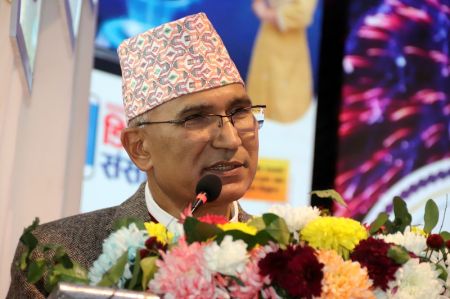

February 3: The Government of Nepal has reached an understanding to sign a Memorandum of Understanding (MoU) with Malaysia to revise the bilateral labor…

February 3: The Government of Nepal has reached an understanding to sign a Memorandum of Understanding (MoU) with Malaysia to revise the bilateral labor…

February 3: Finance Minister Bishnu Paudel has started preparations to reduce the size of this fiscal year’s budget brought by the previous…

Nepal Airlines Corporation (NAC) has started an online ticketing system for both domestic and international flights of the Nepal…

February 3: The Election Commission (EC) has announced to return Rs 3 billion to the state coffers that was not spent during the general elections held on November…

Saptakoshi Development Bank has appointed Dinesh Kumar Pokhrel as its Chief Executive…

February 3: The business of non-life insurance companies has improved in the current fiscal year.…

February 3: The demand for vehicles, which has been sluggish for almost ten months, will take more time to return to normalcy.…

February 3: The police have arrested ‘fugitive’ lawmaker Arun Kumar Chaudhary of Nagarik Unmukti Party in connection to a decade-old arson…

Nepal government and Nepal Rastra Bank seem positive to remove the upper limit of Rs 120 million on loan against shares. In the fiscal year 2078/79, Nepal Rastra Bank(NRB) had tightened loans against shares by introducing the credit limit of 40/120…

Ganesh Raj Pokharel has been reappointed as Chief Executive Officer of Citizens Bank International Limited.…

A Canadian national was arrested along with nine kilograms of gold from the Tribhuvan International Airport (TIA) in…

February 2: Pooja International Nepal Pvt Ltd, the sole authorized importer and distributor of Volkswagen vehicles in Nepal, has announced the launch of its “Switch to Premium Car Culture” Exchange Camp.…

February 2: Government data shows that both the farming area and production of pre-monsoon paddy (Chaite dhaan) are on a downward…

February 2: Iron and its related materials are the second most imported items in Nepal after petroleumproducts, according to the Department of…

February 2: India has reduced the grant aid to Nepal in its annual…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '16924', 'article_category_id' => '1', 'title' => 'Nepal, Malaysia Agree to Revise Labour Agreement', 'sub_title' => '', 'summary' => 'February 3: The Government of Nepal has reached an understanding to sign a Memorandum of Understanding (MoU) with Malaysia to revise the bilateral labor agreement.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">February 3: The Government of Nepal has reached an understanding to sign a Memorandum of Understanding (MoU) with Malaysia to revise the bilateral labor agreement.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The two sides reached an agreement to this effect during the visit of a delegation led by Home Minister of Malaysia, Saifuddin Nasution Ismail. The visiting delegation met Prime Minister Pushpa Kamal Dahal on Friday.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the PM Dahal’s Secretariat, the authorities concerned of both countries would work on mutual cooperation for the same. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">During the meeting, discussions were held on the issues related to carrying out activities jointly in the sector of trade, investment, tourist, and economic development by increasing high-level political and administrative visit and dialogue between the two countries.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">On the occasion, Prime Minister Dahal stressed that the concerns of welfare and security of Nepali workers in Malaysia should be addressed. “I on behalf of the government want to thank the Malaysian government for the environment provided to the Nepali workers. We are confident that the Malaysian government will ensure Nepali worker’s welfare and security by making legal and institutional reform to address the problems, if any, in this regard. We are ready to collaborate with the Malaysian government for it,” the PM said.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif""> Prime Minister Dahal thanked the government of Malaysia for increasing the minimum wage of workers to 1,500 Ringgit from 1,200. Expressing commitment to strictly implement free visa, free ticket system, he opined that the employment sector could be made more systematic if the provision was implemented. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Urging the Malaysian government to increase the number of Nepali workers in Malaysia in future, he laid emphasis on the need of the Malaysian government’s support on the issue of making the labor sector open, transparent, accountable, effective and systematic for Nepali workers in Malaysia. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Similarly, the Malaysian Home Minister said that the Malaysian government was serious on the issue of welfare and security of Nepali workers and bringing in foreign workers in Malaysia. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Stating that there is a need for workers in five economic sectors in Malaysia, he expressed commitment to make policy-level reforms for the welfare of the workers. -- RSS </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16663', 'image' => '20230203102912_PW-Kathmandu-6F8A6563.JPG', 'article_date' => '2023-02-03 22:28:06', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '16923', 'article_category_id' => '1', 'title' => 'Finance Minister Preparing to Downsize Budget ', 'sub_title' => '', 'summary' => 'February 3: Finance Minister Bishnu Paudel has started preparations to reduce the size of this fiscal year’s budget brought by the previous government.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">February 3: Finance Minister Bishnu Paudel has started preparations to reduce the size of this fiscal year’s budget brought by the previous government. After concluding that the election-focused budget introduced by the then finance minister Janardan Sharma cannot be fully implemented, FM Poudel started preparing to amend the budget.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The Ministry of Finance preparing for the half-yearly review of the budget soon.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">A source close to the finance minister said that the half-yearly review will be held within the Nepali month of Magh (by mid-February) and preparations are being made to amend the budget at the same time.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The general elections were held on November 20 last year. Due to the election, the current budget has been spent to the maximum, but the development budget has not been spent. Only 16.13 per cent of the capital budget has been spent so far. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Also, the National Planning Commission has recommended the government bring the next year's budget smaller in size than the current one. Accordingly, the authorities have started making the budget. Finance Minister Poudel has also said that the upcoming budget will decrease in size. In an event held in the capital on Wednesday, Minister Poudel said that the past practice will not be repeated when determining the size of the budget. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">“There is a practice of bringing a large budget. However, we are not in favour of it. Our emphasis will be on making structural changes in the economy," he said.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Successive governments have been announcing budget which is large in size, but with poor implementation, the ability of government officials has been questioned. According to the med-term expenditure structure, the government should bring a budget of Rs 1900 billion for the upcoming year, but the National Planning Commission has not given permission to issue such a large budget.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The NPC has suggested to bring a budget of Rs 1500-1600 billion. Finance Minister Paudel is forming a core team to review the current budget and prepare the next budget.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Paudel has brought six joint secretaries to the Ministry of Finance through a recent cabinet decision.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16662', 'image' => '20230203064820_HB_KTM-IMG_1450.jpg', 'article_date' => '2023-02-03 18:47:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '16922', 'article_category_id' => '1', 'title' => 'Nepal Airlines Corporation(NAC) Starts Online Ticketing System ', 'sub_title' => '', 'summary' => 'Nepal Airlines Corporation (NAC) has started an online ticketing system for both domestic and international flights of the Nepal Airlines. ', 'content' => '<p><span style="font-size:18px">FEBRUARY 3: Nepal Airlines Corporation (NAC) has started an online ticketing system for both domestic and international flights of the Nepal Airlines. </span></p> <p><span style="font-size:18px">“Nepal Airlines Corporation has arranged the online ticketing system through eSewa for both domestic and international flights of the national flag carrier,” said a press statement issued by the corporation.</span></p> <p><span style="font-size:18px">NAC will manage the online ticketing system through the wallet and website as well in the future, corporation stated. NAC has kept people from far-flung areas in the priority list of domestic air services. </span></p> <p><span style="font-size:18px">Number of seats available for domestic flights will be updated based on the aircraft’s capacity, weather condition, availability of fuel, and other factors, according to the NAC. With the e-ticketing system in place, customers can purchase their tickets easily. </span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16661', 'image' => '20230203045540_collage - 2023-02-03T164953.849.jpg', 'article_date' => '2023-02-03 16:49:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 3 => array( 'Article' => array( 'id' => '16920', 'article_category_id' => '1', 'title' => 'EC to Return Rs Three Billion out of Election Budget ', 'sub_title' => '', 'summary' => 'February 3: The Election Commission (EC) has announced to return Rs 3 billion to the state coffers that was not spent during the general elections held on November 20. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 3: The Election Commission (EC) has announced to return Rs 3 billion to the state coffers that was not spent during the general elections held on November 20. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The government had allocated a budget of Rs 10 billion for the election and had released Rs 8.49 billion. The actual amount spent during the election was Rs 6.54 billion, said Chief Election Commissioner Dinesh Kumar Thapaliya during a press conference.</span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">CEC Thapaliya said the commission adopted austerity measures and transparency during the election expenditures to limit the election expenses. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to EC officials, some budget will be used in the elections of the president, vice-president and the NA member by-election and the remaining amount will be returned to the state coffers. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He took time to pledge legal amendments for providing temporary voting card to government and private sector employees to ensure their election rights towards the proportional electoral system from the centers accessible for them in the next periodic elections. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">He was of the opinion of legally defining the matter of implementing the electrical voting system. Thapaliya also assured that the EC would assess the nature of invalid votes and situation behind it and make the voter education more effective in the days to come. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">He said if the date of elections of all levels or the term of people’s representatives are clearly specified in the law, there would be no questions while announcing the election dates. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Chief Election Commissioner further viewed that the Office of the Election is not legally allowed to disqualify any election candidate when the candidate self- announces that he/she holds all the documents demanded by the law towards that end.-- RSS </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16659', 'image' => '20230203042126_EC.jpg', 'article_date' => '2023-02-03 16:20:39', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '16919', 'article_category_id' => '218', 'title' => 'Dinesh Kumar Pokhrel appointed CEO of Saptakoshi Development Bank ', 'sub_title' => '', 'summary' => ' Saptakoshi Development Bank has appointed Dinesh Kumar Pokhrel as its Chief Executive Officer(CEO).', 'content' => '<p>February 3: Saptakoshi Development Bank has appointed Dinesh Kumar Pokhrel as its Chief Executive Officer(CEO). The meeting of the Board of Directors held on January 22 decided to appoint Pokhrel to the post of CEO.</p> <p>The decision came to this effect from January 23. Pokhrel has been appointed for four-year term. <br /> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16658', 'image' => '20230203034214_collage - 2023-02-03T154037.455.jpg', 'article_date' => '2023-02-03 15:35:12', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 5 => array( 'Article' => array( 'id' => '16918', 'article_category_id' => '1', 'title' => 'Business of Non-Life Insurance Companies Improving', 'sub_title' => '', 'summary' => 'February 3: The business of non-life insurance companies has improved in the current fiscal year. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">February 3: The business of non-life insurance companies has improved in the current fiscal year. The non-life insurance companies, which lost 13 percent of their business in the first quarter of the current fiscal year due to lack of liquidity in the financial sector, improved by more than 5 percent in the second quarter.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to the data of the Nepal Insurance Authority, non-life insurance companies issued 1,395,032 insurance policies worth around Rs 20.825 billion. Compared to the same period last year the number of insurance policies of the companies have decreased by 6.11 percent. The insurance fee on the other hand increased by 5.15 percent. By January last year those companies had issued 1,485,851insurance policies and collected Rs 19.982 billion in insurance fees.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">In the Nepali month of Poush (mid-December to mid-January) of the current fiscal year, non-life insurance companies collected insurance fees of Rs 4.1 billion. The authority informed that the companies sold a total of 247,768 insurance policies during the review month. Compared to last year, the business of the companies increased by 11.79 percent as the companies collected Rs 3.67 billion in insurance fees in mid-December to mid-January during the last fiscal year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Similarly, the business of the companies in the previous month (mid-November to mid-December) increased by 56.65 percent compared to the corresponding period of last year where the companies collected insurance fees of Rs 2.61 billion during this period. The non-life insurance business, which had been declining since the beginning of the current fiscal year, has seen an improvement in January.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to the authority, the companies collected Rs 4.48 billion in the first month of the current FY (mid-July to mid-August), followedby Rs 3.39 billion in mid-August to mid-September, Rs 2.96 billion in mid-September to mid-October, Rs 2.51 billion in mid-October to mid-November and Rs 2.61 billion in mid-November to mid-December.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">There is a provision that banks must insure the collateral taken while disbursing loans. Due to lack of liquidity, banks' credit investment is often stopped. Similarly, due to the strictness of the government on the import of vehicles, the non-life insurance business has also been affected.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Rajuraman Paudel, executive director and spokesperson for the Authority said that there has been some improvement in the non-life insurance business, which was declining due to the decline in economic activities.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif""><strong>How much business of which company?</strong></span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to the authority's data, out of the 18 non-life insurance companies in operation, 9 of them did business worth above a billion rupees in mid- January to mid-December. Shikhar Insurance collected the highest insurance fee of Rs 2.65 billion in the review month. Similarly, National Insurance collected the lowest insurance fee of Rs 494 million.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16657', 'image' => '20230203014557_20200223013317_aaaa.jpg', 'article_date' => '2023-02-03 13:45:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '16917', 'article_category_id' => '1', 'title' => 'NRB Policy to Blame for Lacklusture Demand for Vehicles', 'sub_title' => '', 'summary' => 'February 3: The demand for vehicles, which has been sluggish for almost ten months, will take more time to return to normalcy. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">February 3: The demand for vehicles, which has been sluggish for almost ten months, will take more time to return to normalcy. As the Nepal Rastra Bank is yet to revise itd policy, which importers consider to be the main reason for the decrease in the demand for vehicles, there is no possibility of an immediate increase in sales.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Around ten months ago, Nepal Rastra Bank raised the risk weight of auto loans from 75 to 150 per cent. Auto traders state that the sale of vehicles decreased with the introduction of the policy. </span></span></span></p> <p> </p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Nepal Rastra Bank increased the risk weight to discourage investment in unproductive sector. As a result, banks have started reducing credit flow in those areas.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">In the meantime, the government also imposed a ban on the import of vehicles run on petrol and diesel for private purposes for eight months. Although the liquidity in the banking sector has improved recently, the businesses express that the sale of vehicles has not increased.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">After the decrease in the demand for vehicles, the auto traders did not even check the vehicles arriving at the customs checkpoint. Businessmen said that they did not pass the customs clearance because they have to pay more revenue than the price for the import of vehicles. In addition to that, they have to bear the loss due to the lack of sales of vehicles despite such large investments.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">If the auto traders do take away the vehicles, the government is also be deprived of the revenue it should get..</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Dhruba Thapa, president of the National Automobile Dealers Association (NADA), an organization of auto dealers, said that the policy of NRB is to blame for the lacklusture demand for vehicles. “NRB increased the risk weight of auto loans from 75 to 150 per cent. Because of this, banks are not willing to invest in this sector," he said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Thapa said that due to the high-risk load, banks have gone to safe areas with low risk instead of autos.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Thapa also urged the NRB to seriously consider the situation in the automobile sector and reduce the risk burden. However, the officials of the NRB argue that since the country is in a difficult situation, it is not possible to improve everything at the same time and that the improvement will come gradually. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">However, auto traders are worried that the automobile sector will collapse until NRB makes policy reforms.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Thapa said that the 50 per cent down payment has also added to the problem. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">"The customer does not have cash, so how can the sale be made after a 50 per cent down payment?" he asked. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to him, the customers are confused because they have to spend a lot of cash, while earlier they could buy a car even by spending a small amount of cash.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Officials of NRB said that the policy has been introduced based on long studies, practice and experience, taking into account all aspects of the economy. For a long time, there was pressure on Nepal's foreign exchange reserves. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">This policy has come in a situation where the current account deficit is high, and liquidity is low," said NRB spokesperson Gunakar Bhatt.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Bhatt also said that NRB expects businesses to move forward with their plan after gradual improvement in all aspects of the economy.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16656', 'image' => '20230203111546_nada.jpg', 'article_date' => '2023-02-03 11:14:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '16916', 'article_category_id' => '1', 'title' => 'Fugitive MP Chaudhary Arrested ', 'sub_title' => '', 'summary' => 'February 3: The police have arrested ‘fugitive’ lawmaker Arun Kumar Chaudhary of Nagarik Unmukti Party in connection to a decade-old arson case. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">February 3: The police have arrested ‘fugitive’ lawmaker Arun Kumar Chaudhary of Nagarik Unmukti Party in connection to a decade-old arson case. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Chaudhary, who was in the most-wanted list of police, was arrested on Thursday afternoon from Tikapur, Kailali.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Nepal Police Spokesperson Deputy Inspector General (DIG) Posharaj Pokharel confirmed the arrest of Chaudhary to the state-owned national news agency RSS. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Chaudhary was elected a member of the House of Representatives from Kailali constituency 2 during the recently held election on November 20. He will be presented before the Dhangadhi District Court on Friday, the police said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">It may be noted that the Kailali District Court had sentenced three people including MP Chaudhary to six months in jail in the arson case that dates back to more than a decade. MP Chaudhary along with two others were convicted of setting a tractor on fire 13 years ago but is yet to serve a jail term. </span></span></span></p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16655', 'image' => '20230203105644_nepal police.jpg', 'article_date' => '2023-02-03 10:55:57', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '16915', 'article_category_id' => '218', 'title' => 'Government, NRB Positive to Remove Rs 120 millions' Threshold on Margin Lending ', 'sub_title' => '', 'summary' => 'Nepal government and Nepal Rastra Bank seem positive to remove the upper limit of Rs 120 million on loan against shares. In the fiscal year 2078/79, Nepal Rastra Bank(NRB) had tightened loans against shares by introducing the credit limit of 40/120 millions. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">February 3: Nepal government and Nepal Rastra Bank seem positive to remove the upper limit of Rs 120 million on loan against shares. </span></span><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">In the fiscal year 2078/79, Nepal Rastra Bank(NRB) had tightened loans against shares by introducing the credit limit of Rs 40/120 millions. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">In the current fiscal year, the central bank had removed the limit of Rs 40 million on credit against shares. However, the central bank had kept the upper threshold on the margin loan unchanged. </span></span><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The central bank’s policy of Rs 40/120 million credit threshold against the shares had put the share market in crisis.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">At a programme organized by Economic Media Operators’ Association in Kathmandu on Thursday, Deputy Prime Minister and Finance Minister Bishnu Prasad Poudel and NRB Governor Maha Prasad Adhikari indicated that upper slab for margin credit might be removed. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Poudel informed that Ministry of Finance, Nepal Rastra Bank and stakeholders could meet and discuss to find out a solution to 120 million slabs for the loans against shares.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“NRB Governor is positive to figure out solutions to the state of liquidity, interest rates and a slab of Rs 120 million lending on shares,” Poudel said. He, however, added that the government could not dictate the central bank to change interest rates as it is an independent institution.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">NRB governor Maha Prasad Adhikari said that temporary financial instruments used by the central bank for financial stability were being removed keeping in view the latest state of liquidity in the market. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Nepal Rastra Bank’s policies are clear and they will be changed in accordance with financial indicators,” Adhikari stated. He held that Rastra Bank had tightened loans against shares, polices on the import, among others, to avert the possible financial crisis in the country. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">NRB, through its Monetary Policy of 2021/22, had capped loans to up to Rs 40 million from a single bank or financial institution and the total limit for a borrower at Rs 120 million from different banks and financial institutions. In the current fiscal year, the central bank removed the lower limit on loans against shares.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2023-02-03', 'modified' => '2023-02-03', 'keywords' => '', 'description' => '', 'sortorder' => '16654', 'image' => '20230203072628_collage (100).jpg', 'article_date' => '2023-02-03 07:17:19', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 9 => array( 'Article' => array( 'id' => '16914', 'article_category_id' => '218', 'title' => 'Ganesh Raj Pokharel Re-appointed as CEO of Citizens Bank International ', 'sub_title' => '', 'summary' => ' Ganesh Raj Pokharel has been reappointed as Chief Executive Officer of Citizens Bank International Limited. ', 'content' => '<p> </p> <p>January 12: Ganesh Raj Pokharel has been reappointed as Chief Executive Officer of Citizens Bank International Limited. <br /> The meeting of the Board of Directors held on February decided to reappoint Pokharel to the CEO for another four-year term. The decision will come into effect from March 1. </p> <p>Pokharel holds an Executive MBA degree in Finance from Kathmandu University and an MBA (Marketing) and BL (Banking) degrees from Tribhuvan University. He is a professional banker with more than 28 years of experience. <br /> </p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16653', 'image' => '20230202045847_collage (99).jpg', 'article_date' => '2023-02-02 16:55:43', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 10 => array( 'Article' => array( 'id' => '16913', 'article_category_id' => '1', 'title' => 'Canadian National Held with 9-kg Gold at TIA ', 'sub_title' => '', 'summary' => 'A Canadian national was arrested along with nine kilograms of gold from the Tribhuvan International Airport (TIA) in Kathmandu.', 'content' => '<p> </p> <p><span style="font-size:18px">February 2: A Canadian national was arrested along with nine kilograms of gold from the Tribhuvan International Airport (TIA) in Kathmandu. A team of the TIA Customs Office apprehended Canadian citizen Mohammad Kamal Mahagob, 35, in the course of security screening on Wednesday night.</span></p> <p><span style="font-size:18px">He was found carrying gold from the United Arab Emirates. Mohammad, who came to Kathmandu via the Fly Dubai f-2573, was caught at 12.00 Wednesday night, said TIA Customs Office Chief Arun Pokharel. An investigation is underway into the incident, according to Pokhrel. ----RSS </span><br /> </p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16652', 'image' => '20230202035507_collage (98).jpg', 'article_date' => '2023-02-02 15:53:05', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 11 => array( 'Article' => array( 'id' => '16912', 'article_category_id' => '236', 'title' => 'Volkswagen Announces Exchange Offer', 'sub_title' => '', 'summary' => 'February 2: Pooja International Nepal Pvt Ltd, the sole authorized importer and distributor of Volkswagen vehicles in Nepal, has announced the launch of its “Switch to Premium Car Culture” Exchange Camp. ', 'content' => '<p><span style="font-size:18px">February 2: Pooja International Nepal Pvt Ltd, the sole authorized importer and distributor of Volkswagen vehicles in Nepal, has announced the launch of its “Switch to Premium Car Culture” Exchange Camp that allows customers to trade in their old cars of any brand and take home a brand-new Volkswagen. <br /> As per the company officials, the customers will get the guaranteed best valuation for their old vehicles than they can get in the market.<br /> According to the company, its customers will also benefit from excellent cash discounts, the best exchange value for their old cars, and spot exchange services. In addition, the offer includes a loyalty bonus and an exchange bonus as well as a 2-year unlimited km warranty, reads a statement issued by the company. <br /> The camp which started on February 1 will run up to March 30. Customers who are interested in trading in their old four-wheelers can visit any Volkswagen showroom and dealers all over Nepal, added the statement.<br /> Volkswagen Nepal currently offers the Polo, Taigun, Allspace, and Touareg models in the Nepalese market. The company said it is dedicated to providing customers with the highest quality products and the best customer service.<br />  </span><br /> </p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16651', 'image' => '20230202030317_vw.jpg', 'article_date' => '2023-02-02 15:02:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => false, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '16911', 'article_category_id' => '1', 'title' => 'Production and Farming Area of Pre-Monsoon Paddy Declining', 'sub_title' => '', 'summary' => 'February 2: Government data shows that both the farming area and production of pre-monsoon paddy (Chaite dhaan) are on a downward trend.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">February 2: Government data shows that both the farming area and production of pre-monsoon paddy (Chaite dhaan) are on a downward trend. According to the data provided by the Ministry of Agriculture and Livestock Development, it has been found that the area under paddy cultivation and its production have been decreasing in recent years. This is the result of lack of irrigation. As a result, farmers’ attraction of towards paddy production is declining.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to the ministry, in the fiscal year (FY) 2078/79, a total of 561,197 metric tons of paddy was produced in 120,042 hectares of land. In FY 2079/80, the production area decreased by 11,435 hectares to 108,607 hectares. This year, the production of pre-monsoon paddy also decreased by 20,866 metric tons to 540,331 tons.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">President of the National Farmers' Commission, Prem Dangal said that the government is to blame for the decline in paddy production. According to him, if the support price of pre-monsoon paddy is fixe in time and the government also makes arrangements to buy it in time, in addition to ensuring fertilizer supply, seed and irrigation facilities, the farmers will show enthusiasm in production.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to the data, the highest pre-monsoon paddy production was reported in Province 1, which produced 300,000 metric tons in 58,000 hectares of land. This is more than half of the total production. The data shows that Karnali province produces the least pre-monsoon paddy, about 850 metric tons in 191 hectares of land.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Prakash Kumar Sanjel, the spokesperson for the Ministry of Agriculture and Livestock Development said that although the government sees good prospects for paddy production, the lack of irrigation is the main reason for the decrease in the interest of farmers. He said, “Regular irrigation is essential for paddy crops, but at the time of planting paddy, rainfall does not occur. Pre-monsoon paddy is cultivated only in those places where canals are available for irrigation.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The period of pre-monsoon paddy (the time from planting to ripening) is also about 30 days longer than that of annual paddy, so there are many problems affecting the farmers. The minimum time for ripening of annual paddy is 120 days and the time for ripening of pre-monsoon paddy is 150 days. In addition to this, as moisture is high in pre-monsoon paddy, it needs a lot of time to dry. Farmers have to prepare for annual paddy as soon as they finish threshing paddy. Due to this, the farmers do not have time to dry the paddy. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""> </span></span></p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16650', 'image' => '20230202025230_1675301519.jpg', 'article_date' => '2023-02-02 14:51:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '16910', 'article_category_id' => '1', 'title' => 'Extraction of Iron from Dhaubadi Mine to Reduce Imports by 25 Percent', 'sub_title' => '', 'summary' => 'February 2: Iron and its related materials are the second most imported items in Nepal after petroleumproducts, according to the Department of Customs.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">February 2: Iron and its related materials are the second most imported items in Nepal after petroleumproducts, according to the Department of Customs.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The import of iron and iron-related products can be reduced after Dhaubadi Iron Mine comes into operation.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Dhaubadi Iron Company Limited, which was established with the plan to make the private sector a partner, is now owned by the government. Analyzing the statistics of the import of iron and iron products and the market situation, it is estimated that the import can be reduced by 25 per cent after the operation of the mine. The company's chief executive officer (CEO) Dr Janak Bahadur Chand said that the reduction of imports and the use of domestic raw materials will reduce the trade deficit.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">"The company has analyzed the import of iron and iron products," said Chand. Analyzing the data, if 1600 tons of iron ore is extracted daily, the import can be reduced in that proportion. The company's study has shown that the mine has reserves of more than 150 million metric tons of iron. Out of this, if the mine is operational and 1,600 tons of iron ore is extracted daily, import can be reduced by 25 per cent, he said.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">According to Trade and Export Promotion Center, till the end of December of the current fiscal year, Nepal has imported iron and iron products worth Rs 78.12 billion. This year's import is less compared to the last fiscal year, when Nepal had imported iron and iron products worth Rs 96.51 billion. Items like construction materials, agricultural equipment, grills, and machinery are prepared from imported iron.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">A preliminary study has shown that the iron produced from the mines of Dhaubadi can be used to make billets (raw material for steel) for construction materials. Now the company is studying the feasibility of the mine. Chand informed me that the report will be ready by the end of March. The study will clarify how much iron ore can be extracted and produced commercially from the mine.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The current feasibility study is being done through a joint venture (JV) of two Indian companies along with a Nepali company. A detailed project report (DPR) will be prepared after the feasibility study. The government has been announcing the commercial production of iron from Dhaubadi in every annual budget. </span></span></p> <p> </p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Shailesh Thapa, director of the company, said that there is still a lot of work to be done.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">"Now the possibility is being studied. After that, it takes about eight months to make a detailed project report (DPR),” said Thapa, adding, “After that, it takes two years to build the plant. It is estimated that it will take at least three years for commercial production. At present, an access road is being built from Danda in Nawalparasi on the east-west highway to this mine. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">He said that the Nepal Electricity Authority is creating a 'Dhabadi Transmission Line Unit' for electricity.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The authority is working on transmission lines and substations. According to Thapa, survey work is underway for the construction of 132 KVA and 220 KVA transmission lines. It is said that Gandaki province will have a 3% share, and local people will have a 2% share in this company, while the government will have a 50% share. Likewise, it is said that the private sector will have a 45 per cent share. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Thapa said that the private sector will be invited only after the feasibility study. Dhaubadi iron ore mine is 10 kilometres long, 15 to 30 meters wide and 100 meters deep. The iron ore of the mine has the quality to make rods. The Department of Mines and Geology had sent five tons of iron to China for analysis. </span></span></p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif""><strong> </strong></span></span></p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16649', 'image' => '20230202020719_20220220042539_application_iron-ore_723x365.jpg', 'article_date' => '2023-02-02 14:06:15', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '16909', 'article_category_id' => '1', 'title' => 'India Downsizes Grants for Nepal', 'sub_title' => '', 'summary' => 'February 2: India has reduced the grant aid to Nepal in its annual budget.', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">February 2: India has reduced the grant aid to Nepal in its annual budget. In the upcoming fiscal year, India has pledged to provide INR 5.5 billion to Nepal, which is INR 2 billion less than the pledged amount in the current fiscal year. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">India has allocated INR 7.5 billion for Nepal in the current fiscal year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">Meanwhile, India has increased grants to Bhutan and the Maldives. Next year, India will provide grants worth INR 24 billion to Bhutan, up from INR 22 billion in the current year. The amount allocated for Bhutan is the highest amount India has pledged for friendly countries in the coming year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">New Delhi has promised a grant of INR 4 billion to Maldives in the coming year, up from INR 3.6 billion this year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">The grant aid to be given to Afghanistan is equal to that of the current year. Grants to Myanmar, Bangladesh, Sri Lanka, and Mongolia have been reduced as well. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">It is mentioned in the budget that India will give INR 4 billion to Myanmar, INR 2 billion to Bangladesh, INR 1.5 billion to Sri Lanka and INR 70 million to Mongolia. In the current year, grants allocation for these countries stand at INR 6 billion, INR 3 billion, INR 2 billion and INR 120 million respectively.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-02-02', 'modified' => '2023-02-02', 'keywords' => '', 'description' => '', 'sortorder' => '16648', 'image' => '20230202013220_Fl_600x600.jpg', 'article_date' => '2023-02-02 13:31:34', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117