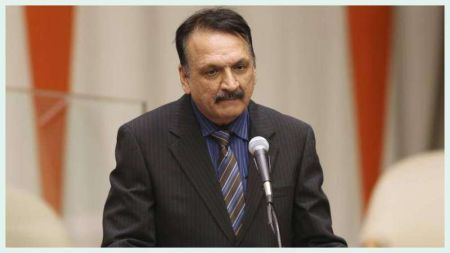

February 18: Nabil Bank’s Chief Executive Officer (CEO) Gyanendra Prasad Dhungana has said that banks will not be able to pay dividends next year unless the economy picks up…

February 18: Nabil Bank’s Chief Executive Officer (CEO) Gyanendra Prasad Dhungana has said that banks will not be able to pay dividends next year unless the economy picks up…

February 18: A meeting of the House of Representatives on Sunday passed the Financial Procedures and Financial Liability (First Amendment) Ordinance, 2080 by a…

The Nepal Stock Exchange (NEPSE) experienced a decline of 27.21 points or 1.31% compared to the previous day's closing, concluding at 2,034.82 points on the first trading day of the week, on…

February 18: Finance Minister Dr Prakash Sharan Mahat has warned to punish the people who urge others not to repay bank loans by spreading rumours that banks are about to become…

February 18: The government has made legal arrangements to address the problems arising from the same individual or group owning both businesses and banks, according to Prime Minister Pushpa Kamal…

February 18: Aloi Private Limited, a platform dedicated to lending to emerging market green micro-entrepreneurs through verified merchants, and Kumari Bank Limited announced the signing of a Memorandum of Understanding (MoU) on February 15 to explore, evaluate, cooperate, and potentially work towards initiating and upscaling sustainable and green financing through digital financial literacy…

February 18: The government has started its homework of preparing budget for the next…

February 18: At a time when the government is gearing up for the Third Investment Summit, Nepal Rastra Bank has also turned flexible in the provision related to foreign investment.…

February 18: Doctors have said childhood cancers are more responsive to…

February 16: Researchers are still discovering how smoking continues to harm people's health even years after they quit, with a new study revealing tobacco's lasting effect on the immune system, AFP…

The U.K. and Japan entered into recessions at the end of last year as cutbacks in spending by consumers took a toll on their economies, data released…

February 16: The World Trade Organization regulates large swathes of global trade, but is handicapped by a rule requiring full consensus for any decisions, and a dispute settlement system crippled by US opposition, according to…

February 16: Banks and financial institutions deposited about Rs 28 billion in the Standing Deposit Facility announced by Nepal Rastra…

February 16: Stakeholders of Nepal and India have decided to establish a regulatory mechanism to start the cross-border payment service between the two…

February 16: Airbus revenues increased by 11 percent to 65.4 billion euros (70.2 billion U.S. dollars) in 2023, with revenues in commercial aircraft up by 15 percent, the European aircraft manufacturer said…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '20288', 'article_category_id' => '1', 'title' => 'Banks unlikely to Pay Dividend Next Year if Economy does not Improve: Nabil Bank’s CEO', 'sub_title' => '', 'summary' => 'February 18: Nabil Bank’s Chief Executive Officer (CEO) Gyanendra Prasad Dhungana has said that banks will not be able to pay dividends next year unless the economy picks up pace.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">February 18: Nabil Bank’s Chief Executive Officer (CEO) Gyanendra Prasad Dhungana has said that banks will not be able to pay dividends next year unless the economy picks up pace.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">CEO Dhungana said this while speaking at an interaction programme organized by the Female Economic Journalists Association (FEJA). He said that the problems that were never seen in the past are now seen in the economy and their impacts on banks are clearly evident.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He said that there has been a slump in purchase and sales as well as borrowing in the market and the overall economy is in crisis. As a result, the banks’ recovery has been badly hit, he said. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">“If there is no improvement in the economy, banks and financial institutions will have to face more problems,” he warned.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">He said that the practice of reducing the size of the budget rather than increasing the capital expenditure in the country is not correct. He said this will not help revitalize the economy. He said that the economy is in crisis as people are compelled to take loans for day-to-day expenses.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Nirmala UI","sans-serif"">Sharmila Thakuri, president of the Female Economic Journalism Association, said that the interaction was held to support women's capacity development. The event was inaugurated by Acting Governor of Nepal Rastra Bank Dr Neelam Dhungana. Nabil Bank was the co-host of the interaction programme.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20015', 'image' => '20240218094218_ceeee.jpg', 'article_date' => '2024-02-18 21:41:55', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '20286', 'article_category_id' => '1', 'title' => 'Lower House Approves Financial Procedures Ordinance', 'sub_title' => '', 'summary' => 'February 18: A meeting of the House of Representatives on Sunday passed the Financial Procedures and Financial Liability (First Amendment) Ordinance, 2080 by a majority. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 18: A meeting of the House of Representatives on Sunday passed the Financial Procedures and Financial Liability (First Amendment) Ordinance, 2080 by a majority. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The ordinance was tabled by Finance Minister Dr Prakash Sharan Mahat. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Prior to the endorsement, the meeting rejected the proposal put forward by MP Prem Suwal to reject the ordinance. The proposal of MP Suwal was rejected by a majority of the lower house. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">It may be noted that President Ram Chandra Paudel had issued the Financial Procedures and Financial Liability (First Amendment) Ordinance, 2080 on January 18 upon the recommendation of the government. The ordinance has opened the door for the government to submit the principles and priorities of the budget before the parliament within the last week of February. The previous deadline for setting the budget ceiling was also amended through the ordinance. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The approval of the ordinance also allows the government to present the principles and priorities of the government's budget three months prior to submission of the Appropriation Bill. Earlier, the time was at least 15 days prior to submission of the bill. There is a legal provision that the federal government should table the appropriation bill before the parliament on Jestha 15 (May end) according to the Nepali calendar. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, the MPs will now have thirty days to give their comments and feedback on the principles and priorities of the government's budget and programs. Previously, the parliamentarians were required to do so within seven days after its submission to the parliament. -- RSS</span></span></span></p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20013', 'image' => '20240218064242_20231102105019_1698891708.1663413681.Pratinidhi Shabha.jpg', 'article_date' => '2024-02-18 18:42:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '20285', 'article_category_id' => '1', 'title' => 'NEPSE Records Loss of 27.21 Points, Closing at 2034.82', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) experienced a decline of 27.21 points or 1.31% compared to the previous day's closing, concluding at 2,034.82 points on the first trading day of the week, on Sunday.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">February 18: The Nepal Stock Exchange (NEPSE) experienced a decline of 27.21 points or 1.31% compared to the previous day's closing, concluding at 2,034.82 points on the first trading day of the week, on Sunday.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Throughout today’s trading session, a total of 315 different stocks were traded in 97,105 transactions. A total of 10,772,483 shares changed hands, resulting in a turnover of Rs. 3.77 billion.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Himalayan Reinsurance Limited (HRL) led the turnover with transactions totaling Rs. 40.90 crores, closing at a market price of Rs. 645.10. </span></span><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Samaj Laghubittya Bittiya Sanstha Limited (SAMAJ) and Bottlers Nepal (Balaju) Limited (BNL) each experienced a 10% rise and hit the positive circuit for the day.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">However, Samling Power Company Limited (SPC) experienced the most significant decline, marking a loss of 8.21%.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">All 13 sector indices closed in the red, with the "Finance Index" recording the most substantial loss at 2.70%, while the Mutual Fund Index experienced the least decline at 0.16%.</span></span></p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20012', 'image' => '20240218041801_collage (1).jpg', 'article_date' => '2024-02-18 16:16:20', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 3 => array( 'Article' => array( 'id' => '20284', 'article_category_id' => '1', 'title' => 'Finance Minister Warns of Action Against those Spreading Rumours about Bankruptcy of BFIs', 'sub_title' => '', 'summary' => 'February 18: Finance Minister Dr Prakash Sharan Mahat has warned to punish the people who urge others not to repay bank loans by spreading rumours that banks are about to become bankrupt.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 18: Finance Minister Dr Prakash Sharan Mahat has warned to punish the people who urge others not to repay bank loans by spreading rumours that banks are about to become bankrupt.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Speaking at the 4th National Microfinance Members' Conference in Kathmandu on Saturday, Finance Minister Dr. Mahat said that attempts are being made to destabilize the banking sector by creating fake rumors that banks and becoming bankrupt. He said some elements are trying to invite trouble by urging the depositors to withdraw their money from banks.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"I would like to warn them on behalf of the government that we will not hesitate for a moment to take action against such tendencies under any circumstances,” said the finance minister.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">He also urged the borrowers not to be under the illusion that they do not have to pay their debts. Certain groups with vested interest are trying to play the spoilsport by raising hopes that they do not have to pay the loan and that the government will waive the debts, said the minister.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"The loan taken from the savings of the depositors can never be waived. On the other hand, the government is facilitating those who are in trouble to repay their debts. But the debts must be paid,” he added.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">He suggested that microfinance institutions should be focused on rural development, micro-enterprises and self-employment rather than as profit-making tools. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"If someone has acted contrary to the purpose of being a microfinance operator, has misused it, and is trying to gain personal benefits in an opaque manner, then all of you should discourage it," he said.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Acting Governor of Nepal Rastra Bank Dr Neelam Dhungana Timsina praised the role played by microfinance at a time when 21 percent of the population does not have access to formal channel of financing.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Stating that there is risk when the non-performing loan increases above 6 percent, she suggested that everyone should work responsibly to prevent the situation from deteriorating further.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Shankarman Shrestha, president of Swabalamban Development Center, the organizer of the conference, said that microfinance was started with a target to facilitate the poor and the disadvantaged families and pointed out the need to bring those who have gone astray on the right path.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">In the meantime, Shrestha shed light on some problems observed in the microfinance sector. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">He noted that microfinance institutions were run in accordance with the Companies Act. According to Shrestha, microfinance companies drew investors after they started issuing dividends to the shareholders</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">“The investors believed that microfinance was a place where they could make a lot of profit. We did not make the members of the microfinance as shareholders, which was a big mistake," he said. "There was carelessness even while giving loans.”</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Ram Bahadur Yadav, president of Nepal Microfinance Bankers Association, complained that the government has neglected the microfinance sector, which has promoted investment and enterprise along with financial awareness in the villages through its nearly six million members. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">According to him, the reason for the current problem is that the government has not paid much attention to the areas such as spreading economic activities in far-flung areas, uplifting the poor, ending poverty, and empowering women.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20011', 'image' => '20240218040450_20230402035731_1680390939.prakash sharan mahat.jpg', 'article_date' => '2024-02-18 16:04:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '20282', 'article_category_id' => '1', 'title' => 'Govt Adopts Policy against Same Individual Owning Business and Bank', 'sub_title' => '', 'summary' => 'February 18: The government has made legal arrangements to address the problems arising from the same individual or group owning both businesses and banks, according to Prime Minister Pushpa Kamal Dahal. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 18: The government has made legal arrangements to address the problems arising from the same individual or group owning both businesses and banks, according to Prime Minister Pushpa Kamal Dahal. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Responding to the queries raised by MPs at a meeting of the House of Representatives on Sunday, Prime Minister Dahal said further policy and legal reforms are also being made towards this end. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">"If the limited resources of the country are confined to a selected few then it will invite various risks and also limit the outcome only to those few," he said while pointing out to the provision that puts a limit on an individual or group to acquire loan from banks. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">On a different note, Prime Minister Dahal said the government has given high priority to increasing domestic production and job creation. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">"The government has launched the campaign of Domestic Employment Promotion Decade to create employment opportunities within the country," he said, "There are initiatives to increase investment in the productive sector with priority for dometic labor in the country itself." </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Prime Minister Dahal also shared that the format of the Prime Minister's Employment Program will be changed and will be linked to the outcome to make it more effective. -- RSS </span><br /> </span></span><br /> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20010', 'image' => '20240218031321_Banks - Copy.jpg', 'article_date' => '2024-02-18 15:12:19', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '20283', 'article_category_id' => '218', 'title' => ' Aloi and Kumari Bank Collaborate for Digital Green Financing', 'sub_title' => '', 'summary' => 'February 18: Aloi Private Limited, a platform dedicated to lending to emerging market green micro-entrepreneurs through verified merchants, and Kumari Bank Limited announced the signing of a Memorandum of Understanding (MoU) on February 15 to explore, evaluate, cooperate, and potentially work towards initiating and upscaling sustainable and green financing through digital financial literacy programs.', 'content' => '<div> <p><span style="font-size:18px"><span style="font-family:Arial,"sans-serif""><span style="font-family:"Times New Roman","serif"">February 18: Aloi Private Limited, a platform dedicated to lending to emerging market green micro-entrepreneurs through verified merchants, and Kumari Bank Limited announced the signing of a Memorandum of Understanding (MoU) on February 15 to facilitate green financing.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Arial,"sans-serif""><span style="font-family:"Times New Roman","serif"">As per the MoU, the two organisations will explore, evaluate, cooperate, and potentially work towards initiating and upscaling sustainable and green financing through digital financial literacy programs.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Arial,"sans-serif""><span style="font-family:"Times New Roman","serif"">The MoU signifies a strategic partnership aimed at digitizing green and sustainable financing, with an initial focus on digital financial literacy workshops, reads a joint statement issued by the organisations. Under this collaboration, Kumari Bank and Aloi Private Limited will work together to provide digital financial literacy workshops to MSMEs in the agricultural sector.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Arial,"sans-serif""><span style="font-family:"Times New Roman","serif"">As per the statement, the agreement was formalized through the signing ceremony attended by Arpan Paudel, the Transaction Banking Head of Kumari Bank, and Sonika Manandhar, CTO/Co-Founder and Tiffany Tong CEO/Co-Founder of Aloi.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Arial,"sans-serif""><span style="font-family:"Times New Roman","serif"">The association said it will focus on bridging the gap in micro-business loans, catering to entrepreneurs who require more financing than microfinance can provide but cannot access commercial bank loans.</span></span></span></p> </div> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20009', 'image' => '20240218033943_aloi.jpg', 'article_date' => '2024-02-18 15:37:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '20281', 'article_category_id' => '1', 'title' => 'NPC Fixes Budget Ceiling for Next FY', 'sub_title' => '', 'summary' => 'February 18: The government has started its homework of preparing budget for the next fiscal.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 18: The government has started its homework of preparing budget for the next fiscal. The National Planning Commission has also determined the ceiling (limit) of the new budget. The ministries have started their homework of the budget within the limit fixed by the NPC.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Finance Minister Dr. Prakasharan Mahat confirmed that the NPC has set a budget ceiling of Rs 18 billion for the next fiscal year. The resource estimation committee of the National Planning Commission led by NPC Vice Chairman Dr Meen Bahadur Shrestha recommended the budget ceiling. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"The ceiling of the budget was determined after discussions with the prime minister, the Resource Estimation Committee and the Ministry of Finance," Minister Mahat said at a press conference held at the Ministry of Finance in Singh Durbar on Friday.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The mid-term expenditure structure projected that the next fiscal year's budget would be equal to Rs 1949.5 billion. The NPC set the budget ceiling of Rs 150 billion than the mid-term expenditure structure projection. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">It has become a tradition to announce a big-size budget and later downsize it due to the government’s failure to spend the budget.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">If we look at the current fiscal year's budget, Finance Minister Mahat had announced a budget of Rs 1751.31 billion even though the NPC had set a ceiling of Rs 1688 billion. However, the government revised the budget estimate to Rs 1530.26 billion through the mid-term review of budget after realizing that it will not be able to spend the initially announced budget.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Finance Minister Mahat insists that the Ministry of Finance has not reduced the size of the budget but only presented the estimated the income and expenses of the budget. According to him, the Ministry of Finance cannot make cuts and amendments to the budget passed by the Parliament. However, the ministry has the authority to estimate how much can be spent in the next 6 months based on 6 months of expenditure and income. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">For the year 2079/80, the then Finance Minister Janardan Sharma had announced a budget of Rs 1793 billion but the government failed to spend the budget. The government during last fiscal year revised the budget estimate to Rs 1549 billion. However, the total expenditure of the budget stood at Rs 1429.56 billion.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">There has been a problem with the government's spending system for a long time. In order to address the problem, the government also amended the policy arrangements related to financial procedures and financial responsibility through an ordinance.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20008', 'image' => '20240218022924_budget.jpg', 'article_date' => '2024-02-18 14:28:27', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '20280', 'article_category_id' => '1', 'title' => 'NRB Turns Flexible in Provision Related to Foreign Investment', 'sub_title' => '', 'summary' => 'February 18: At a time when the government is gearing up for the Third Investment Summit, Nepal Rastra Bank has also turned flexible in the provision related to foreign investment. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 18: At a time when the government is gearing up for the Third Investment Summit, Nepal Rastra Bank has also turned flexible in the provision related to foreign investment. The central bank has amended the 'Foreign Investment and Credit Management Regulations 2078' relaxing the provision requiring NRB’s prior approval for foreign investment.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">As per the revised regulations, investors do not require the approval of the central bank to inject foreign investment by changing the share ownership. However, there is a provision that even if the share ownership of foreign investment changes, the ownership ratio of Nepali shareholders should not decrease. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Likewise, the amended law has a provision that does not require the approval of the central bank to bring in foreign investment in companies listed in the stock market and for sick industries as per the Industrial Enterprises Act, 2076.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Until now, the approval of the central bank was mandatory for financing foreign investment. Now, the investors only need to inform the central bank about the foreign investment. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">As per the revised rules, the foreign investment financing industries and foreign loan borrowers must submit details as requested by the central bank.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Similarly, the NRB has also facilitated the provision of bank guarantee for foreign currency. By issuing instructions to banks and financial institutions, it has made arrangements so that that foreign bank guarantees can be directly issued for non-loan purposes such as bid bonds and performance bonds. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Similarly, foreign pension funds, hedge funds, government/inter-government owned development finance institutions, etc. can also accept financial guarantees issued by lending institutions without the approval of the central bank. However, a maximum commission fee of 1.5 percent has been set for bank guarantees taken from foreign banks and financial institutions.</span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20007', 'image' => '20240218010534_Foreign investment.jpg', 'article_date' => '2024-02-18 13:04:46', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '20279', 'article_category_id' => '1', 'title' => ''Childhood Cancers Responsive to Treatment' ', 'sub_title' => '', 'summary' => 'February 18: Doctors have said childhood cancers are more responsive to treatment.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 18: Doctors have said childhood cancers are more responsive to treatment. Pediatric Oncologist at Patan Academy of Health Sciences, Dr Sucharika Tandukar, said childhood cancers have better cure rates as compared to cancers in adults. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">"Other diseases could be seen along with cancer in adults," she mentioned, adding as children suffering from cancer have less possibility of having other diseases, there is higher chance of recovery. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Dr Tandukar shared, "Many children die an untimely death due to cancer in lack of access to treatment in Nepal. Around 1,000 children suffer from cancer every year, only 500 have access to treatment." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Pediatric Oncologist at Bhaktapur Cancer Hospital, Dr Rhitu Sapkota, explained that 30 per childhood cancer is cured, stating that around 70 per cent of children cannot be completely cured due to lack of timely treatment. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Underdeveloped countries like Nepal have low childhood cancer survival rate, added Dr Sapkota, sharing that it is 80-90 per cent in developed countries. Chances of curing cancer are less in adult as adults are found suffering from different diseases likes high blood pressure and diabetes. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The government has a target of curing 60 per cent childhood cancers till 2030 in Nepal, added Dr Sapkota. Blood cancer cure rate on children is 97 per cent in the world. Children are found suffering mostly from blood cancer, bone cancer and eye cancer. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Ten per cent of children suffer from cancer due to heredity and 90 per cent due to genetic defects. Childhood cancers are treated at Patan Academy of Health Sciences, BP Koirala Memorial Hospital, Bhaktapur Cancer Hospital and Kanti Children’s Hospital. -- RSS</span></span></span></p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20006', 'image' => '20240218123340_Childhood-Cancer.jpg', 'article_date' => '2024-02-18 12:32:59', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '20278', 'article_category_id' => '1', 'title' => 'Tobacco Kills Over Eight Million People a Year Globally: WHO', 'sub_title' => 'Research shows lasting effects of smoking after quitting', 'summary' => 'February 16: Researchers are still discovering how smoking continues to harm people's health even years after they quit, with a new study revealing tobacco's lasting effect on the immune system, AFP reported.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">February 16: Researchers are still discovering how smoking continues to harm people's health even years after they quit, with a new study revealing tobacco's lasting effect on the immune system, AFP reported.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">Despite the tobacco industry long fighting to conceal the dangers of smoking, tobacco is now known to kill more than eight million people globally a year, according to the World Health Organization.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">But the myriad of ways the habit damages bodies are still coming to light, added the French news agency.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">According to AFP, the new study, published in the journal Nature, found that smoking alters the immune system, which protect bodies from infection, for far longer than previously thought.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">It particularly highlighted changes to what is called adaptive immunity, which is built up over time as the body's specialised cells remember how to fight back against foreign pathogens they have encountered before.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The findings were based on analysing blood and other samples taken from 1,000 healthy people in France starting from more than a decade ago.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">Smoking was found to have more influence on adaptive immunity than other factors such as amount of sleep or physical activity, the researchers said.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The study also confirmed previous research which has shown smoking's effect on "innate immunity," which is the body's first line of defence against invading pathogens.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">While innate immunity rebounded immediately after people stopping smoking, adaptive immunity remained effected for years, even decades after quitting, the study said.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The sample size was too small to give a precise timeline for how long these changes last.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The researchers emphasised that the effect does wear off -- so the sooner people quit the better.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">Of course, it is still better "for long term immunity to never start smoking," lead study author Violaine Saint-Andre of France's Pasteur Institute told a press conference.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The researchers could not say for sure what consequences these changes may have on health. But they hypothesised that it could affect people's risk of infections, cancer or autoimmune diseases.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">Another study, published last week in the journal NEJM Evidence, aimed to determine how much quitting smoking was linked to a lower risk of disease and dying early.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">It covered 1.5 million people across the United States, Canada, Norway and the UK, some of them active smokers, some who never started -- and everyone in between.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">When people quit smoking, it took 10 years for their average life expectancy to return to the same level as non-smokers, according to the study.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">Again, the researchers emphasised the importance of quitting as soon as possible -- some benefits were evident as early as three years after kicking the habit.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-family:"Calibri","sans-serif"">The effect was noticeable no matter what age people quit, however the benefits were more pronounced for those under 40. – AFP/RSS</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20005', 'image' => '20240218105952_tobacco.jpg', 'article_date' => '2024-02-18 10:58:58', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '20277', 'article_category_id' => '1', 'title' => 'UK and Japan Fell into Recessions at the End of Last Year', 'sub_title' => '', 'summary' => 'The U.K. and Japan entered into recessions at the end of last year as cutbacks in spending by consumers took a toll on their economies, data released recently show.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 18: The U.K. and Japan entered into recessions at the end of last year as cutbacks in spending by consumers took a toll on their economies, data released recently show.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The weakness in the two major economies is in stark contrast to that of the U.S. economy, which grew at an annualized rate of 3.3% in the fourth quarter, far faster than the 2% economists were expecting. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The U.K.’s gross domestic product shrank by an annualized rate of 1.4% in the final three months of 2023, in its second consecutive quarterly decline—the technical definition of a recession.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">GDP in the U.K. fell 0.3% in the three months to December versus the previous three months, following a 0.1% decline in the third quarter, according to data from the Office for National Statistics.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">During the last three months of 2023, Japan’s GDP contracted at an annualized pace of 0.4%, after falling 3.3% retreat in the previous quarter, according to government data.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Japan’s shrinking economy is now the fourth-largest in the world, losing its spot in the top three behind the U.S. and China to Germany. (Agencies) </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-18', 'modified' => '2024-02-18', 'keywords' => '', 'description' => '', 'sortorder' => '20004', 'image' => '20240218070739_collage (36).jpg', 'article_date' => '2024-02-18 07:05:50', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 11 => array( 'Article' => array( 'id' => '20275', 'article_category_id' => '1', 'title' => 'Is World Trade Organization No Longer Relevant?', 'sub_title' => 'WTO: The Sick Man of Global Trade?', 'summary' => 'February 16: The World Trade Organization regulates large swathes of global trade, but is handicapped by a rule requiring full consensus for any decisions, and a dispute settlement system crippled by US opposition, according to AFP.', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">February 16: The World Trade Organization regulates large swathes of global trade, but is handicapped by a rule requiring full consensus for any decisions, and a dispute settlement system crippled by US opposition, according to AFP.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The WTO, which holds its two-yearly ministerial conference in Abu Dhabi from February 26 to 29, is the only international organisation that deals with the rules governing trade between countries, the French news agency stated in a recent news report.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">But as the organisation itself acknowledges on its website, it "is not Superman, just in case anyone thought it could solve -- or cause -- all the world's problems!"</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><strong>Post Cold War rules </strong></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The WTO was created on January 1, 1995, but is based on a trading system established nearly half a century earlier, in 1948, with its predecessor the General Agreement on Tariffs and Trade.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The GATT was part of a framework of international organisations created after World War II to discourage policies such as protectionism that were considered to have aggravated the Great Depression of the 1930s.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The WTO was formed at the end of the eighth round of GATT trade liberalisation negotiations, known as the Uruguay Round, which stretched from 1986 to 1994.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Whereas the GATT mainly dealt with trade in goods, the WTO and its agreements now also cover trade in services, inventions, creations and designs.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">"The system's overriding purpose is to help trade flow as freely as possible -- so long as there are no undesirable side-effects -- because this is important for economic development and well-being," the WTO says.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">But some accuse the organisation of becoming too bulky, a massive bureaucratic machine.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">With a budget of nearly 205 million Swiss francs ($234 million) this year, it employs some 600 people at its Geneva headquarters, including an army of lawyers, economists and statisticians.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><strong>WTO straitjacket </strong></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The WTO's 164 member states call the shots.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">And making decisions is no easy feat: any agreement requires full consensus, meaning every member holds veto power.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Around three-quarters of the WTO's members are considered developing or among the least-developed countries, which benefit from more flexibility in the way trade rules are applied.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">All large economies are members, but around 20 countries are currently on a waiting list to join, including Iran, Algeria, Serbia and Iraq.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The accession process can take years, as it entails long negotiations with all WTO members, which each have the power to block a country from joining.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">East Timor and the Comoros are expected to join the WTO soon, in the least-developed countries category. Their membership bids will be formally presented in Abu Dhabi.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><strong>Dispute settlement in disarray</strong></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">The WTO is a forum where governments negotiate multilateral trade deals affecting all member states.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">But amid the difficulty of obtaining full consensus, more and more plurilateral agreements -- deals with a narrower number of signatories -- are being reached, applying only to the participating countries.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">This is the case for instance with an important agreement offering exemptions from customs duties on electronic transactions.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Once painstakingly agreed, the international trade rules often require interpretation, with the WTO serving as an arbitrator in disputes.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">Countries of any size can file complaints with WTO's Dispute Settlement Body over alleged trade rules violations, and it is not uncommon for the world's biggest economies to be tripped up in disputes filed by smaller ones.</span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif"">But the system is in disarray, since Washington brought its appeals court to a screeching halt in late 2019 after years of blocking the appointment of new judges. – AFP/RSS</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-02-16', 'modified' => '2024-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '20002', 'image' => '20240216100904_placeholder_md.jpg', 'article_date' => '2024-02-16 22:08:28', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '20274', 'article_category_id' => '1', 'title' => 'Banks Deposit Rs 28 Billion under NRB’s Standing Deposit Facility', 'sub_title' => '', 'summary' => 'February 16: Banks and financial institutions deposited about Rs 28 billion in the Standing Deposit Facility announced by Nepal Rastra Bank.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 16: Banks and financial institutions deposited about Rs 28 billion in the Standing Deposit Facility announced by Nepal Rastra Bank.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The banks kept their excess liquidity as deposits with the central bank on the first day of the introduction of the new tool by the central bank to mop excess liquidity.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The regulations and procedures related to open market transactions has arrangements for banks to utilize the Standing Deposit Facility only once every Sunday and Wednesday. As per the legal provision, nine banks on Wednesday kept fixed deposits worth Rs 27.85 billion under the Standing Deposit Facility. Banks will get three percent interest rate on this deposit which matures in four days.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">In order to effectively implement the interest rate corridor, the central bank had made arrangements through the monetary policy of the current fiscal year to provide permanent deposit facility at the deposit collection rate which is the lower limit of the interest rate corridor. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Accordingly, the central bank announced during the semi-annual review of the monetary policy that the permanent deposit facility will be implemented from February 13.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">According to the 'Interest Rate Corridor Procedure 2076', there is an arrangement to set the upper limit of the bank rate and the lower limit of the deposit collection rate and keep the interbank interest rate in between. For this purpose, Nepal Rastra Bank has a provision to use various monetary instruments for releasing liquidity and mopping excess liquidity.</span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2024-02-16', 'modified' => '2024-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '20001', 'image' => '20240216023205_Nepal_Rastra_Bank2 2.jpg', 'article_date' => '2024-02-16 14:31:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '20273', 'article_category_id' => '1', 'title' => 'Nepal, India agree to Set up Regulatory Mechanism for Cross-Border Payments Service', 'sub_title' => '', 'summary' => 'February 16: Stakeholders of Nepal and India have decided to establish a regulatory mechanism to start the cross-border payment service between the two countries.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">February 16: Stakeholders of Nepal and India have decided to establish a regulatory mechanism to start the cross-border payment service between the two countries. Eight months after a formal agreement between the two countries to operate inter-state payment service, the authorities concerned have started technical preparations. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The United Payment Interface (UPI), which is working as a payment switch in India, and the National Payment Interface (NPI), which is working as a payment switch in Nepal, reached an agreement on Thursday to establish a bilateral regulatory mechanism. Nepal Rastra Bank confirmed that the mechanism has been created to carry out the necessary preparations before starting cross-border payments.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"Regulatory and technical work is necessary to start cross-border payment," said Deputy Information Officer of Nepal Rastra Bank, Bhagwat Acharya, adding, “The two countries have signed an agreement to create a bilateral regulatory mechanism for seamless payment service.” </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The mechanism will also determine the amount of money that can be paid in which areas using which technology and the service fee.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">During the state visit of Prime Minister Pushpa Kamal Dahal to India last May, Nepal and India had reached an understanding to start the cross-border payment service. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">NIPL, the international branch of National Payments Corporation of India (NPCI), and Nepal Clearing House Limited (NCHL) in which Nepal Rastra Bank has its stakes, signed an agreement to this effect during the visit. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Then in August, NIPL also entered into an agreement with Nepal's private sector payment service provider, PhonePay, for the operation of cross-border payment service. The agreement was signed at the Global Fintech Fest 2023 in the presence of Nepal Rastra Bank’s Governor Maha Prasad Adhikari.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Although the Indian side has signed agreements with two Nepalese companies for the cross-border payment service, this service has not yet been started due to lack of regulatory approval. Both companies of Nepal have said that the necessary preparations for service operation have been completed. Both the companies have applied with Nepal Rastra Bank seeking permission to operate the service.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">If the cross-border payment service comes into operation, the compulsion of citizens of both countries to carry cash for travel and business will end. This is expected to increase trade, tourism and other activities between the two countries.</span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2024-02-16', 'modified' => '2024-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '20000', 'image' => '20240216020515_Untitled.jpg', 'article_date' => '2024-02-16 14:04:39', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '20272', 'article_category_id' => '1', 'title' => 'Airbus Revenues Increase by 11 Percent in 2023 ', 'sub_title' => '', 'summary' => 'February 16: Airbus revenues increased by 11 percent to 65.4 billion euros (70.2 billion U.S. dollars) in 2023, with revenues in commercial aircraft up by 15 percent, the European aircraft manufacturer said Thursday. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 16: Airbus revenues increased by 11 percent to 65.4 billion euros (70.2 billion U.S. dollars) in 2023, with revenues in commercial aircraft up by 15 percent, the European aircraft manufacturer said Thursday. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">"In 2023 we recorded strong order intake across all our businesses and we delivered on our commitments. This was a significant achievement given the complexity of the operating environment," said Airbus Chief Executive Officer Guillaume Faury. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Airbus delivered 735 commercial aircraft in 2023, comprising 68 A220s, 571 A320 Family, 32 A330s and 64 A350s, marking an 11-percent increase in the number of units over 2022 when 661 units were delivered, according to its report of full-year 2023 results. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">In 2023, Airbus Helicopters delivered 346 units, almost unchanged from the 344 units delivered in 2022, resulting in a 4 percent rise in revenues. Moreover, revenues of Airbus Defence and Space increased by 2 percent. A total of eight A400M military airlifters were delivered last year, in comparison to 10 units in 2022. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">However, consolidated net income, or profits, fell by 11 percent to 3,789 million euros due to high special charges in the defence and aerospace division. For 2024, the group said it "targets to achieve around 800 commercial aircraft deliveries" on the basis that "it assumes no additional disruptions to the world economy, air traffic, the supply chain, the Company's internal operations, and its ability to deliver products and services." (1 euro = 1.07 U.S. dollar) – Xinhua/RSS </span></span></span></p> ', 'published' => true, 'created' => '2024-02-16', 'modified' => '2024-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '19999', 'image' => '20240216012820_4str-080531_Airbus_380_F-WWDD_Berlin_(ILA).jpg', 'article_date' => '2024-02-16 13:27:32', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117