A meeting of ruling coalition partners convened by Prime Minister Pushpa Kamal Dahal 'Prachanda' has decided to launch a thorough investigation into the sale and purchase of shares in the private telecommunications company,…

A meeting of ruling coalition partners convened by Prime Minister Pushpa Kamal Dahal 'Prachanda' has decided to launch a thorough investigation into the sale and purchase of shares in the private telecommunications company,…

A tiger has been transferred to Bardiya due to the shortage of cage at the Chitwan National Park…

The Nepal Stock Exchange (NEPSE) witnessed a loss of 10.10 points or 0.54%, with the index closing at 1837.71 on the third trading day of the week on…

December 5: Project officials are dilly-dallying in re-inviting tender bids of transmission lines under the US-funded Millennium Challenge Corporation (MCC).…

December 5: The Public Procurement Monitoring Office has blacklisted five construction and supply companies. Issuing a notice on Tuesday, the office said it has blacklisted the companies for their failure to comply with the rules. …

December 5: The northern belt of Gorkha district has witnessed snowfall since Monday night. Chum and Nubri valleys located in the upper region of the district received snowfall, according to Chairman of Chumnubri Rural Municipality, Nima…

December 5: Pakistan’s Habib Bank, the foreign partner of Himalayan Bank, is preparing to sell its shares in the bank to Himalayan Reinsurance…

December 5: Trans Nepal Freight Services JV, selected from an international bid for the operation of Chobhar Dry Port, has signed an agreement with Nepal Intermodal Transport Development Committee to share a minimum of Rs 28.8 million rent and charge for five years while operating the newly-built…

December 5: Expressing serious concerns over the news circulating about the sale and purchase of Ncell's share, Prime Minister Pushpa Kamal Dahal has directed the concerned authorities to determinate whether the deal was in line with Nepal's existing laws and legal…

December 5: The government has confirmed the death of six Nepali citizens serving in the Russian Army.…

Manang district has received the highest number of foreign tourists since the outbreak of the COVID-19 pandemic. According to Annapurna Conservation Area Project (ACAP)'s Area Office in Manang, over 20,800 foreign tourists came to Manang in the last 11…

Dhorpatan witnessed this season's first snowfall on Monday. It snowed in Dhorpatan, including in the Dhorpatan Hunting Reserve in the morning, said Birendra Kandel, Chief of the Dhorpatan Hunting Reserve…

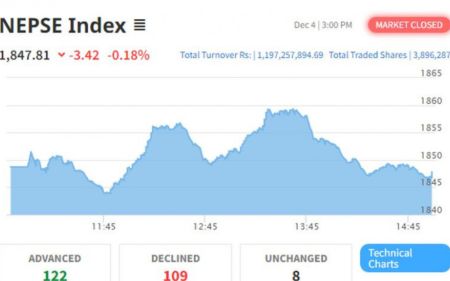

The Nepal Stock Exchange (NEPSE) Index experienced a decline, losing 3.42 points or 0.18%, concluding the second trading day of the week at 1847.81 points on Monday.…

December 4: The Securities Board of Nepal (SEBON) has not approved the IPO of any company from October…

December 4: The rate of return of microfinance companies has started to…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '19651', 'article_category_id' => '1', 'title' => 'Government to Investigate Ncell Shares Transaction', 'sub_title' => '', 'summary' => 'A meeting of ruling coalition partners convened by Prime Minister Pushpa Kamal Dahal 'Prachanda' has decided to launch a thorough investigation into the sale and purchase of shares in the private telecommunications company, Ncell.', 'content' => '<p> </p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 5: A meeting of ruling coalition partners convened by Prime Minister Pushpa Kamal Dahal 'Prachanda' has decided to launch a thorough investigation into the sale and purchase of shares in the private telecommunications company, Ncell.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">The gathering held at the Prime Minister's residence in Baluwatar on Tuesday evening decided that the government will take swift action to investigate the matter. A forthcoming Cabinet meeting will be tasked with making the necessary arrangements for this inquiry.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Rekha Sharma, Minister for Communications and Information Technology and the government spokesperson, disclosed that a high-level investigation committee will be established during the next cabinet meeting to ascertain the facts surrounding the acquisition and divestiture of Ncell shares. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Minister Sharma denied any involvement of top leaders from the coalition parties in the case. She asserted, "If top leaders were implicated, there would be no investigation. The government is resolute in upholding the rule of law and safeguarding national interests."</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Prime Minister Dahal, Nepali Congress President Sher Bahadur Deuba, CPN (Unified Socialist) Chair Madhav Kumar Nepal, Deputy Prime Minister and Home Minister Narayan Kaji Shrestha, Finance Minister Dr. Prakash Sharan Mahat, and Communications Minister Sharma, among others, were present in the meeting. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-06', 'modified' => '2023-12-06', 'keywords' => '', 'description' => '', 'sortorder' => '19379', 'image' => '20231206060409_collage (2).jpg', 'article_date' => '2023-12-06 05:59:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 1 => array( 'Article' => array( 'id' => '19650', 'article_category_id' => '1', 'title' => 'Tiger Relocated to Bardiya from Chitwan', 'sub_title' => '', 'summary' => 'A tiger has been transferred to Bardiya due to the shortage of cage at the Chitwan National Park (CNP.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 5: A tiger has been transferred to Bardiya due to the shortage of cage at the Chitwan National Park (CNP). </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">CNP's Information Officer Ganesh Prasad Tiwari said that man-eating and violent tigers are kept in cage, but a tiger is being shifted to Bardiya due to paucity of space. A male tiger of around four years old has been sent to Bardiya.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">This tiger was captured in August after it devoured a man in Kumroj settlement of Khairahani Municipality-12. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Four ferocious tigers are kept in cage at Kasara while two such tigers are kept in Sauraha. A female tiger of about 10 years of age has been kept at Sauraha after it attacked a person in Manahari of Makawanpur some days back.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Meanwhile, the CNP is having difficulty managing the increasing number of aggressive tigers. A tiger has to be fed five kilos of buff in a gap of one day. Managing the tigers kept in cage has become difficult for CNP due to shortage of space, human resources and food.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">There are 355 tigers throughout the country, including 128 tigers in CNP. The Park has relocated two aggressive tigers in the current fiscal year. Earlier, a tiger was transferred to Parsa National Park. (RSS) </span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19378', 'image' => '20231205043127_collage (1).jpg', 'article_date' => '2023-12-05 16:30:29', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 2 => array( 'Article' => array( 'id' => '19649', 'article_category_id' => '1', 'title' => 'NEPSE Drops by 10.10 to Close at 1837.71', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) witnessed a loss of 10.10 points or 0.54%, with the index closing at 1837.71 on the third trading day of the week on Tuesday.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 5: The Nepal Stock Exchange (NEPSE) witnessed a loss of 10.10 points or 0.54%, with the index closing at 1837.71 on the third trading day of the week on Tuesday. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Market observers and investors attribute continued downturn trend to various factors, prominently pointing to the stringent policies imposed by the Nepal Rastra Bank (NRB) on the stock market.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Investor Prem Wali said, “The market is unlikely to experience an upward trajectory unless the NRB relaxes its policies related to the stock market”.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">During today’s trading session, a total of 292 scrips were exchanged through 38,584 transactions, involving 4,698,682 traded shares and a turnover of Rs 1.54 billion.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Notably, Mountain Energy Nepal Limited (MEN) dominated the market with the highest turnover of Rs 36 crores.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Singati Hydro Energy Limited (SHEL) experienced the most significant gain, hitting a positive circuit of 10%, while Bishal Bazar Company Limited (BBC) incurred the highest loss of 9.53%.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">In terms of sector indices, all sectors, except Life Insurance, concluded in the red territory. The Manufacturing and Processing sector witnessed the most substantial loss at 2.57%, whereas Mutual Fund showed the least decline at 0.15%.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19377', 'image' => '20231205035742_collage.jpg', 'article_date' => '2023-12-05 15:56:08', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 3 => array( 'Article' => array( 'id' => '19645', 'article_category_id' => '1', 'title' => 'MCA Nepal Delays Re-Inviting Tender for Transmission Line under MCC', 'sub_title' => '', 'summary' => 'December 5: Project officials are dilly-dallying in re-inviting tender bids of transmission lines under the US-funded Millennium Challenge Corporation (MCC). ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">December 5: Project officials are dilly-dallying in re-inviting tender bids of transmission lines under the US-funded Millennium Challenge Corporation (MCC). The countdown of the five-year deadline of the much-hyped project began with the Entry into Force (EIF) on August 30.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">There are doubts that the project will be completed on time due to the delay in implementing the project plans by setting work priority </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The Millennium Challenge Account (MCA) Nepal, which is responsible for implementing the project, had canceled the contract process of the transmission lines in October citing extremely high bids from the interested parties. The MCA Nepal had pledged to initiate the process of re-inviting the tender bids soon. But the tenders have not been called again till date.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">A senior official of MCA Nepal said that it has not yet been decided when and how to re-issue the tender bids for the construction of the transmission line. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"The process of issuing the tenders is underway," said the official, adding, "It seems that it will take a few more weeks to reach a decision."</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">According to him, the process had to be canceled after the lowest bid in the tender was 66 percent higher than the cost estimate. At that time, MCA Nepal had invited bids for the construction of the 315 km long transmission line project dividing it into three parts – Lapsifedi-Ratmate-New Hetaunda section, Ratmate-New Damauli section, New Damauli-New Butwal section of the transmission line.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">As the tender was canceled and the MCA Nepal has not re-issued not new tenders, there is a confusion regarding the construction of transmission line. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">When the tender was called for the first time, MCA Nepal had estimated the cost of USD 226 million to build the transmission line. However, the offer made by the companies that offered the lowest price was much higher than that.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">MCA Nepal has not been able to call for a new tender after making a new estimate of the cost. This has increased the risk of affecting the schedule of the MCC project which has to be completed within five years.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">MCA Nepal did not even inform the board meeting led by the finance secretary about the cancellation of the contract. The operation of MCA-Nepal is done by the executive committee formed under the chairmanship of the secretary of the Ministry of Finance.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Other members of the Board of Directors are Joint Secretary of Ministry of Physical Infrastructure and Transport, Joint Secretary of Ministry of Energy, Water Resources and Irrigation and Managing Director of Nepal Electricity Authority.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Likewise, there are two representatives of the private sector and civil society in the board of directors. The executive director of MCA-Nepal is a member-secretary of the board of directors.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The initial agreement for the project was signed between the Finance Ministry and the US government representatives on September 14, 2017.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">However, the MCC was delayed due to widespread protest by a section of the society on the pretext that the grant agreement was allegedly a part of the Indo-Pacific Strategy of the US government.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">After much debate and deliberations, the House of Representatives finally ratified the MCC grant agreement on February 27, 2022 with a 12-point explanatory note clarifying that the project should not be associated with any military alliance and that the grant agreement must abide by the Constitution of Nepal.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The total cost of the project is USD 697 million (about Rs 92 billion. The US government will provide a grant of USD 500 million dollars while the Government of Nepal will contribute USD 197 million.</span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19375', 'image' => '20231205012546_MCC.jpg', 'article_date' => '2023-12-05 13:24:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '19647', 'article_category_id' => '1', 'title' => 'Five Construction Companies Blacklisted ', 'sub_title' => '', 'summary' => 'December 5: The Public Procurement Monitoring Office has blacklisted five construction and supply companies. Issuing a notice on Tuesday, the office said it has blacklisted the companies for their failure to comply with the rules. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 5: The Public Procurement Monitoring Office has blacklisted five construction and supply companies. Issuing a notice on Tuesday, the office said it has blacklisted the companies for their failure to comply with the rules. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The blacklisted companies include Kathmandu-based Bharat Construction-Mainachuli-Siddhisai JV, which has been blacklisted for three years for abandoning the work on the Pushpalal Highway under the Department of Roads. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Mainachuli-Siddhi JV has been placed on a blacklist for stranding the construction work on the Pushpalal Highway. Panchthar-based Sherpa-Hena-Sunami JV, Dhading-based Kasyang Construction and Suppliers and Jumla-based Ezone Nirman Sewa have been blacklisted for one year each. -- RSS </span></span></span></p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19374', 'image' => '20231205014209_ppmo.jpg', 'article_date' => '2023-12-05 13:41:03', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '19643', 'article_category_id' => '1', 'title' => 'Snowfall in Upper Belt of Gorkha Throws Life out of Gear', 'sub_title' => '', 'summary' => 'December 5: The northern belt of Gorkha district has witnessed snowfall since Monday night. Chum and Nubri valleys located in the upper region of the district received snowfall, according to Chairman of Chumnubri Rural Municipality, Nima Lama. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 5: The northern belt of Gorkha district has witnessed snowfall since Monday night. Chum and Nubri valleys located in the upper region of the district received snowfall, according to Chairman of Chumnubri Rural Municipality, Nima Lama. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Chumchet and Chhekampar of Chum valley and Lho, Prok and Samagaon of Nubri valley were covered with snow, causing severe cold. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Hotel entrepreneur at Samdo, Nima Dorje Lama, informed that the snowfall has caused sheer inconvenience to daily life. Grazing cattle and collecting grass and fodder has been difficult. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The people are also facing problems of drinking water as the water has frozen at its source. Especially the elderly people, children and sick have been hit hard by the chill. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">The Samdo village is located at 3,500 meters above the sea level. A local Chhang Dorje Lama informed that the highlands of mountain region were blanketed with snow. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The snow has also caused difficulty in the movement of foreign and domestic trekkers. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Manaslu Conservation Area Project (MCAP) office said the tourists arrived at Manaslu area were bound to stay inside hotels. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">However, the farmers here have been elated with the snowfall as it would be beneficial for winter crops and fruits. </span></span></span><br /> <span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-family:"Arial Unicode MS","sans-serif"">Snowfall disrupts Mid-Hill Highway in Baglung</span></strong> <br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Meanwhile, the snowfall taking place from Monday morning has disrupted vehicular movement along the Baglung-Rukum East section of the Mid-Hill Highway. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The local residents said that the snowfall has occurred at Nisikhola in Baglung and Patihalne of Rukum East. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Til Bahadur Ghartimagar, a local resident, said that vehicles have remained completely off the road due to continuous snowfall. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The area witnessed rainfall since Sunday evening and snowfall since early morning on Monday. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to Ghartimagar, the cattle taken for grazing have been taken to the lowlands due to snowfall there. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The area of the Dhorpatan Hunting Reserve is covered with snow and the normal life of the people there is badly affected. The Dhorpatan valley and the highlands are covered with snow, hotelier Ganga Bahadur Bhandari said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">However, the farmers there are also elated with the snowfall coupled with rain, which occurred after a long gap as they are hopeful of better yield of the winter crops. -- RSS</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19373', 'image' => '20231205121411_20190208014800_aaaa.jpg', 'article_date' => '2023-12-05 12:13:35', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '19644', 'article_category_id' => '1', 'title' => 'Habib Bank to Sell its Shares in Himalayan Bank to Himalayan Reinsurance Company', 'sub_title' => '', 'summary' => 'December 5: Pakistan’s Habib Bank, the foreign partner of Himalayan Bank, is preparing to sell its shares in the bank to Himalayan Reinsurance Company.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">December 5: Pakistan’s Habib Bank, the foreign partner of Himalayan Bank, is preparing to sell its shares in the bank to Himalayan Reinsurance Company.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Sources informed that Habib and Himalayan Reinsurance have reached an agreement for the purchase and sale of shares at Rs </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">130</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> per share and a correspondence has been sent to Nepal Rastra Bank for approval. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Before the merger of Himalayan Bank with Civil Bank, Habib owned </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">20</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent shares in Himalayan Bank. When shares were adjusted after the merger, Habib's ownership fell to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">12</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent. Accordingly, Habib Bank is going to sell </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">28</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">,</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">12</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">,</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">447</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> shares. However, neither the two banks nor the reinsurance company and Nepal Rastra Bank have formally informed about this deal.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">According to the provisions of the Banks and Financial Institutions Act (BAFIA), promoter shares cannot be sold for five years of operation of banks and financial institutions. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Similarly, the approval of the central bank is required for the sale of shares of companies and organizations with more than </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent share ownership. According to the provisions of the Act, the purchase and sale process will proceed only after the central bank approves the agreement between Habib and Himalayan Reinsurance.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Habib Bank had tried to sell shares of Himalayan Bank four years ago. Although Habib made an agreement with the British Commonwealth Development Corporation (CDC), it was broken after the opposition from Himalayan Bank's management.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Now the reinsurance company is going to buy the shares. The chairman of the company is Shekhar Golcha of Golcha Group. He is also the former president of the Federation of Nepalese Chamber of Commerce and Industries.</span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19372', 'image' => '20231205124741_jpgShare-Swap-02-1024x428.jpg', 'article_date' => '2023-12-05 12:47:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '19641', 'article_category_id' => '1', 'title' => 'Private Sector Company Trans Nepal Freight gets Responsibility to Operate Chobhar Dry Port ', 'sub_title' => '', 'summary' => 'December 5: Trans Nepal Freight Services JV, selected from an international bid for the operation of Chobhar Dry Port, has signed an agreement with Nepal Intermodal Transport Development Committee to share a minimum of Rs 28.8 million rent and charge for five years while operating the newly-built facility.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 5: Trans Nepal Freight Services JV, selected from an international bid for the operation of Chobhar Dry Port, has signed an agreement with Nepal Intermodal Transport Development Committee to share a minimum of Rs 28.8 million rent and charge for five years while operating the newly-built facility. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Nepal Intermodal Transport Development Committee is currently entrusted with the operation of the dry port.</span> <span style="font-family:"Arial Unicode MS","sans-serif"">The committee is a regulatory body formed in accordance with the Nepal Intermodal Transport Development Committee (formation) Order, 2054. As per the agreement signed on Monday, Trans Nepal Freight will operate and manage Chobhar Dry Port from December 15. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Director of the committee Yubak Dangol and Managing Director of Trans Nepal Freight, Mukesh Kumar Rathi, signed the contract agreement in the presence of the committee’s Executive Director Ashish Gajurel. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The committee had issued international tender bids on July 24 for the operation and management of the dry port and integrated check post as well as container freight station under the committee. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">On the occasion, Executive Director Gajurel shared that the commercial use of Chobhar Dry Port has increased within 20 months of its operation and the government will get more revenue if the operation and management of the dry port is given to the private sector. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Managing Director Rathi expressed the belief that the support received earlier from other government bodies and stakeholders including Nepal Intermodal Transport Development Committee will continue for the effective operation and management of the dry port in the coming days. -- RSS</span></span></span></p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19369', 'image' => '20231205112519_Chobhar Dy port.jpg', 'article_date' => '2023-12-05 11:24:41', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '19640', 'article_category_id' => '1', 'title' => 'PM Directs Authorities to Ascertain Legitimacy of Ncell's Share Deal ', 'sub_title' => '', 'summary' => 'December 5: Expressing serious concerns over the news circulating about the sale and purchase of Ncell's share, Prime Minister Pushpa Kamal Dahal has directed the concerned authorities to determinate whether the deal was in line with Nepal's existing laws and legal procedures. ', 'content' => '<p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 5: Expressing serious concerns over the news circulating about the sale and purchase of Ncell's share, Prime Minister Pushpa Kamal Dahal has directed the concerned authorities to determinate whether the deal was in line with Nepal's existing laws and legal procedures. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Prime Minister's press coordinator Surya Kiran Sharma told the state-owned RSS that the PM has directed the authorities to take stock about the legal compliance behind the deal. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Sharma shared that PM Dahal has asked to immediately study the status of Nepal's telecommunications sector, impact on FDI and the revenue collection of the government from the commercial deal of Ncell. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Malaysian company 'Axiata Group Berhad' had decided to sell its 80 per cent of the shares to Spectrlite UK Limited, a company based in the UK. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Questions have been raised from different walks of life over the legitimacy and transparency of the business deal as it was agreed without informing the regulatory body as well, RSS reported. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, the Public Accounts Committee of the Federal Parliament has written to different state agencies about the status of the reported business deal of Ncell. </span></span></span></p> <p><span style="font-size:16px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Axiata, which purchased the shares of Ncell from Swedish company TeliaSonera in 2016 for Rs143 billion recently decided to sell its stakes in less than Rs 7 billion, raising suspicion about the deal.</span></span></span></p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19368', 'image' => '20231205103733_ncell.jpg', 'article_date' => '2023-12-05 10:36:49', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '19639', 'article_category_id' => '1', 'title' => 'Govt Confirms Death of Six Nepalis serving in Russian Army ', 'sub_title' => '', 'summary' => 'December 5: The government has confirmed the death of six Nepali citizens serving in the Russian Army. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">December 5: The government has confirmed the death of six Nepali citizens serving in the Russian Army. The Russian government has been urged to promptly send the bodies back to their homes and ensure compensation to the bereaved families. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Issuing a press statement on Monday, the Ministry of Foreign Affairs said that the government has identified the deceased. The government has urged Russia not to recruit any Nepali citizens in its military force and if anyone is still serving, to return him/her to Nepal. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Earlier on August 1, the government issued a notice stating that the government has no policy of approving the recruitment of any Nepali citizens in foreign military forces expect in the national army of a few friendly nations in accordance with the long-standing agreement. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to the ministry, it has received information about the demise of six Nepali citizens working for the Russian military force. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The government has expressed condolences to the dead ones and expressed deep sympathies to their families. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Those Nepalis dead while working for the Russian Army include Sandip Thapaliya of Gorkha, Rupak Karki of Kapilbastu, Dewan Rai of Kaski, Pritam Karki of Syangja, Raj Kumar Roka of Dolakha and Gangaraj Moktan of Ilam. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, the ministry said that diplomatic initiatives are ongoing to repatriate one Bibek Khatri, who is held hostage in Ukraine. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The ministry has urged Nepali nationals to receive approval letter to be issued from the Department of Consular Services of the Ministry of Foreign Affairs if they are travelling to Russia for other reasons except for government assignment, study purpose in Russian scholarship and businesses. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The ministry has also urged Nepalis not to get recruited in the military service of the war-ravaged nations on the basis of false information or other's temptation. -- RSS</span></span></span></p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19367', 'image' => '20231205101148_russ.jpg', 'article_date' => '2023-12-05 10:11:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '19638', 'article_category_id' => '1', 'title' => 'Manang Draws Highest Number of Foreign Tourists Since COVID-19', 'sub_title' => '', 'summary' => 'Manang district has received the highest number of foreign tourists since the outbreak of the COVID-19 pandemic. According to Annapurna Conservation Area Project (ACAP)'s Area Office in Manang, over 20,800 foreign tourists came to Manang in the last 11 months.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 4: Manang district has received the highest number of foreign tourists since the outbreak of the COVID-19 pandemic. </span></span><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">According to Annapurna Conservation Area Project (ACAP)'s Area Office in Manang, over 20,800 foreign tourists came to Manang in the last 11 months. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">ACAP's Manang Office Chief, Dhak Bahadur Bhujel, shared that Manang welcomed most tourists in October. The tourists mostly visited the district for adventure trekking in the rugged high hills and mountainous zone.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Among all the foreign tourists who visited Manang from January to November this year, the French arrived in the highest number followed by Israeli, German, British, American, and Russian, informed Bhujel.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Similarly, tourists from Austria, the Netherlands, and India reached Manang, according to the ACAP, Manang. </span></span><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">In 2022, a total of 15,903 foreign tourists had visited the district. (RSS) </span></span></p> ', 'published' => true, 'created' => '2023-12-05', 'modified' => '2023-12-05', 'keywords' => '', 'description' => '', 'sortorder' => '19366', 'image' => '20231205101259_20231118091755_Manang becoming a Preferred Choice among Domestic Tourists.jpg', 'article_date' => '2023-12-05 05:50:45', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 11 => array( 'Article' => array( 'id' => '19637', 'article_category_id' => '1', 'title' => 'Snowfall in Dhorpatan Hits Life Hard', 'sub_title' => '', 'summary' => 'Dhorpatan witnessed this season's first snowfall on Monday. It snowed in Dhorpatan, including in the Dhorpatan Hunting Reserve in the morning, said Birendra Kandel, Chief of the Dhorpatan Hunting Reserve Office.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 4: Dhorpatan witnessed this season's first snowfall on Monday. It snowed in Dhorpatan, including in the Dhorpatan Hunting Reserve in the morning, said Birendra Kandel, Chief of the Dhorpatan Hunting Reserve Office.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">"This is the first time snowfall in Dhorpatan this year. Dhorpatan Valley has been blanketed with snow. Normal life has been affected due to the freezing cold due to the snowfall," he said.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">It has become difficult to even give fodder, feed and water to the livestock due to the snow, said Kul Bahadur BK, a local of Dhorpatan. (RSS) </span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-04', 'modified' => '2023-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '19365', 'image' => '20231204043354_collage (19).jpg', 'article_date' => '2023-12-04 16:33:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 12 => array( 'Article' => array( 'id' => '19636', 'article_category_id' => '1', 'title' => 'NEPSE Drops 3.42 Points to Close at 1847.81', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) Index experienced a decline, losing 3.42 points or 0.18%, concluding the second trading day of the week at 1847.81 points on Monday. ', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">December 4: The Nepal Stock Exchange (NEPSE) Index experienced a decline, losing 3.42 points or 0.18%, concluding the second trading day of the week at 1847.81 points on Monday. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">The persistent bearish trend in the market has been attributed to several factors, including the prevailing negative psychology among investors and the stringent policies of the Nepal Rastra Bank regarding the stock market.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">During the day's trading session, a total of 292 scrips were traded, involving 43,428 transactions and 3,896,287 units of shares, with a total turnover of Rs 1.19 billion.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif"> Sonapur Minerals and Oil Limited (SONA) led in turnover, reaching 7.46 crores and closing at a market price of Rs 300 per share.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif"> Meanwhile, Samaj Laghubitta Bitiya Sanstha (SAMAJ) experienced the highest gain at 8.06%, whereas NRN Infrastructure and Development (NRN) and Mountain Energy Nepal Limited (MEN) each incurred losses of 9.99%, closing at market prices of Rs 311 and Rs 477, respectively.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">In terms of sector indices, the Development Bank Index, Finance Index, Life Insurance, Non-Life Insurance, and Mutual Fund closed in the green zone, while other sectors ended up in the red zone.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-04', 'modified' => '2023-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '19364', 'image' => '20231204033514_collage (17).jpg', 'article_date' => '2023-12-04 15:34:11', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 13 => array( 'Article' => array( 'id' => '19635', 'article_category_id' => '1', 'title' => 'IPO Approval Stalled Since October 18', 'sub_title' => '', 'summary' => 'December 4: The Securities Board of Nepal (SEBON) has not approved the IPO of any company from October 18.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">December 4: The Securities Board of Nepal (SEBON) has not approved the IPO of any company from October </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">1</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">8.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The regulatory body took such decision following complaints that the secondary market has been flooded with Initial Public Offerings (IPO).</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">On October </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">1</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">8, the Board had allowed Himalayan Reinsurance Limited to sell its IPO at Rs </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">206</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> per share with premium price. Since then, the IPO issuance has been suspended.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">SEBON Chairman Ramesh Kumar Hamal put the process of issuing IPOs on hold after the board was criticizing even for issuing IPOs of the companies that had completed all the due processes as per the rules. Hamal claimed that even though he was working as per the rules, he had to face many legal battles which have affected the performance of the board.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">After he was criticized for approving the files that had completed the legal processes, Chairman Hamal is considering that the IPOs should be approved by the board of directors. He said that the proposal has not reached the Board of Directors as discussions are ongoing with the management on whether or not the policy put forward by him will be effective for the long-term development of the secondary market.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Hamal said that the issuance of IPOs is being done in a clean and transparent manner by forming a department for the approval process..</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">After the Board delayed the IPO approval process, the investors have insisted on finding a way out soon. Acting President of Share Investors Association (Nepal) Tara Prasad Fullel said that it is not appropriate to stop the IPO approval process. He argued that the regulatory body should not delay the IPO approval by violating its own rules because of criticism.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Lately, the board had given special priority to IPOs. Due to this priority of the board, many companies from the real sector to the hydropower sector have shown interest in IPO. The board opened the way from allowing profitable companies to issue IPO at a premium price to sell shares through the book building method.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The process of selling shares through the book building method was done by Sarvottam Cement. The cut-off price of the IPO sold to qualified institutional investors has been fixed at Rs </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">401</span></span> <span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">per shares. Now the company will sell shares to the general public at </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">10</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent less than this price.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2023-12-04', 'modified' => '2023-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '19363', 'image' => '20231204022456_20210105042837_20190101042956_IPO.jpg', 'article_date' => '2023-12-04 14:24:28', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '19634', 'article_category_id' => '1', 'title' => 'Rate of Return of Microfinance Companies Declining', 'sub_title' => '', 'summary' => 'December 4: The rate of return of microfinance companies has started to decline.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">December 4: The rate of return of microfinance companies has started to decline.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The slump in economic activities due to the effects of the Covid-</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">19</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> epidemic and Russia-Ukraine war among others have resulted in the decline in the profit of microfinance companies. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Nepal Rastra Bank's decision to set the ceiling on interest rates, service charges, etc has also reduced the income of microfinance companies. In recent times, the return on equity (ROE) of microfinance companies has been decreasing due to the increase in bad loans.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">According to Nepal Rastra Bank, the average ROE of microfinance institutions was </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">61.8</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent in the fiscal year (FY) </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2071/72. </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">By March </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2079/80</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, it decreased to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">5.20</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent. The rate of return on equity decreased in </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2076/77</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> due to the impact of Covid-</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">19</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, but then it increased. However, last year, the return of investment decreased due to the decrease in economic activity and the rise in bad loans.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The committee formed to study the problems of microfinance companies has also pointed out that investors are attracted towards microfinance due to high profits but the rate of return has been decreasing of late. According to the committee, the return on equity of commercial banks remained at an average of </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">10.30</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent from </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2072</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2080</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, while that of microfinance was above </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">30</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent. Investors were more enthusiastic about microfinance due to this return.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The return on equity of </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">20</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> institutions turned negative as of March </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2079</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, indicating that the financial condition of the microfinance institutions has been deteriorating, the committee mentioned in the report.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Microfinance companies were established to provide financial services to the underprivileged groups who are out the reach of banks and financial institutions. With the increase in complaints of high interest rates from these institutions, the central bank has started fixing ceiling on interest rates since </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2076. </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">Initially, microfinance companies were not allowed to charge more than </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">18</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent but that was lowered to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">15</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent since </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2078</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The central bank has also set a limit of </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">1.5</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent on the service fee charged by them.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The microfinance operators are demanding a system under which they can determine the interest rate by adding a certain percentage premium to the base rate. The study committee has also recommended to implement the base rate as in case of banks and financial institutions.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The number of microfinance institutions that have obtained permission from the NRB reached the peak in </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2075</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> when there were </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">91</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> such institutions</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">. </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">With the central bank's emphasis on merger and acquisition, the number of microfinance institutions fell to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">63</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> in </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2079. </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">From the year </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2070/71</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> to </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2078/79</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, the non-performing loan of microfinance was less than </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">3</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent of the total loan, but after March </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">2079</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">, it reached </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">7.43</span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif""> percent.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">The study committee has suggested that the microfinance companies cannot be sustainable if the rate of return is weak. It has suggested setting a limit of </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial Unicode MS","sans-serif"">15 </span></span><span style="font-size:15.0pt"><span style="font-family:"Arial","sans-serif"">percent on dividend distribution and removing the limit on the interest rate and applying the spread rate.</span></span></span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2023-12-04', 'modified' => '2023-12-04', 'keywords' => '', 'description' => '', 'sortorder' => '19362', 'image' => '20231204020521_decline_opt.jpg', 'article_date' => '2023-12-04 14:04:47', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117