Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '349',

'hit' => '1034'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '349',

'hit' => '1034'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '349',

'hit' => '1034'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '349',

'hit' => '1034'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '349',

'magazine_issue_id' => '119',

'magazine_category_id' => '0',

'title' => 'Politics Still Ruling',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>By Bikram Chitrakar</strong></div>

<div>

</div>

<div>

<img alt="" src="/userfiles/images/stock.jpg" style="float: right; margin: 10px; height: 500px;" /></div>

<div>

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors. </div>

<div>

</div>

<div>

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule. </div>

<div>

</div>

<div>

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs. </div>

<div>

</div>

<div>

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days. </div>

<div>

</div>

<div>

Performance by Sector </div>

<div>

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96. </div>

<div>

</div>

<div>

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions. </div>

<div>

</div>

<div>

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest. </div>

<div>

</div>

<div>

<strong>- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.</strong></div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-29 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.',

'sortorder' => '326',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '119',

'image' => '',

'sortorder' => '59',

'published' => true,

'created' => '2013-06-20 05:17:54',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-03-01',

'parent_id' => '59',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '349',

'hit' => '1034'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Politics Still Ruling

By Bikram Chitrakar

The possibility of a national government under the leadership of the Chief Justice accelerated the stock market most of the trading days during the review period. Effort of the major political parties for finding a new prime minister, forming a national consensus government and holding fresh elections soon have boosted the sentiments of the investors.

During the review period, the Securities Board of Nepal (SEBON) made credit rating mandatory for all companies that want to raise funds from the public exceeding Rs 30 million. This rule is mandatory effective from February 24. However, companies that had already filed application at SEBON, are exempted from the new rule.

Two huge initial public offerings (IPOs) - from Century Commercial Bank Nepal and Mega Bank Nepal – are in the offing. Recently, Commerz and Trust Bank Nepal‘s IPO received overwhelming subscription -11 times higher than the company demanded. Market analysts expect to see how the credit rating will influence the sentiment of general investors in the forthcoming IPOs.

Fall in the interest rate on deposits, yet to be seen recovery in real estate sector and commodity markets and beginning of operation of credit rating agency and central depository system have provided the room for bullish sentiment to rule the secondary market. Since the Nepali stock market is influenced a lot by sentiments, the recent growth does not confirm the beginning of bullish trend. Hence few sideways movements at this level are expected in the coming few days.

Performance by Sector

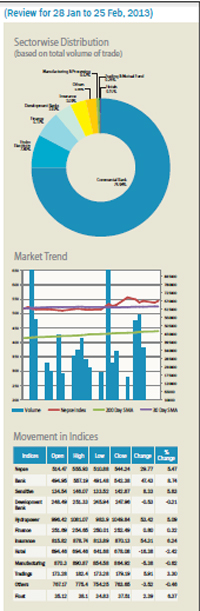

The banking sector that accounts for heavy volume of trade in the Nepali stock exchange, added 47.43 points or 8.74% to settle at 542.38. Insurance sub-index gained double digits or 54.31 points along with 53.42 points gain in hydropower sub-index that reached 870.13 and 1049.84 respectively. The trading sector moved higher by 5.91 points or 3.30 % to reach 179.19. However, hotels sector descended 16.38 points to rest at 678.08. Manufacturing sector plummeted 5.38 points or 0.62% to close at 864.92. Others sector lost 3.52 points or 0.46% to 763.65. Development bank skid modestly (0.53 points or 0.21%) to close at 247.96.

Sensitive index that measures the performance of 120 blue chips at the secondary market went uphill 8.33 points or 5.83% to 142.87 while the float index calculated on the basis of real transaction ascended 2.39 points or 6.37% to 37.51. Total of Rs. 2,157,002,662 turnover was realized during the review period from 6,638,956 units of shares traded via 22,459 transactions.

The accompanying figure depicts the sector-wise distribution based on the total volume of trade. As usual, commercial banking sector occupied 74.94% of total trade. Hydropower sector accounted for 7.80% while finance sector constituted 6.14% and remaining sectors made up for the rest.

- Chitrakar is a Stock Analyst with Jamb Technologies Pvt Ltd.