Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1907',

'hit' => '3911'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1907',

'hit' => '3911'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1907',

'hit' => '3911'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1907',

'hit' => '3911'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1907',

'magazine_issue_id' => '977',

'magazine_category_id' => '108',

'title' => 'Matchmakers : The New Economics of Multisided Platforms',

'image' => null,

'short_content' => 'Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free.',

'content' => '<div style="text-align: justify;"><img alt="" src="/userfiles/images/br%2811%29.jpg" style="float:right; height:247px; margin:5px; width:150px" />Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers. </div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: justify;">Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.</div>

<div style="text-align: justify;"> </div>

<div style="text-align: center;"><img alt="" src="/userfiles/images/br1%283%29.jpg" style="height:950px; width:700px" /></div>

<div style="text-align: center;"> </div>

<div style="background: rgb(230, 230, 250);padding:10px">

<p><span style="font-size:16px"><strong>Key Takeaways</strong></span></p>

<ul>

<li>Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.</li>

<li>With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.</li>

<li>Six technologies have helped drive innovation at matchmaking companies: more powerful chips, the Internet, the World Wide Web, broadband communications, programming languages and operating systems, and the Cloud. </li>

<li>Business opportunities typically arise for multisided platforms when various types of friction or transaction cost prevent market participants from interacting easily and directly. </li>

<li>The right pricing structure is critical for launching a multisided platform and ensuring it is profitable. </li>

<li>The new economics of multisided platforms demonstrate that certain guidelines almost always apply, such as making markets thick, remembering that small can be beautiful, facilitating searching and matching, and balancing externalities.</li>

<li>While turbocharged matchmakers will transform industries, the transformation will happen slowly over the course of many years, with some bursts of rapid change along the way.</li>

</ul>

</div>

<p style="text-align:right"><em>Compiled by Nabin Shrestha, Brand Consulting and Design www.water-comm.com</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-09-10 14:45:44',

'modified' => '2017-09-10 14:48:24',

'keywords' => '',

'description' => '',

'sortorder' => '1868',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '977',

'image' => '20170905113115_cover.jpg',

'sortorder' => '1526',

'published' => true,

'created' => '2017-09-05 11:31:15',

'modified' => '2017-09-06 09:12:04',

'title' => 'September 2017',

'publish_date' => '2017-09-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '108',

'title' => 'Living +',

'sortorder' => '507',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '0000-00-00 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1907',

'hit' => '3911'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Matchmakers : The New Economics of Multisided Platforms

Sharing isn't new. Giving someone a ride, having a guest in your spare room, running errands for someone, helping to sell old stuff-- these are not revolutionary concepts. What is new, in the "sharing economy," is that you are not helping a friend for free. Rather you are providing these services to a stranger for money. In this book, David Evans and Richard Schmalensee, two economists and experts on the sharing economy, explain the transition to what they describe as "crowd-based capitalism", a new way of organising economic activity that may supplant the traditional corporate-centred model.

Leveraged by modern technologies like high bandwidth data transfer, smart phones, online payment systems, data cloud, a lot of new companies have managed to crack the code of disruptive business and scaled up very fast. The book looks at “multi-sided platforms” or platforms that generate all or most of their income by providing a value-added service to two or more groups of customers.

Examples of multi-sided platforms abound including Facebook, Uber, Airbnb, Alibaba, Google Play Store, YouTube, Amazon, PayPal. It is a two-sided instead of one-sided interaction. Here in Nepal also, we have disruptors like Hamrobazaar, Sastodeal, Foodmandu, eSewa to name a few. It is a two-sided instead of a one-sided interaction.

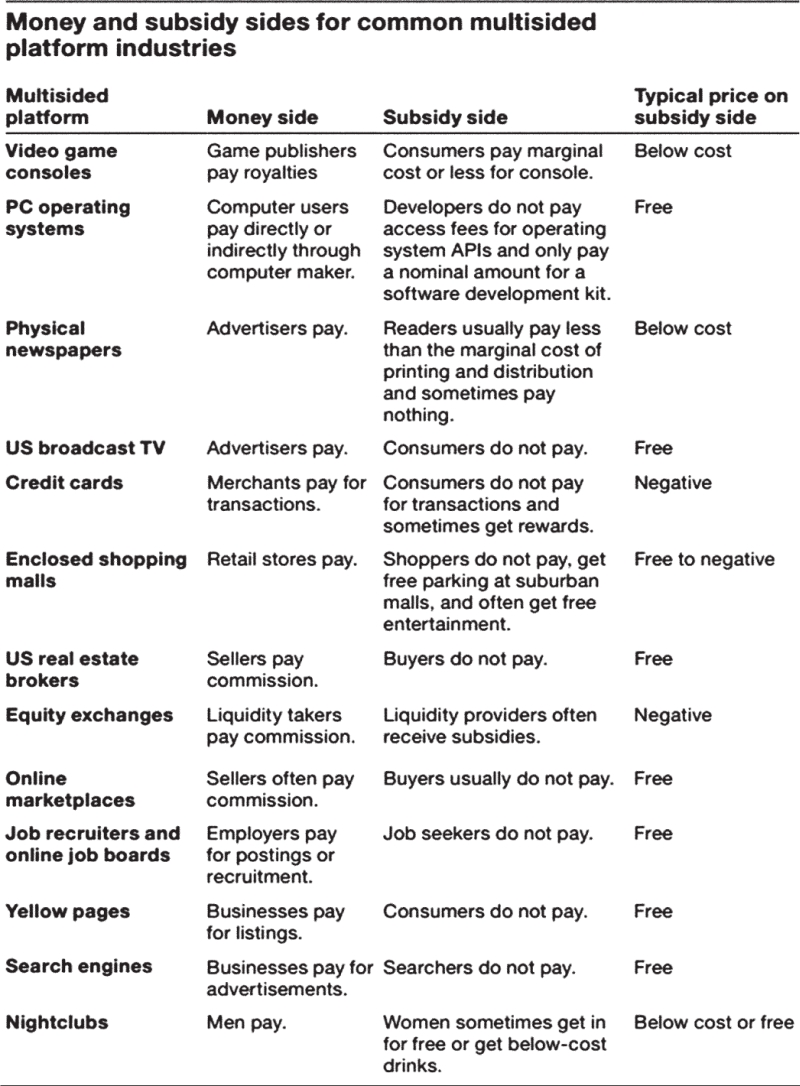

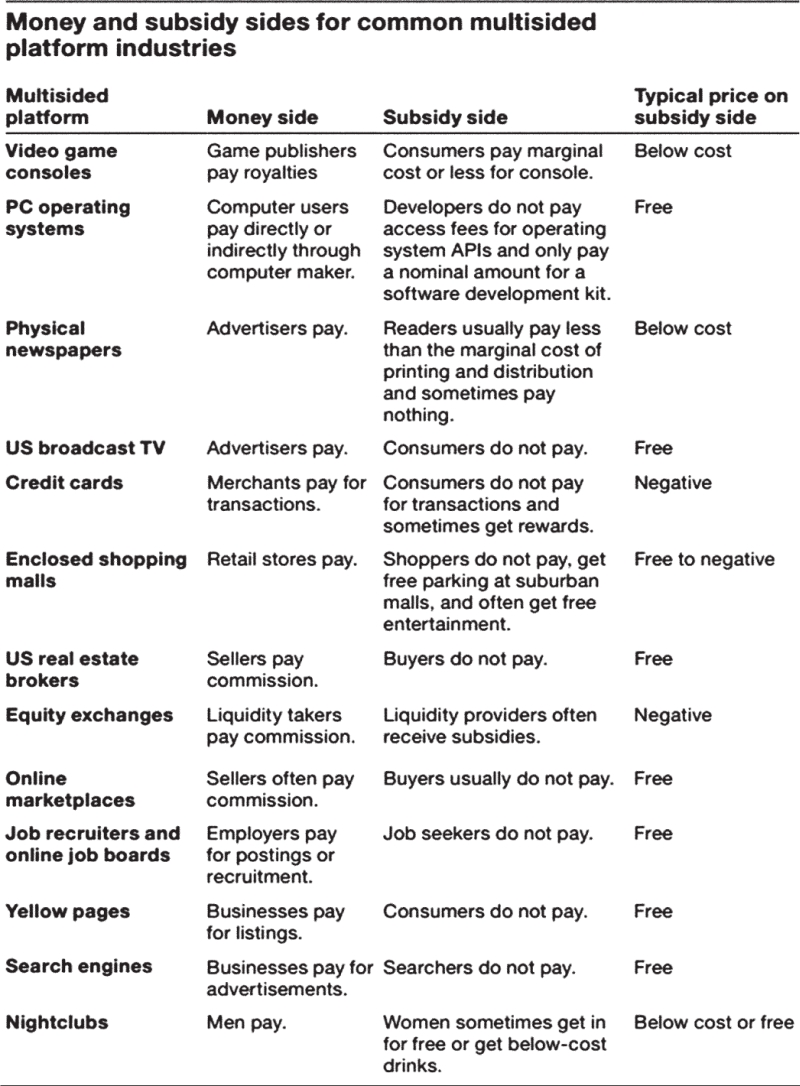

Matchmakers is quick to point out that these businesses don’t follow the expected traditional business model. Unlike traditional businesses, multi-sided platforms often charge little or nothing to one group of customers on a permanent rather than temporary basis. Multi-sided platforms also depend heavily on leveraging networks to achieve a critical mass of two groups of customers (often advertisers on one side and consumers on the other). In most cases, users aren’t charged a dime to access a lot of services, yet these users provide income through advertising or transactions. For example, a money-sending platform would charge more for sending money to a person who was not signed up than to a person who was signed up.

Whether you're an entrepreneur, an investor, a consumer, or an executive, your future will involve more and more multisided platforms, and "Matchmakers"--rich with stories from platform winners and losers—will help one to navigate this appealing but confusing world.

Key Takeaways

- Multisided platforms must attract two or more types of customers by enabling them to interact on favourable terms. They may be physical or virtual in nature.

- With multisided platform businesses, there must be a sufficient number of participants on both sides that would benefit from getting together. To secure critical mass, companies may use a zigzag strategy, a twostep strategy, a commitment strategy, or a combination of these.