that people engaged in such activities follow social distancing rules. “However, administrative restrictions in movement of people will be given continuity to stop community-level transmission of coronavirus,” he mentioned. According to Oli, the government will make necessary arrangements to start development works, easing of supply of daily essential items, imports and exports, and provide employment to jobless people residing in Nepal and those who return from abroad after losing their jobs in the wake of Covid-19 pandemic. He informed that the government will issue order to immediately start rescue of Nepalis stranded in different countries. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">PM Oli also said that relief will be provided to the crisis-stricken business sector. “The Ministry of Finance will issue a comprehensive proposal regarding the country’s economic recovery. It will include measures such as tax and non-tax exemptions, interest rate concession, availability of bank loans and electricity bill concessions,” he stated. The Prime Minister also said that the government will further expand the scope of Covid-19 testing to at least two percent of the country’s population. </span></span></span></span></h1> ', 'published' => true, 'created' => '2020-05-26', 'modified' => '2020-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '11824', 'image' => '20200526033647_kp-sharma-oli.jpg', 'article_date' => '2020-05-26 15:35:13', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 6 => array( 'Article' => array( 'id' => '12073', 'article_category_id' => '1', 'title' => 'Dairy Industry Losses Amount to Rs 3 billion', 'sub_title' => '', 'summary' => 'Nepali dairy industries have incurred a total loss of around Rs 3 billion in the two months of the ongoing lockdown. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Nepali dairy industries have incurred a total loss of around Rs 3 billion in the two months of the ongoing lockdown. In a video press conference organised by the Nepal Dairy Association (NDA) today, entrepreneurs informed that sales of dairy products have declined by 80 percent over the past two months due to the travel and transport restrictions imposed by the government to curb the spread of coronavirus. “The loss of market in the main production season has created several problems for us from making payments to farmers, rent, electricity bills to provide salaries to staff,” said Pralahad Dahal, general secretary of NDA. According to him, the losses will increase further as items skim milk powder and butter worth Rs 5 billion stocked by dairy industries are set to expire in the next few months. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Dahal informed that Rs 30 billion has been invested in the Nepali dairy industry till date. Similarly, half a million farmers and 20,000 workers are directly associated with the sector. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Dairy sector seeks government support</span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">As the situation worsens due to the lockdown becoming longer than anticipated, dairy entrepreneurs look for support from the government. At the press conference, NDA made public its demands seeking relief package to help dairy industries to withstand the crisis. Entrepreneurs urged the government to include measures to address their grievances in the Federal Budget for the upcoming fiscal year. They have demanded to provide collateral-free concessional loan for a period of five years. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Similarly, their other demands include increasing of loan terms and lowering of lending interest rate for the lockdown period. They have asked the government to re-introduce 50 percent VAT exemption to dairy industries and 50 percent discount on electricity bills. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-25', 'modified' => '2020-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '11823', 'image' => '20200525083714_dairy.jpg', 'article_date' => '2020-05-25 20:34:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 7 => array( 'Article' => array( 'id' => '12072', 'article_category_id' => '1', 'title' => 'Development Banks Leave Behind Commercial Banks in Profit Growth', 'sub_title' => '', 'summary' => 'Development banks have registered higher profit growth than commercial banks in the third quarter of the current fiscal year. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">Development banks have registered higher profit growth than commercial banks in the third quarter of the current fiscal year. In this period, the average profit growth of 27 commercial banks is just 2.36 percent higher compared to the corresponding period of the last fiscal year 2018/19, whereas the average profit growth of 21 development banks has been registered at 10.39%.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">In the third quarter of the current fiscal year, 21 development banks have earned a total of Rs 4.55 billion in profit which was Rs 4.12 billion in the corresponding period of FY2018/19. Muktinath Bikas Bank has logged highest profit among the class ‘B’ banks. The bank earned Rs 676 million in profit, up 8 percent from Rs 625.5 million in the same period of last fiscal year. Garima Baikas Bank and Lumbini Bikas Bank are second and third high profit earners, respectively; Garima Bikas has registered a profit of Rs 496.40 million while Lumbini Bikas reported profit of Rs 437.60 million. Similarly, Shine Resunga Development Bank has earned Rs 436.70 in profit, up 40.48 percent from Rs 310.90 in the corresponding period of the last fiscal year. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">Among the 21 development banks, seven development banks, namely Corporate Development Bank, Deva Bikas Bank, Excel Development Bank, Gandaki Bikas Bank, Sahara Bikas Bank, Sindhu Bikas Bank and Shangri-la Development Bank, have seen their profits decline in the 3<sup>rd</sup> quarter of the current fiscal year. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-25', 'modified' => '2020-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '11822', 'image' => '20200525045007_BXhAQ3Ymmd6DpgS5WarrmL3d6YEm1ZAAHEAS4sBr.jpg', 'article_date' => '2020-05-25 16:46:33', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 8 => array( 'Article' => array( 'id' => '12071', 'article_category_id' => '1', 'title' => 'IB Sets Standards for Covid-19 Insurance', 'sub_title' => '', 'summary' => 'With risks rising due to the increasing number of coronavirus infected people across the country, the Insurance Board (IB), the insurance sector regulator, has set criteria in the Covid-19 insurance policy.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">With risks rising due to the increasing number of coronavirus infected people across the country, the Insurance Board (IB), the insurance sector regulator, has set criteria for Covid-19 insurance policy. The policy launched by IB on April 16 originally did Not included any criteria. However, IB has now directed general insurance companies to issue the Covid-19 policy only after fulfilling the conditions. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Particularly, the criteria have been aimed at Nepalis coming from neighbouring and other countries, and their family members. As per the new arrangement, Covid-19 infected patients, who have come from abroad, need to mandatorily stay in quarantine for 15 days to be eligible to purchase the insurance policy. Furthermore, the returnees and their family members are also required to be tested negative in Rapid Diagnostic Test (RDT) before they buy the policy. Similarly, the IB has made it mandatory to include Covid-19 reports while selling the policy online. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">With the directive, IB has stepped up to address the concerns of insurers who were worried about negative financial impacts of the Covid-19 insurance policy in case of outbreak of coronavirus across the country. “People are returning from India in large numbers. Nepali migrant workers are also likely to return from other countries. This is why we have issued a special underwriting directive to insurers,” said Nirmal Adhikari, information officer at IB. The regulatory authority issued the policy on April 16 collaborating with Nepal Insurers’ Association. Insurance companies have been doing the transactions of this policy through the micro-insurance pool. Nepal Insurers’ Association is the coordinator of the programme while Sikhar Insurance is the insurance policy issue manager. According to the data provided by the association, 185,628 people have purchased the Covid-19 insurance policy as of May 23 and insurers have collected Rs 100 million in insurance premium. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-25', 'modified' => '2020-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '11821', 'image' => '20200525021952_Adobegermumbrella.jpg', 'article_date' => '2020-05-25 14:17:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 9 => array( 'Article' => array( 'id' => '12070', 'article_category_id' => '1', 'title' => 'SMEs Struggle for their Existence', 'sub_title' => '', 'summary' => 'With the lockdown imposed by the government going longer than anticipated, many owners of small and medium enterprises (SMEs) have made up their mind to exit from their business. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">With the lockdown imposed by the government going longer than anticipated, many owners of small and medium enterprises (SMEs) have made up their mind to exit from their business. Floriculture businesspersons say that the daily business loss in the floriculture sector is Rs 10 million currently. Similarly, the prolonged lockdown has put jobs of 20,000 people engaged in production and import of electrical items into risk, according to the Federation of Electrical Entrepreneurs of Nepal (FEEN). Likewise, Federation of Handicraft Association of Nepal (FHAN) has informed that local business of handicraft has fallen to zero since March 24 when the lockdown started and export of metalcraft, felt and pashmina has also begun to decline. It is estimated that SME sector contribute 22 percent to Nepal’s gross domestic product (GDP) and provide employment to 1.7 million people.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">“SMEs are the hardest hit businesses by the Covid-19 pandemic. Among them, businesses that are related to tourism and exports have been affected the most. With travel and tourism taking a big hit, businesses such as restaurants and handicraft are at risk,” said Shabda Gyawali, investment director at Dolma Impact Fund. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">Siddhant Raj Pandey, chairman and CEO of Business Oxyzen (BO2), a SME-focused private equity fund, said that the nature of problems for BO2 funded businesses are different. “Many are facing lack of raw materials for production. Those who have raw materials are facing shortage of workers due to which manufacturing industries are in even more difficulties,” he shared. Similaly, lack of coordination among government agencies have added to the problems of food business entrepreneurs. “While their operation has been permitted by the government, they face problems in transportation to deliver the food items to their customers,” he said. Pandey suggested the government to change the modality of the lockdown to ease the difficulties of SMEs. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">Retail businesses are also among the badly affected by the lockdown. Those operating stores at shopping malls say that the current situation has forced them to exit the business. “With no business for a prolonged time, we are pressurised by bank loans, store rents and staff salary. This will ultimately lead to our exit from business,” said Sushma Mahara, president of Kathmandu Mall Byapar Sangh. Sujit Tandukar, vice president of Civil Mall Byapar Sangh expressed views similar to Mahara. “Most businesspersons have given up their hopes. Many are planning to venture into agribusiness,” he said. Data published by Nepal Rastra Bank (NRB) shows that 50 percent of SMEs are dependent on loans from banks and financial institutions (BFIs). According to Rajendra Serchan, president of Kathmandu Chamber of Commerce and Industry, high rent levels at places such as New Road, Khichapokhari and adjacent areas have added to the mounting problems of business owners. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI",sans-serif">According to economist Dr Govinda Nepal, limited scope of business and income of SMEs make it difficult for such businesses to survive during the time of crisis. “Big businesspersons have multiple sources of income. But SME owners have limited resources making them vulnerable to difficult situation like present,” he mentioned, adding, “The government, business associations and house owners should come together to provide subsidy on bank interest rate and rent to SME owners to help them survive.” </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-24', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11820', 'image' => '20200524072335_SMES.jpg', 'article_date' => '2020-05-24 19:18:47', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 10 => array( 'Article' => array( 'id' => '12069', 'article_category_id' => '1', 'title' => 'Coca-Cola and CREASION Join Hands to Provide Relief to 3,200 Waste Workers ', 'sub_title' => '', 'summary' => 'Soft drinks maker Coca-Cola has announced a joint intitiave named Waste Worker Emergency Relief Project (WWERP) in association with CREASION, a non-government organization, to provide awareness, safety gears and relief materials for vulnerable waste workers and their families to help protect them from the impacts of coronavirus. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Soft drinks maker Coca-Cola has announced a joint intitiave named </span></span><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">Waste Worker Emergency Relief Project (WWERP) in association with CREASION, a non-government organization, to provide awareness, safety gears and relief materials for vulnerable waste workers and their families to help protect them from the impacts of coronavirus. Issuing a press statement, the company said that the project is part of Coca-Cola in Nepal’s initial pledge of Rs 80 million towards the fight against COVID-19. “This initiation aims to reach 3,200 waste workers and their families ensuring their safety and livelihood at the current situation of crisis while over 2,500 waste workers will be directly benefitted,” said the company. According to the statement, the project will be further carried out in different municipalities of Kathmandu, Kiritipur, Lalitpur, Bhaktapur, Chitwan, Lahan, Saptari and Siraha.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">“The first programme of the project commenced on 15<sup>th</sup> May in a safety awareness and distribution event of relief materials to 150 waste workers which was held at Women for Human Rights in Buddhanilkantha, Kathmandu,” informed the company. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">So far, four relief programs have been conducted successfully which has directly benefited 460 waste workers. “They were provided with safety and awareness programs, food relief packages, dignity kits for female beneficiaries which includes environmental-friendly and reusable sanitary pads along with personal hygiene materials such as soaps, detergents, gloves and essential medicines to ensure their primary needs and protect their livelihood,” reads the statement. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">According to the company, protective jumpsuits and safety gears will be provided to 100 frontline waste workers in a relief programme on May 25 which will be facilitated by Mayor of Kathmandu Metropolitian City Bidya Sundar Shakya.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-24', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11819', 'image' => '20200524051125_Picture_1[5545].jpg', 'article_date' => '2020-05-24 17:08:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 11 => array( 'Article' => array( 'id' => '12068', 'article_category_id' => '1', 'title' => 'eSewa Starts Wallet-to-Wallet Remit Service from Malaysia ', 'sub_title' => '', 'summary' => 'eSewa Money Tranfer, a subsidiary of Nepali fintech major f1Soft International, has started remittance transaction from Malaysia. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">eSewa Money Tranfer, a subsidiary of Nepali fintech major f1Soft International, has started remittance transactions from Malaysia. It is the second international expansion of the company after Japan. eSewa Money Transfer in a press statement said that it has partnered with the Malaysian company Valyou for remittance transactions. “With this, Nepalis residing in Malasiya can transfer money to Valyou agents, eSewa wallets in Nepal from Valyou wallets, and to any bank account in Nepal,” reads the statement. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">According to the company, it is for the first time eSewa has launched wallet-to-wallet money transfer service. “It will make it easier for Nepalis in Malaysia to send money back home. The wallet-to-wallet service has freed them from reaching out to remit agents to transfer money,” said the company. eSewa Money Transfer informed that it will commence this service from other countries in the coming days. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-24', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11818', 'image' => 'eMT & Valyou[5543].png', 'article_date' => '2020-05-24 16:27:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 12 => array( 'Article' => array( 'id' => '12067', 'article_category_id' => '1', 'title' => 'Govt Prepares for Austerity Budget ', 'sub_title' => '', 'summary' => 'With the Covid-19 pandemic and lengthening lockdown putting a big dent on revenue collection of the government, the Ministry of Finance (MoF) is preparing to introduce austerity measures in the federal budget for the fiscal year 2020/21.', 'content' => '<p><span style="font-size:20px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Nirmala UI",sans-serif">With the Covid-19 pandemic and lengthening lockdown putting a big dent on revenue collection of the government, the Ministry of Finance (MoF) is preparing to introduce austerity measures in the federal budget for the fiscal year 2020/21. At a time when managing revenue resources has become much more challenging and people are looking for government support, the ministry, which is in the final stage of drafting the budget, is preparing to axe allocation of budget under different headings that have been deemed unnecessary. According to high officials at MoF, the ministry will drastically cut a range of unproductive spendings from vehicle purchase and repair to employee allowances under different headings and implement past recommendations of Public Expenditure Review Commission and High-Level Administrative Reform Implementation and Monitoring Commission. </span></span></span></p> <p><span style="font-size:20px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Nirmala UI",sans-serif">Sources say that duplication in expenditure headings including agriculture subsidy and social security allowances will be removed in the upcoming budget. “Right now, the government has limited resources. We have to address the expectations of many at this time of crisis. So, we will not include unfruitful programmes in the upcoming budget,” the official told New Business Age. According to him, budget of programmes bearing names of President and Prime Minister will also be reduced. The ministry has planned to mobilise foreign resources to develop health, agriculture, employment and other long-term infrastructures. “But we will refrain from additional fiscal burden,” he said. </span></span></span></p> <p><span style="font-size:20px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Nirmala UI",sans-serif">It is certain that the government will broadly miss its revenue target for the current fiscal year. The revenue collection till May 22 has totaled Rs 612 billion against the target of Rs 1,112 billion set for FY2019/20. The data published by the Financial Comptroller General Office (FCGO)</span> shows that the government, which aimed collecting Rs 900 billion in revenue by the end of Baisakh, has just collected 55.11 percent of the target. This clearly indicates the pressure the government is facing in terms of managing resources. </span></span></p> <p><span style="font-size:20px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Nirmala UI",sans-serif">Experts also stress of the necessity to drastically cut government expenditure at a time when the country’s economy has been surrounded by unprecedented headwinds due to the Covid-19 crisis. Former secretary Bimal Wagle say that while it will not be possible for the government to reduce the number of civil servants and security personnel for the time being, it can lower the number of politically appointed individuals. “The post of advisor at the Prime Minister Secretariat is not a necessary one. Simialrly, members of parliament do not need personal secretaries. If these posts occupied by politically appointed people are abolished, the government can save a lot of money,” he said. According to him, cutting down billions in unnecessary employee allowances and putting a stop to programmes that are run by forming consumer committees and avoiding same work by multiple government staff will help to general internal financial resources. </span></span></span></p> <p><span style="font-size:20px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Nirmala UI",sans-serif">According to former National Planning Commission member Dr Dilli Raj Khanal, the government can generate huge resource just by implementing the recommendations of the Public Expenditure Review Commission. </span></span></span></p> ', 'published' => true, 'created' => '2020-05-24', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11817', 'image' => '20200524030610_tft-532019-11.jpg', 'article_date' => '2020-05-24 14:58:53', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 13 => array( 'Article' => array( 'id' => '12066', 'article_category_id' => '1', 'title' => 'NRB to Issue Monetary Tools: Governor ', 'sub_title' => '', 'summary' => 'Nepal Rastra Bank (NRB) Governor Maha Prasad Adhikari has warned that it will be very challenging for businesses to resume their activities after the lockdown is lifted. ', 'content' => '<p><span style="font-size:22px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Cambria",serif">Nepal Rastra Bank (NRB) Governor Maha Prasad Adhikari has informed that the central bank will issue monetary tools to help ease the financial problems created by the Covid-19 induced pandemic. “Lowering of bank interest rate has already been decided. Now banks will be allowed to capitalisation of interest on loans and increase their lending,” Adhikari said addressing a webinar titled ‘Global Webinar on Role of Professional Accountants in Business Continuity, Crisis Management and Financial Reporting: Post COVID - 19 Pandemic’<strong> </strong>organised by the Institute of Chartered Accountants of Nepal (ICAN). He</span></span></span><span style="font-size:22px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Cambria",serif"> warned that it will be very challenging for businesses to resume their activities after the lockdown is lifted. Adhikari said that the growing number of coronavirus infected people in the recent days have added to the mounting economic challenges. According to him, the sharp contraction in domestic and international job markets has created big problems. “4.4 million people associated with informal sectors have been affected by the pandemic-induced crisis,” he said, adding that hotel, restaurants and the overall tourism sector are likely to face even bigger problems for the next 1-2 years. </span></span></span></p> <p><span style="font-size:22px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Cambria",serif">He further warned that sharp fall in remittance inflow will hit areas ranging from liquidity in the banking system to aggregate consumer demand. “The outlook of external sector also looks bleak due to the declining remittance inflow,” he mentioned. The problem of unemployment will be severe as large number of Nepali migrant workers are likely to the country, according to Adhikari.</span></span></span></p> <p><span style="font-size:22px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Cambria",serif">In his opening remark, ICAN President CA Krishna Prasad Acharya highlighted on the adverse effects of the Covid-19 pandemic on global economy. “Companies in the hospitality industry and SMEs will be among the hardest hit. Many businesses have been forced to reduce operations or shut down and an increasing number of people are expected to lose their jobs,” he said. </span></span></span></p> <p><span style="font-size:22px"><span style="font-family:"Times New Roman",serif"><span style="font-family:"Cambria",serif">According to Acharya, the pandemic has also affected the profession of chartered accounting. “Professionals engaged in audit and assurance services face difficulties in implementing various standards while discharging their duties and many professionals in advisory services may lose their revenue due to this situation,’ he said, adding, “However, accounting professionals can play crucial role in curtailing cost cutting competition arising from this pandemic.” </span></span></span></p> <p><span style="font-size:22px"><span style="font-family:Calibri,sans-serif"><span style="font-family:"Cambria",serif">The webinar was participated by presidents of International Federation of Accountants (IFAC), South Asian Federation of Accountants (SAFA), Institute of Chartered Accountants in England and Wales, Chartered Accountants Australia and New Zealand (CA ANZ), Institute of Chartered Accountants of India</span> (ICAI), Vice President of <span style="font-family:"Cambria",serif">Institute of Chartered Accountants of Bangladesh (ICAB)</span>, Executive Director of Confederation of Asian and Pacific Accountants (<span style="font-family:"Cambria",serif">CAPA</span>) and experts from CPA Australia and Sri Lanka. </span></span></p> ', 'published' => true, 'created' => '2020-05-23', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11816', 'image' => '20200523051832_webinar.jpg', 'article_date' => '2020-05-23 17:13:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 14 => array( 'Article' => array( 'id' => '12065', 'article_category_id' => '1', 'title' => 'EPF to Start Online Loan Service ', 'sub_title' => '', 'summary' => 'The Employees Provident Fund (EPF) has announced to start the Special Loan Service to help its depositors affected by the lockdown. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt">The Employees Provident Fund (EPF) has announced to start the Special Loan Service to help its depositors affected by the lockdown. Issuing a press statement, EPF informed that depositors can borrow money from Sunday (May 24) using its online service. For now, depositors who have updated their know-your-customer (KYC) details are eligible to borrow money from EPF. According to the statement, the minimum and maximum borrowings limits have been set at Rs 20,000 and Rs 1 million, respectively. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt">EFP said that the money will be deposited directly into the bank accounts of its depositors after their requests are approved. EPF, which ceased its operations after the government announced lockdown on March 24, is also planning to gradually resume other services. <em>(RSS)</em></span></span></span></p> ', 'published' => true, 'created' => '2020-05-23', 'modified' => '2020-05-23', 'keywords' => '', 'description' => '', 'sortorder' => '11815', 'image' => '20200523051150_epf.jpg', 'article_date' => '2020-05-23 17:10:33', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ) ) $current_user = null $logged_in = false $cat_id = '1' $categoryTitle = array( 'ArticleCategory' => array( 'id' => '1', 'name' => 'NEWS', 'parentOf' => '0', 'published' => true, 'registered' => '2015-07-20 00:00:00', 'sortorder' => '158', 'del_flag' => '0', 'homepage' => true, 'display_in_menu' => true, 'user_id' => '1', 'created' => '0000-00-00 00:00:00', 'modified' => '2018-11-22 11:58:49' ) ) $article = array( 'Article' => array( 'id' => '12068', 'article_category_id' => '1', 'title' => 'eSewa Starts Wallet-to-Wallet Remit Service from Malaysia ', 'sub_title' => '', 'summary' => 'eSewa Money Tranfer, a subsidiary of Nepali fintech major f1Soft International, has started remittance transaction from Malaysia. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">eSewa Money Tranfer, a subsidiary of Nepali fintech major f1Soft International, has started remittance transactions from Malaysia. It is the second international expansion of the company after Japan. eSewa Money Transfer in a press statement said that it has partnered with the Malaysian company Valyou for remittance transactions. “With this, Nepalis residing in Malasiya can transfer money to Valyou agents, eSewa wallets in Nepal from Valyou wallets, and to any bank account in Nepal,” reads the statement. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:14.0pt"><span style="font-family:"Arial",sans-serif">According to the company, it is for the first time eSewa has launched wallet-to-wallet money transfer service. “It will make it easier for Nepalis in Malaysia to send money back home. The wallet-to-wallet service has freed them from reaching out to remit agents to transfer money,” said the company. eSewa Money Transfer informed that it will commence this service from other countries in the coming days. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-24', 'modified' => '2020-05-24', 'keywords' => '', 'description' => '', 'sortorder' => '11818', 'image' => 'eMT & Valyou[5543].png', 'article_date' => '2020-05-24 16:27:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ) $width = (int) 450 $height = (int) 299 $ratio = (float) 1.505016722408 $img_width = (int) 280 $img_height = (float) 186.04 $date = '2020-05-24 17:08:56' $dateFromDatabase = (int) 1590319436 $dateTwentyforHoursAgo = (int) 1756337932 $today = '2025-08-29 05:23:52am' $today2 = (int) 1756424332 $newDate = 'May 24, 2020' $commentCount = (int) 0 $word_count = (int) 395 $time_to_read = (float) 1.98 $time_to_read_min = (float) 1 $time_to_read_second = (float) 59getimagesize - [internal], line ?? include - APP/View/Articles/index.ctp, line 35 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117