May 26: More than 263,000 tourists visited the Chitwan National Park (CNP) in the current fiscal year (FY 2022/23).…

May 26: More than 263,000 tourists visited the Chitwan National Park (CNP) in the current fiscal year (FY 2022/23).…

May 26: Swisscontact, a non-profit organization of the Swiss private sector, organized a discussion on Small and Medium Enterprises (SME) and sustainable economic growth in Kathmandu on Thursday.…

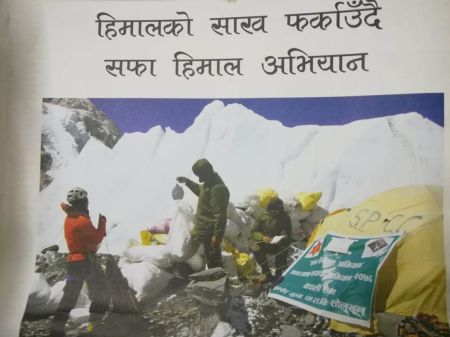

he Nepal Army, through its Safa Himal Campaign 2023, has successfully collected a staggering 35,708 kilograms of solid waste from various…

Of three major areas of investment, stock market offers a comprehensive and wide-ranging avenue for investment in Nepal, allowing all kinds of investors-institutional and retailers- to create capital by outpacing inflation and fixed deposit returns.…

Share investors met with former Prime Minister and Nepali Congress President Sher Bahadur Deuba and submitted a memorandum to him on…

Rohto Mentholatum Nepal, a renowned multinational company, has launched Melano product range. The latest offerings include a luxurious lotion, an invigorating essence, a refreshing gel, and a rejuvenating…

May 25: The private sector stakeholders believe that the government’s revenue collection will be higher if the tax rate is lower.…

May 25: The NADA Automobiles Dealers Association has taken strong exception to the government’s decision to curtail facilities such as tax exemption and other facilities for vehicle assembling industry.…

May 25: Minister for Industry, Commerce and Supplies, Ramesh Rijal, has urged all to play their part with honesty to reduce trade…

May 25: With the improvement in the external and internal sectors of the economy, cash transactions in the market have also started to…

May 25: The government collected capital gains tax (CGT) of Rs 135.48 million in the month of Baishakh (mid-April to mid-May).…

May 25: The Nepal Police has clarified that the Inspector General of Police is not involved in the fake Bhutanese refugee…

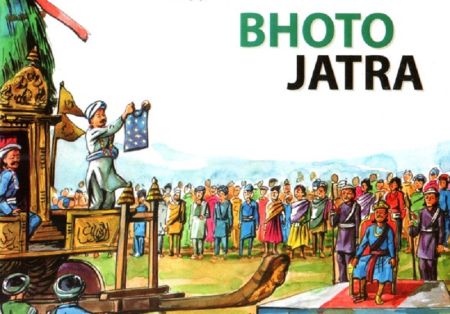

May 25: The government has announced a public holiday today (Thursday) in the Kathmandu Valley on the occasion of the Rato Machhindranath…

Nepal Airlines Corporation (NAC), the national flag carrier, has secured slots at Sydney Airport in Australia. Sydney Airport has granted permission and slots to NAC for two weekly flights on Thursdays and…

Kathmandu District Attorney Office has filed a charge sheet against 30 individuals in fake Bhutanese refugee scam at the District…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '17984', 'article_category_id' => '1', 'title' => 'Over 205K Tourists Visit Chitwan National Park', 'sub_title' => '', 'summary' => 'May 26: More than 263,000 tourists visited the Chitwan National Park (CNP) in the current fiscal year (FY 2022/23). ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Surya Prasad Adhikari</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">May 26: More than 263,000 tourists visited the Chitwan National Park (CNP) in the current fiscal year (FY 2022/23). According to the park officials, 263,806 domestic and foreign tourists entered the park from last July to May this year.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The statistics of the CNP shows that most of the tourists visited the national park in the month of Kartik (mid-October to mid-November) of the current year and the least number of tourists visited in the month of Bhadra (mid-August to mid-September). </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">As per the data, 42,641 people visited the park in mid-October to mid-November while 8,880 people visited the park in mid-August to mid-September.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Similarly, 9,691 people visited the park in the month of Shrawn (mid-July to mid-August), 26,016 in Asoj (mid-September to mid-October), 22,008 in Mangsir (mid-November to mid-December) and 31,953 in Push (mid-December to mid-January). Similarly, 23,647 people visited the park in the month of Magh (mid-January to mid-February), 29,196 in the month of Falgun (mid-February to mid-March), 34,489 people in the month of Chaitra (mid-March to mid-April) and 37,285 people in the month of Baisakh (mid-April to mid-March).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Tourists have to pay the fee for the entrance, jeep safari and other activities. Nepali citizens have to pay a fee of Rs 150 per person to enter the national park while visitors from SAARC countries have to pay Rs 1,000 per person. Similarly, tourists from other countries have to pay Rs 2,000 per person to enter the park.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">During the 10 months of the current fiscal year, the park has collected more than Rs 193.9 million from visitors. According to the CNP office, the national parks collects revenue from tourists' entrance fees and jeep safaris.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">During the review period, the highest revenue worth Rs 25.2 million was collected in the month of Baisakh (mid-April to mid-May) and the lowest of Rs 4.8 million in Shrawn (mid-July to mid-August).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Ganesh Prasad Tiwari, information officer of the CNP, informed New Business Age that the revenue collection of the national park is less during the rainy season when the tourists do not visit the CNP.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">“During the rainy season, there are less number of tourists and jeep rides are stopped and the revenue is also reduced,” said Tiwari.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">According to Tiwari, the national park also earns revenue from other sources besides tourism activities. Accordingly, in the period of 10 months of the current FY, the park collected Rs 718,402 from the sale of timber, Rs 47.97 million from the sale of non-timber forest products, Rs 822,039 from fines, and Rs 1.52 under other headings.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Tiwari said that the park has collected a total of 244.9 million in 10 months of the current year under all these headings.</span></span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-05-26', 'modified' => '2023-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '17715', 'image' => '20230526114136_20230207084654_DA_Tribeni-DSC_0071.jpg', 'article_date' => '2023-05-26 11:41:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '17983', 'article_category_id' => '1', 'title' => 'Swisscontact Organises Discussion on SMEs and Sustainable Economic Growth', 'sub_title' => '', 'summary' => 'May 26: Swisscontact, a non-profit organization of the Swiss private sector, organized a discussion on Small and Medium Enterprises (SME) and sustainable economic growth in Kathmandu on Thursday. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">May 26: Swisscontact, a non-profit organization of the Swiss private sector, organized a discussion on Small and Medium Enterprises (SME) and sustainable economic growth in Kathmandu on Thursday. The discussion was organized with the aim of providing insight into the situation of SMEs in Nepal.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Chief Operating Officer (COO) and co-founder of thulo.com Surakchya Adhikari; Founder of Kokroma, Revati Gurung; Manoj Paudel, co-founder of Adhyanta; technology rntrepreneur Princi Koirala and Chief Executive Officer (CEO) of Swisscontact Dr Philippe Schneuwly shared their views during the discussion.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">During the program, discussions were held on the topics of inclusive business models for SMEs, financial instruments, marketing of products, role of development agencies, risks of starting an enterprise. Established in 1959, Swisscontact has been cooperating with the private sector in various development projects in Nepal since 1991. The organization is currently conducting six projects for inclusive economic promotion in Nepal.</span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-05-26', 'modified' => '2023-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '17714', 'image' => '20230526104619_SME.jpg', 'article_date' => '2023-05-26 10:45:17', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '17982', 'article_category_id' => '1', 'title' => 'Over 35,000 kg of Garbage Collected', 'sub_title' => '', 'summary' => 'he Nepal Army, through its Safa Himal Campaign 2023, has successfully collected a staggering 35,708 kilograms of solid waste from various mountains.', 'content' => '<p><span style="font-size:18px">May 26: The Nepal Army, through its Safa Himal Campaign 2023, has successfully collected a staggering 35,708 kilograms of solid waste from various mountains. This exceeds their initial target of 35,000 kg, showcasing their dedication to preserving the natural beauty of these majestic peaks.</span></p> <p><span style="font-size:18px">Under the supervision of the NA Directorate of Military Public Relations and Information, the campaign achieved notable results. Specifically, 3,567 kg of waste was collected from Mt Annapurna, 18,520 kg from Mt Baruntse, and an impressive 13,621 kg from Everest and Lhotse combined.</span></p> <p><span style="font-size:18px">As the campaign nears its completion, the Nepal Army team stationed at the base camp of Everest, responsible for cleaning the area, is returning after accomplishing their mission. The campaign's official conclusion will be marked by a formal event held in Kathmandu on World Environment Day, which falls on June 5.</span></p> <p><span style="font-size:18px">It may be noted that tragically two Sherpa guides, who were instrumental in assisting the NA team in cleanliness campaign, lost their lives. Additionally, four Nepali Army personnel fell ill and have been taken to India for further treatment.</span></p> <p> </p> ', 'published' => true, 'created' => '2023-05-26', 'modified' => '2023-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '17713', 'image' => '20230526062732_collage (13).jpg', 'article_date' => '2023-05-26 06:25:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 3 => array( 'Article' => array( 'id' => '17981', 'article_category_id' => '251', 'title' => 'Unlocking Investment Potential in Nepal: Exploring the Stock Market as a Path to Wealth Creation', 'sub_title' => '', 'summary' => 'Of three major areas of investment, stock market offers a comprehensive and wide-ranging avenue for investment in Nepal, allowing all kinds of investors-institutional and retailers- to create capital by outpacing inflation and fixed deposit returns. ', 'content' => '<p><span style="font-size:18px">May 26: While Nepal's investment options maybe limited, it is important to recognize that investing remains the most reliable approach to outpacing inflation, creating capital, and generating substantial wealth. </span></p> <p><span style="font-size:18px">Although depositing money in bank accounts can yield modest returns, it falls short in terms of multiplying capital and enabling the creation of significant wealth.</span></p> <p><span style="font-size:18px">Nepal has primarily three areas available for investment- real estate, business and stock market. Once upon a time, investing in real estate was widely regarded as one of the most lucrative endeavors. </span></p> <p><span style="font-size:18px">If you had invested Rs 1 to 3 million in the early 2000s, the potential for exponential returns was immense, with the possibility of multiplying your capital by up to tenfold. Savvy investors who entered the real estate market in Kathmandu and other major cities during that era reaped massive wealth within a decade.</span></p> <p><span style="font-size:18px">However, the tides have turned in the realm of real estate. Land sizes have diminished, and the value of land has skyrocketed to exorbitant levels. Presently, even the farthest outskirts of the Kathmandu valley have per anna land prices ranging from 25 to 30 lakhs. </span></p> <p><span style="font-size:18px">As a result, individuals with limited capital shy away from investing in real estate due to the lack of sufficient funds. Additionally, the Nepal Rastra Bank has imposed stringent lending regulations on real estate, allowing only 30 percent loan against the total collateral valuation for homes and land. This not only makes it challenging for small-scale investors but also poses difficulties for larger investors looking to venture into the real estate market.</span></p> <p><span style="font-size:18px">Moreover, the government has introduced new legislation that classifies land into ten categories based on various features and geographic considerations. These categories include agricultural, residential, commercial, industrial, mines, forests, public use, and cultural-archeological designations, among others. </span></p> <p><span style="font-size:18px">Furthermore, land plotting has been prohibited unless the land has been appropriately classified, further complicating and diminishing the viability of real estate investments.</span></p> <p><span style="font-size:18px">Engaging in business endeavors within Nepal presents significant challenges, particularly for newcomers and those lacking experience. The country boasts several well-established business conglomerates with a global presence, including the likes of Chaudhary Group, Golchha Organization, Murarak Group, Chachan Group, Golyan Group, Kedia Organization, Khetan Group, Vishal Group, Vaidya Organization of Industries and Trading Houses (VOITH), Prabhu Group, Laxmi Group, Shanker Group, Universal Group, IME Group, and Jyoti Group. </span></p> <p><span style="font-size:18px">These influential entities exert control over a wide range of sectors encompassing manufacturing, trade, banking, insurance, healthcare, agriculture, hydropower, tourism, real estate, food and beverage, as well as vehicle import and sales.</span></p> <p><span style="font-size:18px">For individuals entering the business arena with limited capital and lacking political and bureaucratic connections, competing with these established business houses proves immensely challenging. Newcomers and aspiring entrepreneurs rarely manage to establish themselves successfully in the business world due to these barriers.</span></p> <p><span style="font-size:18px">Furthermore, the majority of people in Nepal tend to be risk-averse and lack the courage to venture into entrepreneurial pursuits. Additionally, the insufficient capital resources further hinder their ability to start their own businesses.</span></p> <p><span style="font-size:18px">Although a nascent startup culture has begun to emerge in Nepal, the government is yet to formulate comprehensive laws and regulations to promote and support such initiatives. All these factors contribute to the prevailing perception that doing business in Nepal is a daunting and arduous task.</span></p> <p><span style="font-size:18px">Investing in Nepal's stock market offers a comprehensive and wide-ranging avenue for investment. While there are stories of individuals losing their assets and even resorting to extreme measures due to stock market investments, many people remain hesitant to participate in the secondary market due to perceived risks. These cautionary tales serve as warnings, deterring others from venturing into the stock market.</span></p> <p><span style="font-size:18px">Undoubtedly, investing entails risks, and the stock market is no exception. However, a careful study and analysis of the stock market reveal that it is not as perilous as commonly portrayed. </span></p> <p><span style="font-size:18px">Despite inherent risks, stock market presents ample benefits. One of the advantages is the ability to start investing with any amount of surplus funds, whether it's Rs 50,000, Rs 5,000,000, or even higher. Unlike other ventures like businesses or real estate, which often require substantial capital, the stock market allows individuals to embark on their investment journey with any available surplus fund. </span></p> <p><span style="font-size:18px">Unlike real estate, which typically maintains its value even during bearish periods, the secondary market, NEPSE, moves in cycles of bullish and bearish trends. This presents an opportunity to purchase shares of favored companies at low prices during downward trends. </span></p> <p><span style="font-size:18px">In contrast, it is rare to find heavily discounted land or properties in the real estate market during downturns. In the stock market, one is never left behind, always having the chance to acquire shares of top-performing companies at unimaginably low prices.</span></p> <p><span style="font-size:18px">Another advantage of the stock market is its liquidity. Life's uncertainties may require immediate financial solutions, such as medical emergencies, funding for education, or urgent travel expenses. </span></p> <p><span style="font-size:18px">In such cases, selling shares can provide the necessary cash. Real estate investments may not provide the same level of flexibility in addressing immediate and urgent financial needs, especially during downturns when selling property becomes challenging.</span></p> <p><span style="font-size:18px">The stock market offers a wide range of options to choose from, with numerous real and manufacturing sectors, banks, and insurance companies listed on NEPSE. These listed companies operate real businesses in the tangible world. </span></p> <p><span style="font-size:18px">By conducting thorough analyses and investing in companies with growth and expansion potential, there is a significant opportunity to multiply investments. A company valued at Rs 10 million can grow into a billion-dollar enterprise, resulting in an unimaginable expansion of one's portfolio. In contrast, the size of land remains fixed, limiting its growth potential.</span></p> <p><span style="font-size:18px">The stock market experiences cycles of bears and bulls. By studying technical charts, indicators, and keeping an eye on fundamental factors such as the country's economy, interest rates, liquidity in the banking system, and political conditions, investors have a chance to multiply their capital within a short period. Such rapid growth opportunities are not as readily available in real estate or start-up businesses.</span></p> <p><span style="font-size:18px">Investing in the stock market offers transparency and convenience. While buying real estate often involves inspecting numerous plots before making a decision, studying and researching companies listed on NEPSE can be done from the comfort of one's home. </span></p> <p><span style="font-size:18px">Transaction costs, including broker commissions, taxes, and regulatory fees, are fixed and transparent, ensuring fair dealings without any hidden agendas. Stock markets are regulated and operate under strict rules, providing transparency and investor protection. Access to company information, financial reports, and market trends empowers investors to make informed decisions.</span></p> <p><span style="font-size:18px">Diversification is another bright side of investing in NEPSE. It allows investors to spread their investment across different sectors, such as banking, insurance, manufacturing, hotels and tourism, and investments, among others. </span></p> <p><span style="font-size:18px">This diversification helps to reduce overall risk and potentially increase overall portfolio returns. Even if losses occur in one company, they can be offset by profits from another, minimizing the impact of individual setbacks.</span></p> <p><span style="font-size:18px">Nepal's stock market holds significant promise as an emerging market, indicating considerable potential for growth. Emerging markets, being in the early stages of economic development, often offer higher returns compared to established markets.</span></p> <p><span style="font-size:18px">Investing in NEPSE can be particularly advantageous for long-term investors who are willing to hold their investments over an extended period. As Nepal's economy continues to progress and mature, the stock market has the potential to deliver substantial returns for patient investors.</span></p> <p><span style="font-size:18px">Another benefit of investing in NEPSE is the opportunity to earn dividend income. Many companies distribute a portion of their profits to shareholders in the form of dividends. This practice provides a reliable and steady stream of income, making dividend-paying stocks attractive for income-oriented investors seeking regular cash flow. </span></p> <p><span style="font-size:18px">By investing in such stocks, investors can benefit from both potential capital appreciation and recurring dividend payments, enhancing their overall investment returns.</span></p> <p><span style="font-size:18px">After analyzing the four bullish and bearish trends in the NEPSE, it becomes evident that newcomers tend to enter the stock market when the bull run is at its peak. Their decision is often influenced by hearing about their friends and neighbors making substantial profits.</span></p> <p><span style="font-size:18px">Conversely, experienced and savvy investors choose to exit their positions during the mid to peak points of a bullish trend. Unfortunately, newbies enter the market at this juncture, experiencing initial gains and a sense of elation. </span></p> <p><span style="font-size:18px">However, as the market eventually shifts into a bearish mode, their hopes of quick and easy profits are shattered. This unfavorable turn of events often leads to significant financial losses, feelings of despair, and even cases of suicide, thereby spreading negative sentiments about the stock market.</span></p> <p><span style="font-size:18px">Ultimately, the success of investing in the NEPSE stock market relies on taking certain precautions and adopting a strategic approach. By considering the following guidelines, individuals can enhance their chances of making informed investment decisions and creating wealth:</span></p> <p><span style="font-size:18px">1. Study the bullish and bearish trends in the stock market to understand the market dynamics and identify favorable entry and exit points.<br /> 2. Develop a basic understanding of technical charts, which can provide insights into price patterns and trends.<br /> 3. Conduct thorough research on companies, analyzing their past performance, current situation, and potential for future growth.<br /> 4. Capitalize on opportunities when the market is in a bearish trend, as this may present favorable prices for acquiring stocks.<br /> 5. Take advantage of bullish trends by selling stocks and patiently waiting for opportune moments to reinvest your money.<br /> 6. Avoid being swayed by rumors and hearsay, as they can often mislead investors.<br /> 7. Stay informed about the state of liquidity in banks, interest rates, and the overall financial condition of the country, as these factors can impact stock market performance.<br /> 8. Consider the effects of major calamities, pandemics, and unforeseen disasters, as the NEPSE has historically experienced growth following such events.<br /> 9. Select a few top-performing companies with growth prospects from various sectors and focus your investments on them.</span></p> <p><span style="font-size:18px">By following these precautions and guidelines, investors can approach the stock market with a more informed and calculated approach, increasing their chances of success and wealth creation.</span><br /> </p> ', 'published' => true, 'created' => '2023-05-26', 'modified' => '2023-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '17712', 'image' => '20230526060045_collage (12).jpg', 'article_date' => '2023-05-26 05:40:58', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 4 => array( 'Article' => array( 'id' => '17980', 'article_category_id' => '1', 'title' => 'Share Investors Meet Former PM Deuba and Submit Memorandum ', 'sub_title' => '', 'summary' => 'Share investors met with former Prime Minister and Nepali Congress President Sher Bahadur Deuba and submitted a memorandum to him on Thursday. ', 'content' => '<p><span style="font-size:18px">May 25: Share investors met with former Prime Minister and Nepali Congress President Sher Bahadur Deuba and submitted a memorandum to him on Thursday. </span></p> <p><span style="font-size:18px">Nepal Investors Forum Chairman Tulsi Ram Dhakal, erstwhile chair Chhotelal Rouniyar, Nepal Stock Market Investors Association Chairperson Radha Pokharel, and Share Investors Association Nepal's Acting Chair Taraprasad Fullel, along with other investors, met with Sher Bahadur Deuba and handed him a memorandum with six demands.</span></p> <p><span style="font-size:18px">The investors effectively apprised Deuba of the prevailing state of the stock market, emphasizing the urgent need for essential reforms to be promptly implemented. </span></p> <p><span style="font-size:18px">The share investors submitted a memorandum to the former Prime Minister, outlining six pivotal demands. The memorandum calls for expediting the process of distributing new broker licenses, new stock exchange license, and commodity exchange licenses, without any undue delay.</span></p> <p><span style="font-size:18px">Moreover, the investors have urged the government to eliminate the existing cap of Rs 120 million on share loans and reduce the current risk weightage of 150% to a 100%. </span></p> <p><span style="font-size:18px">Additionally, they have advocated for a 5% capital gain tax for short-term investors and a 3% capital gain tax for long-term investors. The investors have stressed the necessity of reducing the bank interest rate to a single-digit.</span></p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17711', 'image' => '20230525045320_collage (2).jpg', 'article_date' => '2023-05-25 16:51:26', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 5 => array( 'Article' => array( 'id' => '17979', 'article_category_id' => '266', 'title' => 'Rohto Mentholatum Nepal Unveils Exciting New Melano Products ', 'sub_title' => '', 'summary' => 'Rohto Mentholatum Nepal, a renowned multinational company, has launched Melano product range. The latest offerings include a luxurious lotion, an invigorating essence, a refreshing gel, and a rejuvenating mask.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">May 25: Rohto Mentholatum Nepal, a renowned multinational company, has launched Melano product range. The latest offerings include a luxurious lotion, an invigorating essence, a refreshing gel, and a rejuvenating mask. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Building on their success, Sunplay Skin Aqua has also introduced an exquisite selection of premium sunscreens, featuring the Silky White Gel, Clear White Milk, UV Sunscreen Whitening Lotion, and the Tone Up Lavender & Rose variants.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Rohto Mentholatum Nepal organized a grand National Dealer Meet and Product Launch Programme at Hotel Yak and Yeti on May 17. The event saw enthusiastic participation from over 200 esteemed dealers who were eager to witness the unveiling of these cutting-edge products.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The Melano CC range, known for its exceptional quality and efficacy, has been directly imported from Japan. Specifically designed for melasma treatment and skin brightening, these products incorporate the latest technology and premium ingredients. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">On the other hand, Sunplay Skin Aqua presents a top-tier sunscreen collection with superior sun protection factors, boasting SPF 50+ and PA+++. Carefully formulated to cater to the unique needs of Nepali skin tones, both ranges guarantee an unparalleled skincare experience.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">During the grand launch ceremony and dealers' meet, the Chairman of Rohto Mentholatum Nepal, Mr. Hirofumi Shiramastu, and the Managing Director, Mr. Shunsuke Shinoda, expressed their appreciation for the Nepalese dealers and reaffirmed their commitment to further expanding business opportunities.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">The event was hosted by former Miss Nepal, Sadichha Shrestha, and featured the presence of Rohto Mentholatum Nepal Brand Ambassador, Upasana Singh Thakuri, and popular makeup artist @ksuskalology.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Founded in 1899, Rohto Mentholatum has a rich history as a global company, with its headquarters located in Osaka, Japan. In 2018, Rohto Mentholatum Nepal was established in Nepal, setting up its own factory in Banepa, Kavre. The facility manufactures a diverse range of skincare products, aiming to enhance beauty and empower individuals.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">With an unwavering commitment to innovation, research, and customer satisfaction, Rohto Mentholatum Nepal has firmly established itself as a trusted brand in the Nepali market. </span></span></p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17710', 'image' => '20230525040053_collage (1).jpg', 'article_date' => '2023-05-25 15:58:22', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 6 => array( 'Article' => array( 'id' => '17978', 'article_category_id' => '1', 'title' => 'What does the Private Sector Want from Budget', 'sub_title' => '', 'summary' => 'May 25: The private sector stakeholders believe that the government’s revenue collection will be higher if the tax rate is lower. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">May 25: The private sector stakeholders believe that the government’s revenue collection will be higher if the tax rate is lower. The gray economy has increased due to the increase in customs duty, excise duty and VAT. This problem will be solved if customs and VAT are adjusted to be equal to India's GST, said the private sector businessmen. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">“When all transactions come under the scope of customs, it will increase the revenue,” they said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">They were of the view that some amount of social security fund should be spent on industrial infrastructure development and expansion. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">A law that restricts businessmen does not create a viable environment for industries and commerce to flourish.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">“The government's job is to increase revenue, not to arrest businessmen,” said one of the businessmen. According to him, a policy of amending such laws should be adopted. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">“It is not possible for industries that require raw materials in small quantities to bring them in large quantities. Therefore, such raw materials from commercial establishments should also have low customs duty. As liquidity is easing now, the current capital loan limit should be removed,” he further said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The businessmen and traders believe that if the limit of 25 percent of current capital loan is removed, businesses will improve. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">They also complained that Indian tourists are not treated well at the border. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">“Many tourists come to Nepal from India. Harassment of Indian tourists at the border does not increase the number of tourists. There should be a system of parity and facilitation of the Indian currency.”</span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-26', 'keywords' => '', 'description' => '', 'sortorder' => '17709', 'image' => '20230525033010_Budget.jpg', 'article_date' => '2023-05-25 15:29:24', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '17977', 'article_category_id' => '1', 'title' => 'Facilities of Assembling Industries Should not be Curtailed: NADA', 'sub_title' => '', 'summary' => 'May 25: The NADA Automobiles Dealers Association has taken strong exception to the government’s decision to curtail facilities such as tax exemption and other facilities for vehicle assembling industry. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">May 25: The NADA Automobiles Dealers Association has taken strong exception to the government’s decision to curtail facilities such as tax exemption and other facilities for vehicle assembling industry. NADA said its attention has been drawn to the decision taken by the government for the upcoming fiscal year’s budget.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NADA recalled that the government arranged various exemptions and facilities for the establishment of the vehicle assembling industry considering the demands placed by NADA. According to NADA, some of the vehicle manufacturing and assembling industries in Nepal are in operation and some are in the process of being established. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">As per NADA, when a vehicle assembling industry is established in Nepal itself, the general public will get vehicles at a cheaper price, more jobs will be created and foreign technology will also be transferred to Nepal, which will greatly help in the development of Nepali technicians.</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NADA expressed its concerns because many other industries are dependent on vehicle assembling plant. </span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">“If the government comes up with a policy to curtail facilities while underestimating such facts, not only will the investment of industrialists investing in such assembling industries sink, but the industrialization of Nepal will definitely lag behind.”</span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NADA has requested the government to adopt a policy to further encourage the vehicle assembling industry while formulating the budget.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17708', 'image' => '20230525032755_20210112010154_Clipboard0111.jpg', 'article_date' => '2023-05-25 15:26:21', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '17974', 'article_category_id' => '1', 'title' => 'All Should Play Role to Reduce Trade Deficit: Minister Rijal ', 'sub_title' => '', 'summary' => 'May 25: Minister for Industry, Commerce and Supplies, Ramesh Rijal, has urged all to play their part with honesty to reduce trade deficit. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 25: Minister for Industry, Commerce and Supplies, Ramesh Rijal, has urged all to play their part with honesty to reduce trade deficit. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Minister Rijal said so in a meeting held to discuss the action plan and implementation of trade deficit reduction under the Nepal Trade Integrated Strategy organised at the ministry on Wednesday. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Stating that policies are formulated in the country, but implemented less while the implemented policies too have not got the desired results, he pointed out that support of all sectors was necessary for the reduction of trade deficit. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Minister Rijal said, "Success will be achieved in export trade promotion, trade deficit reduction and current situation of earning foreign exchange by running targeted activities with required resources as per the Nepal Trade Integrated Strategy, 2080." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The National Action Plan related to Trade Deficit Reduction was passed by cabinet on April 11 to address the increasing trade deficit. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, a cabinet meeting held on May 9 had passed Nepal Trade Integrated Strategy, 2080. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17705', 'image' => '20230525122537_trade_imbalance.jpg', 'article_date' => '2023-05-25 12:24:44', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '17973', 'article_category_id' => '1', 'title' => 'Cash Circulation Rising in the Market ', 'sub_title' => '', 'summary' => 'May 25: With the improvement in the external and internal sectors of the economy, cash transactions in the market have also started to increase.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">May 25: With the improvement in the external and internal sectors of the economy, cash transactions in the market have also started to increase. According to the data published by Nepal Rastra Bank (NRB), it has been found that the cash in circulation in the market has increased in the month of Baishak (mid-April to mid-May).</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to NRB, by the end of Baishak (mid-May) of the current fiscal year (FY), the market had a cash circulation of Rs 623 billion. At the end of the last fiscal year (mid-July 2022), Rs 612.2 billion were in circulation, but in mid-May 2023, it increased by Rs 11.87 billion.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">The cash in circulation had been continuously decreasing since the start of the current fiscal year. The circulation of cash in the market started to decrease with the decline in economic activities due to the outbreak of Covid-19 and the Russia-Ukraine war. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">In the first month of the current FY (mid-July to mid-August), Rs 599 billion in cash was in circulation. After the government and NRB tightened the import and issued a tight monetary policy, the economic indicators improved. In Baisakh, the liquidity of banks and financial institutions in Nepal also increased.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">In Ashar 2079 (last July), the deposits of banks were Rs 188 billion, and by the end of Baishak (mid-May), it climbed up to Rs 212 billion. Since the current year, the NRB has increased the mandatory cash reserve ratio (CRR), causing the deposits to increase.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to the NRB’s latest Current Macroeconomic and Financial Situation Report, the country's balance sheet, foreign exchange reserves, reserve adequacy and other indicators have reached a comfortable level in Baishak.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Along with this, the bank's base rate and interest rate, which had reached a high point, have started to decrease, while there has been an improvement in deposit collection and loan disbursement, NRB said.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Along with the decrease in imports, the increase in remittances has also increased the foreign exchange reserves. In Ashar, NRB had a total of Rs 114.4 billion in foreign currency reserves, which increased to Rs 149 billion at the end of Baishak.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Due to the strict provisions of the monetary policy, the interest rate which has been continuously rising has started to decrease. Similarly, bank deposits and credit flow of banks have also started to increase.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:"Times New Roman","serif"">NRB has reduced the bank rate by 1.5 percentage points to 8.5 per cent through the review of monetary policy. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17704', 'image' => '20230525122359_banknotes.jpg', 'article_date' => '2023-05-25 12:23:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '17972', 'article_category_id' => '1', 'title' => 'Capital Gains Tax from Securities Market Declines by Almost Rs 40 Million in Baisakh', 'sub_title' => '', 'summary' => 'May 25: The government collected capital gains tax (CGT) of Rs 135.48 million in the month of Baishakh (mid-April to mid-May). ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">May 25: The government collected capital gains tax (CGT) of Rs 135.48 million in the month of Baishakh (mid-April to mid-May). The tax was collected from individual and institutional investors who sold securities bond at a profit.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">According to CDS and Clearing Limited (CDSC), there has been a decrease in tax collection in the same period this year due to the decline in turnover and share price in the secondary market of securities. According to CDSC spokesperson Suresh Neupane, capital gains tax collected from the securities market is less by Rs 37.3 million in the review period compared to the previous month (mid-March to mid-April). Previously, more than Rs 172.8 million was collected as capital gains tax.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">From mid-April to mid-May, CGT of more than Rs 61.2 million was collected from short-term investors and Rs 59.99 million from long-term investors. According to Neupane, more than Rs 14.3 million of such tax was collected from institutional investors.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">From mid-March to mid-April, more than Rs 75.6 million of CGT was collected from short-term investors and Rs 84.7 million from long-term investors. Neupane said that more than Rs 12 million capital gains tax was collected from institutional investors.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Investors of the securities market have paid more than Rs 10 billion in taxes to the government in the past one year. According to CDSC, the government collected more than Rs 10.35 billion capital gains tax from securities traders in the fiscal year 2021/22. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Investors say that government income can be increased by further developing and expanding the securities market amid current economic crisis. Tara Prasad Fullel, acting president of the Stock Brokers Association of Nepal (SBAN), says that tax collection from this sector should be prioritized by operating two stock exchanges. He said that as the income of the government declined along with the share price and turnover, attention should be paid to the expansion of this sector.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Fullel said that the capital gains tax for individual investors should be at most 5 percent. He said that 5 percent of short-term and 3 percent of long-term capital gains tax should be exempted for individuals.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Times New Roman","serif"">Securities traders have to pay capital gains tax up to 10 percent on profits. Institutional investors are charged 10 percent and individuals are charged a maximum of 7.5 percent capital gains tax. There are two types of capital gains tax on individuals. Those who hold shares for more than 1 year and sell them are considered long-term investors and those who sell them in less than 1 year are considered short-term investors. Short-term investors have to pay 7.5 percent capital gains tax and long-term investors have to pay 5 percent capital gains tax. </span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17703', 'image' => '20230525113508_taxxxxx.jpg', 'article_date' => '2023-05-25 11:34:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '17971', 'article_category_id' => '1', 'title' => 'No Involvement of IGP in Fake Bhutanese Refugees Scam: Nepal Police ', 'sub_title' => '', 'summary' => 'May 25: The Nepal Police has clarified that the Inspector General of Police is not involved in the fake Bhutanese refugee scam. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 25: The Nepal Police has clarified that the Inspector General of Police is not involved in the fake Bhutanese refugee scam. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Issuing a press statement on Wednesday, Spokesperson for the Nepal Police, Kuber Kadayat, made it clear that IGP Basanta Kunwar was not involved in the fake Bhutanese refugees scam. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The statement reads, "The news disseminated on the sensitive issue like crime investigation without basis, fact and evidence will create confusion among the people and the Nepal Police Headquarters fully disagrees with the news that defames the credibility, image and chain of command of the police organization." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">It is highly condemnable to drag the IGP in controversy based on conversation of two people accusing the police chief of taking financial benefit from the accused of fake Bhutanese refugees scam, which the police says is an attempt to establish exaggerated facts. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">"Nepal Police is aware and committed to stand by the constitution, laws and the organisation's values and to ensure that no innocent is implicated and no guilty is left scot-free," added the statement. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Stating that the IGP had played a role to protect the accused of the fake Bhutanese refugees scam, lawmakers in Wednesday’s meeting of the House of Representatives had drawn the attention of the home minister to carryout investigation by suspending him. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17702', 'image' => '20230525103352_police logo - Copy.jpg', 'article_date' => '2023-05-25 10:33:10', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '17970', 'article_category_id' => '1', 'title' => 'Public Holiday in Kathmandu Valley Today ', 'sub_title' => '', 'summary' => 'May 25: The government has announced a public holiday today (Thursday) in the Kathmandu Valley on the occasion of the Rato Machhindranath festival. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">May 25: The government has announced a public holiday today (Thursday) in the Kathmandu Valley on the occasion of the Rato Machhindranath festival. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Today, the bhoto (a customary vest-like attire) of Rato Machhindranath will be exhibited to the public.</span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Ministry of Home Affairs announced the public holiday in three districts of the valley – Kathmandu, Lalitpur and Bhaktapur on the occasion. The ministry informed about this through a public notice on Wednesday. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The legendary vest is exhibited at Jawalakhel of Lalitpur each year during the festival</span>. -- RSS</span></span></p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17701', 'image' => '20230525095621_bhoto.jpg', 'article_date' => '2023-05-25 09:55:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '17969', 'article_category_id' => '1', 'title' => 'Nepal Airlines Corporation to Commence Flights to Sydney from June 21', 'sub_title' => '', 'summary' => 'Nepal Airlines Corporation (NAC), the national flag carrier, has secured slots at Sydney Airport in Australia. Sydney Airport has granted permission and slots to NAC for two weekly flights on Thursdays and Saturdays.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">May 25: Nepal Airlines Corporation (NAC), the national flag carrier, has secured slots at Sydney Airport in Australia. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Sydney Airport has granted permission and slots to NAC for two weekly flights on Thursdays and Saturdays. Following the receipt of flight approval from Sydney Airport, NAC has submitted the necessary documentation to the Australian Civil Aviation Authority.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Ganesh Kumar Ghimire, the Assistant Spokesperson of NAC, stated that initially, the flights to Sydney will include a 'technical landing' in Singapore. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">He mentioned that the necessary procedures to commence flights from June 21 are being actively pursued. NAC has already initiated the selection process for an aviation fuel provider in Singapore and Sydney, and they have chosen an MRO (maintenance, repair, and operation) company for both Singapore and Sydney airports.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">NAC is fully prepared to operate direct flights to Sydney, Australia, utilizing the wide-body Airbus 'A' 330 aircraft, as per the corporation's plans.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif"> Additionally, NAC will begin regular flights to Gautam Buddha International Airport from Malaysia starting on June 12. The promotional airfare from Malaysia to Gautam Buddha International Airport is incredibly affordable at just Rs 11,461.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">"We are delighted to offer tickets for the Malaysia-Bhairahawa-Kathmandu route at a highly competitive price," added Ghimire. Furthermore, the airfare for the Malaysia-Bhairahawa-Kathmandu route has been fixed at Rs 12,346. -----RSS </span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17700', 'image' => '20230525064255_Nepal-Airlines-1-3.jpg', 'article_date' => '2023-05-25 06:41:05', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 14 => array( 'Article' => array( 'id' => '17968', 'article_category_id' => '1', 'title' => '30 Individuals Sued in Fake Bhutanese Refugee Scam', 'sub_title' => '', 'summary' => 'Kathmandu District Attorney Office has filed a charge sheet against 30 individuals in fake Bhutanese refugee scam at the District Court.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">May 25: Kathmandu District Attorney Office has filed a charge sheet against 30 individuals in fake Bhutanese refugee scam at the District Court.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Out of the accused, 16 have been apprehended, while 14 others remain at large. District Attorney Mahesh Khatri said that arrest warrants would be issued for the absconding individuals, and their assets and properties would be frozen pending investigation. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The accused individuals are Keshav Prasad Dulal, Sanu Bhandari, Sagar Rai, Sandesh Sharma, Tankakumar Gurung, Indrajit Rai, Top Bahadur Rayamajhi, Sandeep Rayamajhi, Tekanarayan Pandey, Narendra KC, Bikram also known as Govindakumar Chaudhary, Ramsharan KC, and Balkrishna Khan. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Other accused include Angtawa Sherpa, Shamsher Miya, Tekanath Rijal, Keshav Tuladhar, Laxmi Maharjan, Bhakta Maharjan, Ashok Pokharel, Dhiren Rai, Deepa Humagai, Niraj Rai, Rajesh Aryal, Mohanraj Rai, Ashish Budathoki, Binita Savden Limbu, Niranjankumar Kharel, Sunil Budathoki, and Pratik Thapa. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">With the registration of the charge sheet, the court proceedings have begun, with statements being recorded and pleas being heard to determine whether the arrested individuals should be remanded in custody for further investigation.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">The accused face charges for their alleged involvement in fraud, document forgery, organised crime and treason. Those holding public positions will also face charges under anti-corruption and money laundering laws.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">District Attorney Khatri disclosed that the sued individuals are being pursued for the recovery of over Rs 270 million. The charges of fraud and forgery carry a maximum sentence of seven years, while involvement in crimes against the state may result in up to five years of imprisonment. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,sans-serif">Additionally, appropriate legal provisions will be applied to those implicated in organized crime.</span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-05-25', 'modified' => '2023-05-25', 'keywords' => '', 'description' => '', 'sortorder' => '17699', 'image' => '20230525061401_collage (9).jpg', 'article_date' => '2023-05-25 06:12:06', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117