Hotel Association Nepal (HAN) has lowered the charges for providing Covid-19 quarantine facilities at hotels.…

Hotel Association Nepal (HAN) has lowered the charges for providing Covid-19 quarantine facilities at hotels.…

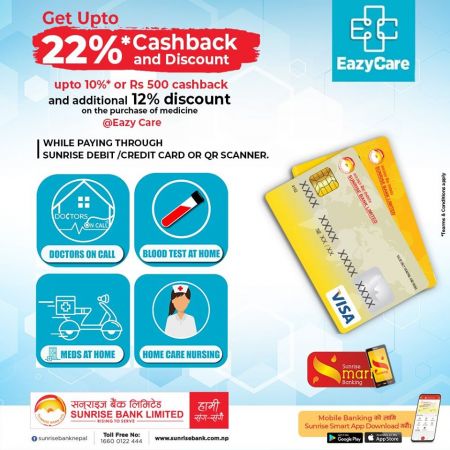

Sunrise Bank Limited has signed an agreement with the online medical site Eazy Care to provide healthcare to its customers.…

Finance Minister Dr Yuba Raj Khatiwada has said that the budget has offered an additional Rs 60 billion in relief to…

The Federal Budget for FY2020/21 has drawn mixed reaction from former finance ministers, economists and private sector leaders.…

The government has dashed the hopes of the country’s private sector that a comprehensive stimulus package will be announced in the Federal Budget for FY2020/21 to kick-start the economic recovery.…

At a time when unemployment in Nepal has excerberated as a result of sharp increase in the number of Nepalis losing jobs inside and outside the country due to the Covid-19 pandemic, the government has announced new programmes in the Federal Budget for FY2020/21 to create 800,000 jobs.…

The government has prioritised the agriculture sector development by announcing a slew of programmes in the Federal Budget for…

The government has announced the Federal Budget of Rs 1,474.64 billion for the fiscal year…

The government has announced to provide concession on electricity bill to the industries that have remained shut down during the period of lockdown.…

The budget allocation for the Prime Minister Employment Programme (PMEP) has been increased by over two-fold for the upcoming fiscal…

The government has allocated a Rs 6 billion for prevention and control of coronavirus in the Federal Budget for FY2020/21.…

The government has announced to deposit Social Security Fund (SSF) contribution of employee and their employers on salary of employees for the lockdown period.…

In a sign of increasing disquiet among members of the business community as a result of the government’s Covid-19 response and its crippling impacts to industrial and business activities, industrialists of Biratnagar have started to raise voices to draw attention of the government towards their grievances by hanging banners outside industrial and offices…

At a time when the country’s economy has been ravaged by the Covid-19 pandemic causing a huge loss of government revenue, Finance Minister Dr Yuba Raj Khatiwada is unveiling the Federal Budget for fiscal year 2020/21 today facing a big pressure to have a delicate balance between management of resources and stimulus package to help start the recovery of the crisis-stricken economy.…

Despite the government’s policy to discourage non-utilisation of arable land, lands used for plantation for major crops have been shrinking across the…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '12094', 'article_category_id' => '1', 'title' => 'HAN Revise Charges for Covid-19 Quarantine at Hotels', 'sub_title' => '', 'summary' => 'Hotel Association Nepal (HAN) has lowered the charges for providing Covid-19 quarantine facilities at hotels. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Cambria",serif">Hotel Association Nepal (HAN) has lowered the charges for providing Covid-19 quarantine facilities at hotels. The hotel industry body, which had earlier set charges ranging from Rs 3,000 to Rs 16,000 per person to keep foreign returnees has now reduced the charge to Rs 3,000 per person for one-star and tourist-level hotels. According to Sajan Shakya, general secretary at HAN, two individuals sharing a same room at tourist-level hotels have to pay Rs 4,000 per day as per the revised rate. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Cambria",serif">Earlier, the rate was Rs 5,000 for a person and Rs 6,000 for two. HAN has said that 20,000 hotel rooms across the country can be used as quarantine facilities. Among the 15 chapters of HAN, Kathmandu, Bhaktapur, Pokhara, Chitwan, Bhairahawa, Nepalgunj and Biratnagar chapters have already notified the industry body about the number of hotel rooms that can be used as isolation facilities. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Cambria",serif">According to Shakya, 3,100 hotel rooms in Kathmandu, 4,000 each in Pokhara, Chitwan and Bhairahawa, 2,500 in Nepalgunj and the remaining 2,400 rooms in Bhaktapur and Biratnagar can be used for accommodation of foreign returnees. As per arrangements announced by HAN, individuals using rooms of five-star hotels and deluxe resorts will be charged Rs 16,000 per person while it is Rs 10,000 for two individuals sharing a same room. Similarly, the rates for using a four-star hotel room have been set at Rs 14,000 and Rs 8,000. The isolation stay at three-star and two-star hotels has been set at Rs 10,000 for an individual and Rs 6,000 for two people sharing a same room. HAN has informed that hotels will provide meals four times a day, communications and other basic services to those coming for isolation. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-31', 'modified' => '2020-05-31', 'keywords' => '', 'description' => '', 'sortorder' => '11844', 'image' => '20200531051443_room.jpg', 'article_date' => '2020-05-31 17:11:55', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 1 => array( 'Article' => array( 'id' => '12093', 'article_category_id' => '1', 'title' => 'Sunrise Bank and Eazy Care Join Hands ', 'sub_title' => '', 'summary' => 'Sunrise Bank Limited has signed an agreement with the online medical site Eazy Care to provide healthcare to its customers. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Sunrise Bank Limited has signed an agreement with the online medical site Eazy Care to provide healthcare to its customers. Issuing a press statement, the bank said that its customers can get upto 22 percent in discount while availing services from Eazy Care during the lockdown.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">As per the agreement, the bank’s customers can get 12 percent discount and further 10 percent or upto Rs 500 in cashback by making payments to Eazy Care using QR scanner, debit and credit cards on purchase of medicine. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-30', 'modified' => '2020-05-30', 'keywords' => '', 'description' => '', 'sortorder' => '11843', 'image' => '20200530044555_sunrise.jpg', 'article_date' => '2020-05-30 16:43:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 2 => array( 'Article' => array( 'id' => '12092', 'article_category_id' => '1', 'title' => 'Budget Provides an Additional Rs 60 billion Relief to Private Sector: FinMin ', 'sub_title' => '', 'summary' => 'Finance Minister Dr Yuba Raj Khatiwada has said that the budget has offered an additional Rs 60 billion in relief to businesses.', 'content' => '<h2><span style="font-size:13pt"><span style="font-family:"Calibri Light",sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Finance Minister Dr Yuba Raj Khatiwada has said that the budget has offered an additional Rs 60 billion in relief to businesses. "The relief will be provided in the forms of cash, subsidy, tax and fine discounts and concessional loans and the cumulative amount would reach Rs.60 billion," he said in a post-budget interaction with financial journalists organised at the Ministry of Finance on May 29.</span></span></span></span></h2> <h2><span style="font-size:13pt"><span style="font-family:"Calibri Light",sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">According to Dr Khatiwada, the refinancing facility to the businesses amounts to Rs 20 billion and the government will mobilise Rs 14 billion to subsidise the interest of the business loans. The government in the Federal Budget for FY 2020/21 has announced to provide business loan at 5 percent. The rest of the interest, which is about 6-7 percent, will be paid to the banks and financial institutions by the government. The finance minister said that the tax concessions would provide a benefit of Rs 6.5 billion to the private sector.</span></span></span></span></h2> <h2><span style="font-size:13pt"><span style="font-family:"Calibri Light",sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">"The government will pay the social security contributions of the private sector workers for the lockdown period," Dr Khatiwada said. He said the budget was labour-centred and aims to create jobs, provide social security and relief to the workers. "We aim to create about 500,000 additional employments in various sectors like business, industries, infrastructure and self-employment," he said. <em>(RSS)</em></span></span></span></span><br /> </h2> ', 'published' => true, 'created' => '2020-05-30', 'modified' => '2020-05-30', 'keywords' => '', 'description' => '', 'sortorder' => '11842', 'image' => '20200530042434_post-budget interaction.jpg', 'article_date' => '2020-05-30 16:22:42', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 3 => array( 'Article' => array( 'id' => '12091', 'article_category_id' => '1', 'title' => '‘Budget Traditional, Economic Growth Target Unrealistic’', 'sub_title' => '', 'summary' => 'The Federal Budget for FY2020/21 has drawn mixed reaction from former finance ministers, economists and private sector leaders. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">The Federal Budget for FY2020/21</span></span><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif"> has drawn mixed reaction from former finance ministers, economists and private sector leaders. In a post-budget virtual interaction programme organised by the Society of Economic Journalists – Nepal (SEJON) on May 29, they describe the budget for the upcoming fiscal year as ‘traditional’ and ordinary which cannot fulfill the needs of the extraordinary times and take the country’s economy out of the crisis. They also said that the economic growth target of 7 percent as unrealistic to achieve. According to them, the targets of economic growth, revenue collection, foreign assistance and public expenditure are ambitious. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Commenting on the budget, former Prime Minister and finance minister Dr Baburam Bhattarai said, “The budget should have long term plans for socio-economic development. But this year’s budget is nothing more than ‘traditional’. </span></span><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">The pandemic presented a right time for the finance minister to turn challenges into opportunities. But his divided loyalties stopped him to do so. The budget has failed to give priority to economic sectors that need significant investment to revive.” Dr Bhattarai said that the budget is directionless which is neither socialism-oriented nor market-oriented. According to him, government to take responsibility to ensure education and health to all citizens which won’t be possible through a traditional budget. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">“Budget for the Prime Minster Employment Programme (PEMP) has been increased. But neither the targeted group will benefit nor the money from state coffer will be utilized if the earmarked budget is spent in activities such as cutting of grasses like in previous years,” said Dr Bhattarai. He suggested the government to increase foreign borrowing to manage finances for economic recovery. “Foreign debt accounts for 32 percent of Nepal’s GDP. It can be increased to 60-65 percent. The government must not hesitate to take loans in these trying times,” he added. He claimed that the budget won’t be able generate employment as targeted due to the scattered allocations. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Former finance minister Dr Ram Sharan Mahat said that the budget for the upcoming fiscal year is filled with promises and promotional programmes. According to him, the assurances given for employment generation, agriculture and industrial sector development are very difficult to implement at the moment. Dr Mahat objected the internal debt target set by the government in the budget. “In the past, the government use to take internal loans not more than 2-3 percent of GDP. But this time it has been set at 5 percent. If the government increases internal borrowings, it will reduce the liquidity in the financial market and will affect generation of jobs and expansion of industrial and business activities,” he said. He criticised the government for not lowering corporate tax and increasing customs duty on import of electric vehicles even seeing possibility of excess of electricity in the country. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Another former finance minister Surendra Pandey, however, defended the budget saying that the government has announced arrangements by properly evaluating the country’s economic situation and public health. “Slashing of public expenditure and increase of budget in public health are positive steps. However, there are challenges to keep the hospitals operational,” said Pandey. According to him, there can be difficulties for the government to sustain recurrent expenditures as the revenue target of Rs 900 billion set the upcoming fiscal is relatively low. Similarly, he viewed the 7 percent economic growth target for the upcoming fiscal year as challenging. </span></span></span></span></p> <p><strong><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Targets Unachievable: Economists</span></span></span></span></strong></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Speaking at the interrraction programme, economists said that many targets in the budget won’t be unachieved. Dr Shankar Sharma, former vice chairman of National Planning Commission (NPC) said, “</span></span><span style="font-size:15.0pt"><span style="font-family:"Mangal",serif">The target to increase foreign assistance by 125 percent compared to the current fiscal year is impossible to achieve. Given our capacity, I think foreign assistance will be 40 percent less than aimed. On the other hand the 7 percent economic growth target is challenging because of protracted halt in industrial and business activities, and decline in remittance inflow which has already gone down by 20 percent and could further decrease by 50 percent in the coming months.” </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Mangal",serif">Prof Dr Govinda Nepal said that the size of the budget is appropriate to deal with the current situation. According to him, the budget was unveiled with a broader consensus and the government’s priority to the health sector development and prevention and control of coronavirus is positive. “However, the relief measures announced for various economic sectors are not sufficient. The government needs to form separate task force comprising of all stakeholders to review the measures,” he mentioned. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><strong><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif"> Not a stimulus package, scattered relief: Private Sector</span></span></strong></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">The country’s private sector, which had demanded that the government to come up with stimulus package 5 percent of GDP, has expressed its displeasure over the measures announced in the Federal Budget for FY2020/21. Speaking at the programme, private sector leaders said that the measures announced by the government cannot be called stimulus package and that the scattered relief won’t be helpful to revive economic activities. Shekhar Golchha, senior vice president of Federation of Nepalese Chamber of Commerce and Industries (FNCCI), commented , “At a time when economic loss has reached 2-3 percent of the country’s GDP and 1.5 million Nepalis have lost their jobs, the budget has indicated that the government has remained conservative rather than becoming liberal to take the economy out of the crisis.” According to him, the private sector had demanded that the budget incorporate appropriate measures for liquidity management, bank interest rate, labour management and concession in demand charge of electricity. “Among them, the budget has failed to address our demand of labour management which has become the most challenging issue for us at present,” he said. Golchha mentioned that the government also did not addressed private sector’s demand to ease labour management for those looking to close their industries, archiving of assets and VAT concession.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Kamalesh Agrawal, vice president of Nepal Chamber of Commerce (NCC) said that the government did not meet the expectations of business community as it was under political pressure. “The stimulus package suggested by the private sector was not taken seriously. Refinancing and stimulus package differ in scope and features. We have demanded stimulus package worth 5 percent of the country’s GDP, but the relief measures announced in the budget are just 1.5 percent of GDP,” said Agrawal. According to him, the target to raise Rs 225 billion through internal borrowing will result in shortage of liquidity and affect bank interest rates. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Cambria",serif">Vishnu Agrawal, senior vice president of Confederation of Nepalese Industries (CNI) commented that the budget has failed to incorporate measures to increase the aggregate demand in the market. “The scattered relief measures will not be much helpful in the economic recovery,” he remarked. Agrawal said that the revenue target of the government is challenging as demand will remain low in the next fiscal year, hence impacting collection of VAT and income taxes. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-05-30', 'modified' => '2020-05-30', 'keywords' => '', 'description' => '', 'sortorder' => '11841', 'image' => '20200530032905_photo post budget[6898].jpg', 'article_date' => '2020-05-30 15:25:01', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 4 => array( 'Article' => array( 'id' => '12090', 'article_category_id' => '1', 'title' => 'Arrangements in Budget Inadequate to Revive Economic Activities: Private Sector', 'sub_title' => '', 'summary' => 'The government has dashed the hopes of the country’s private sector that a comprehensive stimulus package will be announced in the Federal Budget for FY2020/21 to kick-start the economic recovery. ', 'content' => '<h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government has dashed the hopes of the country’s private sector that a comprehensive stimulus package will be announced in the Federal Budget for FY2020/21 to kick-start the economic recovery. Industrialists and businesspersons say that the measures announced in the budget haven't offered substantial relief to the crisis-stricken private sector and that many of their demands have gone unaddressed. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government has announced establishment of two refinancing funds totaling Rs 150 billion. As per the arrangements, Nepal Rastra Bank will provide refinancing facility of Rs 100 billion. Separately, a Rs 50 billion refinancing fund will be established with money received from the government, state-owned enterprises. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Both funds will provide concessional loans to businesses to restart their activities and pay salaries to their employees. According to the arrangements in the budget, businesses in agriculture, cottage industries, small and medium enterprises (SMEs), manufacturing industries, hotels and tourism sector enterprises can avail credit from the fund at 5 percent interest rate. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">“These are only basic reliefs for the private sector. We had suggested the government to bring stimulus package worth 5 percent of the country’s GDP. The measures announced in the budget are 4 percent of GDP,” Said Bhawani Rana, president of Federation of Nepalese Chamber of Commerce and Industry (FNCCI). “There are not many things in the budget to encourage the private sector. However, arrangement for refinancing, programmes to support MSMEs, reduction in demand charge of electricity, income tax concession for tourism sector are positive steps,” she added. Rana said that it has become challenging for the crisis-stricken businesses to move ahead in the coming days due to lack of clarity in mobilization of capital and relief packages. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Rajendra Malla, senior vice president of Nepal Chamber of Commerce (NCC) said that the budget is overall positive for the private sector. “The increase of budget allocation for public health is very timely. However, the Ministry of Finance has not given its attention to the revenue target and whether or not the government can manage its expenses at present. The revenues sources have shrunken significantly at the moment,” he opined. According to Malla, the government, which has prioritised agriculture sector development in the Federal Budget for FY2020/21, has not given preference to internal logistic and transportation due to which production of goods will remain costlier. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Dhruva Thapa, president of Cement Manufacturers’ Association, Nepal (CMAN) said the the arrangements in the budget are ‘traditional’ except for the health sector development. He stated continuation of consituency development fund and failure to bring budget on the basis of priority even at this time of crisis as dejected. “There are concerns how all industrialists and business persons can avail the refinancing facilities. The success of the government’s announcement depends on how the arrangements in the budget are implemented,” he said. </span></span></span></span></h1> ', 'published' => true, 'created' => '2020-05-29', 'modified' => '2020-05-29', 'keywords' => '', 'description' => '', 'sortorder' => '11840', 'image' => '20200529043520_recovery.jpg', 'article_date' => '2020-05-29 16:33:43', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 5 => array( 'Article' => array( 'id' => '12089', 'article_category_id' => '1', 'title' => 'Govt Aims to Create 800,000 Jobs', 'sub_title' => '', 'summary' => 'At a time when unemployment in Nepal has excerberated as a result of sharp increase in the number of Nepalis losing jobs inside and outside the country due to the Covid-19 pandemic, the government has announced new programmes in the Federal Budget for FY2020/21 to create 800,000 jobs. ', 'content' => '<h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">At a time when unemployment in Nepal has excerberated as a result of sharp increase in the number of Nepalis losing jobs inside and outside the country due to the Covid-19 pandemic, the government has announced new programmes in the Federal Budget for FY2020/21 to create 800,000 jobs. Presenting the budget in the House of Representatives, Finance Minister Dr Yuba Raj Khatiwada said that the creation of new jobs has been prioritised in the budget for the upcoming fiscal year estimating that one million Nepalis will lose their jobs within the country while 500,000 will become jobless abroad. Dr Khatiwada mentioned that the programmes in the new budget aim to provide employment opportunities to all Nepalis through dignified jobs, social security and ideal labour relations to increase the labour productivity in the country. </span></span></span></span></h1> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">It is estimated that 500,000 Nepalis enter job market every year. The government has predicted that out of 4.79 million people currently in foreign employment, the pandemic-induced crisis has forced about 1.5 million to return to the country. This situation has posed a huge challenge for the government which has so far struggled to generate enough for Nepalis youths. </span></span></span></span></h1> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The Prime Minister Employment Programme (PMEP) will be the biggest government undertaking in employment creation which aims to generate 200,000 jobs. PMEP, which has been implemented in all three levels of the government, will ensure 100-day employment. The budget allocation for the programme for the upcoming fiscal year has been increased to Rs 11.60 billion from Rs 5 billion in the current fiscal year. Similarly, Rs 1 billion has been allocated to conduct handicraft, plumbing, electronics, cook, mansion, tailoring, beautician, barber trainings on federal and central levels to generate 50,000 jobs. Meanwhile, Rs 4.34 billion has been allocated to provide technical trainings to 75,000 individuals. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The budget has aimed to generate 40,000 jobs through Small Farmers Credit Programme and 12,000 jobs through Self-employment Loan Programme. Meanwhile, the government has targeted to create 127,000 through micro entrepreneurship programme and an additional 30,000 jobs through programmes based on utilisation of forest resources. “32,000 instituions promoted by the Poverty Allevation Fund will transformed into cooperatives to create 150,000 jobs,” Finance Minister Dr Khatiwada said. </span></span></span></span></p> <h1><span style="font-size:24pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">In his budget speech, the finance minister said that local units will run infrastructure development and social programmes and ‘food for work’ programme targeting people from poor families. Similarly, those who have lost their jobs in the country and foreign returnees will be employed in labour-intensive development works. The government has announced to further tighten to employ foreign workers without obtaining labour permits. Presently, there is an arrangement in this regard, but hundreds of thousands of foreign workers, particularly from India, are working in Nepal without such permits due to lax regulation and monitoring. Economists say that this situation offers big opportunities to Nepal to replace foreign workforce in the country with Nepali workers. Dr Shankar Sharma, former vice chairman of National Planning Commission (NPC) thinks that this will help to enhance skills of Nepali workers which would ultimately make a big difference. </span></span></span></span></h1> ', 'published' => true, 'created' => '2020-05-29', 'modified' => '2020-05-29', 'keywords' => '', 'description' => '', 'sortorder' => '11839', 'image' => '20200529013427_employment.jpg', 'article_date' => '2020-05-29 13:32:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 6 => array( 'Article' => array( 'id' => '12088', 'article_category_id' => '1', 'title' => 'Irrigation and Agriculture Sector-focused Programmes Get Priority', 'sub_title' => '', 'summary' => 'The government has prioritised the agriculture sector development by announcing a slew of programmes in the Federal Budget for FY2020/21.', 'content' => '<h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">The government has prioritised the agriculture sector development by announcing a slew of programmes in the Federal Budget for FY2020/21. Presenting the budget in the House of Representatives, Dr Yuba Raj Khatiwada said that Rs 41 billion has been allocated for promoting agricultural products and Rs 27 billion for irrigation infrastructure development. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">The programmes announced for agriculture sector development include facilitation of contract and land pooling, establishment of 78 wholesale markets for agriculture produce across covering all seven provinces, cash subsidy to farmers for improvised seed production, installation of weather radars, formation of land banks at 300 locations across the country, international promotion and branding of Nepali coffee, major herbs and other cash crops, launching of farmers credit card, setting up of standard food testing lab one each in Gandaki and Karnali provinces and setting up of well-facilitated animal quarantine labs at all major border customs across the country. Similarly, Rs 11 billion has been allocated in the budget for supply and distribution of chemical fertilisers, while Rs 950 million has been allocated for promotion of sugarcane cultivation. Likewise, Rs 3.22 billion has been allocated to run ‘One Local Level, One Pocket Product’ programme. </span></span></span></span></h2> <h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">Meanwhile, the government has announced to promote shallow water irrigation system with a view to expand irrigation to additional 22,000 hectares of land across the country. Finance Minister Dr Khatiwada also said that the construction of the proposed Mahakali Irrigation Project will move ahead as a national pride project. </span></span></span></span></h2> <p> </p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11838', 'image' => '20200528075055_irrigation.jpg', 'article_date' => '2020-05-28 19:47:42', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 7 => array( 'Article' => array( 'id' => '12087', 'article_category_id' => '1', 'title' => 'Govt Brings Budget of Rs 1,474.64 billion, Targets 7% Economic Growth', 'sub_title' => '', 'summary' => 'The government has announced the Federal Budget of Rs 1,474.64 billion for the fiscal year 2020/21.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">The government has announced the Federal Budget of Rs 1,474.64 billion for the fiscal year 2020/21. In his budget speech, Finance Minister Dr Yuba Raj Khatiwada informed that a total of Rs 948.94 billion has been allocated for recurrent expenditure while Rs 352.91 billion has been allocated for capital expenditure in the next fiscal year. The budget has targeted to raise Rs 889.62 billion through revenue collection while aiming to raise Rs 60.52 billion through foreign assistance. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">Similarly, it has aimed raising Rs 299.50 billion and Rs 225 billion in external and internal debts, respectively. Meanwhile, the government has set economic growth target at 7 percent for FY2020/21. Likewise, it has announced to keep inflation rate target at 7 percent for the next fiscal year, an increment of one percentage point from current fiscal year’s target of 6 percent. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11837', 'image' => '20200528070154_budget nepal.jpg', 'article_date' => '2020-05-28 19:00:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 8 => array( 'Article' => array( 'id' => '12086', 'article_category_id' => '1', 'title' => 'Industries Shut Down during Lockdown to Get Electricity Bill Concession ', 'sub_title' => '', 'summary' => 'The government has announced to provide concession on electricity bill to the industries that have remained shut down during the period of lockdown. ', 'content' => '<h2><span style="font-size:18pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:16.0pt"><span style="font-family:"Arial",sans-serif">The government has announced to provide concession on electricity bill to the industries that have remained shut down during the period of lockdown. Unveiling the Federal Budget for FY2020/21, Dr Yuba Raj Khatiwada informed the parliament that the industries will receive concession in demand charge of electricity and will also get 50 percent discount on electricity bill during off-peak hours. </span></span></span></span></h2> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11836', 'image' => '20200528060901_power meter.jpg', 'article_date' => '2020-05-28 18:07:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 9 => array( 'Article' => array( 'id' => '12085', 'article_category_id' => '1', 'title' => 'PMEP Budget Increased by Two-Fold ', 'sub_title' => '', 'summary' => 'The budget allocation for the Prime Minister Employment Programme (PMEP) has been increased by over two-fold for the upcoming fiscal year.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The budget allocation for the Prime Minister Employment Programme (PMEP) has been increased by over two-fold for the upcoming fiscal year. In his budget speech, Dr Yuba Raj Khatiwada informed that Rs 11.60 billion has been allocated for PMEP for FY2020/21 which was Rs 5.1 billion in the current fiscal year. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Dr Khatiwada said that the government aims to create 200,000 jobs for the youths through the programme in FY2020/21. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11835', 'image' => '20200528082637_Prime-Minister-Self-employment-Programme.jpg', 'article_date' => '2020-05-28 18:00:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 10 => array( 'Article' => array( 'id' => '12084', 'article_category_id' => '1', 'title' => 'Rs 6 billion to Fight Coronavirus', 'sub_title' => '', 'summary' => 'The government has allocated a Rs 6 billion for prevention and control of coronavirus in the Federal Budget for FY2020/21. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government has allocated a Rs 6 billion for prevention and control of coronavirus in the Federal Budget for FY2020/21. Unveiling the budget, Finance Minister Dr Yuba Raj Khatiwada said that the allocated amount will be used to expand the scope of COVID-19 testing, increase and manage quarantine facilities and mange health facilities throughout the country. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11834', 'image' => '20200528055828_covid-19 testing.jpg', 'article_date' => '2020-05-28 17:57:29', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 11 => array( 'Article' => array( 'id' => '12083', 'article_category_id' => '1', 'title' => 'Government to Deposit SSF Contribution for Lockdown Period', 'sub_title' => '', 'summary' => 'The government has announced to deposit Social Security Fund (SSF) contribution of employee and their employers on salary of employees for the lockdown period. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government has announced to deposit Social Security Fund (SSF) contribution of employee and their employers on salary of employees for the lockdown period. In his speech of the Federal Budget for FY2020/21, Finance Minister Dr Yuba Raj Khatiwada said the government will deposit the money into the respective SSF accounts of the employees. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman",serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The government in March had decided to deposit the SSF contribution of 158,509 employees of private sector companies and I/NGOs associated with the fund. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11833', 'image' => '20200528055558_khatiwada.jpg', 'article_date' => '2020-05-28 17:54:47', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 12 => array( 'Article' => array( 'id' => '12082', 'article_category_id' => '1', 'title' => 'Biratnagar Industrialists Demand An End to Government Indifference', 'sub_title' => '', 'summary' => 'In a sign of increasing disquiet among members of the business community as a result of the government’s Covid-19 response and its crippling impacts to industrial and business activities, industrialists of Biratnagar have started to raise voices to draw attention of the government towards their grievances by hanging banners outside industrial and offices complexes.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">In a sign of increasing disquiet among members of the business community as a result of the government’s Covid-19 response and its crippling impacts to industrial and business activities, industrialists of Biratnagar have started to raise voices to draw attention of the government towards their grievances by hanging banners outside industrial and offices complexes. The banners that started appearing from the morning of May 27 reads the slogan, “Government! Industries and business that are the basis of economic development and employment are in crisis!!” The banners were displayed on the joint call by Morang Merchant Association (MMA), Chamber of Industries Morang (CIM) and Birat Trade Association (BTA). </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Officials of the associations say they took the step against the government’s indifference towards the grief of business community. According to them, the move is aimed at pressurising the government to address the demands jointly presented by the main business bodies Federation of Nepalese Chambers of Commerce and Industry (FNCCI), Confederation of Nepalese Industries (CNI) and Nepal Chamber of Commerce (CNI). Banners have been displayed outside the offices of MMA, CIM and BTA. Similarly, various business houses, industrial enterprises and industries situated at Sunsari-Morang Industrial Corridor have also displayed the banners outside their gates. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Bhim Ghimire, president of CIM said that this step has been aimed towards putting pressure onto the government to address grievances of business community in the budget for fiscal year 2020/21. “We have been working to help the government to meet its aim of ‘Prosperous Nepal, Happy Nepalis’ by generating employment opportunities and contributions to the country’s economy,” he said, adding, “Industries, which serve as base of economic prosperity, are in crisis at the moment. Therefore, the government must not show indifference towards the demands of business community members.” </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11832', 'image' => '20200528043720_banner.jpg', 'article_date' => '2020-05-28 16:33:08', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ), (int) 13 => array( 'Article' => array( 'id' => '12081', 'article_category_id' => '1', 'title' => 'Budget 2020/21: FinMin Faces Pressure to Balance Economic Recovery Needs and Resource Management', 'sub_title' => '', 'summary' => 'At a time when the country’s economy has been ravaged by the Covid-19 pandemic causing a huge loss of government revenue, Finance Minister Dr Yuba Raj Khatiwada is unveiling the Federal Budget for fiscal year 2020/21 today facing a big pressure to have a delicate balance between management of resources and stimulus package to help start the recovery of the crisis-stricken economy. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">At a time when the country’s economy has been ravaged by the Covid-19 pandemic causing a huge loss of government revenue, Finance Minister Dr Yuba Raj Khatiwada is unveiling the Federal Budget for fiscal year 2020/21 today facing a big pressure to have a delicate balance between management of resources and stimulus package to help start the recovery of the crisis-stricken economy. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">According to officials at the Ministry of Finance (MoF), the key focuses of budget for the upcoming fiscal year will be on minimising Covid-19 impacts on Nepal’s economy, enhancement of health infrastructure and employment generation. Ministry sources say that the government will allocate significant amount of money for health infrastructure. Similarly, the budget will also prioritise commercial agriculture and farming to provide employment opportunities to those who have lost their jobs inside and outside of the country due to the pandemic. “There will be arrangement in the budget for supplying required human resource to the local levels through job bank,” said a MoF official engaged in preparation of budget who wished not to be named. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Tax and non-tax revenue, foreign aid and internal borrowing - major income resources for the government- are under immense pressure right now because of the abrupt halt in domestic economic activities and severe disruptions in Nepal’s foreign trade. The fact that revenue collection reached only half of the targeted amount of Rs 1,112 billion by mid-May shows the level of immense pressure government is currently under in terms of resource management. The MoF source say that budget for the upcoming year will have austerity measures to curb unnecessary expenses. It is being said that the size of the Federal Budget for FY2020/21 will be similar to the budget of the current fiscal year. The severe constrain in resources has led the government to put its high hopes on foreign aid for the upcoming budget. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">As the government is yet to respond calls to announce stimulus package to kickstart economic recovery, all eyes are on the Finance Minister now to see how he addresses the demand of the private sector and unemployed people. It has been estimated that stimulus package of Rs 200 billion is immediately needed to support the ailing economy. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">At the time of the crisis, resource management has become cumbersome for the government also because of its obligation to mandatory liabilities such as pension, salary and allowances to civil servants, security personnel, payment of principle and interest of foreign borrowings and social security allowances. According to the Financial Comptroller General Gopinath Mainali, 60 percent of expenses in the budget of current fiscal year have been allocated for mandatory liabilities. The government currently spends Rs 55 billion in pension, Rs 66 billion in social security allowances to 2.9 million people, Rs 100 billion in principle and interest payment of foreign loans and Rs 300 billion in renumeration of security personnel and teachers. This liability of government has been increasing every year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">The share of development budget allocated for the current fiscal year is just 26 percent of the total allocations. According to Mainali, the government can lower the resource management pressure if it cancels unnecessary civil service positions, commissions, political appointments and cuts down number of ministries and divisions. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Jagdish Chandra Pokharel, former vice chairman of National Planning Commission said that the government’s recurrent expenditure has been increasing constantly than capital expenditure since 2008 when the country was declared a republic state. According to him, the country’s overall economic system has been moving in uncontrolled ways due to this imbalance. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-28', 'modified' => '2020-05-28', 'keywords' => '', 'description' => '', 'sortorder' => '11831', 'image' => '20200528020639_Yubaraj-Khatiwada.jpg', 'article_date' => '2020-05-28 14:04:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '31' ) ), (int) 14 => array( 'Article' => array( 'id' => '12080', 'article_category_id' => '1', 'title' => 'Arable Land Shrinking: Economic Survey ', 'sub_title' => '', 'summary' => 'Despite the government’s policy to discourage non-utilisation of arable land, lands used for plantation for major crops have been shrinking across the country.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Despite the government’s policy to discourage non-utilisation of arable land, lands used for plantation for major crops have been shrinking across the country. According to Economic Survey 2019/20, agricultural land has shrunken by 0.9 percent in the current fiscal year compared to the last fiscal year. “Fragmentation of land and flight of young workforce from to work abroad have been the major reasons for shrinkage of arable land,” reads the report. According to the survey, land used for paddy plantation has decreased by 2.2 percent in FY2019/20 compared to last fiscal year. Similarly, the government has estimated decline in production of paddy by 1.1 percent which was 8.1 percent in FY2018/19. The survey has cited inadequate rainfall this year for the decline of paddy production. Nevertheless, the area of maize and wheat plantation has increased by 0.2 percent and 0.3 percent, respectively. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Meanwhile, share of agriculture sector in the country’s GDP has also decreased. The contribution of the sector to GDP, which was 37.1 percent in FY2010/11, is expected to decline to 27.7 percent in the current fiscal year. The agriculture sector productivity, which grew by 5.1 percent in FY2018/19 is estimated to shrink to 2.6 percent in the current fiscal year. According to Economic Survey, the decrease in paddy production and the lockdown imposed by the government to stop the spread of coronavirus have affected production of vegetables, meat and dairy items. The government has estimated that production of vegetables, which had increased by 4 percent in FY2018/19, will dip by 4.3 percent to 40,089 metric tonnes in the current fiscal year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,sans-serif"><span style="font-size:15.0pt"><span style="font-family:"Arial",sans-serif">Despite decreasing contribution to the country’s GDP, agriculture sector’s contribution to the economic growth has been seen fluctuating. According to Economic Survey, the contribution of agriculture sector to Nepal’s overall economic growth is estimated to be 32.7 percent in the current fiscal year which was 21.2 percent in FY2018/19. </span></span></span></span></p> ', 'published' => true, 'created' => '2020-05-27', 'modified' => '2020-05-27', 'keywords' => '', 'description' => '', 'sortorder' => '11830', 'image' => '20200527082816_State_of_agriculture.jpg', 'article_date' => '2020-05-27 20:20:55', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '31' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117