Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '227',

'hit' => '2377'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '227',

'hit' => '2377'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '227',

'hit' => '2377'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '227',

'hit' => '2377'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '227',

'magazine_issue_id' => '169',

'magazine_category_id' => '0',

'title' => 'Warehousing Problems: Insufficient Pre-requisites',

'image' => null,

'short_content' => null,

'content' => '<p>

<strong>By Chittaranjan Pandey</strong></p>

<p>

<img alt="" src="/userfiles/images/warehouse.jpg" style="float: right; width: 300px; height: 262px; margin: 10px;" /><br />

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.<br />

<br />

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.<br />

<br />

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.<br />

<br />

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.<br />

<br />

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.<br />

<br />

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.<br />

<br />

<strong>Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.</strong><br />

</p>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-19 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'description' => 'new business age sectoral news & articles, sectoral news & articles from new business age nepal, sectoral headlines from nepal, current and latest sectoral news from nepal, economic news from nepal, nepali sectoral economic news and events, ongoing sectoral news of nepal',

'sortorder' => '207',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '169',

'image' => 'small_1371808631.jpg',

'sortorder' => '109',

'published' => true,

'created' => '2013-06-21 02:57:47',

'modified' => null,

'title' => 'Sectoral',

'publish_date' => '2013-01-01',

'parent_id' => '61',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '227',

'hit' => '2377'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Warehousing Problems: Insufficient Pre-requisites

By Chittaranjan Pandey

Commodities exchanges in Nepal are handicapped by the lack of a warehouse receipt system to help the country’s agricultural development. The Nepali media recently launched a tirade of criticisms against the commodity exchanges in Nepal. One of the main points of that criticism was that the exchanges have not included the local agro-products, or any local product for that matter, in the list of commodities traded on their systems and that they are just making the investors trade in foreign commodities. The media also questioned the process of deriving the prices of the foreign commodities quoted in these exchanges. But unfortunately not even once did anybody try to know why the local products have not been introduced to the trading systems of these exchanges.

The answer is simple. These exchanges are not able to introduce the local commodities in their trading systems because of the lack of the necessary legal provision for the same. Yes, the Secured Transaction Act 2063 BS does list “Warehouse Receipts” as one of the tradable instruments. But just listing the name “Warehouse Receipt” in the law is not enough to hope that such receipts will be actually traded in the market.

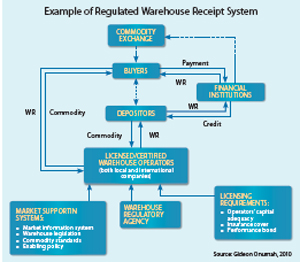

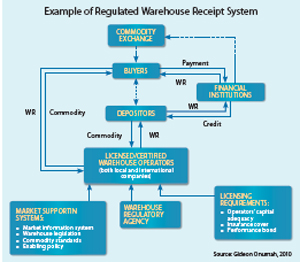

The flowchart given here presents an ideal system required to make warehouse receipts tradable. There are many infrastructural shortcomings we face in this regard. A commodity exchange is essential for this system but not sufficient. Like in any other market, the primary requirements here are the buyers and sellers. Then we need financial institutions like commercial banks. And we need a policy from the central bank that allows the banks to treat warehouse receipts as tradable (negotiable) instruments.

The issue with the commercial banks now is that they want to know who will take the responsibility if the products in the warehouse are not sold. So, we need the Insurance Board to come up with a policy that makes the insurance companies insure the agro-products stored in the warehouse. But as the situation is today, the insurance companies do not want to insure agro-products stored in the warehouse because of the higher risks.

Next, we need a public authority assigned with the task of licensing and regulating the warehouses that store agro-products and issue the warehouse receipts. We also need a proper market channel; a proper Supply Chain Management System. This requires competent transport companies that can deliver the goods to the buyers. Also required is a strong rule of law so that the transport companies are not obstructed anywhere on the roads while they are carrying the goods to their destinations.

Thus, for the local agro-products to be traded on the systems of these commodities exchanges, the basic pre-requisites are: a proper mechanism for warehouse receipt issuance and a proper mechanism for warehouse receipt financing. Agriculture, a less valued occupation at present, will be valued higher only when these systems are in place. A culture of commercial farming has actually started in the country but we still need a proper supply chain for this trend of commercial farming to thrive. A commodity exchange can help in this and eliminate the current system in which the number of intermediaries in the supply chain is unnecessarily high. Reduction in the number of intermediaries will bring the prices of agro-commodities up for the farmers and down for the consumers to a reasonable level. And this is possible once the general public and the policy makers think about it seriously.

Mr. Pandey is Asst. Manager, Research & Development Department in Mercantile Exchange Nepal Limited. He can be contacted at r&d@ mexnepal.com.