Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

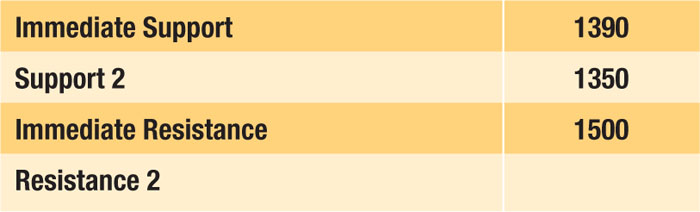

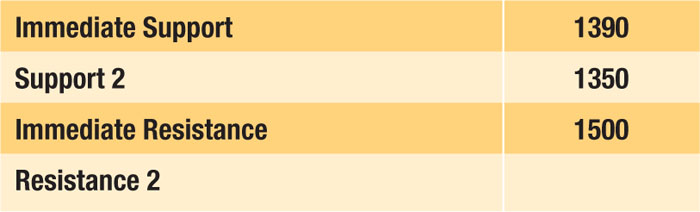

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

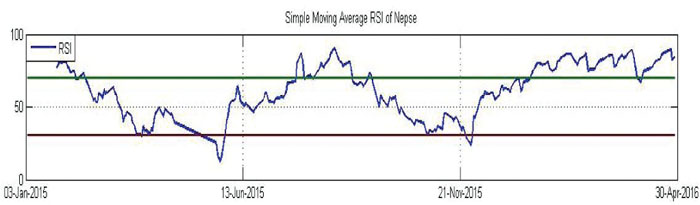

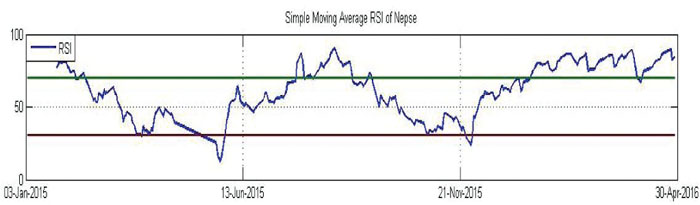

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1481',

'hit' => '4222'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1481',

'hit' => '4222'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1481',

'hit' => '4222'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />

On-Balance Volume (OBV) is a momentum indicator that relates volume to the current price of the index or security. It measures buying and selling pressure at the market. It acts as a cumulative indicator that adds volume on up days and subtracts volume on down days. If a price increase is supported by OBV, it confirms an uptrend, whereas if a price decrease is supported by OBV, it confirms a downtrend. </p>

<p>As evident from the graph above, the OBV (On-Balance Volume) has been rising at a much faster rate as compared to the rise witnessed by Nepse index. Although the average monthly volume transactions decreased slightly to NPR 73.28 crores from NPR 77.52 crores the month prior, the average volume is still considered high as compared to that of previous months. Such a rise in the index and the volume supports the bullish sentiment present in the market.</p>

<p><img alt="" src="/userfiles/images/s6%281%29.JPG" style="height:527px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p><span style="font-size:16px"><strong>Overview</strong></span><br />

The benchmark index gained a decent 73.28 points (or up 6.21%) to close at 1464.91 last month. The index is moving well above the 50-day and 200-day moving average, indicating the overall market outlook looks good. The RSI continues to signal high buying pressure in the market as it is hovering at 84.35 level. The macd is climbing up and above the signal line, which supports the optimism present in the market. However, the distance between the lines is gradually converging. The Bollinger bands show high buying pressure in the market as the index is hovering close to the upper band. The bands also indicate an increase in the market volatility as the upper and lower bands have diverged significantly. The new support and resistance level stands at 1390 and 1500 respectively.</p>

<p> </p>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2016-05-22 12:56:50',

'modified' => '2016-05-22 12:56:50',

'keywords' => '',

'description' => '',

'sortorder' => '1443',

'feature_article' => true,

'user_id' => '11',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '961',

'image' => '20160513033211_cover.JPG',

'sortorder' => '1510',

'published' => true,

'created' => '2016-05-13 15:32:11',

'modified' => '2016-05-13 15:39:55',

'title' => 'May 2016',

'publish_date' => '2016-05-13',

'parent_id' => '0',

'homepage' => true,

'user_id' => '11'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => '11',

'user_detail_id' => '0',

'group_id' => '24',

'username' => 'nsingha@abhiyan.com.np',

'name' => '',

'email' => 'nsingha@abhiyan.com.np',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2015-04-08 13:22:59',

'last_login' => '2023-04-16 09:29:47',

'ip' => '172.69.77.43'

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1481',

'hit' => '4222'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1481',

'magazine_issue_id' => '961',

'magazine_category_id' => '63',

'title' => 'Monthly Technical Analysis of Nepse (28 March to 28 April 2016)',

'image' => null,

'short_content' => 'The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points.',

'content' => '<p><span style="font-size:18px"><strong>High Buying Pressure with Rising Volatility</strong></span></p>

<p><span style="font-size:18px"><strong><img alt="" src="/userfiles/images/s%284%29.JPG" style="height:275px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Nepse Figure</strong></span></p>

<p><span style="font-size:16px"><strong><img alt="" src="/userfiles/images/s1%282%29.JPG" style="height:558px; margin-left:10px; margin-right:10px; width:700px" /></strong></span></p>

<p><span style="font-size:16px"><strong>Trend Analysis</strong></span><br />

The benchmark index continued its upward climb last month as well. Nepse index gained 87.58 points (or up 6.21%) to close at an all time height of 1464.91. The index witnessed some corrections at the beginning of the month, as it declined by 25.79 points. However, it has been creating new heights ever since. The refund of NIB FPO, as well as positive third quarter reports of the BFIs have supported the bullish sentiment present in the market. Gains in the development banks sector has also caused the index to climb up.</p>

<p><strong>Resistance and Support</strong></p>

<p><img alt="" src="/userfiles/images/s2%285%29.jpg" style="height:212px; margin-left:10px; margin-right:10px; width:700px" /><br />

The benchmark indexcrossed the immediate resistance level of 1390, as well as the psychological resistance of 1400 during the middle of last month. The index has been creating new height since then. Currently the new immediate support and resistance level stands at 1390 and 1500 respectively. As the market is currently on a bullish run, the Nepse index will likely cross the resistance level of 1500 in the coming weeks. </p>

<p><span style="font-size:16px"><strong>Nepse Trend Indicator</strong></span><br />

<strong>a. MACD</strong></p>

<p><img alt="" src="/userfiles/images/s3%282%29.JPG" style="height:223px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </p>

<p>The Macd and the signal line, at the beginning of the month,stood at 29.01 and 25.51 respectively. In the course of the month, the macd and the signal line climbed up 5.67 and 7.01 points to close at 34.68 and 32.53 respectively. The macd remaining above the signal line gives a positive indication in the market. However, the distance between the lines has converged, with an average distance between the line being 1.43 points.</p>

<p><strong>b. RSI</strong></p>

<p><img alt="" src="/userfiles/images/s4%285%29.jpg" style="height:205px; width:700px" /></p>

<p>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </p>

<p>RSI at the beginning of the month stood at 86.90 level. During the beginning of the week, it fell below the 70’s zone by landing at 67.11 level. However, as the bullish momentum continued to rise, the RSI increased above the 70s zone and has been hovering around the 80s zone for most of last month. This indicates high over-bought condition in the market. In the course of the week, The RSI declined by 2.54 points to close at 84.35 level.</p>

<p><strong>c. Bollinger Bands</strong></p>

<p><img alt="" src="/userfiles/images/s5%281%29.JPG" style="height:425px; margin-left:10px; margin-right:10px; width:700px" /></p>

<p>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </p>

<p>The benchmark index continues to hover close to the upper Bollinger band, signifying high buying pressure in the market.The distance between the upper and lower bands has also diverged significantly as compared to the previous months, indicating an increase in market volatility.</p>

<p><span style="font-size:16px"><strong>Volume Indicator (On-Balance Volume)</strong></span><br />