Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '519',

'hit' => '1250'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '519',

'hit' => '1250'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '519',

'hit' => '1250'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '519',

'hit' => '1250'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '519',

'magazine_issue_id' => '403',

'magazine_category_id' => '0',

'title' => 'Stagnant Market Ahead of Earning Reports',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.</div>

<div>

</div>

<div>

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements. </div>

<div>

</div>

<div>

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns. </div>

<div>

</div>

<div>

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain. </div>

<div>

</div>

<div>

Performance by Sector</div>

<div>

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46. </div>

<div>

</div>

<div>

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.</div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.</div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions. </div>

<div>

</div>

<div>

<em>(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)</em></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/sctrl.jpg" style="width: 550px; height: 230px; margin-left: 10px; margin-right: 10px;" /></div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-10-25 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.',

'sortorder' => '493',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '403',

'image' => 'small_1382259571.jpg',

'sortorder' => '298',

'published' => true,

'created' => '2013-10-20 02:00:49',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-10-01',

'parent_id' => '384',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '519',

'hit' => '1250'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Stagnant Market Ahead of Earning Reports

--By Bikram Chitrakar

The stock market of Nepal turned stable during the review period between 20 August and 19 September, ahead of the earning reports of different banking and financial institutions. The benchmark Nepse index added a modest 0.66 points or 0.12 per cent to rest at 548.98. The highest point for the review period was reached on 9 September 552.34 while the lowest was reached on 4 September 545.5.

Investors await the report on earnings from different banking and financial institutions which have driven the index for most of the time. The Standard Chartered Bank Nepal has declared 10 per cent bonus share and 40 per cent cash dividend; Nabil Bank has announced a 40 per cent cash and 25 per cent bonus share; Nepal SBI Bank decided to propose 12.5 per cent bonus share and 7.5 per cent cash dividend while other institutions are also in row to declare their earnings’ announcements.

Profit booking has also been noticed in a few sessions after the escalation of the market. Investors rush to secure their profit with a steady market growth and also heed dividend giving stocks and settle with those less attractive or with no returns.

As investors intensify their expectations, the deceleration of the earning for the fiscal year 2069/70 will guide the market move ahead of Dasain.

Performance by Sector

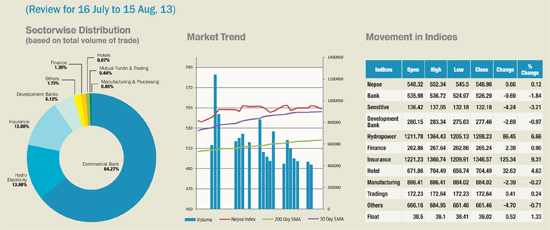

Following previous trends, the insurance sector added 125.34 points or 9.31 per cent to rest at 1346.57. The hydropower sector moved higher by 86.45 points or 6.66 per cent to 1298.23 while the hotels sector gained 32.63 points to reach 704.49. The commercial banking sector, however, plunged by 9.69 points or 1.84 per cent to rest at 526.29. The ‘Others’ sector with the heavy scrip of Nepal Telecom descended 4.70 points to 661.46 whereas the development bank sector went down by 2.69 points to 277.46.

The sensitive index that measure the performance of 120 blue chips at secondary market plummeted by 4.24 points or 3.21 per cent to 132.18. However, the float index calculated on the basis of real transactions ascended by 0.52 points or 1.33 per cent to 39.02. A total of Rs. 3,580,221,388 turnover was realized during the review period from 11101443 units of shares traded via 39,607 transactions.

The accompanying figure depicts the sector-wise distribution based on total volume of trade. Commercial banks dominated the total volume of trade with 64.27 per cent holdings. Development banks covered 13.98 per cent, the insurance sector accounted for 12.08 points and the rest of the sectors made up for the remaining.

Technically, the Simple Moving Average (SMA) has dominated both short term and long term SMA. However, narrowing down of the index suggests a few sideway movements for upcoming sessions.

(Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.)