Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

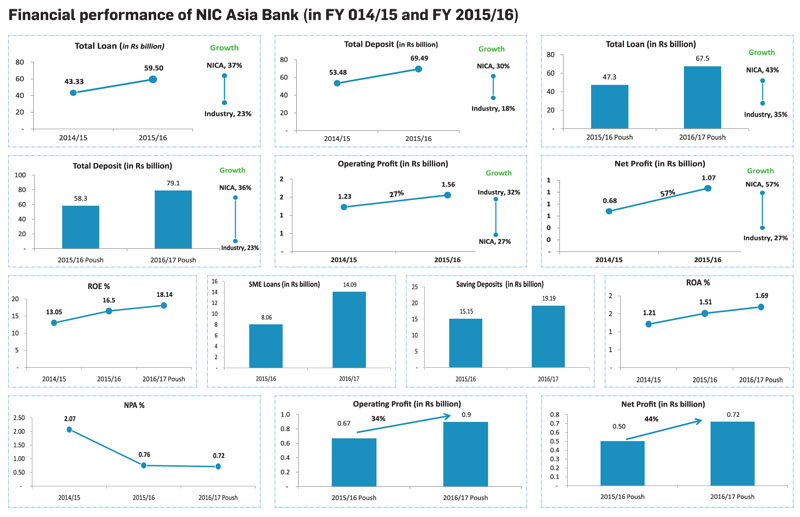

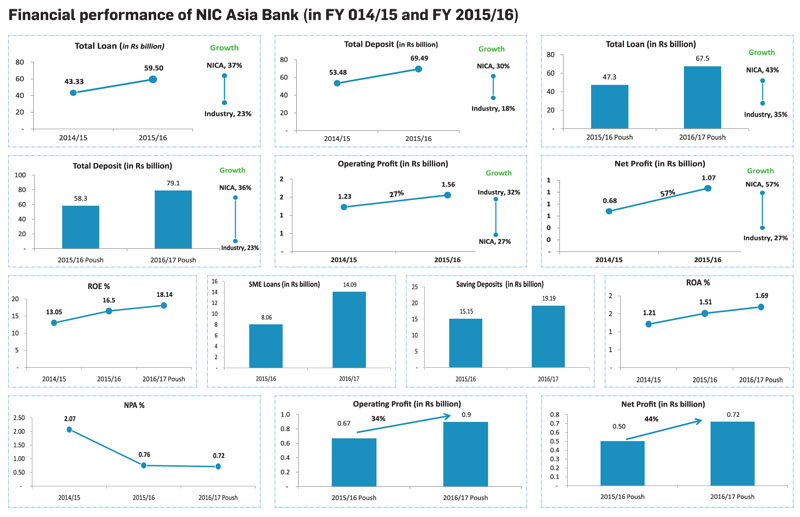

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1705',

'hit' => '3738'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1705',

'hit' => '3738'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,

'modified' => '2017-05-03 15:30:01'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1705',

'hit' => '3738'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1705',

'magazine_issue_id' => '970',

'magazine_category_id' => '106',

'title' => 'The Game Changer',

'image' => null,

'short_content' => 'Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader ..',

'content' => '<p style="text-align:center"><span style="font-size:16px"><em>Some well thought out and strong positive changes have seen NIC Asia Bank's worth spike upwards in the last year and a half. </em></span></p>

<p style="text-align:justify">Laxman Risal is amongst a rare breed of young executives having experience of leading companies in banking as well as insurance. He is regarded as a dependable and committed leader having a deep knowledge of the sector and as a person capable of motivating a team and bringing positive changes in the work place. Risal started his career with Nepal Grindlays Bank (now Standard Chartered Bank Nepal) in 1990 in an entry-level position. His career progression there was amongst the fastest and he was a senior executive by the time he left Standard Chartered Bank Nepal Limited, in 2002, to head the Financial Institution business of Standard Chartered Group in Nepal that was managed through a representative office. He left Standard Chartered Group in 2004 to join the then NIC Bank as the Chief Operating Officer. He took a radical decision in 2008 to leave the banking sector and joined the life insurance sector as the founding CEO of Prime Life Insurance Company Limited. There, he was highly successful in establishing and managing a new life insurance company amidst stiff competition. The company posted a healthy net profit of over 50 million in its first full year of operation.</p>

<p style="text-align:justify">Risal moved back to banking in September 2009 to join a newly established commercial bank, Bank of Asia Nepal Limited, as General Manager. He became the bank’s Acting CEO in 2012 and successfully steered its historic merger with NIC Bank. The merged entity, NIC Asia Bank, commenced its joint operations in June 2013. This merger was the first of its kind in the Nepali financial sector as it was a merger between two full-fledged commercial banks in good health. This successful merger was well regarded not only domestically but internationally as well. The merged entity, NIC Asia Bank was awarded with a prestigious international award - ‘Bank of the Year 2013 – Nepal’, by the Financial Times Group, UK. Risal was assigned the responsibilities of leading NIC Asia Bank as Acting Chief Executive Officer in June 2015 and then as CEO in May 2016. The bank has been on a growth trajectory under his leadership and has posted highly progressive results for FY2015/16 and for the first half of FY2016/17. The re-branding initiatives taken by the bank have created a buzz in the market and appear to have helped the bank to create a strong positive image for itself. The New Business Age team analysed the performance of NIC Asia Bank for the last three and half years and spoke with Risal to find out how he brought in the changes that have steered the Bank to new heights within a short period of time. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/ew1.JPG" style="height:517px; margin-left:10px; margin-right:10px; width:800px" /></p>

<div style="background: rgb(230, 230, 250);padding:10px">

<div class="content-wrapper" style="box-sizing: border-box; padding-left: 10px;">

<div class="highlight-column" style="box-sizing: border-box; width: 200px; padding: 5px; float: right; clear: left; margin-left: 5px; margin-top: 5px; margin-bottom: 5px; text-align: center; background: rgb(230, 230, 250);">

<p><span style="font-family:helvetica neue,helvetica,arial,sans-serif; font-size:14.84px"><img alt="Laxman Risal, CEO, NIC Asia Bank" src="/userfiles/images/ew.jpg" style="height:258px; width:190px" /></span><strong>Laxman Risal</strong><br />

CEO, NIC Asia Bank</p>

</div>

</div>

<p><span style="font-size:16px"><strong>NIC Asia Bank posted very impressive results last year and for the first half of the current fiscal year. What changes did you bring in to create such impressive results?</strong></span><br />

Well, the last one and half years have been very challenging for me as well as for the Bank. Last year, we had a series of workshops, discussions, heated debates and brain storming sessions amongst ourselves, including the Board to decide what course of action we wanted to take and where do we want to see ourselves in the next five years. The outcome was a long-term strategy document covering the entire spectrum of the Bank. We also identified the changes we needed to bring in order to achieve the long-term goals we had set for ourselves. We identified the tasks we needed to complete in the short term that paved the way for us to achieve our annual goals. We implemented a strong mechanism to periodically monitor the completion of these tasks within dead lines and take quick corrective actions where required. We invested in process automation to reduce the processing time for all of our internal processes. We defined and implemented challenging turn-around times for all of our products and services we offer to our customers. We wanted to be a customer friendly bank and accordingly revised many of our products and processes to enhance customer experience while doing business with us. These well thought major changes, apart from many other changes, resulted in many quick wins, enhanced customer experience and increased business.</p>

<p><span style="font-size:16px"><strong>Don’t you think your aggressive growth will result in additional risk for the bank?</strong></span><br />

It depends on the segment you are growing as well as in the control and risk management capabilities and systems you have in place to measure, monitor, report and manage the risks you are taking. We have strengthened our control and risk management capabilities to a great extend. We have a strong measuring, monitoring, reporting system in place to manage all the risks we are exposed to. We have probably the strongest team of professionals amongst the commercial banks in control and risk management functions. We are therefore capable of containing and managing the majority of risks associated with our business and one of the indications of our risk management capabilities is the gradual reduction in our non-performing assets and provisioning requirements.</p>

<p><span style="font-size:16px"><strong>You appear to have become very aggressive in branding as well in branch expansion. What motivated you?</strong></span><br />

Well, despite being a fairly old and established bank we realised that we are not very well known in the segments we wanted to grow. In addition, we wanted to communicate the changes we have adopted to all of our stake-holders. Our re-branding exercise is focused on our revised business philosophy and our aim to become a “top of the mind” bank in the segments we want to grow.</p>

<p>Our branch expansion drive is also driven by our revised business philosophy. We want to grow significantly in the SME/micro-SME segment on the lending side and savings on the deposit side. We believe a significant growth in these segments is possible only through expanding our footprint.</p>

<p><span style="font-size:16px"><strong>It’s not easy to bring in changes. What difficulties did you face and how did you handle them?</strong></span><br />

Yes, it’s not easy to bring in changes. However, the changes we brought were well discussed, challenged, debated and ultimately agreed on by senior management as well as the Board. It is much easier to implement changes when you have a buy-in of all the change drivers.</p>

<p><span style="font-size:16px"><strong>What is your management style?</strong></span><br />

I believe in a “participative” style but at times I tend to follow an “authoritative” style when things do not move as desired. I believe in decentralisation of power, delegation of authority, accountability, meritocracy, transparency and teamwork. I prefer to see leaders driving their teams in their own style but within the overall management philosophy of the organisation. I do not like naysayers. I do not like organisational bureaucracy and the blame game. I strongly believe that not deciding in time is equivalent to not deciding at all. For day-to-day work, I have disciplined myself not to leave any unresolved matter on my desk by the time I leave office for the day and encourage others to do the same.</p>

<p><span style="font-size:16px"><strong>What about your family? How do you manage time for your family?</strong></span><br />

My wife works for herself. My two daughters are in colleges in the US. I find it difficult to manage time for my family during work days but I strictly do not carry work home. I plan my annual leave according to the college break of my daughters to have some quality time with the family. </p>

</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2017-02-23 16:11:34',

'modified' => '2017-02-23 16:14:53',

'keywords' => '',

'description' => '',

'sortorder' => '1664',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '970',

'image' => '20170213025424_cover.JPG',

'sortorder' => '1519',

'published' => true,

'created' => '2017-02-13 14:54:24',

'modified' => '2023-08-13 16:34:54',

'title' => 'February 2017',

'publish_date' => '2017-02-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '106',

'title' => 'Executive Watch',

'sortorder' => '105',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => false,