Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '10714',

'article_category_id' => '1',

'title' => 'Market Watch of May 19 (Sunday) ',

'sub_title' => '',

'summary' => 'is it the right time to invest in the market? ',

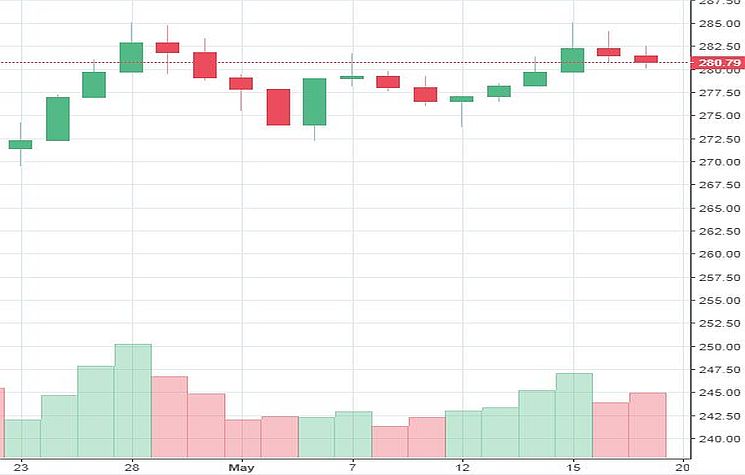

'content' => '<p style="text-align: center;">

<strong>Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Current Price (CMP): 1316.84</strong></p>

<p>

<strong>OHLC Update of </strong><strong>5<sup>th</sup> </strong><strong>Jestha:</strong></p>

<p style="margin-left: 40px;">

O: 1318.71<br />

H: 1322.09<br />

L: 1312.81<br />

C: 1316.84</p>

<p>

<strong>Pivot for </strong><strong>6<sup>th </sup></strong><strong>Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" style="width:632px;" width="632">

<tbody>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>1,303.12</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,307.97</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,312.4</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,317.25</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,321.68</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,326.53</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,330.96</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>Pivot for the 2<sup>nd</sup> Week of Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:84px;height:28px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:84px;height:37px;">

<p style="text-align: center;">

<strong>1,240.68</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,262.42</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,290.57</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,312.31</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,340.46</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,362.2</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,390.35</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for Month of Jestha: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>1,082.82</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,132.34</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,223.9</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,273.42</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,364.98</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,414.5</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,506.06</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p style="margin-left: 40px;">

On Month of Baisakh: 1,803.05 Crores</p>

<p style="margin-left: 40px;">

Weekly volume of this week (29<sup>th</sup> Baisakh – 2<sup>nd</sup> Jestha): NRs. 494.93 Crores</p>

<p style="margin-left: 40px;">

2<sup>nd</sup> Jestha: Nrs. 94.76 Crores</p>

<p style="margin-left: 40px;">

5<sup>th</sup> Jestha: Nrs. 109.03 Crores</p>

<p>

</p>

<p>

<strong>Commentary:</strong></p>

<ul>

<li>

1. Today market is negative like the last traded day. Along with the market other sub indices are also negative. NEPSE Market has lost 0.14% likewise Sensitive also lost 0.23%.</li>

<li>

2. The volume today has risen in comparison to the last day of this traded day.</li>

<li>

3. Out of 12 Sub-indices 6 of them are positive. The noticeable change on the Sub- Indices is negative change of Trading by 3.21%.</li>

<li>

4. The CMP of 5<sup>th</sup> Jestha is below the pivot of 6<sup>th</sup> Jestha but above the monthly pivot and the weekly pivot.</li>

<li>

5. Comparing NEPSE Market and Sensitive we can see that the NEPSE Market has more fluctuation than the Sensitive.</li>

</ul>

<p>

</p>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 22.68 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>336</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 18.70 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BPCL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.29 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>405</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PRVU</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.24 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>278</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>ADBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 2.82 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>422</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>57</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>CORBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>111</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>10</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RLFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>140</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>11</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PROFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>110</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>8</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BARUN</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>98</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>7</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BBC</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,630</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-100</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>GILB</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,228</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-70</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>IGI</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>430</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-24</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NADEP</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>472</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-26</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RBCLPO</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>10,265</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-544</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

<strong>Sector Wise Summary: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>NRs. 47.75 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>1,515,751</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>3,975</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>NRs. 1.21 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>88,679</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 1.14 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>22,229</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>86</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 21.57 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>321,094</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>1,749</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Others</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 2.87Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>57,332</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>215</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 5.73 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>203,508</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>1,128</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 8.42 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>141,044</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>713</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 9.18 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>510,276</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>1,236</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Mutual Fund </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>202,394</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>52</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Trading </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.004 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>30</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>3</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

</p>

<p>

</p>

<p>

<img alt="" src="/app/webroot/userfiles/images/s.JPG" style="width: 745px; height: 475px;" /></p>

<p style="text-align: center;">

<strong>Pic. Showing Sensitive Candle Stick Chart</strong></p>

<p>

</p>

<p>

<strong>Analysis: </strong></p>

<ul>

<li>

1. The CMP of 5<sup>th</sup> Jestha is below the Pivot of 6<sup>th</sup> Jestha and the volume is higher than that of last traded volume. Analyzing this we can say that the market now might enter bearish trend.</li>

<li>

2. Observing today’s candle stick pattern it is “Morning Star”.</li>

<li>

3. There is high trade volume today because of the opening of this week and we can analyze that the investors has started investing in the market.</li>

<li>

4. This is a suitable time for the interested buyers to invest in the market.</li>

</ul>

<p>

</p>

<p>

</p>

',

'published' => true,

'created' => '2019-05-19',

'modified' => '2019-05-19',

'keywords' => '',

'description' => '',

'sortorder' => '10466',

'image' => '20190519041953_n.JPG',

'article_date' => '2019-05-19 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => null,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '10714',

'article_category_id' => '1',

'title' => 'Market Watch of May 19 (Sunday) ',

'sub_title' => '',

'summary' => 'is it the right time to invest in the market? ',

'content' => '<p style="text-align: center;">

<strong>Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Current Price (CMP): 1316.84</strong></p>

<p>

<strong>OHLC Update of </strong><strong>5<sup>th</sup> </strong><strong>Jestha:</strong></p>

<p style="margin-left: 40px;">

O: 1318.71<br />

H: 1322.09<br />

L: 1312.81<br />

C: 1316.84</p>

<p>

<strong>Pivot for </strong><strong>6<sup>th </sup></strong><strong>Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" style="width:632px;" width="632">

<tbody>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>1,303.12</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,307.97</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,312.4</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,317.25</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,321.68</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,326.53</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,330.96</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>Pivot for the 2<sup>nd</sup> Week of Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:84px;height:28px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:84px;height:37px;">

<p style="text-align: center;">

<strong>1,240.68</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,262.42</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,290.57</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,312.31</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,340.46</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,362.2</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,390.35</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for Month of Jestha: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>1,082.82</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,132.34</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,223.9</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,273.42</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,364.98</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,414.5</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,506.06</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p style="margin-left: 40px;">

On Month of Baisakh: 1,803.05 Crores</p>

<p style="margin-left: 40px;">

Weekly volume of this week (29<sup>th</sup> Baisakh – 2<sup>nd</sup> Jestha): NRs. 494.93 Crores</p>

<p style="margin-left: 40px;">

2<sup>nd</sup> Jestha: Nrs. 94.76 Crores</p>

<p style="margin-left: 40px;">

5<sup>th</sup> Jestha: Nrs. 109.03 Crores</p>

<p>

</p>

<p>

<strong>Commentary:</strong></p>

<ul>

<li>

1. Today market is negative like the last traded day. Along with the market other sub indices are also negative. NEPSE Market has lost 0.14% likewise Sensitive also lost 0.23%.</li>

<li>

2. The volume today has risen in comparison to the last day of this traded day.</li>

<li>

3. Out of 12 Sub-indices 6 of them are positive. The noticeable change on the Sub- Indices is negative change of Trading by 3.21%.</li>

<li>

4. The CMP of 5<sup>th</sup> Jestha is below the pivot of 6<sup>th</sup> Jestha but above the monthly pivot and the weekly pivot.</li>

<li>

5. Comparing NEPSE Market and Sensitive we can see that the NEPSE Market has more fluctuation than the Sensitive.</li>

</ul>

<p>

</p>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 22.68 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>336</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 18.70 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BPCL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.29 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>405</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PRVU</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.24 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>278</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>ADBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 2.82 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>422</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>57</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>CORBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>111</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>10</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RLFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>140</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>11</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PROFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>110</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>8</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BARUN</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>98</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>7</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BBC</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,630</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-100</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>GILB</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,228</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-70</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>IGI</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>430</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-24</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NADEP</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>472</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-26</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RBCLPO</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>10,265</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-544</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

<strong>Sector Wise Summary: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>NRs. 47.75 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>1,515,751</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>3,975</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>NRs. 1.21 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>88,679</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 1.14 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>22,229</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>86</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 21.57 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>321,094</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>1,749</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Others</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 2.87Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>57,332</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>215</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 5.73 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>203,508</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>1,128</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 8.42 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>141,044</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>713</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 9.18 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>510,276</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>1,236</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Mutual Fund </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>202,394</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>52</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Trading </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.004 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>30</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>3</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

</p>

<p>

</p>

<p>

<img alt="" src="/app/webroot/userfiles/images/s.JPG" style="width: 745px; height: 475px;" /></p>

<p style="text-align: center;">

<strong>Pic. Showing Sensitive Candle Stick Chart</strong></p>

<p>

</p>

<p>

<strong>Analysis: </strong></p>

<ul>

<li>

1. The CMP of 5<sup>th</sup> Jestha is below the Pivot of 6<sup>th</sup> Jestha and the volume is higher than that of last traded volume. Analyzing this we can say that the market now might enter bearish trend.</li>

<li>

2. Observing today’s candle stick pattern it is “Morning Star”.</li>

<li>

3. There is high trade volume today because of the opening of this week and we can analyze that the investors has started investing in the market.</li>

<li>

4. This is a suitable time for the interested buyers to invest in the market.</li>

</ul>

<p>

</p>

<p>

</p>

',

'published' => true,

'created' => '2019-05-19',

'modified' => '2019-05-19',

'keywords' => '',

'description' => '',

'sortorder' => '10466',

'image' => '20190519041953_n.JPG',

'article_date' => '2019-05-19 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => null,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

'article_id' => '10714',

'hit' => '1075'

)

),

'Slider' => array()

)

$current_user = null

$logged_in = false

$image = 'https://old.newbusinessage.com/app/webroot/img/news/20190519041953_n.JPG'

$user = null include - APP/View/Articles/view.ctp, line 115

View::_evaluate() - CORE/Cake/View/View.php, line 971

View::_render() - CORE/Cake/View/View.php, line 933

View::render() - CORE/Cake/View/View.php, line 473

Controller::render() - CORE/Cake/Controller/Controller.php, line 968

Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200

Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167

[main] - APP/webroot/index.php, line 117 Notice (8)APP/View/Articles/view.ctp , line 115 ]Code Context $user = $this -> Session -> read ( 'Auth.User' );

//find the group of logged user

$groupId = $user [ 'Group' ][ 'id' ];

$viewFile = '/var/www/html/newbusinessage.com/app/View/Articles/view.ctp'

$dataForView = array(

'article' => array(

'Article' => array(

'id' => '10714',

'article_category_id' => '1',

'title' => 'Market Watch of May 19 (Sunday) ',

'sub_title' => '',

'summary' => 'is it the right time to invest in the market? ',

'content' => '<p style="text-align: center;">

<strong>Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Current Price (CMP): 1316.84</strong></p>

<p>

<strong>OHLC Update of </strong><strong>5<sup>th</sup> </strong><strong>Jestha:</strong></p>

<p style="margin-left: 40px;">

O: 1318.71<br />

H: 1322.09<br />

L: 1312.81<br />

C: 1316.84</p>

<p>

<strong>Pivot for </strong><strong>6<sup>th </sup></strong><strong>Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" style="width:632px;" width="632">

<tbody>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>1,303.12</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,307.97</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,312.4</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,317.25</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,321.68</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,326.53</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,330.96</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>Pivot for the 2<sup>nd</sup> Week of Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:84px;height:28px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:84px;height:37px;">

<p style="text-align: center;">

<strong>1,240.68</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,262.42</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,290.57</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,312.31</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,340.46</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,362.2</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,390.35</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for Month of Jestha: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>1,082.82</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,132.34</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,223.9</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,273.42</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,364.98</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,414.5</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>1,506.06</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Turnover Update:</strong></p>

<p style="margin-left: 40px;">

On Month of Baisakh: 1,803.05 Crores</p>

<p style="margin-left: 40px;">

Weekly volume of this week (29<sup>th</sup> Baisakh – 2<sup>nd</sup> Jestha): NRs. 494.93 Crores</p>

<p style="margin-left: 40px;">

2<sup>nd</sup> Jestha: Nrs. 94.76 Crores</p>

<p style="margin-left: 40px;">

5<sup>th</sup> Jestha: Nrs. 109.03 Crores</p>

<p>

</p>

<p>

<strong>Commentary:</strong></p>

<ul>

<li>

1. Today market is negative like the last traded day. Along with the market other sub indices are also negative. NEPSE Market has lost 0.14% likewise Sensitive also lost 0.23%.</li>

<li>

2. The volume today has risen in comparison to the last day of this traded day.</li>

<li>

3. Out of 12 Sub-indices 6 of them are positive. The noticeable change on the Sub- Indices is negative change of Trading by 3.21%.</li>

<li>

4. The CMP of 5<sup>th</sup> Jestha is below the pivot of 6<sup>th</sup> Jestha but above the monthly pivot and the weekly pivot.</li>

<li>

5. Comparing NEPSE Market and Sensitive we can see that the NEPSE Market has more fluctuation than the Sensitive.</li>

</ul>

<p>

</p>

<p>

<strong>Top 5 Scrips by turnovers:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>Turnover</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Closing Price</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 22.68 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>336</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 18.70 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BPCL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.29 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>405</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PRVU</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 3.24 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>278</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>ADBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>NRs. 2.82 Crores</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>422</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Gainers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>SHIVM</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>629</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>57</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>CORBL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>111</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>10</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RLFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>140</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>11</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>PROFL</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>110</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>8</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BARUN</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>98</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>7</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Top 5 Losers: </strong></p>

<table border="1" cellpadding="0" cellspacing="0" width="602">

<tbody>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>Scrips</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>LTP</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>Point Change</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>BBC</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,630</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-100</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>GILB</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>1,228</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-70</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>IGI</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>430</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-24</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>NADEP</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>472</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-26</strong></p>

</td>

</tr>

<tr>

<td style="width:200px;">

<p style="text-align: center;">

<strong>RBCLPO</strong></p>

</td>

<td style="width:202px;">

<p style="text-align: center;">

<strong>10,265</strong></p>

</td>

<td style="width:199px;">

<p style="text-align: center;">

<strong>-544</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

<strong>Sector Wise Summary: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Sector</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover Values</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Turnover volume</strong></p>

</td>

<td style="width:160px;height:33px;">

<p style="text-align: center;">

<strong>Total Transaction</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>Commercial Banks</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>NRs. 47.75 Crores</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>1,515,751</strong></p>

</td>

<td style="width:160px;height:29px;">

<p style="text-align: center;">

<strong>3,975</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>Finance</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>NRs. 1.21 Crores</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>88,679</strong></p>

</td>

<td style="width:160px;height:34px;">

<p style="text-align: center;">

<strong>250</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Hotels</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 1.14 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>22,229</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>86</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;">

<p style="text-align: center;">

<strong>Manufacturing And Processing</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>NRs. 21.57 Crores</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>321,094</strong></p>

</td>

<td style="width:160px;">

<p style="text-align: center;">

<strong>1,749</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Others</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 2.87Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>57,332</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>215</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>Hydro Power</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>NRs. 5.73 Crores</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>203,508</strong></p>

</td>

<td style="width:160px;height:36px;">

<p style="text-align: center;">

<strong>1,128</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Non Life Insurance</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 8.42 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>141,044</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>713</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Development Banks</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 9.18 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>510,276</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>1,236</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Mutual Fund </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.19 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>202,394</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>52</strong></p>

</td>

</tr>

<tr>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>Trading </strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>NRs. 0.004 Crores</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>30</strong></p>

</td>

<td style="width:160px;height:41px;">

<p style="text-align: center;">

<strong>3</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

</p>

<p>

</p>

<p>

<img alt="" src="/app/webroot/userfiles/images/s.JPG" style="width: 745px; height: 475px;" /></p>

<p style="text-align: center;">

<strong>Pic. Showing Sensitive Candle Stick Chart</strong></p>

<p>

</p>

<p>

<strong>Analysis: </strong></p>

<ul>

<li>

1. The CMP of 5<sup>th</sup> Jestha is below the Pivot of 6<sup>th</sup> Jestha and the volume is higher than that of last traded volume. Analyzing this we can say that the market now might enter bearish trend.</li>

<li>

2. Observing today’s candle stick pattern it is “Morning Star”.</li>

<li>

3. There is high trade volume today because of the opening of this week and we can analyze that the investors has started investing in the market.</li>

<li>

4. This is a suitable time for the interested buyers to invest in the market.</li>

</ul>

<p>

</p>

<p>

</p>

',

'published' => true,

'created' => '2019-05-19',

'modified' => '2019-05-19',

'keywords' => '',

'description' => '',

'sortorder' => '10466',

'image' => '20190519041953_n.JPG',

'article_date' => '2019-05-19 00:00:00',

'homepage' => true,

'breaking_news' => false,

'main_news' => false,

'in_scroller' => null,

'user_id' => '22'

),

'ArticleCategory' => array(

'id' => '1',

'name' => 'NEWS',

'parentOf' => '0',

'published' => true,

'registered' => '2015-07-20 00:00:00',

'sortorder' => '158',

'del_flag' => '0',

'homepage' => true,

'display_in_menu' => true,

'user_id' => '1',

'created' => '0000-00-00 00:00:00',

'modified' => '2018-11-22 11:58:49'

),

'User' => array(

'password' => '*****',

'id' => '22',

'user_detail_id' => '1',

'group_id' => '24',

'username' => 'kishor.bam@newbusinessage.com',

'name' => '',

'email' => 'kishor.bam@newbusinessage.com',

'address' => '',

'gender' => '',

'access' => '1',

'phone' => '',

'access_type' => '0',

'activated' => false,

'sortorder' => '0',

'published' => '0',

'created' => '2018-11-30 10:47:22',

'last_login' => '2019-06-09 10:32:40',

'ip' => '202.63.242.112'

),

'ArticleComment' => array(),

'ArticleFeature' => array(),

'ArticleHasAuthor' => array(),

'ArticleHasTag' => array(),

'ArticleView' => array(

(int) 0 => array(

[maximum depth reached]

)

),

'Slider' => array()

),

'current_user' => null,

'logged_in' => false

)

$article = array(

'Article' => array(

'id' => '10714',

'article_category_id' => '1',

'title' => 'Market Watch of May 19 (Sunday) ',

'sub_title' => '',

'summary' => 'is it the right time to invest in the market? ',

'content' => '<p style="text-align: center;">

<strong>Pic. Showing NEPSE Candle Stick Chart</strong></p>

<p>

<strong>Current Price (CMP): 1316.84</strong></p>

<p>

<strong>OHLC Update of </strong><strong>5<sup>th</sup> </strong><strong>Jestha:</strong></p>

<p style="margin-left: 40px;">

O: 1318.71<br />

H: 1322.09<br />

L: 1312.81<br />

C: 1316.84</p>

<p>

<strong>Pivot for </strong><strong>6<sup>th </sup></strong><strong>Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0" style="width:632px;" width="632">

<tbody>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:79px;height:34px;">

<p style="text-align: center;">

<strong>1,303.12</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,307.97</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,312.4</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,317.25</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,321.68</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,326.53</strong></p>

</td>

<td style="width:92px;height:34px;">

<p style="text-align: center;">

<strong>1,330.96</strong></p>

</td>

</tr>

</tbody>

</table>

<div style="clear:both;">

</div>

<p>

<strong>Pivot for the 2<sup>nd</sup> Week of Jestha:</strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:84px;height:28px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>S1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>Pivot</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R1</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R2</strong></p>

</td>

<td style="width:91px;height:28px;">

<p style="text-align: center;">

<strong>R3</strong></p>

</td>

</tr>

<tr>

<td style="width:84px;height:37px;">

<p style="text-align: center;">

<strong>1,240.68</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,262.42</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,290.57</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,312.31</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,340.46</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,362.2</strong></p>

</td>

<td style="width:91px;height:37px;">

<p style="text-align: center;">

<strong>1,390.35</strong></p>

</td>

</tr>

</tbody>

</table>

<p>

</p>

<p>

<strong>Pivot for Month of Jestha: </strong></p>

<table border="1" cellpadding="0" cellspacing="0">

<tbody>

<tr>

<td style="width:79px;">

<p style="text-align: center;">

<strong>S3</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">

<strong>S2</strong></p>

</td>

<td style="width:91px;">

<p style="text-align: center;">