February 17: Buddha Air is all set to conduct direct flights between Janakpur and Pokhara from March…

February 17: Buddha Air is all set to conduct direct flights between Janakpur and Pokhara from March…

February 16: The distribution of first-ever domestically manufactured anti-cancer drugs has started in Nepal since last Tuesday coinciding with International Childhood Cancer…

February 16: Developing countries face growing risks from financial fragility created by the COVID-19 crisis and non-transparent debt, says a new World Bank…

February 16: NMB Bank signed a Memorandum of Understanding (MoU) with Remit Hydro Ltd to finance the 77.5 MW Ghunsa Khola Hydroelectric Project located in Taplejung…

February 16: At a time when the cryptocurrency issued by the private sector has drawn widespread attention, Nepal Rastra Bank has started preparations to issue its own digital currency (electronic…

February 16: The House of Representatives meeting is scheduled to be held today (February 16) after being deferred twice in recent…

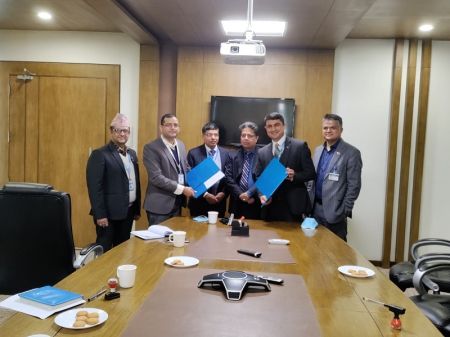

February 16: Nepal Infrastructure Bank Limited (NIFRA) and SMEC International Private Limited, a Singapore-based global urban infrastructure consulting firm, signed a Memorandum of Understanding (MoU) in Kathmandu on Tuesday (February 15) for the development of a smart city in Panchkhal…

February 15: The general public’s access to life insurance has increased by ten percent in the last one year…

February 15: Japan International Cooperation Agency (JICA) has appointed Akimitsu OKUBO as its new chief representative of JICA Nepal…

February 15: Cooperatives are under pressure to increase the interest rate after the banks and financial institutions increased their interest rates from…

February 15: With the increase in number of branches of banks and financial institutions, 33 percent population of Nepal now have access to debit cards (ATM…

February 15: Meeting of the National Development Problem Solving Committee has become uncertain due to the busy schedule of the prime…

February 15: The Nepal Chamber of Commerce has urged Pakistan’s Ambassador to Nepal to facilitate bilateral trade between the two…

February 15: The import of petroleum products via the Birgunj customs, the country’s major transit point, has increased significantly this year compared to the previous…

February 14: The import of apples in the domestic market of Nepal has been steadily rising in recent years.…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '14780', 'article_category_id' => '1', 'title' => 'Direct Flights between Pokhara and Janakpur from March 1 ', 'sub_title' => '', 'summary' => 'February 17: Buddha Air is all set to conduct direct flights between Janakpur and Pokhara from March 1.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 17: Buddha Air is all set to conduct direct flights between Janakpur and Pokhara from March 1.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The company is planning to conduct flights from its base in Pokhara to connect two of the popular tourist destinations of the country.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Buddha Air will conduct three flights a week and will add more flights as per the demand, the company informed.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the company's station manager in Janakpurdham Bijay Kumar Singh, early bookings have been opened from Wednesday (February 16).</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">"The number of flights will be increased as per the passengers need," the state-owned RSS quoted Singh as saying.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to him, the flights between Pokhara and Janakpur will be conducted on Mondays, Thursdays and Saturdays.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The Civil Aviation Office, Janakpur confirmed that the direct flight between Janakpur to Pokhara will commence from March 1 coinciding with the Mahashivaratri festival.</span></span></p> ', 'published' => true, 'created' => '2022-02-17', 'modified' => '2022-02-17', 'keywords' => '', 'description' => '', 'sortorder' => '14523', 'image' => '20220217081512_buddha.jpeg', 'article_date' => '2022-02-17 08:12:46', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '14779', 'article_category_id' => '1', 'title' => 'Distribution of First-ever Nepal Manufactured Anti-Cancer Drug Begins', 'sub_title' => '', 'summary' => 'February 16: The distribution of first-ever domestically manufactured anti-cancer drugs has started in Nepal since last Tuesday coinciding with International Childhood Cancer Day. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 16: The distribution of first-ever domestically manufactured anti-cancer drugs has started in Nepal since last Tuesday coinciding with International Childhood Cancer Day. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Tizig Pharma initiated distribution of the drug which has ended the compulsion for Nepali cancer patients to procure expensive drugs from abroad. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> Tizig Pharma's executive director Shailesh Vaidya shared that they started manufacturing and distributing anti-cancer drugs in Nepal for the first time in the country. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">A factory set up in Kavrepalanchowk district after inking technology transfer agreement with an Indian pharmaceutical company –SP Accure Labs – has begun manufacturing the drug in tablet and capsule form. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Vaidya further shared that they were considering producing the anti-cancer drug in injection form too. The company claims that domestically produced drugs will be less costly than those brought from abroad. Furthermore, there will be less possibility for drug shortage in the market as production has begun locally. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Bharatpur Cancer Hospital's executive chairperson Dr Bishnu Dutta Poudel said it was very good development that anti-cancer drugs were being manufactured in Nepal. He suggested the manufacturers to pay attention to quality of the drugs. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, oncologist Dr Madan Piya echoed the jubilant sentiments with Dr Poudel that anti-cancer drugs were now being manufactured in Nepal and viewed that priority should be accorded to the Nepalis for consumption of those drugs. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, Association of Pharmaceutical Producers of Nepal chairperson Prajwal Jung Pandey asserted that the production of anti-cancer drugs in Nepal showed that Nepal could manufacture any sort of drugs. He pointed out the need to make Nepal self-reliant in drugs by manufacturing drugs like anti-cancer drugs. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Department of Drug Administration's Santosh KC urged the manufacturers of anti-cancer drug to ensure quality of the drugs. The Tigiz Pharma said it has obtained approval for 27 molecules from the Department of Drug Administration for manufacturing anti-cancer drugs. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14522', 'image' => '20220216080544_Untitled.jpg', 'article_date' => '2022-02-16 20:04:10', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '14777', 'article_category_id' => '1', 'title' => 'Greater Transparency on Hidden Debt Can Reduce Global Financial Risks: World Bank', 'sub_title' => '', 'summary' => 'February 16: Developing countries face growing risks from financial fragility created by the COVID-19 crisis and non-transparent debt, says a new World Bank report.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 16: Developing countries face growing risks from financial fragility created by the COVID-19 crisis and non-transparent debt, says a new World Bank report. As rising inflation and interest rate increases pose further challenges to recovery, developing countries need to focus on creating healthier financial sectors.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> According to World Development Report 2022: Finance for an Equitable Recovery, risks may be hidden because the balance sheets of households, businesses, banks, and governments are tightly interrelated. Today, high levels of non-performing loans and hidden debt impair access to credit, and disproportionately reduce access to finance for low-income households and small businesses, the World Bank said in a statement citing the report.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> “The risk is that the economic crisis of inflation and higher interest rates will spread due to financial fragility. Tighter global financial conditions and shallow domestic debt markets in many developing countries are crowding out private investment and dampening the recovery,” said World Bank Group President David Malpass. “It is critical to work toward broad-based access to credit and growth-oriented capital allocation. This would enable smaller and more dynamic firms – and sectors with higher growth potential -- to invest and create jobs.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The global public health crisis triggered by COVID-19 quickly turned into the largest global economic crisis in more than a century, resulting in major setbacks to growth, increased poverty rates, and widened inequality. In response, governments initiated large and unprecedented emergency support measures, which helped mitigate some of the worst social and economic impacts, and increased sovereign debt levels – already at record highs in many countries before the crisis, the report further says. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The response also exposed several challenges with private debt that now need to be urgently addressed – including a lack of transparency in reporting non-performing loans, delayed management of distressed assets, and tighter or no access to credit for the most vulnerable households and businesses.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The new World Development Report highlights several priority areas for action, including early detection of financial risks. Since few countries have the fiscal space and capacity to address all challenges simultaneously, it outlines how countries can prioritize resources depending on their context.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Surveys of businesses in developing countries during the pandemic found that 46 percent expected to fall into arrears. Loan defaults could now sharply increase, and private debt could quickly become public debt, as governments provide support. Despite the severe contraction in incomes and business revenues resulting from the crisis, the share of non-performing loans remains largely unimpacted and below expectations. However, this may be due to forbearance policies and relaxed accounting standards that are masking significant hidden risks that will become apparent only as support policies are withdrawn.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Prior to crises, it’s often the things that you don’t see that ultimately get you. There is reason to expect that many vulnerabilities remain hidden,” said Carmen Reinhart, Senior Vice President and Chief Economist of the World Bank Group. “It’s time to prioritize early, tailored action to support a healthy financial system that can provide the credit growth needed to fuel recovery. If we don’t, it is the most vulnerable that would be hit hardest.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The report also calls for the proactive management of distressed loans. Many households and firms are confronted with unsustainable levels of debt due to lower income and revenue. Effective insolvency mechanisms can help avoid the risk of long-term debt distress and lending to ‘zombie’ firms that undercut economic recovery. Improving insolvency mechanisms, facilitating out-of-court workouts, especially for small businesses, and promoting debt forgiveness can help enable the orderly reduction of private debts.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">In low-income countries, dramatically increased levels of sovereign debt need to be proactively managed in an orderly, and timely manner. The historical track record shows that delays in addressing sovereign debt distress are associated with protracted recessions, high inflation, and fewer resources going to essential sectors like health, education, and social safety nets, with a disproportionate impact on the poor.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Finally, it is critical to work toward inclusive access to finance to support the recovery from a historic pandemic. In low-and-middle income countries, 50 percent of households are unable to sustain basic consumption beyond 3 months. The average business reports that they only have cash reserves to cover two months of expenses.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Households and small businesses have been at greatest risk of being cut off from credit, yet access to credit improves the resilience of low-income households and enables small businesses to navigate shutdowns, stay in business, and eventually grow and support the recovery, the report says. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The policy reforms necessary for achieving an equitable recovery also offer governments and regulators an opportunity and roadmap to accelerate the shift toward a more efficient and sustainable world economy. Climate change is a major source of neglected risk in the world economy. Well-designed crisis response policies and longer-term reforms can encourage capital flows toward greener firms and industries.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14521', 'image' => '20220216034244_World.jpg', 'article_date' => '2022-02-16 15:42:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '14778', 'article_category_id' => '1', 'title' => 'NMB Bank to Finance 77 MW Ghunsa Khola Hydroelectric Project', 'sub_title' => '', 'summary' => 'February 16: NMB Bank signed a Memorandum of Understanding (MoU) with Remit Hydro Ltd to finance the 77.5 MW Ghunsa Khola Hydroelectric Project located in Taplejung district.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">February 16: NMB Bank signed a Memorandum of Understanding (MoU) with Remit Hydro Ltd to finance the 77.5 MW Ghunsa Khola Hydroelectric Project located in Taplejung district. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Having experience of financing around 46 hydropower projects, NMB Bank said it shall lead the project under consortium arrangement with inclusion of other Banks and Financial Institutions to finance the project.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">The estimated cost of the project is Rs 18.25 billion, according to NMB Bank.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">Issuing a statement on Wednesday, the bank said this project has been included in the ‘People’s Hydropower Programme’ of the Government of Nepal.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">According to NMB Bank, the major promoters of Remit Hydro Ltd include Hydroelectricity Investment and Development Company Ltd and equity collected from people working abroad (remittance).</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">NMB Bank said it has already adopted Environmental and Social Risk Policy and started implementing Environmental and Social Management System within its business portfolio as directed by Nepal Rastra Bank’s guidelines on Environmental and Social Risk Management, 2022. In addition, the bank is committed to apply international good practices such as IFC performance standards in project financing including hydropower sectors, the statement added. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial","sans-serif"">NMB Bank has been awarded with the prestigious Bank of the Year award four times, by The Bank Magazine of The Financial Times, London in 2017, 2018, 2020 and 2021. The bank was recently awarded Bank of the Year Asia in 2021. NMB Bank is currently providing its services through 201 branches, 138 ATMs and nine extension counters.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14520', 'image' => '20220216053658_IMG-20220214-WA0000.jpg', 'article_date' => '2022-02-16 17:36:01', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '14776', 'article_category_id' => '1', 'title' => 'NRB Studying Prospects of Digital Currency ', 'sub_title' => '', 'summary' => 'February 16: At a time when the cryptocurrency issued by the private sector has drawn widespread attention, Nepal Rastra Bank has started preparations to issue its own digital currency (electronic currency). ', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">February 16: At a time when the cryptocurrency issued by the private sector has drawn widespread attention, Nepal Rastra Bank has started preparations to issue its own digital currency (electronic currency). </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">At present, NRB is conducting a feasibility study of Central Bank Digital Currency (CBDC), which is in the final stage. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NRB had included the feasibility study of digital currency in the monetary policy of the current fiscal year. The central bank is preparing to conduct the feasibility study in the context that such studies are being conducted throughout the world.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NRB had formed a six-member task force under the coordination of Anuj Dahal, director of the Currency Management Department to conduct the feasibility study. Executive Director of the department Revati Prasad Nepal said that the study report would be ready this month. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">"The task force is studying the feasibility of digital currency, which is in its final stages," he said, "The study report will probably be ready in 15 days." </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The study report will show the potential of digital currency in Nepal and ways of issuing it. NRB says that the process of issuing digital currency will move forward after the study is completed. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The central bank of the country has the right to issue currency of any nature. Accordingly, the right to issue digital currency also belongs to the central bank. However, cryptocurrencies and virtual money that are now traded in the world market have been issued from the private sector. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The digital currency to be issued by the central bank will be fully legalized, which is called Central Bank Digital Currency (CBDC). </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Such currency is kept safe like gold, dollar and other commodities while issuing paper money. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NRB says that the difference is only that, in the past, money was issued on paper, but now it will be issued digitally. Even if digital currency is issued, paper currency will also be issued. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">So far, only the Bahamas Central Bank has introduced digital currency. Other countries are still in the study phase. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14519', 'image' => '20220216015330_Nepal_Rastra_Bank2 2.jpg', 'article_date' => '2022-02-16 13:52:53', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '14774', 'article_category_id' => '1', 'title' => 'Will the MCC be Tabled in HoR Meeting Today?', 'sub_title' => '', 'summary' => 'February 16: The House of Representatives meeting is scheduled to be held today (February 16) after being deferred twice in recent days.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 16: The House of Representatives meeting is scheduled to be held today (February 16) after being deferred twice in recent days. The chances of Millennium Challenge Corporation (MCC) grant agreement being tabled in the parliament meeting has increased considerably after the Nepali Congress decided to seek a resolution through parliament. Speaker of the House of Representatives Agni Prasad Sapkota is also positive about seeking a solution to the current impasse through the House meeting.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">However, political parties are yet to reach a common understanding to endorse the disputed grant assistance through parliament. The ruling Nepali Congress has decided to ratify the MCC but the other two coalition partners – CPN Maoist Centre and CPN Unified Socialist – are yet to take a concrete decision regarding the issue.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Both the parties have summoned their parliamentary party meeting ahead of the House session on Wednesday to discuss the matter. Both Maoist Centre and CPN Unified Socialist are not in favour of endorsing the MCC grant agreement without amendment. If the Nepali Congress tables the agenda during today’s meeting without amendment, the two parties will not oppose the registration of the MCC but have decided not to cast vote in its favour.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">If the MCC grant agreement is not endorsed by the parliament, the government will come under moral crisis. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The main opposition party CPN UML is likely to obstruct the ratification process demanding action against their former MPs who defected to the CPN Unified Socialist.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">UML whip Bishal Bhattarai informed that the party will not support the government in endorsing the MCC grant agreement because the ruling alliance did not discuss the issue with the main opposition party before deciding to present it in parliament.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Our demands have not been fulfilled to resume the House procceedings. Our protest in parliament will continue,” said Bhattarai.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Nepali Congress General Secretary Gagan Thapa is hopeful that the MCC agenda will be tabled in parliament. A parliamentary party meeting of Nepali Congress on Tuesday has already decided to present the MCC in parliament for ratification. Prime Minister Sher Bahadur Deuba said that Nepali Congress will fulfil its duty and not act irresponsibly like the erstwhile government led by CPN UML which decided to present the MCC agenda in parliament but has been obstructing the house proceedings itself, Thapa said quoting the prime minister.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Speaker Sapkota has called for the Business Advisory Committee of the House of Representatives at 11 am ahead of the 10<sup>th</sup> session of parliament scheduled for 1 pm in the afternoon. The Business Advisory Committee meeting is expected to include the MCC agenda for the business list of HoR meeting.</span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14518', 'image' => '20220216111116_MCC.jpg', 'article_date' => '2022-02-16 11:10:33', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '14775', 'article_category_id' => '1', 'title' => 'NIFRA signs MoU with SMEC to Develop Smart City in Panchkhal', 'sub_title' => '', 'summary' => 'February 16: Nepal Infrastructure Bank Limited (NIFRA) and SMEC International Private Limited, a Singapore-based global urban infrastructure consulting firm, signed a Memorandum of Understanding (MoU) in Kathmandu on Tuesday (February 15) for the development of a smart city in Panchkhal Municipality.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 16: Nepal Infrastructure Bank Limited (NIFRA) and SMEC International Private Limited, a Singapore-based global urban infrastructure consulting firm, signed a Memorandum of Understanding (MoU) in Kathmandu on Tuesday (February 15) for the development of a smart city in Panchkhal Municipality. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Chief Executive Officer of NIFRA Ram Krishna Khatiwada and Country Head of SMEC Salim Jahan Fahim signed the MoU on behalf of their respective agencies amidst a function here, according to a statement issued by NIFRA. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The SMEC and NIFRA will collaborate with each other to conduct the preliminary studies, initial structuring of project and to exchange best practices on the development of smart cities, the statement added. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">NIFRA said it will provide necessary facilitation and other services to SMEC during the engagement period. Similarly, NIFRA will arrange necessary financing in coordination with other stakeholders as a lead financer for the development of the Smart City after completion of required studies, designs and legal structuring of the project. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the statement, Panchkhal Municipality has taken the lead in securing the required land in coordination with landowners in the municipality. Panchkhal Smart City, the first of its kind in Nepal, covers an area of around 5500 ropanis. NIFRA has signed a separate MoU with Panchkhal Muncipality for the development of the smart city. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Meanwhile, NIFRA has signed a contract with a US-based consulting firm Jones Lang LaSalle Property Consultants Private Limited for market study of the proposed Smart City. The company is scheduled to submit its report within eight weeks, outlining viability and broader opportunities of the project. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">During Tuesday’s signing ceremony, CEO of NIFRA Ram Krishna Khatiwada reiterated the bank’s commitment for developing the next generation smart city in Nepal. He added that the collaboration with the globally renowned infrastructure development consultant will certainly help to materialize this vision to develop the first smart city in Nepal which will be a model for replicating in other parts of the country. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Mohiuddin Mahmud, Deputy Chief Operating Officer for South Asia and Central Asia, of SMEC said the professional experience of SMEC and SJ in developing smart cities will be instrumental for development of the Panchkhal Smart city soon.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2022-02-16', 'modified' => '2022-02-16', 'keywords' => '', 'description' => '', 'sortorder' => '14517', 'image' => '20220216122802_Untitled.jpg', 'article_date' => '2022-02-16 12:27:21', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '14772', 'article_category_id' => '1', 'title' => '35 Percent of Nepalis Covered by Life Insurance Scheme', 'sub_title' => '', 'summary' => 'February 15: The general public’s access to life insurance has increased by ten percent in the last one year alone.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">February 15: The general public’s access to life insurance has increased by ten percent in the last one year alone. This has been revealed from the data provided by the Insurance Board up to mid-January of the current fiscal year (FY).</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the data, 35 percent of Nepalis have access to life insurance as of mid-January 2022. By mid-January last year, 24.86 percent of Nepalis had access to insurance.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Based on numbers, 31,57,869 Nepalis purchased insurance policy in last year. As of mid-January last year, 73,76,660 Nepalis were covered by insurance scheme. By mid-January of the current fiscal year, that number has reached 15.34 million.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The figure is more than the government's target of access to insurance. The government had set a target of expanding the reach of life insurance to 33.33 percent of Nepalis by mid-July of the current fiscal year.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">However, the data of the Insurance Board has confirmed that access to insurance has reached 35 percent of Nepalis by mid-January.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The board estimates that 40 percent of Nepalis will have access to insurance by mid-July this year.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The board claimed that the access to insurance reached 35 percent of the population, ruling out the possibility of duplication. The same person is also insured two or more times. Considering this situation, there is an international practice of calculating access to insurance by reducing the total number of insurance policies by 5 percent.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Accordingly, the access to insurance has been calculated, said Rajuraman Poudel, executive director of the Insurance Board. According to the board, 1,10,41,088 life insurance policies have been issued, so far. According to Poudel, the number was deducted by 5 percent.</span></span></span></p> <p> </p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the preliminary report of the National Census 2021 (29.1 million), more than 36 percent of Nepalis have access to insurance. However, the board said that the actual access to insurance will be calculated later as per the final report of the census.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Insurance companies started issuing life insurance policies in Nepal almost five decades ago. However, its scope did not expand for a long time.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">However, access to the insurance market has skyrocketed in the last five years. Five years ago, only 7 percent of Nepalis had access to insurance.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The number of people taking out term insurance has increased significantly. The number of people availing of such insurance policies increased by about 45 percent in the last year. The number of people taking out term insurance has also increased significantly.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The number of people purchasing term insurance policies has also increased significantly. As a result, access to insurance has increased significantly, Poudel said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">He estimates that 40 percent of the people will have access to insurance by next July. “We are working to make insurance accessible to 40 percent of the people by next July,” Poudel said. </span></span></span></p> <p><br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> <br /> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14516', 'image' => '20220215053031_Insurance.jpg', 'article_date' => '2022-02-15 17:29:48', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '14773', 'article_category_id' => '1', 'title' => 'JICA Appoints New Chief Representative to Nepal', 'sub_title' => '', 'summary' => 'February 15: Japan International Cooperation Agency (JICA) has appointed Akimitsu OKUBO as its new chief representative of JICA Nepal Office.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 15: Japan International Cooperation Agency (JICA) has appointed Akimitsu OKUBO as its new chief representative of JICA Nepal Office.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to a statement issued by JICA on Tuesday (February 15), Okubo will take over Yumiko Asakuma who recently completed her tenure in Nepal. Prior to this assignment, Okubo was working as a Senior Representative of JICA Nepal Office since August 2021. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">He began his career in JICA from 1998, mainly working in the governance sector handling international cooperation, the statement added. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“He particularly contributed as the Director of Law and Justice Team of Governance Group of JICA headquarters in Tokyo (2014-2018) and was responsible in formulation and management of legal projects not only in Nepal but also many other nations, including Vietnam, Cambodia, Myanmar, and West African countries.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">In order to raise awareness of legal cooperation in the public, he took the initiative in editing a publication, “Legal Cooperation in Japanese Style,” in 2017, the statement further said, adding. “He also served as Director of Legal Affairs Division in the headquarters of JICA in Tokyo before coming to Nepal.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Okubo holds a bachelor’s degree in law from the University of Tokyo (1993) and a master’s degree in law from Cornell Law School (2005).</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">JICA said Okubo is honored to lead JICA Nepal Office and expressed his commitment in providing continued support to the people of Nepal and its government together with colleagues of JICA Nepal Office in enhancing development and prosperity in Nepal by realizing JICA's vision “Leading the World with Trust”.</span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14515', 'image' => '20220215084756_Mr. Akimitsu Okubo.jpg', 'article_date' => '2022-02-15 20:47:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '14771', 'article_category_id' => '1', 'title' => 'Cooperatives Under Pressure to Increase Interest Rates ', 'sub_title' => '', 'summary' => 'February 15: Cooperatives are under pressure to increase the interest rate after the banks and financial institutions increased their interest rates from mid-February. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">February 15: Cooperatives are under pressure to increase the interest rate after the banks and financial institutions increased their interest rates from mid-February. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">As per the provision of the Cooperatives Act-2074, cooperatives are not allowed to charge more than 14.75 percent interest on loan investment. Cooperative officials are lobbying to increase the limitation as they are unable to raise interest rates on savings due to reference rate. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">As per the decision of the Nepal Bankers' Association, the commercial banks have increased the interest rate to 11.03 percent from February 13. On this basis, development banks and finance companies also increased the interest rate, and now cooperatives are under pressure to increase the interest rate. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">As per the provisions of the Cooperatives Act, a committee under the coordination of the Registrar should fix the reference rate. The committee has representatives from the Ministry of Cooperatives, Ministry of Finance, Nepal Rastra Bank, National Cooperative Development Board, National Cooperative Federation of Nepal, and Cooperative Union. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Based on the recommendations of the Ministry, Nepal Rastra Bank, National Cooperative Federation and the committee can determine the reference rates of interest. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Officials of the cooperatives have been pressing for the review of the reference rate fixed for the cooperatives after the interest rates of banks and financial institutions was increased due to lack of liquidity in the banking system in the current fiscal year (FY). For this, a meeting of the reference interest rate committee was held in mid-December. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">At the meeting, the federation had proposed to raise the reference rate to 16.50 percent. However, the meeting was postponed for one week and could not be resumed after the representatives of the Ministry of Finance and Nepal Rastra Bank protested at the meeting saying that there was no basis to increase the interest rate. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Stating that the problem of liquidity in the banks was being solved at that time and there was no need to review the reference rate immediately, the committee did not hold the meeting. Nevertheless, after raising the interest rates of banks since February, the pressure has also increased to increase the interest rate of cooperatives. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">"If the banks had not raised interest rates, there would not have been pressure to increase the interest rates of the cooperatives," said Minraj Kandel, president of the National Cooperatives Federation of Nepal. </span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14514', 'image' => '20220215040640_interest-rates-e1541025967190.jpg', 'article_date' => '2022-02-15 16:06:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '14770', 'article_category_id' => '1', 'title' => 'ATM Cards Issued to 33 Percent of Population', 'sub_title' => '', 'summary' => 'February 15: With the increase in number of branches of banks and financial institutions, 33 percent population of Nepal now have access to debit cards (ATM cards).', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 15: With the increase in number of branches of banks and financial institutions, 33 percent population of Nepal now have access to debit cards (ATM cards).</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Based on the preliminary report of the 2021 Census made public by the Department of Statistics and the report published by Nepal Rastra Bank, 33.76 percent population of Nepal have been issued debit cards.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the central bank, the number of people who have acquired ATM cards as of mid-January 2022 stands at 98,55,221. Among them, 93,99,525 such cards have been issued by commercial banks, 4,17,846 by development banks and 37,850 by finance companies.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">As per the preliminary report of the National Census 2021, the total population has reached 2,91,91,92,480. Taking this data into consideration, the percentage of people who have been issued ATM cards is 33 percent.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Due to the advancement in technology, the number of people using mobile banking and QR Code has also increased. However, these new technologies cannot replace ATM cards at the moment, says Nabil Bank’s General Manager Manoj Gyawali. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to him, there must be an extensive use of cashless transaction in order to replace ATM cards.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“The use of QR Code has reduced cash transaction. However, until cash transaction is completely removed ATM cards cannot be replaced,” says Gyawali.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Gyawali says that the number of customers of banks have increased but the number of ATM card users have not increased in the same proportion. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">A total of 18,6000 ATM cards have been issued in a one year period from mid-January 2021 to mid-January 2022. This number is 22.44 percent more than the number of ATM cards issued in the previous year. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The number of credit card users has also increased. A total of 176,414 credit cards were issued in a one year period until mid-January 2021 which increased to 215,199 in mid-January 2022. The number of credit card users increased by almost 38,000 in one year, which is an increase by 21.98 percent.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14513', 'image' => '20220215014725_Credit-Card-B749.jpg', 'article_date' => '2022-02-15 13:46:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '14769', 'article_category_id' => '1', 'title' => 'Meeting of National Development Problem Solving Committee Uncertain due to PM’s Busy Schedule', 'sub_title' => '', 'summary' => 'February 15: Meeting of the National Development Problem Solving Committee has become uncertain due to the busy schedule of the prime minister.', 'content' => '<p><span style="font-size:14px"><em>Prime Minister Sher Bahadur Deuba. Photo Courtesy: RSS</em></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 15: Meeting of the National Development Problem Solving Committee has become uncertain due to the busy schedule of the prime minister. The committee is considered as a high-level mechanism to monitor and evaluate the development policies, plans and programmes adopted by the country. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The meeting of the committee should be held three times every year before mid-December, mid-April and mid-August to review the first, second and third annual progress reports of development projects respectively under the chairmanship of the prime minister. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">It has not been possible to hold the meeting since the last 13 months because of the busy schedule of Prime Minister Sher Bahadur Deuba. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The meeting of the committee was held last time on January 15, 2021 when it was chaired by the then Prime Minister KP Sharma Oli. The meeting had reviewed the development projects of FY 2076/77 and the projects of the first quarter of FY 2077/78.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The meeting has not been held since then.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to the spokesperson of the committee Dil Bahadur Gurung, the meeting should be held three to four times a year but that has not happened due to the busy schedule of Prime Minister Sher Bahadur Deuba.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“The change of government and the prime minister’s busy schedule are the main reasons for the delay in holding the meeting,” said Gurung.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The meeting also requires the presence of chief ministers and chief secretaries of all seven provinces.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Prior to the committee meeting, ministerial-level meetings to review the progress of development projects need to be done. The ministries have held such meetings and identified the key problems but they have not been able to present their report in the committee meeting.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Therefore, the problems faced in development works have not been addressed so far.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14512', 'image' => '20220215113652_ROS-KTMPM1.jpg', 'article_date' => '2022-02-15 11:35:50', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '14768', 'article_category_id' => '1', 'title' => 'NCC Calls for Trade Facilitation between Nepal and Pakistan ', 'sub_title' => '', 'summary' => 'February 15: The Nepal Chamber of Commerce has urged Pakistan’s Ambassador to Nepal to facilitate bilateral trade between the two countries. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 15: <span style="font-family:"Arial Unicode MS","sans-serif"">The Nepal Chamber of Commerce has urged Pakistan’s Ambassador to Nepal to facilitate bilateral trade between the two countries. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">During a meeting with Pakistan’s Ambassador to Nepal Syed Haider Shah on Monday, NCC President Rajendra Malla appealed to the Pakistani envoy for his positive intervention to begin direct flight from Kathmandu to Karachi to promote trade between the two countries. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">President Malla underscored immediate operation of direct flights between Kathmandu and Karachi to promote tourism and other economic activities. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">“The air distance between Nepal and Pakistan is about three hours. If we could utilize this, we could increase trade volume between two countries and as a member of SAARC forum, both countries could reap benefits by increasing economic activities,” Malla said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Nepal has been importing dates, leather products, machinery products and among others from Pakistan while exporting honey, tea, handicraft products, eye lenses and woolen yarn threads. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Currently, Nepal’s import from Pakistan amounts to over Rs 1.4 billion annually while export to Pakistan is over Rs 100 million. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">On the occasion, Pakistani ambassador Shah said the issue of flight operation should be pushed through government level. He also pointed out the need to identity the areas of economic prospects benefitting both the countries. The Pakistani envoy also vowed to take initiatives to expand the economic activities between the two countries. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14511', 'image' => '20220215105739_Flag-Pins-Pakistan-Nepal_600x600.jpg', 'article_date' => '2022-02-15 10:56:58', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '14767', 'article_category_id' => '1', 'title' => 'Import of Petroleum Products from Birgunj Doubles ', 'sub_title' => '', 'summary' => 'February 15: The import of petroleum products via the Birgunj customs, the country’s major transit point, has increased significantly this year compared to the previous year. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">February 15: The import of petroleum products via the Birgunj customs, the country’s major transit point, has increased significantly this year compared to the previous year. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">A total of 700,835 liters of petroleum products including diesel, petrol, kerosene and aviation turbine fuel worth Rs 31.89 billion were imported through the transit point in the first six months of last fiscal year (FY 2020-21). The import in the first six months of the current fiscal year has jumped to Rs 65.37 billion. </span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif"">It may be noted that the import of fuel had been impacted due to the coronavirus pandemic last year, with industry, trade, transport and development sectors bearing the brunt. As this year, these sectors did not suffer much of an impact the import has thereby increased, said Information Officer at the Customs Office Sumit Gupta. -- RSS </span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-15', 'modified' => '2022-02-15', 'keywords' => '', 'description' => '', 'sortorder' => '14510', 'image' => '20220215104248_Birgunj.jpg', 'article_date' => '2022-02-15 08:17:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '14766', 'article_category_id' => '1', 'title' => 'Import of Apples Increasing', 'sub_title' => 'Domestic Production unable to Meet Market Demand', 'summary' => 'February 14: The import of apples in the domestic market of Nepal has been steadily rising in recent years. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">February 14: The import of apples in the domestic market of Nepal has been steadily rising in recent years. Apples worth Rs 3.82 billion have been imported to the country in the first six months of the current fiscal year (FY 2021/22), according to the Department of Customs.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">During the review period, the import of apples have increased by 23 percent compared to the corresponding period of last fiscal year, when apples worth Rs 3.1 billion were imported.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Nepal imported apples mainly from China, India, Turkey, Guinea Bissau and Indonesia this year. During the six months period, Nepal imported the maximum amount of apples from China. Apples worth Rs 2.68 billion were imported from China during the review period. Likewise, apples worth Rs 1.14 billion were imported from India followed by Turkey (Rs 2.6 million) and Guinea Bissau (Rs 161,000), the department informed.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Amar Baniya, a Kuleshwar-based trader, says that Chinese apples are popular in Nepal and are imported in maximum quantity. He says that most of the apples enter Nepal from Kerung check point of China. Traders however say that the expected amount of apples did not arrive from China owing to the Covid-19 crisis.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Nowadays, it takes months for a consignment of apples to arrive which used to take only a week in the past.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Spokesperson of Kalimati Fruits and Vegetables Development Committee Bikash Shrestha informed that most of the apples arrive in Nepal from China and India. He says that Nepal is dependent on foreign countries for the supply of apples as the local production is not sufficient to meet the market demand.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">“There is a demand for apples across the year. But there is no production as per the demand,” says Shrestha, adding, “So there is no alternative to imports.”</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">According to Shrestha, the domestic market receives apples from Jumla, Mustang, Dolpa, Mugu, Kalikot, Humla, Rukum East, Bajhang, Solukhumbu among other districts of Nepal but the internal production is negligible compared to the demand.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The price of apple at present is Rs 250 to Rs 280 per kilogram. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2022-02-14', 'modified' => '2022-02-14', 'keywords' => '', 'description' => '', 'sortorder' => '14509', 'image' => '20220214024649_1644793529.Clipboard13.jpg', 'article_date' => '2022-02-14 14:45:59', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117