Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '168',

'hit' => '1174'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '168',

'hit' => '1174'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '168',

'hit' => '1174'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '168',

'hit' => '1174'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '168',

'magazine_issue_id' => '287',

'magazine_category_id' => '0',

'title' => 'Decline in Margin Lending: Setback for the Investors',

'image' => null,

'short_content' => null,

'content' => '<div>

<strong>--By Rashesh Vaidya</strong></div>

<div>

</div>

<div>

<img alt="Sectorwise Distribution 19 May to 178 June 2013" src="/userfiles/images/market%20tend.jpg" style="float: right; margin: 0px 0px 0px 10px; width: 300px; height: 909px;" /></div>

<div>

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market. </div>

<div>

</div>

<div>

Some large investors have selling their shares for the repayment of the loans. </div>

<div>

</div>

<div>

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days. </div>

<div>

</div>

<div>

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market. </div>

<div>

</div>

<div>

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market. </div>

<div>

</div>

<div>

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies. </div>

<div>

</div>

<div>

Majority of the shares of finance companies and development banks could not perform well during the period. </div>

<div>

</div>

<div>

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index. </div>

<div>

</div>

<div>

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions. </div>

<div>

</div>

<div>

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.</div>

<div>

</div>',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2013-07-16 00:00:00',

'modified' => '0000-00-00 00:00:00',

'keywords' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'description' => 'new business age stock taking news & articles, stock taking news & articles from new business age nepal, stock taking headlines from nepal, current and latest stock taking news from nepal, economic news from nepal, nepali stock taking economic news and events, ongoing stock taking news of nepal',

'sortorder' => '148',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '287',

'image' => '',

'sortorder' => '194',

'published' => true,

'created' => '2013-07-04 02:54:19',

'modified' => null,

'title' => 'Stock Taking',

'publish_date' => '2013-07-01',

'parent_id' => '234',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => null,

'title' => null,

'sortorder' => null,

'status' => null,

'created' => null,

'homepage' => null,

'modified' => null

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '168',

'hit' => '1174'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Decline in Margin Lending: Setback for the Investors

--By Rashesh Vaidya

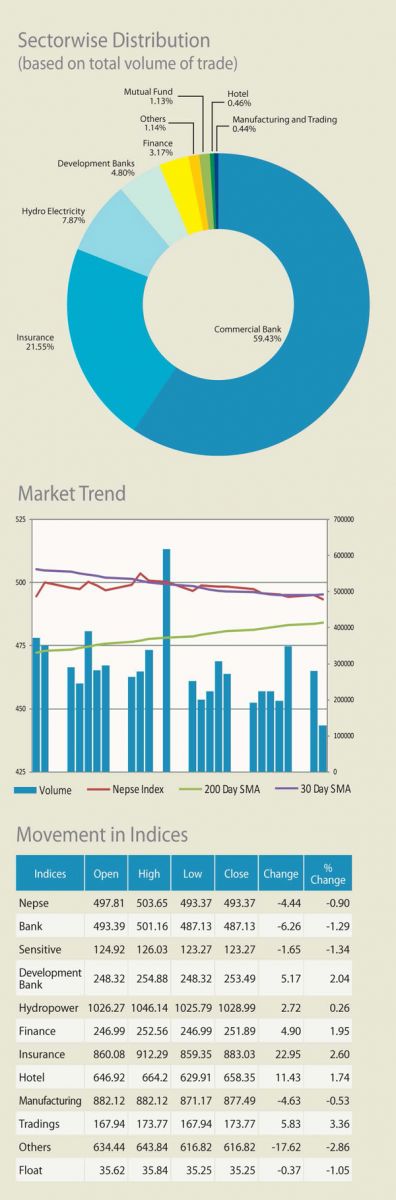

As the banks and financial institutions have started tightening the margin loan, the investors are being compelled to pull back from the stock market.

Some large investors have selling their shares for the repayment of the loans.

Similarly, as the end of the fiscal year is coming nearer, banks and financial institutions are stopping lending against share certificates trying to balance the loan portfolio. So, the pressure on the investors who have invested in stock market using borrowed money is huge. This shows that there is a chance of increasing the supply of the shares in the market in coming days.

The price of the majority of the shares of the commercial banks dropped during the second week of June. The shares of the financially well performing companies have been facing well in the market. This shows the increasing maturity among the Nepali investors. At the same time share price of Nepal Telecom has also declined and it hampered the market.

The influence of the political factors at the stock market looks fading up. The declaration of the election date for the Constituent Assembly did not affect the market.

About 60 percent of the trading of shares during the month from May 19 to June 17, 2013was covered by commercial banks. That ws followed by insurance companies.

Majority of the shares of finance companies and development banks could not perform well during the period.

Among the nine sub-indices, the ‘others’ sub-index dropped the highest by 2.86 points. Similarly, banking sub-index and manufacturing sub-index dropped by 0.53 points and 2.86 points. The drop in the share price of Unilever by Rs 100 during the month caused the fall in the manufacturing and processing sub-index. Similarly, the decline in the share price of Nepal Doorsanchar Company Ltd. by Rs 15 during the month caused the drop in the ‘others’ sub-index.

Total turnover of Rs 1,492,167,219 was recorded during the review period from 5,770,320 scrips of shares traded through 22,088 transactions.

Technically, the Simple Moving Average (SMA) has dominated by Nepse Index in long term as it is seen staying below the index line. The short term index tried to move above the benchmark of 500 points but could not sustain till the end of the month.