Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

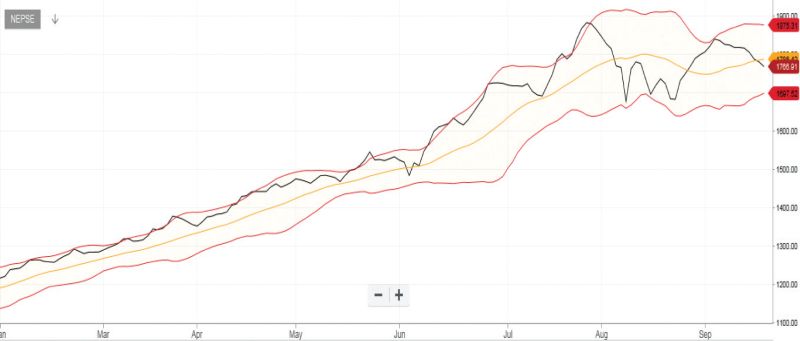

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

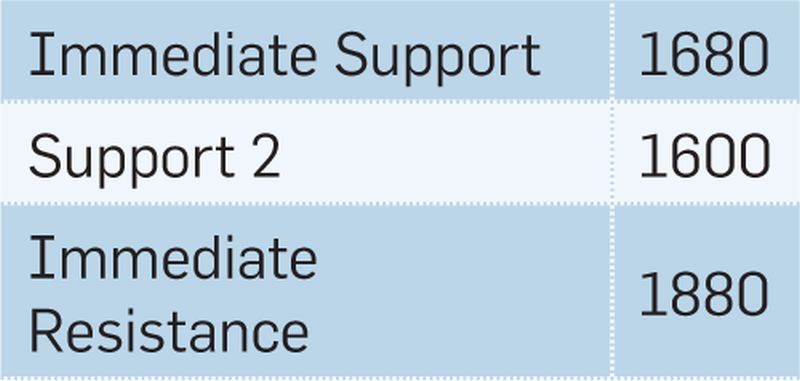

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

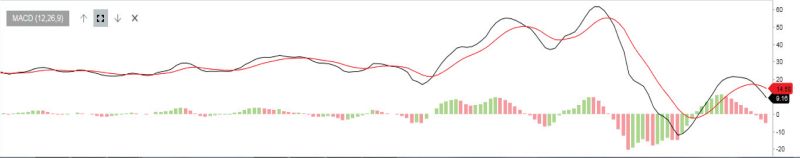

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

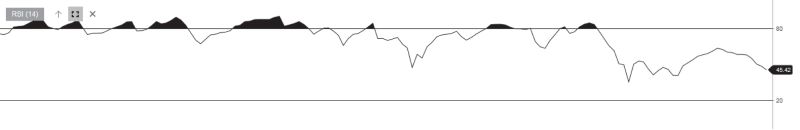

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

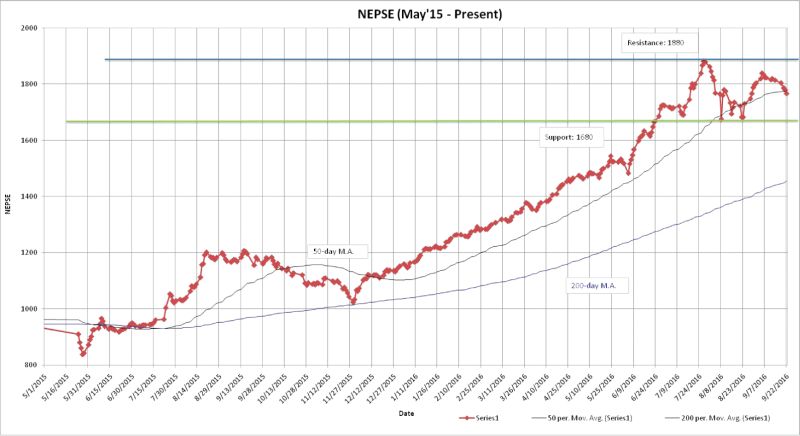

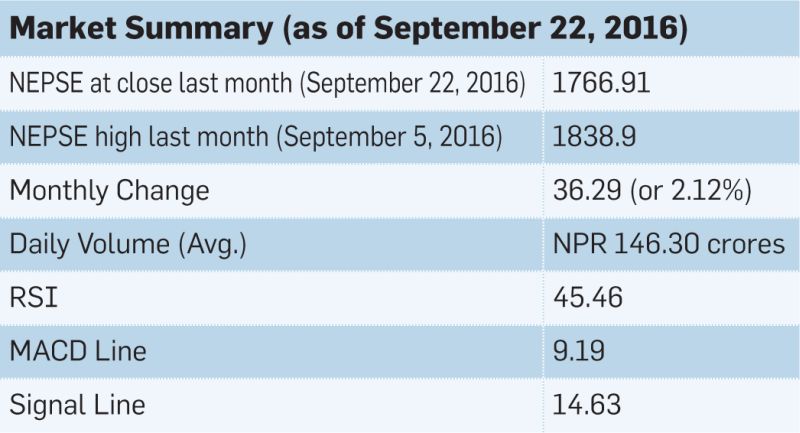

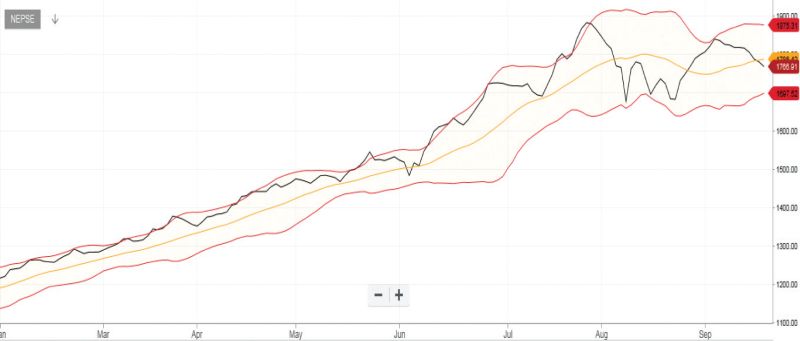

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

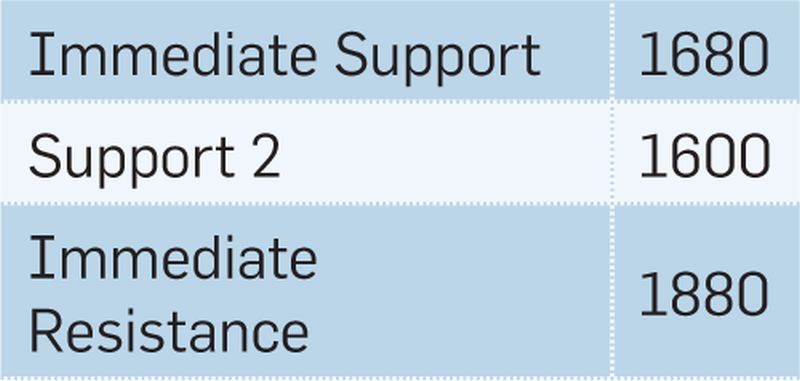

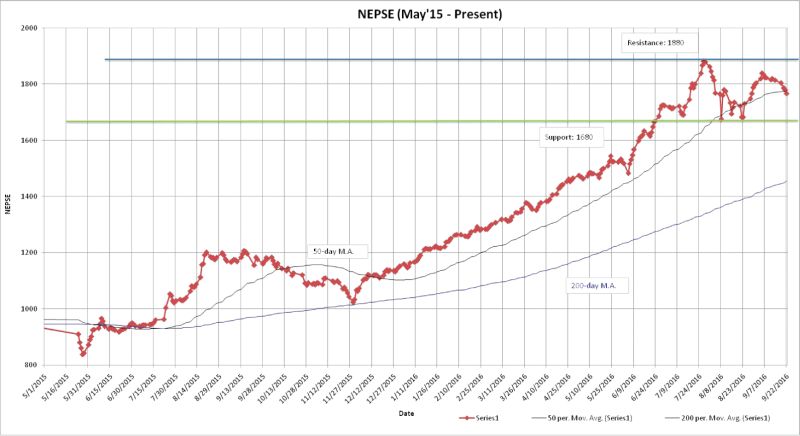

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

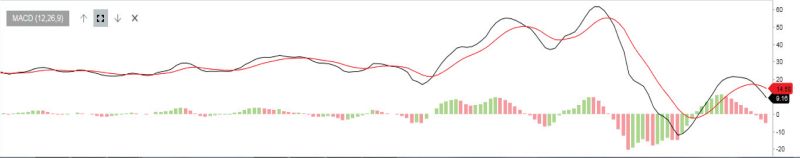

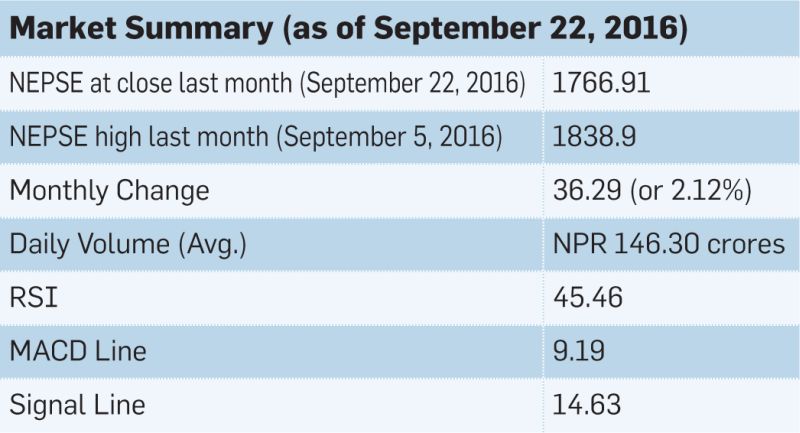

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

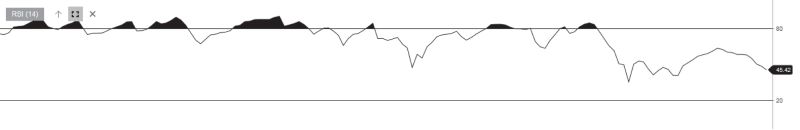

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1598',

'hit' => '4377'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1598',

'hit' => '4377'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1598',

'hit' => '4377'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1598',

'hit' => '4377'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p style="text-align:justify">The MACD and the signal line, at the beginning of the month,stood at -8.78 and -1.71 respectively. The bullish moment during the first half of the month led the MACD and the signal line to move out of the negative territory, where the MACD line surpassed the signal line, giving a positive momentum in the market. However, towards the end of the month, both the lines began to decline, causing the MACD line to move below the signal line. Currently, the MACD and the signal line stands at 9.19 and 14.63 level respectively.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s4%287%29.jpg" style="height:130px; width:800px" /></p>

<p style="text-align:justify"><strong>b. RSI</strong><br />

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p style="text-align:justify">The RSI, at the beginning of last month, stood at 51.23 level. In the course of the month, it lost 5.77 points to close at 45.46 level. The RSI indicates that there is a gradual increase in the selling pressure in the market. If the RSI enters the 30’s zone, it will signify oversold condition in the market.</p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s5%284%29.jpg" style="height:341px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><strong>c. Bollinger Bands</strong><br />

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p style="text-align:justify">The benchmark indextouched the upper bolling band during first half of the month, showing buying pressure in the market. However, towards the second half of the month, Nepse hovered below the middle band, signifying presence of selling pressure. The distance between the upper and lower bands has remained constant, indicating moderate market volatility.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained 36.29 points (or up2.12%) to close at 1766.91. After experiencing a bullish run during the beginning of last month, the index followed a downturn and is hovering around the 50-day moving average, suggesting presence of short term bearish momentum. However, the index is well above the 200 day moving average, indicating the long term market outlook looks good. The technical indicators show bearish presence in the market. The MACD line is moving below the signal line, which is a bearish indicator. The RSI is heading close to the 30’s zone, which could signify oversold condition in the market. The bollinger bands continue to show moderate market volatility. The new support and resistance level stands at 1680 and 1880 respectively.</p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-10-06 16:16:27',

'modified' => '2016-10-06 16:29:31',

'keywords' => '',

'description' => '',

'sortorder' => '1559',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '966',

'image' => '20161006032300_cover.JPG',

'sortorder' => '1515',

'published' => true,

'created' => '2016-10-06 15:23:00',

'modified' => '2016-10-06 15:23:00',

'title' => 'October 2016',

'publish_date' => '2016-10-01',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1598',

'magazine_issue_id' => '966',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 August to 22 September 2016)',

'image' => null,

'short_content' => 'The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. ',

'content' => '<p style="text-align:justify"><span style="font-size:20px"><strong>Long-term Outlook Bullish</strong></span><br />

<img alt="" src="/userfiles/images/s1%289%29.jpg" style="height:436px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s%284%29.jpg" style="height:433px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index experienced a bullish run during the first half of last month. However, the second half of the month was triggered by a bearish momentum. Nepse gained 36.29 points (or up 2.12%) last month to close at 1766.91. The average volume turnover increased to NPR 146.30 crores as compared to NPR 120.64 crores the month prior. The index is currently hovering around the 50-day moving average, indicating presence of bearish attitude in the short run. However, the index continues to run above the 200-day moving average, signifying that the long term market outlook looks good.</p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Resistance and Support</strong></span></p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s3%285%29.jpg" style="height:381px; margin-left:10px; margin-right:10px; width:800px" /></p>

<p style="text-align:justify">The benchmark index hovered between the late 1700 and early 1800 level in the course of last month. The bullish run in the first half of the month directed market to break the resistance level of 1880. However, the second half of the month pulled the market down towards the 1700 zone. The current support and resistance level stands at 1680 and 1880 respectively. Currently, the index is hovering around 50-day moving average. If the 50-day MA acts as a strong support level, Nepse could bounce back up in the 1800 territory in the coming weeks. </p>

<p style="text-align:justify"><img alt="" src="/userfiles/images/s2%286%29.jpg" style="height:158px; width:800px" /></p>

<p style="text-align:justify"><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong><br />