Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1167',

'hit' => '3941'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1167',

'hit' => '3941'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1167',

'hit' => '3941'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1167',

'hit' => '3941'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1167',

'magazine_issue_id' => '863',

'magazine_category_id' => '63',

'title' => 'Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals',

'image' => null,

'short_content' => ' Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. ',

'content' => '<div><strong>Market Trend</strong></div>

<div> Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.</div>

<div> </div>

<div><strong>RSI </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s(1).jpg" style="height:229px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards. </div>

<div> </div>

<div>During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day. </div>

<div> </div>

<div><strong>MACD </strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s1.jpg" style="height:181px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa. </div>

<div> </div>

<div>The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.</div>

<div> </div>

<div><strong>Bollinger Bands</strong></div>

<div> </div>

<div><img alt="" src="/userfiles/images/s2.jpg" style="height:305px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div>The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation. </div>

<div> </div>

<div>During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/s4.jpg" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Overview</strong></div>

<div>Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.</div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2015-04-20 00:00:00',

'modified' => '2015-08-20 14:26:45',

'keywords' => '',

'description' => '',

'sortorder' => '1139',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '863',

'image' => 'small_1429422363.jpg',

'sortorder' => '758',

'published' => true,

'created' => '2015-04-18 10:47:04',

'modified' => '2015-08-20 13:37:57',

'title' => 'April 2015',

'publish_date' => '2015-04-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '63',

'title' => 'Stock Taking',

'sortorder' => '516',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1167',

'hit' => '3941'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 68

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Technical Analysis Monthly (February 19 to March 19, 2015) Bearish Signals

Market Trend

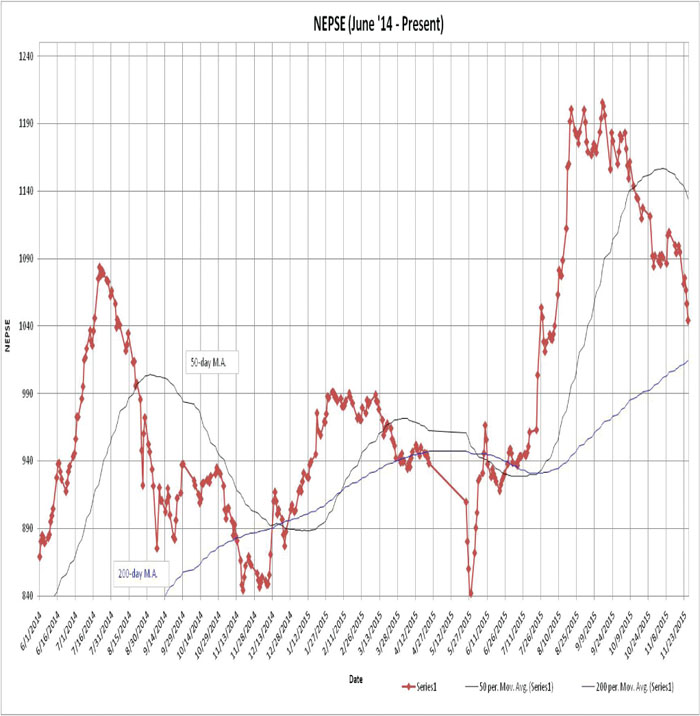

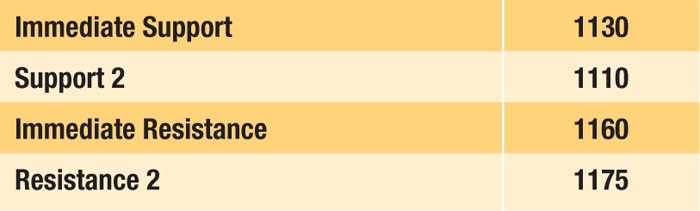

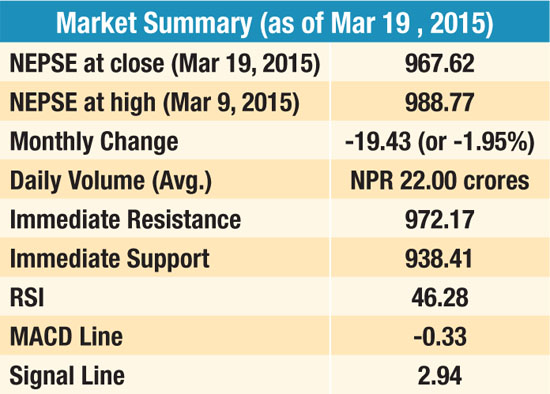

Nepse has not made much improvement in the past 30 days as compared to the growth witnessed in the previous months. Nepse decreased by -19.43 points (or -1.95%) to close at 967.62 points. It fell below its support level of 972.17, which is now its new resistance level. Its new support level stands at 938.41 points. No improvement was observed in the market volume this period as the average daily volume stood at NPR 22.00 crores from NPR 39.84 crores in the previous month. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive.

RSI

RSI is a form of leading indicator that is believed to be most effective during periods of sideways movement. Such indicators may create numerous buy and sell signals that are useful when the market is not clearly trending upwards or downwards.

During this period, the RSI decreased significantly, maintaining within the neutral zone. During first half of the period, the RSI maintained close to the 60 levels. However, by the second half, it fell and headed towards the 40 levels. The RSI stood at 46.28 levels at the last trading day.

MACD

The MACD is a momentum oscillator formed by using two different types of moving averages, which provides specific buying or selling signals. When a MACD line crosses above the signal line, it is considered to be a positive sign and indicates a time to buy, and vice-versa.

The MACD line hovered below the signal line and continued the downward momentum throughout the period. By the end of the period, MACD crossed the zero line reaching -0.33. This is the first time, this year, MACD line reached a negative territory. This is a bearish indicator and triggers a sell signal.

Bollinger Bands

The Bollinger Band is a technical indicator that consists of a moving average (21-day) along with two trading bands above (upper band) and below it (lower band). The bands are an indication of volatility, which are represented by calculating standard deviation.

During the first half of the period, NEPSE index went below the mid-band, and increased again reaching the upper-band. However, by the second half of the period, the index fell back touching the lower-band. By the last trading day, the index seems to be moving closer to the mid-band. The upper and the lower bands still continue to converge indicating a decreasing volatility in the market.

Overview

Although Nepse managed to end on a positive note, it faced many difficulties throughout the period and it was not able to continue its positive performance like the previous periods. Nepse closed lower by -19.43 points (or -1.95%) to end at 967.62 points. The market volume did not improve as much this period with investors trading an average of NPR 22.00 crores each day. The 50-day moving average is still increasing at a higher rate above the 200-day moving average suggesting that the overall view of the market remains positive. The RSI decreased throughout the period, and is still maintaining within the neutral zone. RSI stood at 46.28 levels by the end of the period, which is lower compared to the period’s average of 53.28. The MACD line has reached the negative territory, indicating a bearish sign and sell trigger. The Bollinger Bands indicate a decline in the market volatility as the upper and lower bands still continue to converge.

.jpg)