August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj…

August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj…

August 29: Intex Technologies, the Indian smart phone company has launched its new smart phone in the Nepali market. According to the company, the new smartphone has long battery life and backup with a light sensor. The new smartphone which comes with five megapixels rear camera and two megapixels front camera…

August 29: BF Dear Hill, the manufacturer and seller of Nepali leather shoes has launched more than 50 new and attractive models of shoes in the market aiming the upcoming festival…

August 29: Kia Motors has opened its new showroom in Tinkune, Kathmandu. The new showroom is inaugurated by Suhrid Ghimire, Chairman of Continental Group. The management of the showroom will be…

August 29: NMB Bank has started operation of three new branches in Palpa, Bhairahawa and Damak. Chiranjibi Nepal, Governor of Nepal Rastra Bank (NRB) inaugurated…

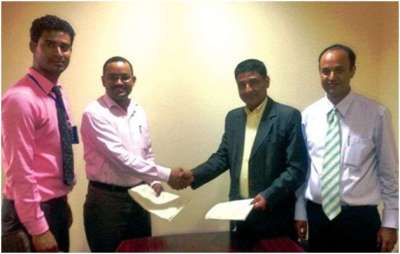

August 28: In the fiscal year (FY) 2072/73, the net revenue from the export of services has dropped by 3.65 percent. As per the report published by Nepal Rastra Bank…

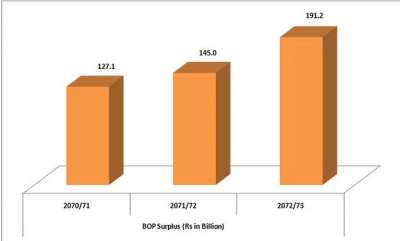

August 28: Major funds operating in the country have shown their desire to invest on hydro power sector of the nation. “We are capable to invest up to Rs 89 billion on the…

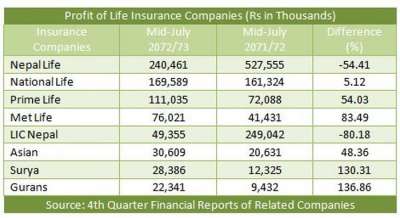

August 28: Profit of life insurance companies has declined in the last FY compared to the previous FY as per the annual financial reports published by the companies. The profit of life insurance companies has declined by 33.45 percent to Rs 727.8 million in the last FY which was Rs 1.09 billion in the previous…

August 28: Asian Life Insurance Company has upgraded its two sub-branches to branches aiming to provide convenient services to the customers. The company has upgraded its sub-branch located in Lalitpur as 23rd branch and sub-branch of Tikapur, Kailali as its 22nd…

August 28: Siddhartha Insurance has entered to an agreement with Health Concern for the promotion of health insurance. Birendra Baidawar Chhetri, Acting General Manager…

August 28: Siddhartha Cement Industries has organised a meeting program with contractors in Soaltee Crowne Plaza on August 24. In the program, Jagadish Agrawal,…

August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the…

August 28: Panchakanya Group has organised blood donation program on the occasion of 'Panchakanya Diwas 2073' as a part of its corporate social responsibility. The company organised the program with the collaboration of Nepal Red cross Society and Central Blood Transfusion…

August 26: The World Bank today approved a credit of USD 55 million for Nepal to scale up its Road Sector Development Program (RSDP) and address post-earthquake reconstruction…

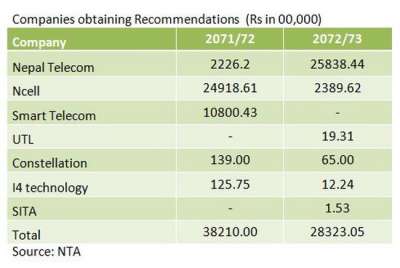

August 26: Nepal Telecom (NT) has obtained the maximum number of recommendations for the import of telecommunication devices during the FY 2072/73. Nepal Telecommunication Authority (NTA) has recommended Rs 2.50 billion above to NT for the import of devices. NT had received Rs 2.58 billion worth of…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4284', 'article_category_id' => '1', 'title' => 'Global IME’s Auto Loan for Suzuki Vehicles', 'sub_title' => '', 'summary' => 'August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj ', 'content' => '<p style="text-align: justify;">August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj Regmi Chief Manager (SME and retail banking) of the bank and Manish Kumar Jain General Manager of Arun Continental signed on the agreement representing their respective company.</p> <p style="text-align: justify;">As per the agreement, the bank will provide loans for purchasing Suzuki brand private and commercial vehicle by charging reasonable interest rate. The bank will provide loans up to 80 percent for the maximum period of 7 years. The agreement has been conducted in order to provide easy auto loan to its customers, informed the bank in a press statement. Presently, it is providing its services through 91 branches, 6 extension counters, 102 ATMs and 42 branchless banking services across the country.</p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4117', 'image' => '20160829011221_ime.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4283', 'article_category_id' => '1', 'title' => 'Intex 3G Smartphone in the Market', 'sub_title' => '', 'summary' => 'August 29: Intex Technologies, the Indian smart phone company has launched its new smart phone in the Nepali market. According to the company, the new smartphone has long battery life and backup with a light sensor. The new smartphone which comes with five megapixels rear camera and two megapixels front camera ha', 'content' => '<p style="text-align: justify;">August 29: Intex Technologies, the Indian smart phone company has launched its new smart phone in the Nepali market. According to the company, the new smartphone has long battery life and backup with a light sensor. The new smartphone which comes with five megapixels rear camera and two megapixels front camera has 1 GB RAM and 8 GB ROM.</p> <p style="text-align: justify;">The new product supporting 3G network service has 1.3 GHz Quadcore processor with android Marshmallow 6.0 version. The smartphone featuring five inches display comes with one year warranty as well. The handset is priced at Rs 8,199 in the Nepali market. </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4116', 'image' => '20160829121854_intex.JPG', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4282', 'article_category_id' => '1', 'title' => 'New BF Dear Hill Shoes in the Market', 'sub_title' => '', 'summary' => 'August 29: BF Dear Hill, the manufacturer and seller of Nepali leather shoes has launched more than 50 new and attractive models of shoes in the market aiming the upcoming festival Dashain-Ti', 'content' => '<p style="text-align:justify">August 29: BF Dear Hill, the manufacturer and seller of Nepali leather shoes has launched more than 50 new and attractive models of shoes in the market aiming the upcoming festival Dashain-Tihar. According to the company, sports shoes and leather belt are two major attractions product line this year. </p> <p style="text-align:justify">“Youth targeted new models of shoes are very attractive and suitable to individuals of every level,” said Homnath Upadhyaya, Managing Director of the company. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4115', 'image' => '20160829115934_dear hill.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4281', 'article_category_id' => '1', 'title' => 'Kia Motors' New Showroom in Tinkune', 'sub_title' => '', 'summary' => 'August 29: Kia Motors has opened its new showroom in Tinkune, Kathmandu. The new showroom is inaugurated by Suhrid Ghimire, Chairman of Continental Group. The management of the showroom will be handle', 'content' => '<p style="text-align:justify">August 29: Kia Motors has opened its new showroom in Tinkune, Kathmandu. The new showroom is inaugurated by Suhrid Ghimire, Chairman of Continental Group. The management of the showroom will be handled by Universal Moto Corp, the authorised distributor of Continental Associates. </p> <p style="text-align:justify"><br /> According to the company, the new showroom occupying 3,000 square feet space will provide comfortable environment to its customers. The company is distributing four-wheelers including Picanto, Rio, Soul, Sportage, Sorento and Grand Carnival in the Nepali market. The company informs that it has been providing 3S facility such as sales, service and spear parts in the major cities of the country. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4114', 'image' => '20160829114435_kia.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4280', 'article_category_id' => '1', 'title' => 'NMB Opens 3 New Branches', 'sub_title' => '', 'summary' => 'August 29: NMB Bank has started operation of three new branches in Palpa, Bhairahawa and Damak. Chiranjibi Nepal, Governor of Nepal Rastra Bank (NRB) inaugurated the', 'content' => '<p style="text-align: justify;">August 29: NMB Bank has started operation of three new branches in Palpa, Bhairahawa and Damak. Chiranjibi Nepal, Governor of Nepal Rastra Bank (NRB) inaugurated the Palpa and Bhairahawa branches amid separate programs. Speaking on the occasion, Governor Nepal said that the Nepali banks needs to increase investment in agricultural sector of the country. “We are dependent on India for a smallest thing. Now the banks need to provide subsidised loans to farmers in order to support them to pursue commercial livestock and agricultural farming,” he added.</p> <p style="text-align: justify;">Meanwhile, Nanda Kishore Rathi, Director of the bank and Ramu Paudyal, NRB’s Regional Director inaugurated the Damak branch. With the addition of the three new branches, the bank now has 71 branches, 50 ATMs and seven extension counters.</p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4113', 'image' => '20160829110222_nmb.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4279', 'article_category_id' => '1', 'title' => 'Decline in Revenue from Service Export ', 'sub_title' => '', 'summary' => 'August 28: In the fiscal year (FY) 2072/73, the net revenue from the export of services has dropped by 3.65 percent. As per the report published by Nepal Rastra Bank (NRB', 'content' => '<p style="text-align: justify;">August 28: In the fiscal year (FY) 2072/73, the net revenue from the export of services has dropped by 3.65 percent. As per the report published by Nepal Rastra Bank (NRB), during the period the total revenue from export of service had decreased by 7.2 percent while the total service expenditure had increased by 5.7 percent that resulted to high decline rate in income from the export of service.</p> <p style="text-align: justify;"><br /> In the last FY, income from service export was negatively affected because of the decrease in the income from tourism sector due to the last year's devastating earthquake, long political instability and undeclared border blockade. Although, the net service revenue declined, the overall BOP surplus has increased by Rs 46 billion to Rs 100.91 billion. </p> <p style="text-align: justify;"><br /> In the FY 2071/72, the net service income had increased by 19.4 percent to Rs 27.61 billion. However, in the last FY, it declined by around 50 percent to Rs 9.84 billion as per the Overall Economic and Financial Situation report of NRB. </p> <p style="text-align: justify;"><br /> Although such revenue received from foreigners has decrease, expenses of Nepalis in the foreign tourism have increased by 6.1 percent. It has lead to the negative growth rate in the net revenue. </p> <p style="text-align: justify;"><br /> The tourism revenue which was increased by 15.2 percent in the previous year has decreased by 21.8 percent in the last year. However, the report mentioned that the tourism expenditure has increased by 6.1 percent. Moreover, the expenditure on foreign education has increased by 18 percent in the last FY which had increased by 12.9 percent in the previous year. According to the NRB, the increased in outflow of service expenditure than the inflow of service revenue has caused the decline in the overall service export revenue of the country.</p> <p style="text-align: justify;"><br /> Another reason for the decrease in the service income is due to the decline in the remittance growth rate. As per the NRB, the growth rate of remittance has declined by 50 percent in the last FY. During the last FY, the growth rate of remittance was 7.77 percent which was 13.6 percent in the previous FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4112', 'image' => '20160828045811_bop[.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4278', 'article_category_id' => '1', 'title' => 'Major Welfare Funds Willing to Invest on Hydro', 'sub_title' => '', 'summary' => 'August 28: Major funds operating in the country have shown their desire to invest on hydro power sector of the nation. “We are capable to invest up to Rs 89 billion on the country', 'content' => '<p style="text-align: justify;">August 28: Major funds operating in the country have shown their desire to invest on hydro power sector of the nation. “We are capable to invest up to Rs 89 billion on the country’s hydropower sector,” stated the funds collectively. The funds have committed to invest in the sector given that the government brings any solid policy to back their investment.</p> <p style="text-align: justify;">The funds including Employees Provident Fund (EPF), Citizens Investment Trust (CIT), Rastriya Bema Sanstha and Nepal Telecom expressed their commitment before Minister of Energy, Dinanath Sharma. In the discussion program held on August 26, EPF committed to investment Rs 32 billion in the hydropower sector. Apart of this, it also mentioned of finalising agreement with various projects in order to invest Rs 35 billion. Similarly, CIT is willing to invest Rs 21 billion whereas NT, Hydropower Investment and Development Company and Nepal Army Welfare Fund are willing to invest Rs 10 billion each. Likewise, Rastriya Beema Sanstha and Nepal Police Welfare Fund are willing to invest Rs 5 billion and 600 million respectively.</p> <p style="text-align: justify;">The funds expressed their desire to invest in the country’s hydropower sector, if the government brings a clear policy. According to the funds, they can invest additional Rs 54 billion annually in the sector. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4111', 'image' => '20160828035646_hydro.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4277', 'article_category_id' => '1', 'title' => 'Profit of Life Insurance Companies Decline', 'sub_title' => '', 'summary' => 'August 28: Profit of life insurance companies has declined in the last FY compared to the previous FY as per the annual financial reports published by the companies. The profit of life insurance companies has declined by 33.45 percent to Rs 727.8 million in the last FY which was Rs 1.09 billion in the previous FY.', 'content' => '<p style="text-align: justify;">August 28: Profit of life insurance companies has declined in the last FY compared to the previous FY as per the annual financial reports published by the companies. The profit of life insurance companies has declined by 33.45 percent to Rs 727.8 million in the last FY which was Rs 1.09 billion in the previous FY.</p> <p style="text-align: justify;">The decline in the profit of the life insurance companies is attributed to the major losses caused by the devastating earthquake of last year. According to the published annual financial reports, Nepal Life Insurance has earned the highest profit in the last FY. However, the profit earned by the company has decreased by 54.40 percent to Rs 240.5 million. Similarly, Gurans Life Insurance has logged the highest profit increase in percentage term despite of lower total amount. The profit of Gurans Life has increased by 136.86 percent during the last FY.</p> <p style="text-align: justify;">According to the numbers of insurance policies issued, Nepal Life Insurance has issued the maximum number of insurance policies. The number of policies has increased to 1.24 million during the last FY. The company has earned the highest amount of insurance premiums as well. It has earned Rs 7.06 billon insurance policies by the end of the last FY.</p> <p style="text-align: justify;">Likewise, Prime Insurance has the highest reserve fund among the insurance companies. The company has increased its reserve fund by 37 percent to Rs 685 million in the last FY from Rs 496.5 million in the previous FY. </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4110', 'image' => '20160828021324_insurance companies.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4276', 'article_category_id' => '1', 'title' => 'Asian Life Upgrades Two Sub-Branches', 'sub_title' => '', 'summary' => 'August 28: Asian Life Insurance Company has upgraded its two sub-branches to branches aiming to provide convenient services to the customers. The company has upgraded its sub-branch located in Lalitpur as 23rd branch and sub-branch of Tikapur, Kailali as its 22nd branch.', 'content' => '<p>August 28: Asian Life Insurance Company has upgraded its two sub-branches to branches aiming to provide convenient services to the customers. The company has upgraded its sub-branch located in Lalitpur as 23rd branch and sub-branch of Tikapur, Kailali as its 22nd branch.</p> <p><br /> Dinesh Lal Shrestha, Director of the company inaugurated branch office of Lalitpur and Rajesh Kumar Shrestha, CEO of the company inaugurated the branch at Tikapur. </p> <p><br /> The company is providing its services through 23 branches and 72 sub-branches across the country. The company informed of opening more branches and sub-branches in near future in order to provide effective customers services. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4109', 'image' => '20160828012321_asian life.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4275', 'article_category_id' => '1', 'title' => 'Agreement between Siddhartha Insurance and Health Concern', 'sub_title' => '', 'summary' => 'August 28: Siddhartha Insurance has entered to an agreement with Health Concern for the promotion of health insurance. Birendra Baidawar Chhetri, Acting General Manager o', 'content' => '<p style="text-align:justify">August 28: Siddhartha Insurance has entered to an agreement with Health Concern for the promotion of health insurance. Birendra Baidawar Chhetri, Acting General Manager of Siddhartha Insurance and Dr Subash Pyakurel, CEO of Health Concern signed the agreement paper on this regard. According to Chhetri, the agreement was carried out in a bid to support the public who are deprived from health facilities by including them in insurance program. CEO of Health Concern, Pyakurel claimed that the health insurance sector will be successful in Nepal as in the developed countries. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4108', 'image' => '20160828010326_health concern.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4274', 'article_category_id' => '1', 'title' => 'Contractors' Meet of Siddhartha Cement', 'sub_title' => '', 'summary' => 'August 28: Siddhartha Cement Industries has organised a meeting program with contractors in Soaltee Crowne Plaza on August 24. In the program, Jagadish Agrawal, Act', 'content' => '<p style="text-align:justify">August 28: Siddhartha Cement Industries has organised a meeting program with contractors in Soaltee Crowne Plaza on August 24. In the program, Jagadish Agrawal, Acting Director of the company expressed his gratitude to all entrepreneurs for selecting Sidhhartha cement for the constructional works. In the program, Rahul Agrawal, Director of the company clarified about the products. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4107', 'image' => '20160828125656_siddhartha cement.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4273', 'article_category_id' => '1', 'title' => 'Non-Performing Loans of Development Banks Shrink', 'sub_title' => '', 'summary' => 'August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the unaudite', 'content' => '<p style="text-align: justify;">August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the unaudited fourth quarter financial reports of 54 development banks, non-performing loans have limited to 1.05 percent average. Experts opined that reduction in non-performing loans can be attributed to Nepal Rastra Bank’s tighten loan management policy and improved performance of the banks.</p> <p style="text-align: justify;">NRB (the Central Bank of Nepal), as a regulatory financial institution of the country, has classified the loan basically into the pass loan, sub-standard loan, doubtful loan and loss or bad loan. Pass loan is that type of loan whose interest or principal payments are less than three months in arrears. Sub-standard loans whose interest or principal payments are longer than three months in arrears of lending conditions are eased. Doubtful is liquidation of outstanding debts appearing uncertain and the accounts suggest that there will be a loss, the exact amount of which cannot be determined. Loss loans are regarded as not collectable, usually loans to firms which applied for legal resolution and protection under bankruptcy laws. Pass loans are under the category of performing loans whereas sub-standard loan, doubtful loan and loss loan are under the non-performing loans.</p> <p style="text-align: justify;"><img alt="" src="/userfiles/images/data%201.JPG" style="height:305px; width:340px" /><img alt="" src="/userfiles/images/data%202.JPG" style="height:303px; width:340px" /></p> <p style="text-align: justify;">Increase in non-performing loans is considered risky in banking sector. Therefore, NRB has directed banks and financial institutions (BFIs) to maintain such loans below 5 percent of total loans. After the NRB directive, Western Development Bank has succeeded to reduce its non-performing loans by 66.84 percent. The bank had 67 percent non-performing loans in the previous FY which has decreased to 0.16 percent during the last FY. Similarly, non-performing loans of Ace Development Bank has decreased to 1.51 percent in the last FY from 3.68 percent in the previous FY. Meanwhile, Sajha Bikash Bank has highest non-performing loans of 2.13 percent. The bank had 0.19 percent non-performing loans in the previous FY that has increased to 3.12 percent in the last FY.</p> <p style="text-align: justify;">At the same time, 5 development banks have zero non-performing loans. The banks having zero non-performing loans are Bagmati, Cosmos, Kakrebihar, Manaslu and Pacific Development Bank. Similarly, 30 development banks have below 1 percent non-performing loans. </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4106', 'image' => '20160828123821_non-pef.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4272', 'article_category_id' => '1', 'title' => 'Panchakanya Group Organises Blood Donation Program', 'sub_title' => '', 'summary' => 'August 28: Panchakanya Group has organised blood donation program on the occasion of 'Panchakanya Diwas 2073' as a part of its corporate social responsibility. The company organised the program with the collaboration of Nepal Red cross Society and Central Blood Transfusion Service.', 'content' => '<p style="text-align: justify;">August 28: Panchakanya Group has organised blood donation program on the occasion of 'Panchakanya Diwas 2073' as a part of its corporate social responsibility. The company organised the program with the collaboration of Nepal Red cross Society and Central Blood Transfusion Service.</p> <p style="text-align: justify;"><br /> According to the organiser, 44 people including directors and employees of the group donated their blood in the program. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4105', 'image' => '20160828112526_bd.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4271', 'article_category_id' => '1', 'title' => 'WB's USD 55mn for Strengthening Strategic Roads and Bridges', 'sub_title' => '', 'summary' => 'August 26: The World Bank today approved a credit of USD 55 million for Nepal to scale up its Road Sector Development Program (RSDP) and address post-earthquake reconstruction needs.', 'content' => '<p>August 26: The World Bank today approved a credit of USD 55 million for Nepal to scale up its Road Sector Development Program (RSDP) and address post-earthquake reconstruction needs. Issuing a press statement the bank said that the loan includes the strengthening of the country’s strategic road and bridge networks to withstand future seismic and climate vulnerabilities. </p> <p>The additional financing will top up World Bank support to the RSDP which has been ongoing since 2008. “When it began, the project intended to provide residents in10 beneficiary districts, including the poorest,in the mid-western and far-western regions of Nepal with all-season road connectivity, reduced travel time, and improvements in access to economic centers and social services,” reads the statement. As per the bank, 25 more districts stand to benefit from the maintenance of earthquake-affected bridges with the additional financing. The original 10 district will also continue to benefit from road upgrading, slope stabilization and bridge works.</p> <p>“The Road Sector Development Project has been the cornerstone of our support to Nepal’s strategic roads network for nearly a decade,” said Takuya Kamata, World Bank Country Manager for Nepal. “While the primary focus has been to develop connectivity in the poorest and remotest regions of the country, the 2015 earthquakes highlighted the need to improve the resilience of key roads and bridges to future natural shocks.”</p> <p>RSDP currently serves a population of two million in 10 districts in the mid-western and far-western regions of Nepal. The project will serve another 10.2 million Nepalis following the maintenance of earthquake affected bridges in the 25 additional districts. The bridges that will undergo maintenance in these districts provide connectivity along the Birgunj-Narayanghat-Mugling-Kathmandu corridor which carries the vast majority of freight into and out of Kathmandu and Pokhara. This corridor is among Nepal’s most vital infrastructure assets for supporting economic growth and development.</p> <p>“Nepal’s hills and mountains are susceptible to extreme precipitation, earthquake, and landslides that can result in severed connectivity, loss of life, and damage to property,” said Farhad Ahmed, Task Team Leader for the project. “Robust construction, better maintenance and improvements in the capacity to respond will help Nepal adapt to unforeseen events.”</p> <p> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-08-26', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4104', 'image' => '20160826061916_logo_worldbank.jpg', 'article_date' => '2016-08-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4270', 'article_category_id' => '1', 'title' => 'NT Importing Telecom Devices worth Rs 2.5 Billion', 'sub_title' => '', 'summary' => 'August 26: Nepal Telecom (NT) has obtained the maximum number of recommendations for the import of telecommunication devices during the FY 2072/73. Nepal Telecommunication Authority (NTA) has recommended Rs 2.50 billion above to NT for the import of devices. NT had received Rs 2.58 billion worth of recomme', 'content' => '<p style="text-align: justify;">August 26: Nepal Telecom (NT) has obtained the maximum number of recommendations for the import of telecommunication devices during the FY 2072/73. Nepal Telecommunication Authority (NTA) has recommended Rs 2.50 billion above to NT for the import of devices. NT had received Rs 2.58 billion worth of recommendations for the same purpose during the last FY. The amount is 91 percent of the total amount provided to import telecom devices.</p> <p style="text-align: justify;">NTA provides recommendations for importing devices to telecom service providers in a bid to operate, expand and improve their services. Such recommendations are provided by NTA to Nepal Rastra Bank through Ministry of Information and Communication. NTA has provided recommendations worth Rs 2.832 billion to import telecommunication devices which is nearly Rs 1 billion less than the previous FY. During the FY 2071/72, NTA had provided recommendation worth Rs 3.820 billion for the import of devices. In the last FY, six different companies including NT, Ncell and UTL obtained the recommendations to import the telecom devices.</p> <p style="text-align: justify;">Although, the regulator recommends billions for the import of telecommunication devices, it is indefinite that the devices have been imported. NTA has not been able to inspect the imported devices by the telecom companies other than NT. According to Achyutananda Mishra, Assistant Spokesperson of the NTA, it lacks required manpower for inspection. </p> ', 'published' => true, 'created' => '2016-08-26', 'modified' => '2016-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '4103', 'image' => '20160826020043_ntc.JPG', 'article_date' => '2016-08-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117

Warning (2): simplexml_load_file() [<a href='http://php.net/function.simplexml-load-file'>function.simplexml-load-file</a>]: I/O warning : failed to load external entity "" [APP/View/Elements/side_bar.ctp, line 60]file not found!Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '4284', 'article_category_id' => '1', 'title' => 'Global IME’s Auto Loan for Suzuki Vehicles', 'sub_title' => '', 'summary' => 'August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj ', 'content' => '<p style="text-align: justify;">August 29: Global IME Bank has signed an agreement to provide auto loan with Arun Continental Traders in a program organized on August 28. During the program, Surendra Raj Regmi Chief Manager (SME and retail banking) of the bank and Manish Kumar Jain General Manager of Arun Continental signed on the agreement representing their respective company.</p> <p style="text-align: justify;">As per the agreement, the bank will provide loans for purchasing Suzuki brand private and commercial vehicle by charging reasonable interest rate. The bank will provide loans up to 80 percent for the maximum period of 7 years. The agreement has been conducted in order to provide easy auto loan to its customers, informed the bank in a press statement. Presently, it is providing its services through 91 branches, 6 extension counters, 102 ATMs and 42 branchless banking services across the country.</p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4117', 'image' => '20160829011221_ime.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 1 => array( 'Article' => array( 'id' => '4283', 'article_category_id' => '1', 'title' => 'Intex 3G Smartphone in the Market', 'sub_title' => '', 'summary' => 'August 29: Intex Technologies, the Indian smart phone company has launched its new smart phone in the Nepali market. According to the company, the new smartphone has long battery life and backup with a light sensor. The new smartphone which comes with five megapixels rear camera and two megapixels front camera ha', 'content' => '<p style="text-align: justify;">August 29: Intex Technologies, the Indian smart phone company has launched its new smart phone in the Nepali market. According to the company, the new smartphone has long battery life and backup with a light sensor. The new smartphone which comes with five megapixels rear camera and two megapixels front camera has 1 GB RAM and 8 GB ROM.</p> <p style="text-align: justify;">The new product supporting 3G network service has 1.3 GHz Quadcore processor with android Marshmallow 6.0 version. The smartphone featuring five inches display comes with one year warranty as well. The handset is priced at Rs 8,199 in the Nepali market. </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4116', 'image' => '20160829121854_intex.JPG', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 2 => array( 'Article' => array( 'id' => '4282', 'article_category_id' => '1', 'title' => 'New BF Dear Hill Shoes in the Market', 'sub_title' => '', 'summary' => 'August 29: BF Dear Hill, the manufacturer and seller of Nepali leather shoes has launched more than 50 new and attractive models of shoes in the market aiming the upcoming festival Dashain-Ti', 'content' => '<p style="text-align:justify">August 29: BF Dear Hill, the manufacturer and seller of Nepali leather shoes has launched more than 50 new and attractive models of shoes in the market aiming the upcoming festival Dashain-Tihar. According to the company, sports shoes and leather belt are two major attractions product line this year. </p> <p style="text-align:justify">“Youth targeted new models of shoes are very attractive and suitable to individuals of every level,” said Homnath Upadhyaya, Managing Director of the company. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4115', 'image' => '20160829115934_dear hill.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 3 => array( 'Article' => array( 'id' => '4281', 'article_category_id' => '1', 'title' => 'Kia Motors' New Showroom in Tinkune', 'sub_title' => '', 'summary' => 'August 29: Kia Motors has opened its new showroom in Tinkune, Kathmandu. The new showroom is inaugurated by Suhrid Ghimire, Chairman of Continental Group. The management of the showroom will be handle', 'content' => '<p style="text-align:justify">August 29: Kia Motors has opened its new showroom in Tinkune, Kathmandu. The new showroom is inaugurated by Suhrid Ghimire, Chairman of Continental Group. The management of the showroom will be handled by Universal Moto Corp, the authorised distributor of Continental Associates. </p> <p style="text-align:justify"><br /> According to the company, the new showroom occupying 3,000 square feet space will provide comfortable environment to its customers. The company is distributing four-wheelers including Picanto, Rio, Soul, Sportage, Sorento and Grand Carnival in the Nepali market. The company informs that it has been providing 3S facility such as sales, service and spear parts in the major cities of the country. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4114', 'image' => '20160829114435_kia.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 4 => array( 'Article' => array( 'id' => '4280', 'article_category_id' => '1', 'title' => 'NMB Opens 3 New Branches', 'sub_title' => '', 'summary' => 'August 29: NMB Bank has started operation of three new branches in Palpa, Bhairahawa and Damak. Chiranjibi Nepal, Governor of Nepal Rastra Bank (NRB) inaugurated the', 'content' => '<p style="text-align: justify;">August 29: NMB Bank has started operation of three new branches in Palpa, Bhairahawa and Damak. Chiranjibi Nepal, Governor of Nepal Rastra Bank (NRB) inaugurated the Palpa and Bhairahawa branches amid separate programs. Speaking on the occasion, Governor Nepal said that the Nepali banks needs to increase investment in agricultural sector of the country. “We are dependent on India for a smallest thing. Now the banks need to provide subsidised loans to farmers in order to support them to pursue commercial livestock and agricultural farming,” he added.</p> <p style="text-align: justify;">Meanwhile, Nanda Kishore Rathi, Director of the bank and Ramu Paudyal, NRB’s Regional Director inaugurated the Damak branch. With the addition of the three new branches, the bank now has 71 branches, 50 ATMs and seven extension counters.</p> ', 'published' => true, 'created' => '2016-08-29', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4113', 'image' => '20160829110222_nmb.jpg', 'article_date' => '2016-08-29 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 5 => array( 'Article' => array( 'id' => '4279', 'article_category_id' => '1', 'title' => 'Decline in Revenue from Service Export ', 'sub_title' => '', 'summary' => 'August 28: In the fiscal year (FY) 2072/73, the net revenue from the export of services has dropped by 3.65 percent. As per the report published by Nepal Rastra Bank (NRB', 'content' => '<p style="text-align: justify;">August 28: In the fiscal year (FY) 2072/73, the net revenue from the export of services has dropped by 3.65 percent. As per the report published by Nepal Rastra Bank (NRB), during the period the total revenue from export of service had decreased by 7.2 percent while the total service expenditure had increased by 5.7 percent that resulted to high decline rate in income from the export of service.</p> <p style="text-align: justify;"><br /> In the last FY, income from service export was negatively affected because of the decrease in the income from tourism sector due to the last year's devastating earthquake, long political instability and undeclared border blockade. Although, the net service revenue declined, the overall BOP surplus has increased by Rs 46 billion to Rs 100.91 billion. </p> <p style="text-align: justify;"><br /> In the FY 2071/72, the net service income had increased by 19.4 percent to Rs 27.61 billion. However, in the last FY, it declined by around 50 percent to Rs 9.84 billion as per the Overall Economic and Financial Situation report of NRB. </p> <p style="text-align: justify;"><br /> Although such revenue received from foreigners has decrease, expenses of Nepalis in the foreign tourism have increased by 6.1 percent. It has lead to the negative growth rate in the net revenue. </p> <p style="text-align: justify;"><br /> The tourism revenue which was increased by 15.2 percent in the previous year has decreased by 21.8 percent in the last year. However, the report mentioned that the tourism expenditure has increased by 6.1 percent. Moreover, the expenditure on foreign education has increased by 18 percent in the last FY which had increased by 12.9 percent in the previous year. According to the NRB, the increased in outflow of service expenditure than the inflow of service revenue has caused the decline in the overall service export revenue of the country.</p> <p style="text-align: justify;"><br /> Another reason for the decrease in the service income is due to the decline in the remittance growth rate. As per the NRB, the growth rate of remittance has declined by 50 percent in the last FY. During the last FY, the growth rate of remittance was 7.77 percent which was 13.6 percent in the previous FY. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4112', 'image' => '20160828045811_bop[.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 6 => array( 'Article' => array( 'id' => '4278', 'article_category_id' => '1', 'title' => 'Major Welfare Funds Willing to Invest on Hydro', 'sub_title' => '', 'summary' => 'August 28: Major funds operating in the country have shown their desire to invest on hydro power sector of the nation. “We are capable to invest up to Rs 89 billion on the country', 'content' => '<p style="text-align: justify;">August 28: Major funds operating in the country have shown their desire to invest on hydro power sector of the nation. “We are capable to invest up to Rs 89 billion on the country’s hydropower sector,” stated the funds collectively. The funds have committed to invest in the sector given that the government brings any solid policy to back their investment.</p> <p style="text-align: justify;">The funds including Employees Provident Fund (EPF), Citizens Investment Trust (CIT), Rastriya Bema Sanstha and Nepal Telecom expressed their commitment before Minister of Energy, Dinanath Sharma. In the discussion program held on August 26, EPF committed to investment Rs 32 billion in the hydropower sector. Apart of this, it also mentioned of finalising agreement with various projects in order to invest Rs 35 billion. Similarly, CIT is willing to invest Rs 21 billion whereas NT, Hydropower Investment and Development Company and Nepal Army Welfare Fund are willing to invest Rs 10 billion each. Likewise, Rastriya Beema Sanstha and Nepal Police Welfare Fund are willing to invest Rs 5 billion and 600 million respectively.</p> <p style="text-align: justify;">The funds expressed their desire to invest in the country’s hydropower sector, if the government brings a clear policy. According to the funds, they can invest additional Rs 54 billion annually in the sector. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4111', 'image' => '20160828035646_hydro.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 7 => array( 'Article' => array( 'id' => '4277', 'article_category_id' => '1', 'title' => 'Profit of Life Insurance Companies Decline', 'sub_title' => '', 'summary' => 'August 28: Profit of life insurance companies has declined in the last FY compared to the previous FY as per the annual financial reports published by the companies. The profit of life insurance companies has declined by 33.45 percent to Rs 727.8 million in the last FY which was Rs 1.09 billion in the previous FY.', 'content' => '<p style="text-align: justify;">August 28: Profit of life insurance companies has declined in the last FY compared to the previous FY as per the annual financial reports published by the companies. The profit of life insurance companies has declined by 33.45 percent to Rs 727.8 million in the last FY which was Rs 1.09 billion in the previous FY.</p> <p style="text-align: justify;">The decline in the profit of the life insurance companies is attributed to the major losses caused by the devastating earthquake of last year. According to the published annual financial reports, Nepal Life Insurance has earned the highest profit in the last FY. However, the profit earned by the company has decreased by 54.40 percent to Rs 240.5 million. Similarly, Gurans Life Insurance has logged the highest profit increase in percentage term despite of lower total amount. The profit of Gurans Life has increased by 136.86 percent during the last FY.</p> <p style="text-align: justify;">According to the numbers of insurance policies issued, Nepal Life Insurance has issued the maximum number of insurance policies. The number of policies has increased to 1.24 million during the last FY. The company has earned the highest amount of insurance premiums as well. It has earned Rs 7.06 billon insurance policies by the end of the last FY.</p> <p style="text-align: justify;">Likewise, Prime Insurance has the highest reserve fund among the insurance companies. The company has increased its reserve fund by 37 percent to Rs 685 million in the last FY from Rs 496.5 million in the previous FY. </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4110', 'image' => '20160828021324_insurance companies.JPG', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 8 => array( 'Article' => array( 'id' => '4276', 'article_category_id' => '1', 'title' => 'Asian Life Upgrades Two Sub-Branches', 'sub_title' => '', 'summary' => 'August 28: Asian Life Insurance Company has upgraded its two sub-branches to branches aiming to provide convenient services to the customers. The company has upgraded its sub-branch located in Lalitpur as 23rd branch and sub-branch of Tikapur, Kailali as its 22nd branch.', 'content' => '<p>August 28: Asian Life Insurance Company has upgraded its two sub-branches to branches aiming to provide convenient services to the customers. The company has upgraded its sub-branch located in Lalitpur as 23rd branch and sub-branch of Tikapur, Kailali as its 22nd branch.</p> <p><br /> Dinesh Lal Shrestha, Director of the company inaugurated branch office of Lalitpur and Rajesh Kumar Shrestha, CEO of the company inaugurated the branch at Tikapur. </p> <p><br /> The company is providing its services through 23 branches and 72 sub-branches across the country. The company informed of opening more branches and sub-branches in near future in order to provide effective customers services. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4109', 'image' => '20160828012321_asian life.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 9 => array( 'Article' => array( 'id' => '4275', 'article_category_id' => '1', 'title' => 'Agreement between Siddhartha Insurance and Health Concern', 'sub_title' => '', 'summary' => 'August 28: Siddhartha Insurance has entered to an agreement with Health Concern for the promotion of health insurance. Birendra Baidawar Chhetri, Acting General Manager o', 'content' => '<p style="text-align:justify">August 28: Siddhartha Insurance has entered to an agreement with Health Concern for the promotion of health insurance. Birendra Baidawar Chhetri, Acting General Manager of Siddhartha Insurance and Dr Subash Pyakurel, CEO of Health Concern signed the agreement paper on this regard. According to Chhetri, the agreement was carried out in a bid to support the public who are deprived from health facilities by including them in insurance program. CEO of Health Concern, Pyakurel claimed that the health insurance sector will be successful in Nepal as in the developed countries. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4108', 'image' => '20160828010326_health concern.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 10 => array( 'Article' => array( 'id' => '4274', 'article_category_id' => '1', 'title' => 'Contractors' Meet of Siddhartha Cement', 'sub_title' => '', 'summary' => 'August 28: Siddhartha Cement Industries has organised a meeting program with contractors in Soaltee Crowne Plaza on August 24. In the program, Jagadish Agrawal, Act', 'content' => '<p style="text-align:justify">August 28: Siddhartha Cement Industries has organised a meeting program with contractors in Soaltee Crowne Plaza on August 24. In the program, Jagadish Agrawal, Acting Director of the company expressed his gratitude to all entrepreneurs for selecting Sidhhartha cement for the constructional works. In the program, Rahul Agrawal, Director of the company clarified about the products. </p> <p> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-29', 'keywords' => '', 'description' => '', 'sortorder' => '4107', 'image' => '20160828125656_siddhartha cement.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 11 => array( 'Article' => array( 'id' => '4273', 'article_category_id' => '1', 'title' => 'Non-Performing Loans of Development Banks Shrink', 'sub_title' => '', 'summary' => 'August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the unaudite', 'content' => '<p style="text-align: justify;">August 28: Non-performing loans of development Banks are apparently decreasing in recent times. It is indicated by the annual financial reports of 54 operating development banks in the last FY. During the last FY, non-performing loans of development banks have decreased by 1.82 percent average. According to the unaudited fourth quarter financial reports of 54 development banks, non-performing loans have limited to 1.05 percent average. Experts opined that reduction in non-performing loans can be attributed to Nepal Rastra Bank’s tighten loan management policy and improved performance of the banks.</p> <p style="text-align: justify;">NRB (the Central Bank of Nepal), as a regulatory financial institution of the country, has classified the loan basically into the pass loan, sub-standard loan, doubtful loan and loss or bad loan. Pass loan is that type of loan whose interest or principal payments are less than three months in arrears. Sub-standard loans whose interest or principal payments are longer than three months in arrears of lending conditions are eased. Doubtful is liquidation of outstanding debts appearing uncertain and the accounts suggest that there will be a loss, the exact amount of which cannot be determined. Loss loans are regarded as not collectable, usually loans to firms which applied for legal resolution and protection under bankruptcy laws. Pass loans are under the category of performing loans whereas sub-standard loan, doubtful loan and loss loan are under the non-performing loans.</p> <p style="text-align: justify;"><img alt="" src="/userfiles/images/data%201.JPG" style="height:305px; width:340px" /><img alt="" src="/userfiles/images/data%202.JPG" style="height:303px; width:340px" /></p> <p style="text-align: justify;">Increase in non-performing loans is considered risky in banking sector. Therefore, NRB has directed banks and financial institutions (BFIs) to maintain such loans below 5 percent of total loans. After the NRB directive, Western Development Bank has succeeded to reduce its non-performing loans by 66.84 percent. The bank had 67 percent non-performing loans in the previous FY which has decreased to 0.16 percent during the last FY. Similarly, non-performing loans of Ace Development Bank has decreased to 1.51 percent in the last FY from 3.68 percent in the previous FY. Meanwhile, Sajha Bikash Bank has highest non-performing loans of 2.13 percent. The bank had 0.19 percent non-performing loans in the previous FY that has increased to 3.12 percent in the last FY.</p> <p style="text-align: justify;">At the same time, 5 development banks have zero non-performing loans. The banks having zero non-performing loans are Bagmati, Cosmos, Kakrebihar, Manaslu and Pacific Development Bank. Similarly, 30 development banks have below 1 percent non-performing loans. </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4106', 'image' => '20160828123821_non-pef.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 12 => array( 'Article' => array( 'id' => '4272', 'article_category_id' => '1', 'title' => 'Panchakanya Group Organises Blood Donation Program', 'sub_title' => '', 'summary' => 'August 28: Panchakanya Group has organised blood donation program on the occasion of 'Panchakanya Diwas 2073' as a part of its corporate social responsibility. The company organised the program with the collaboration of Nepal Red cross Society and Central Blood Transfusion Service.', 'content' => '<p style="text-align: justify;">August 28: Panchakanya Group has organised blood donation program on the occasion of 'Panchakanya Diwas 2073' as a part of its corporate social responsibility. The company organised the program with the collaboration of Nepal Red cross Society and Central Blood Transfusion Service.</p> <p style="text-align: justify;"><br /> According to the organiser, 44 people including directors and employees of the group donated their blood in the program. </p> <p style="text-align: justify;"> </p> ', 'published' => true, 'created' => '2016-08-28', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4105', 'image' => '20160828112526_bd.jpg', 'article_date' => '2016-08-28 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 13 => array( 'Article' => array( 'id' => '4271', 'article_category_id' => '1', 'title' => 'WB's USD 55mn for Strengthening Strategic Roads and Bridges', 'sub_title' => '', 'summary' => 'August 26: The World Bank today approved a credit of USD 55 million for Nepal to scale up its Road Sector Development Program (RSDP) and address post-earthquake reconstruction needs.', 'content' => '<p>August 26: The World Bank today approved a credit of USD 55 million for Nepal to scale up its Road Sector Development Program (RSDP) and address post-earthquake reconstruction needs. Issuing a press statement the bank said that the loan includes the strengthening of the country’s strategic road and bridge networks to withstand future seismic and climate vulnerabilities. </p> <p>The additional financing will top up World Bank support to the RSDP which has been ongoing since 2008. “When it began, the project intended to provide residents in10 beneficiary districts, including the poorest,in the mid-western and far-western regions of Nepal with all-season road connectivity, reduced travel time, and improvements in access to economic centers and social services,” reads the statement. As per the bank, 25 more districts stand to benefit from the maintenance of earthquake-affected bridges with the additional financing. The original 10 district will also continue to benefit from road upgrading, slope stabilization and bridge works.</p> <p>“The Road Sector Development Project has been the cornerstone of our support to Nepal’s strategic roads network for nearly a decade,” said Takuya Kamata, World Bank Country Manager for Nepal. “While the primary focus has been to develop connectivity in the poorest and remotest regions of the country, the 2015 earthquakes highlighted the need to improve the resilience of key roads and bridges to future natural shocks.”</p> <p>RSDP currently serves a population of two million in 10 districts in the mid-western and far-western regions of Nepal. The project will serve another 10.2 million Nepalis following the maintenance of earthquake affected bridges in the 25 additional districts. The bridges that will undergo maintenance in these districts provide connectivity along the Birgunj-Narayanghat-Mugling-Kathmandu corridor which carries the vast majority of freight into and out of Kathmandu and Pokhara. This corridor is among Nepal’s most vital infrastructure assets for supporting economic growth and development.</p> <p>“Nepal’s hills and mountains are susceptible to extreme precipitation, earthquake, and landslides that can result in severed connectivity, loss of life, and damage to property,” said Farhad Ahmed, Task Team Leader for the project. “Robust construction, better maintenance and improvements in the capacity to respond will help Nepal adapt to unforeseen events.”</p> <p> </p> <p style="text-align:justify"> </p> ', 'published' => true, 'created' => '2016-08-26', 'modified' => '2016-08-28', 'keywords' => '', 'description' => '', 'sortorder' => '4104', 'image' => '20160826061916_logo_worldbank.jpg', 'article_date' => '2016-08-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ), (int) 14 => array( 'Article' => array( 'id' => '4270', 'article_category_id' => '1', 'title' => 'NT Importing Telecom Devices worth Rs 2.5 Billion', 'sub_title' => '', 'summary' => 'August 26: Nepal Telecom (NT) has obtained the maximum number of recommendations for the import of telecommunication devices during the FY 2072/73. Nepal Telecommunication Authority (NTA) has recommended Rs 2.50 billion above to NT for the import of devices. NT had received Rs 2.58 billion worth of recomme', 'content' => '<p style="text-align: justify;">August 26: Nepal Telecom (NT) has obtained the maximum number of recommendations for the import of telecommunication devices during the FY 2072/73. Nepal Telecommunication Authority (NTA) has recommended Rs 2.50 billion above to NT for the import of devices. NT had received Rs 2.58 billion worth of recommendations for the same purpose during the last FY. The amount is 91 percent of the total amount provided to import telecom devices.</p> <p style="text-align: justify;">NTA provides recommendations for importing devices to telecom service providers in a bid to operate, expand and improve their services. Such recommendations are provided by NTA to Nepal Rastra Bank through Ministry of Information and Communication. NTA has provided recommendations worth Rs 2.832 billion to import telecommunication devices which is nearly Rs 1 billion less than the previous FY. During the FY 2071/72, NTA had provided recommendation worth Rs 3.820 billion for the import of devices. In the last FY, six different companies including NT, Ncell and UTL obtained the recommendations to import the telecom devices.</p> <p style="text-align: justify;">Although, the regulator recommends billions for the import of telecommunication devices, it is indefinite that the devices have been imported. NTA has not been able to inspect the imported devices by the telecom companies other than NT. According to Achyutananda Mishra, Assistant Spokesperson of the NTA, it lacks required manpower for inspection. </p> ', 'published' => true, 'created' => '2016-08-26', 'modified' => '2016-08-26', 'keywords' => '', 'description' => '', 'sortorder' => '4103', 'image' => '20160826020043_ntc.JPG', 'article_date' => '2016-08-26 00:00:00', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '16' ) ) ) $current_user = null $logged_in = falsesimplexml_load_file - [internal], line ?? include - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117