Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

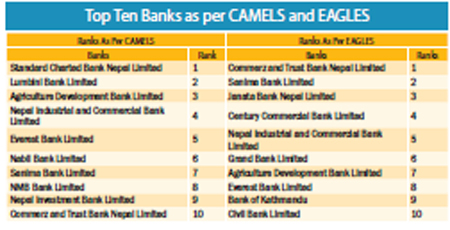

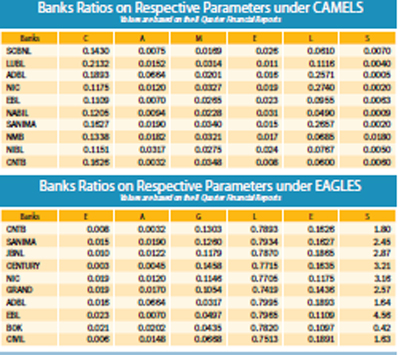

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '354',

'hit' => '6914'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '354',

'hit' => '6914'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>

In the CAMELS rating system, each bank is assigned two sets of ratings: </div>

<div>

1. Performance Ratings, which comprise six individual ratings that address each of the CAMELS components; and </div>

<div>

2. An overall Composite Rating, which is a single rating based on a comprehensive assessment of the bank’s overall condition. </div>

<div>

</div>

<div>

Both the ratings are scored on a numerical scale of 1 to 5 in the ascending order of supervisory concern where “1” represents the best rating and “5” the worst.</div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/bank.jpg" style=";" /></div>

<div>

Here is a description of the rating scores for each of the five components: </div>

<div>

<img alt="" src="/userfiles/images/bank2.jpg" style="float: right; margin: 0px 0px 0px 10px;margin: 10px;" /></div>

<div>

Rating 1 (A) indicates very strong performance </div>

<div>

Rating 2 (B) indicates above-average performance that adequately provides for a safe and sound operation of the BFIs. </div>

<div>

Rating 3 (C) indicates performance that is flawed to some degree. </div>

<div>

Rating 4 (D) indicates unsatisfactory performance which, if left unchecked, could threaten the solvency of the BFIs. </div>

<div>

Rating 5 (E) indicates very unsatisfactory performance and calls for immediate remedial attention for the survival of the BFIs. </div>

<div>

</div>

<div>

The rating of banks can be further developed by giving a score to each component of the CAMELS, known as the Composite CAMELS Rating Score. The Composite CAMELS Rating can be calculated as: </div>

<div>

</div>

<div>

Composite CAMELS Rating= C (0.25) + A (0.25) + M (0.25) + E (0.10) + L (0.10) + S (0.05) </div>

<div>

</div>

<div>

Each of the above six parameters can be weighted on a scale of 1 to 100 and contains a number of sub-parameters with individual weightage. </div>

<div>

</div>

<div>

The EAGLES system is able to measure and compare banks’ performance in a more determinate, objective and consistent manner. The name is derived from the key success factors confronting banks today, i.e. Earning Ability, Asset quality, Growth, Liquidity, Equity and Strategy. This approach has gained credibility among the banking community and fund management industry in Asia, for competition analysis and investment planning, respectively. </div>

<div>

</div>

<div>

EAGLES evaluate banks on the following six parameters: </div>

<div>

1. Earning Ability: Earning ability is shown by three noteworthy indicators – Return on Assets (ROA), Return on Shareholders’ Fund (ROSF) and Income/ Overheads Ratio (IOR). The importance of IOR is usually not well understood. The main point lies in that income depends on external market forces, while overheads are highly influenced by internal staffing. So, the banks must know how to adjust the staffing according to the market demand for its products and services. This is shown by three indicators - ROA, Return on Net worth (RONW) and IOR. </div>

<div>

2. Asset Quality: Asset quality is best assessed by on-site inspection of the bank’s loan portfolio. If this is not possible, asset quality can be measured by the level of bad debt provisions, that is, bad and doubtful debts (BDD) as a percentage of total loans. A conservative approach will dictate that the quantum of provision to err on the high side is rather low. This is best judged by the level of bad debt provisions, that is, bad and doubtful debts as a percentage of total loans. A conservative approach will dictate that the quantum of provision is on the high side is rather low. </div>

<div>

3. Growth: Growth rates of loans and core deposits are the most important indicators of how a bank wants to position itself in the market. </div>

<div>

4. Liquidity: Liquidity can be described as the ability of a bank to have sufficient funds to meet cash demands for loans, deposit withdrawals and operating expenses. For this reason, a balance should be made between the amount of deposits garnered and the quantum of loans extended. The indicator is the deposit-to-loan ratio or credit-deposit ratio (CD Ratio). </div>

<div>

5. Equity: Equity level and capital adequacy have a profound impact on the bank. International guideline (Basel II) stipulates that a bank must have a minimum capital equivalent to 8 per cent of the risk adjusted assets. Even the central bank of Nepal, the NRB, has mentioned a comfort zone of 6 and 10 per cent of core capital and total capital funds, respectively, based on the risk-weight assets (percent). </div>

<div>

6. Strategy: The effective management of a bank’s strategy is indicated by the strategic response quotient (SRQ). It assesses the management’s ability to lend, garner deposits, generate fee-based income and manage the operating cost. An appropriate balance of the three core banking activities depends on the bank’s strategy. The SRQ is obtained by dividing the interest margin by net operating cost (that is, total operating cost minus fee income). </div>

<div>

</div>

<div>

Seventeen banks could not feature on the top-ten list under both ratings. The banks with negative capital adequacy ratio and very low return on assets were seen behind in ranking under CAMELS rating. Similarly, the banks with huge amount of non-performing loan and negative return on assets were seen at the lowest rank under EAGLES rating.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well.',

'sortorder' => '331',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '123',

'image' => 'small_1371799322.jpg',

'sortorder' => '63',

'published' => true,

'created' => '2013-06-20 11:55:51',

'modified' => '2013-06-21 12:22:10',

'title' => 'Sectoral',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '354',

'hit' => '6914'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '354',

'magazine_issue_id' => '123',

'magazine_category_id' => '0',

'title' => 'Banks in CAMELS and EAGLES',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

Standard Charted Bank Nepal Limited is seen at number one position under the CAMELS Rating. The bank stood at the number one position as per the evaluation done on its second quarter financial report of the fiscal year 2012- 13. The bank has been capable to maintain good total expenses to total assets ratio during the period among the 32 commercial banks. Similarly, the bank has also maintained good return on assets as well. </div>

<div>

</div>

<div>

The newly established commercial banks stood at the top rank under the EAGLES Rating. The low level of non-performing loan to total loan and advance ratio was the main reason behind these banks to stand at the top rank. Similarly, the high growth ratio of the loan and advances also boosted them to get top rank. </div>

<div>

</div>

<div>

As per the EAGLES rating, Commerze and Trust Bank Limited stood at the first position. Similarly, Sanima Bank Limited which was upgraded from the development bank to commercial bank came at second. The good position of the credit-deposit ratio and capital adequacy ratio of the newly opened bank has helped them to gain the top position. </div>

<div>

</div>

<div>

The CAMELS system evaluates banks on the following six parameters: </div>

<div>

1. Capital Adequacy: Capital adequacy has been the main pillar of existence of any bank. Banks have to maintain a proper mix of different types of capitals to avoid pressure on their dividend policies and inadequacy of total capital funds against the risk exposure. Capital adequacy is measured by the Capital to Risk-Weighted Assets Ratio (CRAR). A sound capital base strengthens the confidence of depositors. </div>

<div>

</div>

<div>

2. Asset Quality: One of the indicators for asset quality is the ratio of non-performing loans to total loans (Gross Non-Performing Assets - GNPA). The gross non-performing loans to gross advances ratio is more indicative of the quality of credit decisions made by bankers. A higher GNPA is indicative of poor credit decision-making. </div>

<div>

</div>

<div>

3. Management: The ratio of non-interest expenditures to total assets can be one of the measures to assess the working of the management. This variable, which includes a variety of expenses, such as payroll, workers’ compensation and training investment, reflects the management policy stance. </div>

<div>

</div>

<div>

4. Earnings: It can be measured as the return on asset, ratio. </div>

<div>

</div>

<div>

5. Liquidity: The ratio of cash maintained by a bank and balances with the central bank to the total asset, is an indicator of the bank’s liquidity. </div>

<div>

</div>

<div>

6. Sensitivity to Market Risks/ Systems and Control: Risks associated with adverse movements in the exchange rates (including gold positions), interest rates, liquidity and investment in equity are covered under market risk management. A bank faces market risks either from its investments in government securities and bonds or from the exchange rate risk that persist in matching position. The market risk is managed by the banks’ Asset and Liability Committee (ALCO) which assesses policies and levels of risk appetite. Similarly, the central bank of Nepal, Nepal Rastra Bank has made a provision of additional </div>

<div>

</div>

<div>

2 percent of the total Risk Weighted Exposures by Supervisory Review. </div>

<div>

</div>

<div>