Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

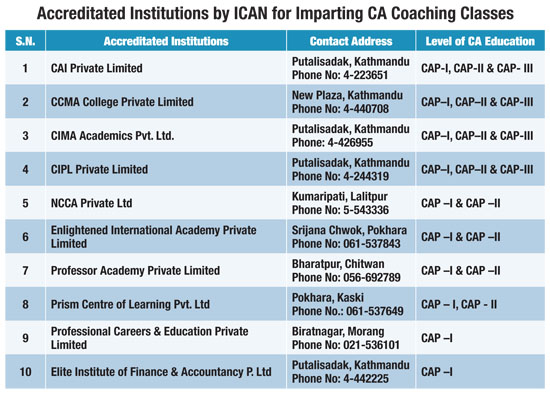

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1040',

'hit' => '7282'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 54]Code Context $user = $this->Session->read('Auth.User');

//find the group of logged user

$groupId = $user['Group']['id'];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1040',

'hit' => '7282'

)

)

)

$current_user = null

$logged_in = false

$user = null

include - APP/View/MagazineArticles/view.ctp, line 54

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Trying to access array offset on value of type null [APP/View/MagazineArticles/view.ctp, line 55]Code Context //find the group of logged user

$groupId = $user['Group']['id'];

$user_id=$user["id"];

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1040',

'hit' => '7282'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

include - APP/View/MagazineArticles/view.ctp, line 55

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 62]Code Context<?php

echo $this->Html->meta(array('name' => 'description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

'magazine_article_id' => '1040',

'hit' => '7282'

)

)

)

$current_user = null

$logged_in = false

$user = null

$groupId = null

$user_id = null

include - APP/View/MagazineArticles/view.ctp, line 62

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117

Notice (8): Undefined index: summary [APP/View/MagazineArticles/view.ctp, line 68]Code Context echo $this->Html->meta(array('property' => 'og:title', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['title']), null, array('inline' => false));?>

<?php

echo $this->Html->meta(array('property' => 'og:description', 'type' => 'meta', 'content' => $magazineArticle['MagazineArticle']['summary']), null, array('inline' => false));?>

$viewFile = '/var/www/html/newbusinessage.com/app/View/MagazineArticles/view.ctp'

$dataForView = array(

'magazineArticle' => array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>

<div>Chartered accountancy has emerged as a high-ranking career option for students nowadays and the market demand for them is high. It has been attracting plus-two pass outs from any background like science, humanities or commerce. Wide range of career and good income opportunities upon completion of the course has been attracting many students to these courses. </div>

<div> </div>

<div>"Due to higher possibility of getting good jobs and relatively lower cost for course completion, many students are getting attracted towards this degree," says Parmananda Adhikari, technical director at The Institute of Chartered Accountants of Nepal (ICAN). "CAs are the most rewarded people in the society nowadays. Earlier people were neither aware of the course nor the job prospects it entailed but now they have realized it and this has increased the attraction towards it,” he adds.</div>

<div> </div>

<div>CA is a professional course in accounting that covers the aspects of practical training such as accounting, auditing, taxation and financial analysis. The course is spread over three levels: CAP I, CAP II, and CAP III. CAP I is an entry level course while CAP II is an intermediate level course and CAP III is the final course. CA is a minimum five-year course in Nepal but there is no limitation to complete the course within a specific duration. </div>

<div> </div>

<div>Adding to it, Adhikari informed that CA students are mandatorily required to enrol for a post qualification course that includes 100 hours of IT Training and 15 days of skills assessment course. He informed that the ICAN has recently tied up with Kathmandu University School of Management (KUSOM) to provide these trainings. The curriculum of CA is extensive and in depth study is required to become a CA. "Hard work and commitment: these two things are must for a student who wants to become a CA," Adhikari says.</div>

<div> </div>

<div>CA courses can be pursued either from ICAN or from The Institute of Chartered Accountants of India (ICAI). ICAN, established in 1997 under the Nepalese Chartered Accountants Act, 1997, is the apex body with sole responsibility to regulate and develop the accounting profession in Nepal. A CA can apply for membership of ICAN after successful completion of the final exam. </div>

<div> </div>

<div>In the past, students who wanted to pursue CA course, needed to go to India. Adhikari claims that 80 percent of the Nepal’s CA have studied from India. But the scenario has changed now. Students can get the best education in Nepal itself. "The CA curriculum is more or less same around the globe. Our curriculum is also set according to the global standard of International Federationof Accountants (IFAC)," he said adding, "We cannot deviate much from that standard except for some local courses." So studying CA is no different here from anywhere in the world.</div>

<div> </div>

<div>ICAN has provided accreditation to 10 coaching centres or colleges across the country, which provide CA course under the guidelines of ICAN. </div>

<div> </div>

<div><img alt="" src="/userfiles/images/be1(3).jpg" style="height:691px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

<div><strong>Career Prospects</strong></div>

<div>Chartered Accountants were previously associated with the job of auditing only. But the scenario has changed now. The CAs are now taken as sophisticated professionals. They are not only confined with the duties of auditing, accounting, and taxation, but are now found working in every field of the society like trade, banking, finance, education, among others. CAs nowadays occupy prominent role among higher-level executives in public as well as private sector. CAs can work as auditors, management and financial consultants, company secretaries, liquidators, tax consultants, certifiers, valuators, accountants and many others. They may also work as a financial adviser and specialist in areas like audit and assurance, corporate finance, insolvency, tax, forensic accounting, financial reporting, among others. </div>

<div> </div>

<div>The growing or changing economy of the country has also opened lots of opportunities for CAs. Some of the areas where CAs can work in are as follows: accounting, planning and management, auditing, taxation, legal matters, financial management and many more.</div>

<div> </div>

<div>Adhikari claims that presently there are around 800 CAs registered at ICAN. This number is too low to meet the current market demand. Thus, the professional CAs in Nepal are in high demand and it is likely to increase in the coming days.</div>

<div> </div>

<div><img alt="" src="/userfiles/images/93%20copy.JPG" style="height:519px; margin-left:10px; margin-right:10px; width:725px" /></div>

<div> </div>

',

'status' => true,

'publish_date' => '0000-00-00',

'created' => '2014-12-19 00:00:00',

'modified' => '2015-08-31 13:03:09',

'keywords' => 'new business age business education news & articles, business education news & articles from new business age nepal, business education headlines from nepal, current and latest business education news from nepal, economic news from nepal, nepali business education economic news and events, ongoing',

'description' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes.',

'sortorder' => '1012',

'feature_article' => true,

'user_id' => '0',

'image1' => null,

'image2' => null,

'image3' => null,

'image4' => null

),

'MagazineIssue' => array(

'id' => '756',

'image' => 'small_1418114239.jpg',

'sortorder' => '651',

'published' => true,

'created' => '2014-12-09 01:37:50',

'modified' => '2015-08-30 14:05:18',

'title' => 'December 2014',

'publish_date' => '2014-12-01',

'parent_id' => '0',

'homepage' => false,

'user_id' => '0'

),

'MagazineCategory' => array(

'id' => '13',

'title' => 'Business Education',

'sortorder' => '520',

'status' => true,

'created' => '0000-00-00 00:00:00',

'homepage' => true,

'modified' => '2013-04-01 00:00:00'

),

'User' => array(

'password' => '*****',

'id' => null,

'user_detail_id' => null,

'group_id' => null,

'username' => null,

'name' => null,

'email' => null,

'address' => null,

'gender' => null,

'access' => null,

'phone' => null,

'access_type' => null,

'activated' => null,

'sortorder' => null,

'published' => null,

'created' => null,

'last_login' => null,

'ip' => null

),

'MagazineArticleComment' => array(),

'MagazineView' => array(

(int) 0 => array(

[maximum depth reached]

)

)

),

'current_user' => null,

'logged_in' => false

)

$magazineArticle = array(

'MagazineArticle' => array(

'id' => '1040',

'magazine_issue_id' => '756',

'magazine_category_id' => '13',

'title' => 'Studying to Become a Chartered Accountant',

'image' => null,

'short_content' => 'With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) ',

'content' => '<div><strong>--By Upashana Neupane</strong></div>

<div> </div>

<div>With rapid changes in economy and the growth of the country’s private sector, demand for professional managers in the market has also grown. It is not only managers or the student of management that are in demand nowadays, also students of chartered accountancy (CA) or chartered accountants are like hot cakes. </div>

<div> </div>