Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

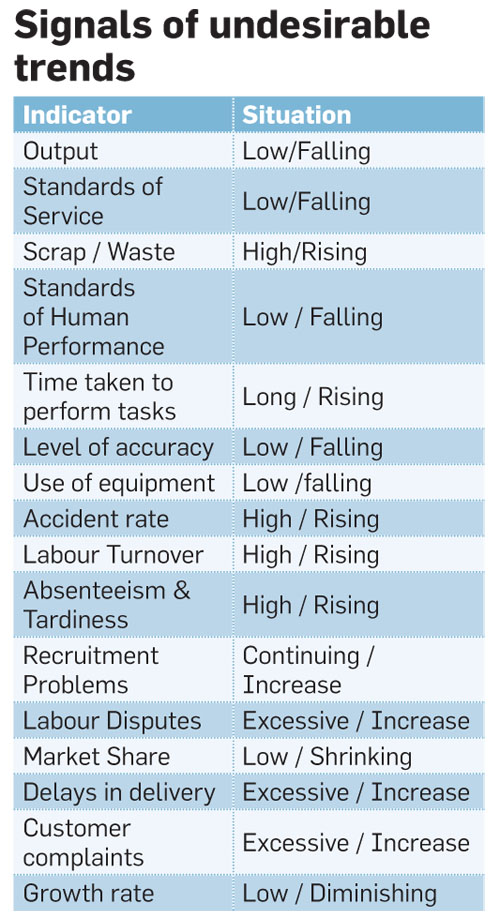

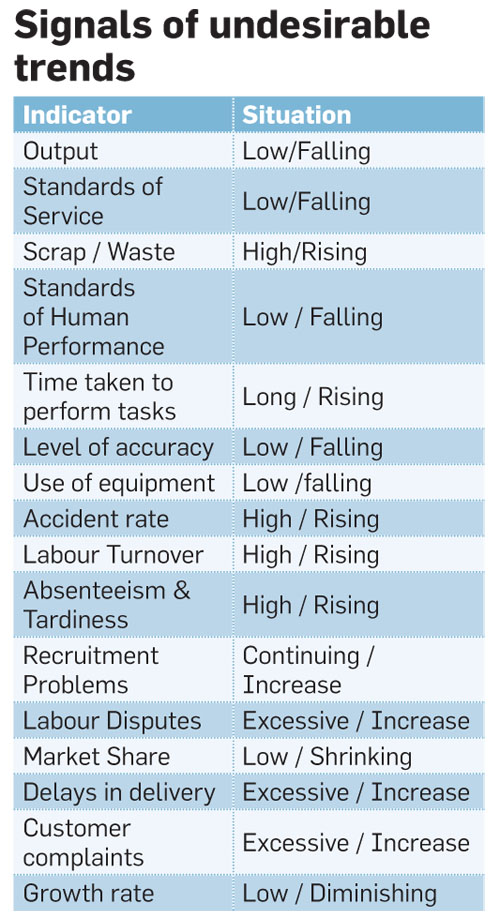

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />

d. Interest Rate – The low interest rate and the availability of funds at these rates trigger investment but the sudden drying up of funds and subsequent high jumps in interest rates increase the cost of working capital thereby making an operation uneconomical. <br />

e. Economic blockade – Recent disruption in supply of materials from India due to political reasons for as long as six months totally left the operation of the industrial units in disarray.<br />

f. Exchange rate – In the past the conversion rate of foreign exchange played havoc with the viability of the enterprises in Nepal which is more dependent on imports for all of its material input.</p>

<p style="text-align: justify;">Power shortages, natural calamities, market forces etc are the other external factors which set the pace for the downhill slide of an enterprise. In the context of Nepal, external forces are more potent in causing sickness in an enterprise than the internal factors.</p>

<p style="text-align: justify;">Along with the undesired trends in operational efficiency, financial consultants have suggested many models based upon a ratio analysis of liquidity, profitability, debt and equity in order to detect the initial symptoms of the disease. Arresting the deteriorating signals and implementing the revival plan are the next steps for an organisation. There are distinct phases of decline and the signals vary with every phase. Sometimes only a few symptoms appear but even a single symptom is a cause for worry. What is important is that instead of doing a post mortem of the sickness the enterprise inculcates, a culture of periodic continuous analysis of its operations should be done to capture the symptoms in the early stages </p>

<p style="text-align: justify;">Any turn-around plan consists of many steps undertaken diligently and seriously with everyone including the board of directors, banks, vendors and customers and all those who will be affected by the decline of the business included in the revival plan. Normally the seniors and outside stakeholders tend to be chiefly concerned with the balance sheet and income statement which may not disclose the hidden problems and tend to remain aloof from any efforts to stem the rot.</p>

<p style="text-align: justify;">The next important steps in the turnaround primer are the participation of employees and the co-operation of the trade union. For any turn around process to succeed it is important to appoint a “Turnaround manager “ who is adept at crisis management, has flexibility and patience as he is the fulcrum for the execution of the revival plan .</p>

<p style="text-align: justify;">Depending upon the stage of decline and the nature of the causes, the revival plan can be <br />

a) Strategic, b) Operational, c) Financial</p>

<p style="text-align: justify;">Each type of turning around process has to focus on a particular strategy such as: <br />

a. Revenue generating activities<br />

b. Product / market refocusing<br />

c. Cost control<br />

d. Asset reducing or maximizing its use.<br />

e. Reshaping the business<br />

f. Combination of any of the above</p>

<p style="text-align: justify;">The time frame for a turnaround varies depending upon the severity of the crisis. A business that has been in decline for many years may take a longer time to revive. Using the correct strategy is part of the art of successfully reviving a company and choosing a correct strategy is also a function of trial and error. The need to address decline and failure is obvious. A structured detecting mechanism in place will sense declining symptoms early and a sense of urgency to address them will avoid many of the bad consequences.</p>

<p style="text-align: justify;">The commercial bankers and lending financial institution have a pivotal role to play in addressing the problems. Their extremely cautious approach sometimes worsens the position of the sick units. However, it is necessary that the banks and the lending institutions move gradually towards a more understanding approach. They have to be in constant touch with the unit and without any bureaucratic delays participate in revival plans.</p>

<p style="text-align: justify;">The role of government is equally important as most of the sickness in Nepali enterprises can be attributed to external factors over which the unit has no control. So far the government intervention and participation has been inadequate and unrealistic. For entrepreneurs to take risks, the government has to ensure that it will immediately intervene and cushion units from the vagaries of external winds. Apart from certain incentives, government should also encourage mergers of these sick units into profitable ones so that the revival plan becomes sustainable.</p>

<p style="text-align: right;"><em>The writer is the chairman of Nimbus Group.</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-03-20 11:30:46',

'modified' => '2017-03-20 11:30:46',

'keywords' => '',

'description' => '',

'sortorder' => '1683',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '971',

'image' => '20170319100809_cover.JPG',

'sortorder' => '1520',

'published' => true,

'created' => '2017-03-19 10:08:09',

'modified' => '2017-03-19 10:30:36',

'title' => 'March 2017',

'publish_date' => '2017-03-19',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '44',

'title' => 'Management Gyan',

'sortorder' => '44',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2013-06-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />

d. Interest Rate – The low interest rate and the availability of funds at these rates trigger investment but the sudden drying up of funds and subsequent high jumps in interest rates increase the cost of working capital thereby making an operation uneconomical. <br />

e. Economic blockade – Recent disruption in supply of materials from India due to political reasons for as long as six months totally left the operation of the industrial units in disarray.<br />

f. Exchange rate – In the past the conversion rate of foreign exchange played havoc with the viability of the enterprises in Nepal which is more dependent on imports for all of its material input.</p>

<p style="text-align: justify;">Power shortages, natural calamities, market forces etc are the other external factors which set the pace for the downhill slide of an enterprise. In the context of Nepal, external forces are more potent in causing sickness in an enterprise than the internal factors.</p>

<p style="text-align: justify;">Along with the undesired trends in operational efficiency, financial consultants have suggested many models based upon a ratio analysis of liquidity, profitability, debt and equity in order to detect the initial symptoms of the disease. Arresting the deteriorating signals and implementing the revival plan are the next steps for an organisation. There are distinct phases of decline and the signals vary with every phase. Sometimes only a few symptoms appear but even a single symptom is a cause for worry. What is important is that instead of doing a post mortem of the sickness the enterprise inculcates, a culture of periodic continuous analysis of its operations should be done to capture the symptoms in the early stages </p>

<p style="text-align: justify;">Any turn-around plan consists of many steps undertaken diligently and seriously with everyone including the board of directors, banks, vendors and customers and all those who will be affected by the decline of the business included in the revival plan. Normally the seniors and outside stakeholders tend to be chiefly concerned with the balance sheet and income statement which may not disclose the hidden problems and tend to remain aloof from any efforts to stem the rot.</p>

<p style="text-align: justify;">The next important steps in the turnaround primer are the participation of employees and the co-operation of the trade union. For any turn around process to succeed it is important to appoint a “Turnaround manager “ who is adept at crisis management, has flexibility and patience as he is the fulcrum for the execution of the revival plan .</p>

<p style="text-align: justify;">Depending upon the stage of decline and the nature of the causes, the revival plan can be <br />

a) Strategic, b) Operational, c) Financial</p>

<p style="text-align: justify;">Each type of turning around process has to focus on a particular strategy such as: <br />

a. Revenue generating activities<br />

b. Product / market refocusing<br />

c. Cost control<br />

d. Asset reducing or maximizing its use.<br />

e. Reshaping the business<br />

f. Combination of any of the above</p>

<p style="text-align: justify;">The time frame for a turnaround varies depending upon the severity of the crisis. A business that has been in decline for many years may take a longer time to revive. Using the correct strategy is part of the art of successfully reviving a company and choosing a correct strategy is also a function of trial and error. The need to address decline and failure is obvious. A structured detecting mechanism in place will sense declining symptoms early and a sense of urgency to address them will avoid many of the bad consequences.</p>

<p style="text-align: justify;">The commercial bankers and lending financial institution have a pivotal role to play in addressing the problems. Their extremely cautious approach sometimes worsens the position of the sick units. However, it is necessary that the banks and the lending institutions move gradually towards a more understanding approach. They have to be in constant touch with the unit and without any bureaucratic delays participate in revival plans.</p>

<p style="text-align: justify;">The role of government is equally important as most of the sickness in Nepali enterprises can be attributed to external factors over which the unit has no control. So far the government intervention and participation has been inadequate and unrealistic. For entrepreneurs to take risks, the government has to ensure that it will immediately intervene and cushion units from the vagaries of external winds. Apart from certain incentives, government should also encourage mergers of these sick units into profitable ones so that the revival plan becomes sustainable.</p>

<p style="text-align: right;"><em>The writer is the chairman of Nimbus Group.</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-03-20 11:30:46',

'modified' => '2017-03-20 11:30:46',

'keywords' => '',

'description' => '',

'sortorder' => '1683',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '971',

'image' => '20170319100809_cover.JPG',

'sortorder' => '1520',

'published' => true,

'created' => '2017-03-19 10:08:09',

'modified' => '2017-03-19 10:30:36',

'title' => 'March 2017',

'publish_date' => '2017-03-19',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '44',

'title' => 'Management Gyan',

'sortorder' => '44',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2013-06-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1720',

'hit' => '3158'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />

d. Interest Rate – The low interest rate and the availability of funds at these rates trigger investment but the sudden drying up of funds and subsequent high jumps in interest rates increase the cost of working capital thereby making an operation uneconomical. <br />

e. Economic blockade – Recent disruption in supply of materials from India due to political reasons for as long as six months totally left the operation of the industrial units in disarray.<br />

f. Exchange rate – In the past the conversion rate of foreign exchange played havoc with the viability of the enterprises in Nepal which is more dependent on imports for all of its material input.</p>

<p style="text-align: justify;">Power shortages, natural calamities, market forces etc are the other external factors which set the pace for the downhill slide of an enterprise. In the context of Nepal, external forces are more potent in causing sickness in an enterprise than the internal factors.</p>

<p style="text-align: justify;">Along with the undesired trends in operational efficiency, financial consultants have suggested many models based upon a ratio analysis of liquidity, profitability, debt and equity in order to detect the initial symptoms of the disease. Arresting the deteriorating signals and implementing the revival plan are the next steps for an organisation. There are distinct phases of decline and the signals vary with every phase. Sometimes only a few symptoms appear but even a single symptom is a cause for worry. What is important is that instead of doing a post mortem of the sickness the enterprise inculcates, a culture of periodic continuous analysis of its operations should be done to capture the symptoms in the early stages </p>

<p style="text-align: justify;">Any turn-around plan consists of many steps undertaken diligently and seriously with everyone including the board of directors, banks, vendors and customers and all those who will be affected by the decline of the business included in the revival plan. Normally the seniors and outside stakeholders tend to be chiefly concerned with the balance sheet and income statement which may not disclose the hidden problems and tend to remain aloof from any efforts to stem the rot.</p>

<p style="text-align: justify;">The next important steps in the turnaround primer are the participation of employees and the co-operation of the trade union. For any turn around process to succeed it is important to appoint a “Turnaround manager “ who is adept at crisis management, has flexibility and patience as he is the fulcrum for the execution of the revival plan .</p>

<p style="text-align: justify;">Depending upon the stage of decline and the nature of the causes, the revival plan can be <br />

a) Strategic, b) Operational, c) Financial</p>

<p style="text-align: justify;">Each type of turning around process has to focus on a particular strategy such as: <br />

a. Revenue generating activities<br />

b. Product / market refocusing<br />

c. Cost control<br />

d. Asset reducing or maximizing its use.<br />

e. Reshaping the business<br />

f. Combination of any of the above</p>

<p style="text-align: justify;">The time frame for a turnaround varies depending upon the severity of the crisis. A business that has been in decline for many years may take a longer time to revive. Using the correct strategy is part of the art of successfully reviving a company and choosing a correct strategy is also a function of trial and error. The need to address decline and failure is obvious. A structured detecting mechanism in place will sense declining symptoms early and a sense of urgency to address them will avoid many of the bad consequences.</p>

<p style="text-align: justify;">The commercial bankers and lending financial institution have a pivotal role to play in addressing the problems. Their extremely cautious approach sometimes worsens the position of the sick units. However, it is necessary that the banks and the lending institutions move gradually towards a more understanding approach. They have to be in constant touch with the unit and without any bureaucratic delays participate in revival plans.</p>

<p style="text-align: justify;">The role of government is equally important as most of the sickness in Nepali enterprises can be attributed to external factors over which the unit has no control. So far the government intervention and participation has been inadequate and unrealistic. For entrepreneurs to take risks, the government has to ensure that it will immediately intervene and cushion units from the vagaries of external winds. Apart from certain incentives, government should also encourage mergers of these sick units into profitable ones so that the revival plan becomes sustainable.</p>

<p style="text-align: right;"><em>The writer is the chairman of Nimbus Group.</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-03-20 11:30:46',

'modified' => '2017-03-20 11:30:46',

'keywords' => '',

'description' => '',

'sortorder' => '1683',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '971',

'image' => '20170319100809_cover.JPG',

'sortorder' => '1520',

'published' => true,

'created' => '2017-03-19 10:08:09',

'modified' => '2017-03-19 10:30:36',

'title' => 'March 2017',

'publish_date' => '2017-03-19',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '44',

'title' => 'Management Gyan',

'sortorder' => '44',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2013-06-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />

d. Interest Rate – The low interest rate and the availability of funds at these rates trigger investment but the sudden drying up of funds and subsequent high jumps in interest rates increase the cost of working capital thereby making an operation uneconomical. <br />

e. Economic blockade – Recent disruption in supply of materials from India due to political reasons for as long as six months totally left the operation of the industrial units in disarray.<br />

f. Exchange rate – In the past the conversion rate of foreign exchange played havoc with the viability of the enterprises in Nepal which is more dependent on imports for all of its material input.</p>

<p style="text-align: justify;">Power shortages, natural calamities, market forces etc are the other external factors which set the pace for the downhill slide of an enterprise. In the context of Nepal, external forces are more potent in causing sickness in an enterprise than the internal factors.</p>

<p style="text-align: justify;">Along with the undesired trends in operational efficiency, financial consultants have suggested many models based upon a ratio analysis of liquidity, profitability, debt and equity in order to detect the initial symptoms of the disease. Arresting the deteriorating signals and implementing the revival plan are the next steps for an organisation. There are distinct phases of decline and the signals vary with every phase. Sometimes only a few symptoms appear but even a single symptom is a cause for worry. What is important is that instead of doing a post mortem of the sickness the enterprise inculcates, a culture of periodic continuous analysis of its operations should be done to capture the symptoms in the early stages </p>

<p style="text-align: justify;">Any turn-around plan consists of many steps undertaken diligently and seriously with everyone including the board of directors, banks, vendors and customers and all those who will be affected by the decline of the business included in the revival plan. Normally the seniors and outside stakeholders tend to be chiefly concerned with the balance sheet and income statement which may not disclose the hidden problems and tend to remain aloof from any efforts to stem the rot.</p>

<p style="text-align: justify;">The next important steps in the turnaround primer are the participation of employees and the co-operation of the trade union. For any turn around process to succeed it is important to appoint a “Turnaround manager “ who is adept at crisis management, has flexibility and patience as he is the fulcrum for the execution of the revival plan .</p>

<p style="text-align: justify;">Depending upon the stage of decline and the nature of the causes, the revival plan can be <br />

a) Strategic, b) Operational, c) Financial</p>

<p style="text-align: justify;">Each type of turning around process has to focus on a particular strategy such as: <br />

a. Revenue generating activities<br />

b. Product / market refocusing<br />

c. Cost control<br />

d. Asset reducing or maximizing its use.<br />

e. Reshaping the business<br />

f. Combination of any of the above</p>

<p style="text-align: justify;">The time frame for a turnaround varies depending upon the severity of the crisis. A business that has been in decline for many years may take a longer time to revive. Using the correct strategy is part of the art of successfully reviving a company and choosing a correct strategy is also a function of trial and error. The need to address decline and failure is obvious. A structured detecting mechanism in place will sense declining symptoms early and a sense of urgency to address them will avoid many of the bad consequences.</p>

<p style="text-align: justify;">The commercial bankers and lending financial institution have a pivotal role to play in addressing the problems. Their extremely cautious approach sometimes worsens the position of the sick units. However, it is necessary that the banks and the lending institutions move gradually towards a more understanding approach. They have to be in constant touch with the unit and without any bureaucratic delays participate in revival plans.</p>

<p style="text-align: justify;">The role of government is equally important as most of the sickness in Nepali enterprises can be attributed to external factors over which the unit has no control. So far the government intervention and participation has been inadequate and unrealistic. For entrepreneurs to take risks, the government has to ensure that it will immediately intervene and cushion units from the vagaries of external winds. Apart from certain incentives, government should also encourage mergers of these sick units into profitable ones so that the revival plan becomes sustainable.</p>

<p style="text-align: right;"><em>The writer is the chairman of Nimbus Group.</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-03-20 11:30:46',

'modified' => '2017-03-20 11:30:46',

'keywords' => '',

'description' => '',

'sortorder' => '1683',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '971',

'image' => '20170319100809_cover.JPG',

'sortorder' => '1520',

'published' => true,

'created' => '2017-03-19 10:08:09',

'modified' => '2017-03-19 10:30:36',

'title' => 'March 2017',

'publish_date' => '2017-03-19',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '44',

'title' => 'Management Gyan',

'sortorder' => '44',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2013-06-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1720',

'hit' => '3158'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />

d. Interest Rate – The low interest rate and the availability of funds at these rates trigger investment but the sudden drying up of funds and subsequent high jumps in interest rates increase the cost of working capital thereby making an operation uneconomical. <br />

e. Economic blockade – Recent disruption in supply of materials from India due to political reasons for as long as six months totally left the operation of the industrial units in disarray.<br />

f. Exchange rate – In the past the conversion rate of foreign exchange played havoc with the viability of the enterprises in Nepal which is more dependent on imports for all of its material input.</p>

<p style="text-align: justify;">Power shortages, natural calamities, market forces etc are the other external factors which set the pace for the downhill slide of an enterprise. In the context of Nepal, external forces are more potent in causing sickness in an enterprise than the internal factors.</p>

<p style="text-align: justify;">Along with the undesired trends in operational efficiency, financial consultants have suggested many models based upon a ratio analysis of liquidity, profitability, debt and equity in order to detect the initial symptoms of the disease. Arresting the deteriorating signals and implementing the revival plan are the next steps for an organisation. There are distinct phases of decline and the signals vary with every phase. Sometimes only a few symptoms appear but even a single symptom is a cause for worry. What is important is that instead of doing a post mortem of the sickness the enterprise inculcates, a culture of periodic continuous analysis of its operations should be done to capture the symptoms in the early stages </p>

<p style="text-align: justify;">Any turn-around plan consists of many steps undertaken diligently and seriously with everyone including the board of directors, banks, vendors and customers and all those who will be affected by the decline of the business included in the revival plan. Normally the seniors and outside stakeholders tend to be chiefly concerned with the balance sheet and income statement which may not disclose the hidden problems and tend to remain aloof from any efforts to stem the rot.</p>

<p style="text-align: justify;">The next important steps in the turnaround primer are the participation of employees and the co-operation of the trade union. For any turn around process to succeed it is important to appoint a “Turnaround manager “ who is adept at crisis management, has flexibility and patience as he is the fulcrum for the execution of the revival plan .</p>

<p style="text-align: justify;">Depending upon the stage of decline and the nature of the causes, the revival plan can be <br />

a) Strategic, b) Operational, c) Financial</p>

<p style="text-align: justify;">Each type of turning around process has to focus on a particular strategy such as: <br />

a. Revenue generating activities<br />

b. Product / market refocusing<br />

c. Cost control<br />

d. Asset reducing or maximizing its use.<br />

e. Reshaping the business<br />

f. Combination of any of the above</p>

<p style="text-align: justify;">The time frame for a turnaround varies depending upon the severity of the crisis. A business that has been in decline for many years may take a longer time to revive. Using the correct strategy is part of the art of successfully reviving a company and choosing a correct strategy is also a function of trial and error. The need to address decline and failure is obvious. A structured detecting mechanism in place will sense declining symptoms early and a sense of urgency to address them will avoid many of the bad consequences.</p>

<p style="text-align: justify;">The commercial bankers and lending financial institution have a pivotal role to play in addressing the problems. Their extremely cautious approach sometimes worsens the position of the sick units. However, it is necessary that the banks and the lending institutions move gradually towards a more understanding approach. They have to be in constant touch with the unit and without any bureaucratic delays participate in revival plans.</p>

<p style="text-align: justify;">The role of government is equally important as most of the sickness in Nepali enterprises can be attributed to external factors over which the unit has no control. So far the government intervention and participation has been inadequate and unrealistic. For entrepreneurs to take risks, the government has to ensure that it will immediately intervene and cushion units from the vagaries of external winds. Apart from certain incentives, government should also encourage mergers of these sick units into profitable ones so that the revival plan becomes sustainable.</p>

<p style="text-align: right;"><em>The writer is the chairman of Nimbus Group.</em></p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-03-20 11:30:46',

'modified' => '2017-03-20 11:30:46',

'keywords' => '',

'description' => '',

'sortorder' => '1683',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '971',

'image' => '20170319100809_cover.JPG',

'sortorder' => '1520',

'published' => true,

'created' => '2017-03-19 10:08:09',

'modified' => '2017-03-19 10:30:36',

'title' => 'March 2017',

'publish_date' => '2017-03-19',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '44',

'title' => 'Management Gyan',

'sortorder' => '44',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2013-06-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1720',

'magazine_issue_id' => '971',

'magazine_category_id' => '44',

'title' => 'Predicting Crisis',

'image' => null,

'short_content' => 'A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both.',

'content' => '<p style="text-align: center;"><span style="font-size:16px"><em>Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time.</em></span></p>

<p style="text-align: justify;"><strong>--BY JAGDISH PRASAD AGRAWAL</strong></p>

<p style="text-align: justify;">A moment of crisis is integral to any business enterprise. Irrespective of quality of management a crisis is likely to happen at an average frequency of 5-7 years from the start of an operation. These crises can be attributed to external or internal factors or a combination of both. They can be severe or normal but whatever their intensity they leave an indelible mark on the future course of any action. An optimistic CEO and a positive board of directors take these crises in their stride and are more mature, whereas inexperienced startups may collapse. Crisis is a time for introspection, a learning period, and evaluation of the weaknesses that have piled up over a period of time. These crises have a noble purpose and they serve the enterprise well as faithfully as any distinguished success. If taken positively, a crisis may have in it a germ of a new unimagined happiness in the future. </p>

<p style="text-align: justify;">The problem is that society does not recognise a crisis as an integral part of any commercial venture and, therefore, there is no structured predicting and monitoring mechanism instituted in business organisations which can forecast undesired trends. The declining signals go unattended, reach critical mass before they manifest as a sickness. Even when the signals are apparent CEOs perhaps cannot take the desired steps because of a limitation of laws, banks, as well as society. The circumstantial compulsion of maintaining the status quo further complicates the issue which leads to commercial sickness which has become so prevalent in Nepal. It is a pity that our standards of auditing fail to forecast any such sickness creeping in an organisation and the prevalent system of bank financing totally ignores the deteriorating health of an enterprise. Hence, any crisis in any commercial venture is always a shock, a sort of trauma attributable to bad management and bad intention of the entrepreneur. The system of black listing of defaulters points to that.</p>

<p>Can sickness be predicted? Yes, it can. Any business organisation which accepts that crisis is an integral part of its business cycle can institute a dedicated cell which can monitor and analyse independently the different parameters to arrive at an index value which forecasts the health of the organisation periodically. The box of parameters can be predetermined by the board of directors out of generic indicators applicable across most of the commercial ventures including any special indicator specific to it. A list of signals of undesirable trends as seen below can be a useful guideline.</p>

<p style="text-align: center;"><img alt="" src="/userfiles/images/f.dmf.JPG" style="height:918px; width:500px" /></p>

<p style="text-align: justify;">These undesirable trends and if addressed early, effectively and seriously can prevent many a crisis from happening. The discovery of these trends can lead to a diagnosis and remedial action before they show their impact on financial results. These trends belong to inefficiencies of internal managerial functions but there can be many more external factors which may also adversely impact the functioning of the enterprise and on, which the management may not have any control over. It has been observed that a delay in the timely tackling of the causal factors does aggravate the situation and leads to sickness in an industry. But these delays are not a choice but a compulsion on the part of the management. The recessionary trend, the slow growth , liquidity crunch, oil prices, interest rates, foreign exchange conversion rates, the recent economic blockade etc all have had, jointly or separately, an adverse impact on the health of business organisations in Nepal. The internal and external factors for industrial sickness in Nepal can be categorised as follows.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>Internal factors</strong></span><br />

<strong>a. Corporate strategies and policies : </strong>The role of the board of directors is important. They may lack quality and skills. They may not be adding value of their own and depend much upon what is submitted to them. It is expected that board of directors have their own vision, take their responsibility more seriously and they are made accountable for any failure. Any rubber stamping in the board is sure to ruin the unit.<br />

<br />

<strong>b. Managerial weakness:</strong> Systematic monitoring, control, evaluation and corrections are part and parcel of managerial functions. The list as given above falls under managerial domain. Periodical survey along the given parameters will always expose the weaknesses of the products, price, promotion, process etc. Deliberate attempt to identify weaknesses of the managerial functioning is a sure way to ward off future crisis.</p>

<p style="text-align: justify;">Creative accounting :- So called creative accounting indulges in wrong practices giving a rosy picture of the operation. Wrong investment, capitalisation of revenue expenditures, over valuation etc are some of the ways by which the financial statements are made rosy. This is resorted to because the shareholder believes more in what is stated in reports and statements and they do not create any counter mechanism to verify what is stated there. Hence the management resorts to creative accounting once the company starts on a sliding path to maintain the financial statement at the same level as that of preceding years at least.</p>

<p style="text-align: justify;"><span style="font-size:16px"><strong>External Factors.</strong></span><br />

As opposed to the internal factors, the external factors are those over which the individual units may not have any control. Some of them as enumerated above can be listed as below.<br />

a. Government policy – Sudden changes render a viable unit into a sick unit.<br />

b. Labour relations – The current trend of union bargaining has made the cost of labour fixed. It is impossible for the management to close off the operation if the financial trend so desires.<br />

c. Oil Crisis – Its impact on raw material prices and on movement of goods has always been a deterrent factor for the continuous viability of the enterprise especially in the context of Nepal where import is a primary factor.<br />