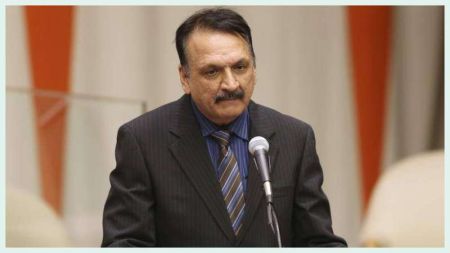

Nepal Rastra Bank Governor Maha Prasad Adhikari heeded to the pressure from all sides as he unveiled a ‘flexible’ monetary policy paving the way for more credit expansion and regulatory…

Nepal Rastra Bank Governor Maha Prasad Adhikari heeded to the pressure from all sides as he unveiled a ‘flexible’ monetary policy paving the way for more credit expansion and regulatory…

KATHMANDU: The government has issued 73-point guidelines for the enforcement of the budget, directed at all ministries, provincial governments, and local governments.…

KATHMANDU: Deputy Prime Minister and Minister for Finance Bishnu Prasad Poudel has assured construction entrepreneurs that their complaints regarding overdue payments from the government will be addressed…

KATHMANDU: President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) Chandra Prasad Dhakal highlighted the need to form a high-level mechanism with private sector’s participation to address the existing economic…

KATHMANDU: Ride-sharing platform inDrive has launched its courier service…

KATHMANDU: The government has consistently failed to achieve its revenue targets of late.…

The government has set its target on achieving a 6% economic growth rate in the next fiscal year, 2023/24. The Finance Minister, Dr. Prakash Sharan Mahat, unveiled this target while presenting the budget statement in Parliament on…

Finance Minister Dr Prakash Sharan Mahat has presented the Economic Survey of Fiscal Year 2022/23 and the Annual Situation Review of Public Corporations, 2023 in the separate meetings of the House of Representatives (HoR) and the National Assembly…

Nepal's per capita income is estimated to reach an all-time high of 1410 US Dollars or NPR 1,84,710 in the current fisacl year, according to the latest statistics released by the National Statistics…

Finance Minister Dr. Prakash Sharan Mahat has emphasized the importance of collective efforts from all sectors and parties to improve the struggling…

Minister for Finance Dr Prakash Sharan Mahat stressed that that the government and private sector should collaborate to remove difficulties facing the country’s…

Nepal Chamber of Commerce (NCC) has urged Finance Minister Dr Prakash Sharan Mahat to expand the scope of tax. A delegation of NCC including its president Rajendra Malla called on the Finance Minister on Tuesday and suggested that the government fulfill the revenue collection target by expanding the tax…

The Asian Development Bank (ADB) has estimated Nepal’s economic growth (gross domestic product growth) rate to be 4.1 per cent for the fiscal year 2023, down from an estimated growth of 5.8% in fiscal year…

The NEPSE index fell 16.67 points and closed at 1,871.88 on the second trading Monday as well. The Sensitive Index plunged by 3.05 points. Likewise, Floated Index, and Sensitive Floated Index decreased by 1.16 and 1.04…

Janakpur Customs Office Janakpurdham is finding it tough to meet its revenue collection target in the current fiscal…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '21660', 'article_category_id' => '274', 'title' => 'Monetary Policy ‘Cautiously Accommodative’ to make the Economy Vibrant: NRB', 'sub_title' => 'Economists, however, argue it might fail to address the issues plaguing Nepal’s economy', 'summary' => 'Nepal Rastra Bank Governor Maha Prasad Adhikari heeded to the pressure from all sides as he unveiled a ‘flexible’ monetary policy paving the way for more credit expansion and regulatory relaxation.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">NewBiz Report</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Kathmandu, July 28</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Nepal Rastra Bank Governor Maha Prasad Adhikari heeded to the pressure from all sides as he unveiled a ‘flexible’ monetary policy paving the way for more credit expansion and regulatory relaxation.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The monetary policy eased many provisions to help the construction sector as contractors are facing financial trouble particularly due to the government's failure to pay their dues.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The private sector’s demand for the working capital guideline has also been addressed by the monetary policy. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Nepal Rastra Bank on Friday (July 26) unveiled the monetary policy for the current fiscal year, 2024-25, which began on July 16. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Governor Maha Prasad Adhikari said, while unveiling the policy, that the central bank has continued its agenda of a ‘cautiously accommodative’ monetary policy to make the economy vibrant. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">While the private sector has welcomed the monetary policy, economists argue it might fail to address the issues which have plagued the economy for the past few years.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Despite the availability of excess liquidity in the banking system, stagnation in credit expansion and surge in non-performing loans have troubled the banks and financial institutions.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">According to the central bank’s data, the credit expansion to the private sector from Banks and Financial Institutions increased by 5.1% year-on-year in the first 11 months of the last fiscal year, until mid-June. The credit expansion growth target for the last fiscal year was 11.5%.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Similarly, the overall non-performing loans ratio was 3.98 in the first nine months, until mid-April, of the last fiscal year.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Sunil KC, CEO of NMB Bank, said that the new monetary policy has tried to identify and address the issues in the overall economy. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“It gives the positive vibe to support the vibrant economic activities,” said KC, who is also the president of the Nepal Bankers’ Association. “But, the monetary policy has its own limitations.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Governor Adhikair said the new monetary policy aims to direct credit expansion towards the productive sectors to help the government achieve its target of 6% growth rate in the current fiscal year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">For this purpose, the growth rate of the broad money supply and the credit to the private sector from the BFIs is projected to be 12% and 12.5%, respectively.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">To boost the demand, the new monetary policy has reduced the bank rate to 6.5% from 7% and the policy rate to 5% from 5.5%, while keeping the deposit collection rate unchanged at 3%.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Bank rate, policy rate and the deposit collection rate are the upper, middle and lower limits of the NRB’s interest rate corridor. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">While BFIs have to pay the central bank an interest as per the bank rate for the Standing Liquidity Facility, policy rate determines the interest in case of overnight repo.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The reduction in bank rate and policy rate is expected to bring down the interest rate on credit in the long run, which contributes to credit expansion. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Nepal’s construction sector is yet to revive itself from the shocks of post-Covid economic slowdown and surge in oil prices following Russia-Ukraine conflict. The construction sector too has welcomed the new monetary policy.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Besides the external causes, lack of payment from the government has made the matter worse for the contractors, said Rabi Singh, president of the Federation of Contractors’ Association of Nepal (FCAN). “Government still owes us around Rs 60 billion for the completed projects.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The central bank has tried to address the concerns of contractors by extending the deadline for the repayment of their loans till mid-December this year. The contractors will also not be blacklisted in cases of dishonoured cheques until further provision is made regarding their credit information. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Singh, from FCAN, said the new monetary policy has attempted to address their concerns.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“We had made the same demand with the same governor when the NRB was formulating a monetary policy for fiscal year 2021-22,” said Singh. “We welcome it, but it has only provided a temporary solution.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“We are reeling from a lack of capital, but we cannot take additional loans for having a bad credit history. The authorities concerned can revitalise the construction industry by providing us additional loans, equal to at least 25% of our existing loans.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The new monetary policy, especially the one regarding the construction sector, has surprised economists.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Economist Keshav Acharya argued that the central bank came under pressure after the government’s budget could not help revitalise the economy. It caused everybody, including the private sector and traders, to put their hope on monetary policy, he said. “It is the first time the central bank has talked so much about the construction sector in its monetary policy.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“The monetary policy diverted from its core objectives,” said Acharya. “It should have been focused on ensuring financial stability to create a favourable environment for investment.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">But people have started to regard it as a policy for expanding credit to the private sector, Acharya added.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Acharya claimed our economic cycle which was hit hard by the Covid pandemic was further disrupted by the then monetary policy after more than Rs. 200 billion was supplied in the market as a refinance facility during the post-Covid period. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“Though there was a massive growth in credit expansion, the money was not invested in productive sectors, but in speculative sectors such as share market and real estate,” Acharya added. “What is the guarantee that credit expansion, which the new monetary policy envisions, will go to the productive sector?”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The monetary policy also scrapped the Rs. 200 million cap on the share mortgage loans for institutional investors. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Economist Acharya suspects that big investors will increase their investment in share market by taking loans. “The same cycle might repeat if the money goes to the unproductive sector.”</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><strong><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Below are other key highlights of the new monetary policy:</span></span></strong></span></span></p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Reduction in loan loss provision on performing loans from 1.2% to 1.1% to ease the pressure on the bank's capital fund. </span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">To coordinate with the government for making necessary laws for the establishment of a separate mechanism for regulation and monitoring of the cooperatives.</span></span></span></span><br /> </li> </ul> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The central bank says it will facilitate the government to return as much as Rs. 500,000 each to depositors of problematic cooperatives, by recovering them from the directors’ properties.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The monetary policy has postponed the deadline for credit integration under the working capital loans by 1 year.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">“The Rs. 10 million cap fixed for micro, cottage and small industry will be reviewed,” reads the monetary policy. </span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Existing provisions will be reviewed to include industries supporting agriculture, producing farming tools, and sectors related to information technology, tourism and domestic production on the list of sectors which are getting up to Rs. 20 million loan with interest rate at premiums not exceeding 2% on the base rate.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The private equity and venture capital firms will not be blacklisted if any institution they had invested in gets blacklisted for not being able to repay its debt.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">For the purpose of establishing an Asset Management Company to manage the non-performing and non-banking assets of BFIs, a draft of the Asset Management Act will be made and presented to the government.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">A guideline will be prepared for the maximum utilisation of Artificial Intelligence in the financial sector after carrying out required study and identifying risks.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The aspiring Nepali migrant workers having labour permits will be provided a collateral-free loan, after assurance that they will send the money home to a bank account.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The monetary policy has encouraged microfinance institutions for merger and acquisitions. It has also made a provision for rescheduling of loans by paying a certain percent of interest, for customers who are unable to pay their loans at such institutions.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Increment in the foreign exchange limit for Draft/ Telex Transfer (TT) facilities in the import of goods from $35,000 to $50,000</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Increase in import limit through ‘Document Against payment’ and ‘Document Against Acceptance’ from existing $60,000 to $100,000</span></span></span></span></li> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Central bank to move forward the work of designing the Wholesale central bank digital currency (CBDC)</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Necessary infrastructure to be prepared to fully operate the National Payment Switch.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">Required facilitation will be provided for debt restructuring and risk management to entrepreneurs and businesses making regular payments of their loans despite their businesses being shut down.</span></span></span></span></li> </ul> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">BFIs will be able to count certain amounts from regulatory reserves as Tier 2 Capital, in line with the provisions of the Capital Adequacy Framework, 2015, in such a way that total capital fund will not be more than twice the primary capital fund.</span></span></span></span></li> </ul> <p> </p> <ul> <li><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt"><span style="font-family:"Georgia","serif"">The new monetary policy has also made a provision that banking related operations of a partner company in a joint venture will not be affected if another partner company gets blacklisted.</span></span></span></span></li> </ul> ', 'published' => true, 'created' => '2024-07-28', 'modified' => '2024-07-28', 'keywords' => '', 'description' => '', 'sortorder' => '21386', 'image' => '20240728121053_20240726013059_424955047_772567931571772_1015407410200493500_n.jpg', 'article_date' => '2024-07-28 12:07:07', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '21575', 'article_category_id' => '274', 'title' => 'Government Issues 73-Point Guidelines for Budget Enforcement', 'sub_title' => '', 'summary' => 'KATHMANDU: The government has issued 73-point guidelines for the enforcement of the budget, directed at all ministries, provincial governments, and local governments. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">KATHMANDU: The government has issued 73-point guidelines for the enforcement of the budget, directed at all ministries, provincial governments, and local governments. The Finance Ministry made public the circular, which aims at promoting efficiency in budget spending and enhancing effectiveness.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">The guidelines cover various agendas, including the authority of budget spending, project approval and allocation, project handover and enforcement, budget transfer, amendment and reporting, fiscal transparency, accountability, and monitoring.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">According to the circular, government bodies allocated budgets for implementation in partnership must inform the Finance Ministry and the Financial Comptroller General Office about the budget share and expected results. Additionally, work procedures for budget implementation should be prepared within this month and updated on the website within a week after endorsement.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">Approval from the Finance Ministry is mandatory for work procedures requiring long-term liability. The adoption of two-shift work has been recommended for projects of national priority.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">As per the guidelines, project chiefs should be selected based on internal competition to ensure effective project enforcement. The new guidelines demand establishing criteria to discourage the transfer of employees assigned as project chiefs during the project term, except for those who fail to achieve adequate marks in performance evaluations.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""><span style="font-size:13.5pt"><span style="font-family:"Calibri","sans-serif"">Furthermore, any works not included in the budget must not be entertained. Finance Secretary Madhu Kumar Marasini informed that the guidelines would be useful in meeting liabilities incurred at the end of the fiscal year. -- RSS</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif""> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-07-18', 'modified' => '2024-07-18', 'keywords' => 'guidelines,, government, Nepal, budget, implementation', 'description' => '', 'sortorder' => '21301', 'image' => '20240718053108_guideline.jpg', 'article_date' => '2024-07-18 05:30:30', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '21574', 'article_category_id' => '274', 'title' => 'Finance Minister Poudel Assures Payment for Construction Entrepreneurs', 'sub_title' => '', 'summary' => 'KATHMANDU: Deputy Prime Minister and Minister for Finance Bishnu Prasad Poudel has assured construction entrepreneurs that their complaints regarding overdue payments from the government will be addressed soon.', 'content' => '<h3><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: Deputy Prime Minister and Minister for Finance Bishnu Prasad Poudel has assured construction entrepreneurs that their complaints regarding overdue payments from the government will be addressed soon.</span></span></h3> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In a meeting with the office-bearers of the Federation of Contractors' Association of Nepal (FCAN) at his office in Singha Durbar on Wednesday, Minister Poudel reassured them that there will be no room for complaints regarding outstanding payments.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The newly appointed Minister Poudel also pledged to resolve the longstanding electricity fee dispute between industrialists and the Nepal Electricity Authority concerning the 'dedicated feeder’ and 'trunk line' in accordance with prevailing law.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He mentioned that the Head of the Government has already outlined the government's stance on the 'dedicated feeder and trunk line dispute' and urged construction entrepreneurs not to panic about this matter.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Minister Poudel emphasized that the government will not create any liabilities through illegal means and will avoid such efforts if any arise.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He further stated that the government, as the guardian of the private sector, is always ready to listen to the problems and complaints of the private sector and seek solutions.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"The incumbent government will not let the trust and confidence of the private sector be broken," he vowed, urging the delegation to move ahead with high morale and contribute to nation-building with confidence.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Minister Poudel acknowledged that his biggest challenge as the Minister for Finance is to raise the morale of the private sector and the general public, which he noted has been waning lately.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He expressed concerns over the decreasing demand and exports, along with the recent dip in revenue collection and capital expenditure.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The finance minister also expressed the government's readiness for legal, structural, and practical reforms to boost the morale of the private sector and enhance the construction sector.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He sought suggestions from construction entrepreneurs on how the government can facilitate supportive policies,, He added that the government has adopted a policy of facilitating, supporting, and collaborating with the private sector.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Minister Poudel assured that the government is aware of the inconveniences faced by the private sector regarding policy implementation and legal arrangements and will consider making laws more flexible and easy to address these issues.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He expressed his belief that the monetary policy to be rolled out by the Nepal Rastra Bank in the next fiscal year would address the existing issues of the financial sector.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-07-18', 'modified' => '2024-07-18', 'keywords' => 'FCAN, construction, payment, dues, government, Nepal', 'description' => '', 'sortorder' => '21300', 'image' => '20240718052912_fcan.jpg', 'article_date' => '2024-07-18 05:28:08', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '21573', 'article_category_id' => '274', 'title' => 'FNCCI Calls on Government for Policy Decision to Motivate Private Sector', 'sub_title' => '', 'summary' => 'KATHMANDU: President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) Chandra Prasad Dhakal highlighted the need to form a high-level mechanism with private sector’s participation to address the existing economic problems.', 'content' => '<h3><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) Chandra Prasad Dhakal highlighted the need to form a high-level mechanism with private sector’s participation to address the existing economic problems.</span></span></h3> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">He made such remarks during a meeting with newly-appointed Finance Minister Bishnu Poudel at his office in Singha Durbar on Wednesday.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"The morale of all sectors, from the general public to industrialists and businessmen, is low while the whole economy is in a weak situation at present. Serious initiation is required for a way out of this situation," he said.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The FNCCI president demanded that industrialists, businessmen, and the private sector be given a place in the protocol (order of precedence) determined by the government.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to him, industrialists and businesspersons are not in a position to make fresh investments enthusiastically.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"Investments are not being made despite adequate liquidity and low interest rates. Industrialists and entrepreneurs have not been able to pay the principal and interest on their loans. New entrepreneurs have not been able to venture into the market," Dhakal said. He suggested instituting a high-level mechanism with private sector’s involvement to take initiatives for resolving these problems without incurring any financial burden on the State.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Dhakal reiterated that the government should make significant policy decisions to motivate the private sector.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The FNCCI president also complained that illegal imports have increased, resulting in lost government revenue and problems for traders and entrepreneurs.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In the meeting, the FNCCI placed several demands before the finance minister, urging government bodies to expedite works related to land acquisition for development projects, construction of approach roads, and carrying out Environmental Impact Assessments.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Additionally, the FNCCI suggested the government clarify the jurisdiction of regulatory bodies, expedite payment of dues to construction entrepreneurs, and promptly resolve the dedicated feeder and trunk line power tariff dispute. The FNCCI also called on the government to seriously address the problems seen in the cooperative and microfinance sectors.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The private sector requested a convenient and flexible system for the upcoming fiscal year's monetary policy that does not upset the existing system. Among other topics, the FNCCI raised the need to ease the implementation of guidelines on current capital loans and adopt a flexible policy for managing the capital budget.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In response, the Finance Minister asserted that meaningful initiatives are being taken to address the problems faced by the microfinance and cooperatives sector.</span></span></p> <p> </p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""> </span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-07-18', 'modified' => '2024-07-18', 'keywords' => 'FNCCI, Minister, Finance, private sector', 'description' => '', 'sortorder' => '21299', 'image' => '20240718052717_FNCCI.jpg', 'article_date' => '2024-07-18 05:26:08', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '21382', 'article_category_id' => '274', 'title' => 'inDrive Launches Courier Service in Nepal', 'sub_title' => '', 'summary' => 'KATHMANDU: Ride-sharing platform inDrive has launched its courier service Nepal.', 'content' => '<p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">KATHMANDU: Ride-sharing platform inDrive has launched its courier service Nepal. Natalia Makarenko, marketing director of Indrive (APAC), stated that the goods delivery service has been initiated to enhance the company's services while remaining committed to increasing mobility in the Nepali market.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Makarenko mentioned that in 2023, inDrive announced the launch of the delivery service in Nepal amid a recent program.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Issuing a statement, Msksrenko said inDrive’s courier service offers delivery of parcels weighing 20 kg or less, on the same day of booking.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“We are excited to announce the launch of inDrive.Delivery in Nepal. With inDrive.Delivery, we hope to meet the logistic challenges faced by small businesses as well as individuals in Nepal,” she said.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">Makarenko also expressed committed towards enhancing mobility in the market of Nepal and added that they are dedicatedly working to make inDrive’s services better and bring more features according to people's need in Nepal. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Thousands of rides are happening on our platform every day. We are getting positive feedback from passengers in Nepal,” she further said.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">According to Makarenko, inDrive experienced a 200 percent increase in business in 2023 compared to the previous year.</span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">As of the first half of 2024, inDrive has recorded a 46% increase in rides, she added. </span></span></p> <p><span style="font-size:18px"><span style="font-family:Calibri,"sans-serif"">“Our growth metrics reflect the trust our users and drivers place in us. We are dedicated to enhancing our services, ensuring safety, and contributing positively to the communities we serve.”</span></span></p> <p> </p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2024-06-28', 'modified' => '2024-06-28', 'keywords' => '', 'description' => '', 'sortorder' => '21108', 'image' => '20240628125903_c24ca48c.jpeg', 'article_date' => '2024-06-28 12:58:25', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '21344', 'article_category_id' => '274', 'title' => 'Government Fails to Meet Revenue Target with Fiscal Year about to End', 'sub_title' => '', 'summary' => 'KATHMANDU: The government has consistently failed to achieve its revenue targets of late. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: The government has consistently failed to achieve its revenue targets of late. The government failed to meet its revenue goals by the end of Jestha (mid-May to mid-June) in the current fiscal year, impacting the overall revenue target.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the Financial Comptroller General Office (FCGO), which monitors the government’s income and expenditure, the total income by the end of Jestha (mid-June) was Rs 942.23 billion. This amounts to only 63.99% of the annual target.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Initially, the government set a revenue target of Rs 1422 billion for the current fiscal year. However, during the half-yearly budget review, then Finance Minister Prakash Sharan Mahat reduced the target by 15% to Rs 1202.29 billion. Later, Finance Minister Barshman Pun revised the revenue collection estimate to Rs 1253.52 billion while announcing the budget for the next fiscal year on May 28.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">With less than a month remaining in the current fiscal year, Rs 311.29 billion still needs to be raised to meet the revised target. A high-ranking official from the Ministry of Finance stated that it is unlikely to meet this target given the substantial daily revenue required.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The government's plan to boost revenue by reforming the tax system has also fallen short this year. The revenue growth rate was negative in the first two months of the current fiscal year (mid-July to mid-September). Although revenue collection in the subsequent nine months was positive, it only increased by an average of 6%.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Tax expert Chandramani Adhikari pointed out that the failure to meet the target is due to recurring issues. He emphasized that for the targets to be met, they should be realistic, and the problems within the tax system need to be addressed.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Finance Minister Pun acknowledged the gravity of the situation, stating that the government's inability to meet revenue targets is a serious problem. "You can deceive others, but not yourself. Questions arise when the fiscal year is about to end, and we must be prepared to answer," he told tax and revenue administration officials on Thursday. He also instructed subordinate agencies to encourage taxpayers to fulfill their obligations.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-23', 'modified' => '2024-06-23', 'keywords' => '', 'description' => '', 'sortorder' => '21070', 'image' => '20240623014521_budget new.jpg', 'article_date' => '2024-06-23 13:44:24', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '18022', 'article_category_id' => '274', 'title' => 'Government Aims for 6% Economic Growth in FY 2023/2024 ', 'sub_title' => '', 'summary' => 'The government has set its target on achieving a 6% economic growth rate in the next fiscal year, 2023/24. The Finance Minister, Dr. Prakash Sharan Mahat, unveiled this target while presenting the budget statement in Parliament on Monday.', 'content' => '<p><span style="font-size:18px">May 30: The government has set its target on achieving a 6% economic growth rate in the next fiscal year, 2023/24. <br /> The Finance Minister, Dr. Prakash Sharan Mahat, unveiled this target while presenting the budget statement in Parliament on Monday.</span></p> <p><span style="font-size:18px">Additionally, the government aims to effectively manage inflation, setting a target of below 6.5%. By keeping inflation in check, the government aims to ensure that the benefits of economic growth are felt by all.</span></p> <p><span style="font-size:18px"> The Nepal Rastra Bank, the country's central bank, will play a vital role by formulating and implementing prudent monetary policies to achieve these targets, said Finance Minister Dr Mahat.</span></p> ', 'published' => true, 'created' => '2023-05-30', 'modified' => '2023-05-30', 'keywords' => '', 'description' => '', 'sortorder' => '17753', 'image' => '20230530053724_EconomicGrowth.jpeg', 'article_date' => '2023-05-30 05:35:35', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 7 => array( 'Article' => array( 'id' => '18003', 'article_category_id' => '274', 'title' => 'Economic Survey for FY 2022/23 Presented in Parliament', 'sub_title' => '', 'summary' => 'Finance Minister Dr Prakash Sharan Mahat has presented the Economic Survey of Fiscal Year 2022/23 and the Annual Situation Review of Public Corporations, 2023 in the separate meetings of the House of Representatives (HoR) and the National Assembly today.', 'content' => '<p><br /> <span style="font-size:18px">May 28: Finance Minister Dr Prakash Sharan Mahat has presented the Economic Survey of Fiscal Year 2022/23 and the Annual Situation Review of Public Corporations, 2023 in the separate meetings of the House of Representatives (HoR) and the National Assembly today.</span></p> <p><span style="font-size:18px">Tabling the Economic Survey, the Finance Minister said that the world economy was in crisis in 2023 and its impact was felt in Nepal's economy also.</span></p> <p><span style="font-size:18px">"There was a contraction in the overall economic activities including the wholesale and retail business, construction and the production of production-based industries due to the international economic situation and structural problems. It is estimated that the country's economic growth rate will be around 2.16 per cent in the current fiscal year as a result of this," he said.</span></p> <p><span style="font-size:18px">The Finance Minister said a strain was seen in resource management as well due to the slowdown in economic activities owing to the contraction in the import of goods and decrease in the overall demand.</span></p> <p><span style="font-size:18px">He pointed out that the problem was also because of the rise in the prices of petroleum products, food grains and raw materials in the world market. </span></p> <p><span style="font-size:18px">Minister Mahat maintained that positive indications have also been seen in the economy like the balance of payment was in surplus, the foreign currency reserve has gone up and tourist arrivals have increased, among others. </span></p> <p><span style="font-size:18px">According to the Economic Survey, the federal government has constructed 34,100 kilometres road and the total installed power capacity has reached 2,666 megawatts, student enrollment has increased at basic level, the net maternal mortality rate and infant mortality rate have gone down, and 95 per cent of the population has access to basic drinking water and electricity service. </span></p> <p><span style="font-size:18px">Also today, the Finance Minister presented in the HoR a report on the status of present performance and financial situation of public corporations along with an analysis of the problems and challenges.</span></p> <p><span style="font-size:18px">"Although the public corporations played a significant role in the country's economic, social and infrastructure development in the past, their overall financial situation is not satisfactory due to the shortcomings, especially seen in the operation and management, over time," he added.</span></p> <p><span style="font-size:18px">As the Finance Minister shared on the occasion, 25 out of the 44 public corporations having the government's investments are in profit while the government's shares and loan investments as of July 16, 2022 has reached Rs 618 billion. </span></p> <p><span style="font-size:18px">The government has acquired profit equivalent to Rs 6.16 billion from the public corporations in the last fiscal year, which is only one percent of the investment. ---RSS </span></p> ', 'published' => true, 'created' => '2023-05-28', 'modified' => '2023-05-29', 'keywords' => '', 'description' => '', 'sortorder' => '17734', 'image' => '20230528064754_collage (6).jpg', 'article_date' => '2023-05-28 18:45:42', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 8 => array( 'Article' => array( 'id' => '17737', 'article_category_id' => '274', 'title' => 'Nepal's Per Capita Income to Reach 1410 US Dollars in the Current Fiscal Year ', 'sub_title' => '', 'summary' => 'Nepal's per capita income is estimated to reach an all-time high of 1410 US Dollars or NPR 1,84,710 in the current fisacl year, according to the latest statistics released by the National Statistics Office.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">May 2: Nepal's per capita income is estimated to reach an all-time high of 1410 US Dollars or NPR 1,84,710 in the current fiscal year, according to the latest statistics released by the National Statistics Office. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The per capita income of Nepalis was 1381 US Dollars in the previous fiscal year. The per capita income is projected to rise by 29 US Dollars in the current fiscal year.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Nepal's per capita income had crossed the 1000 US Dollar threshold in the fiscal year of 2073/74. A decade ago, the per capita income of Nepalis was 814 US Dollars.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The estimated economic growth rate for the current fiscal year is 2.16 %, and the size of Nepal's economy is projected to reach NPR 5381 billion based on market value and NPR 4696 billion based on production value.</span></span></p> ', 'published' => true, 'created' => '2023-05-02', 'modified' => '2023-05-02', 'keywords' => '', 'description' => '', 'sortorder' => '17471', 'image' => '20230502055619_collage (5).jpg', 'article_date' => '2023-05-02 17:54:03', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 9 => array( 'Article' => array( 'id' => '17680', 'article_category_id' => '274', 'title' => 'Collective Efforts Essential to Improve Economy, Says Finance Minister Mahat ', 'sub_title' => '', 'summary' => 'Finance Minister Dr. Prakash Sharan Mahat has emphasized the importance of collective efforts from all sectors and parties to improve the struggling economy. ', 'content' => '<p><br /> <span style="font-size:18px">April 27: Finance Minister Dr. Prakash Sharan Mahat has emphasized the importance of collective efforts from all sectors and parties to improve the struggling economy. </span></p> <p><span style="font-size:18px">During the National Assembly's discussion on a proposal of urgent public importance on economic improvement on Wednesday, Dr Mahat pointed out that the government's efforts alone would not be sufficient to bring about the much-needed economic improvements. </span></p> <p><span style="font-size:18px">Dr Mahat acknowledged that the current economic issues were not solely caused by the incumbent or previous governments, and called for a shared perspective among political parties to revitalize the economy.</span></p> <p><span style="font-size:18px">While acknowledging that the country's economy is facing several challenges, Dr. Mahat reassured that it is not beyond our capacity to manage. Mahat stressed that patience is required to address the issues, which have been accumulating over a long time. </span></p> <p><span style="font-size:18px">Finance Minister admitted that there are structural problems in the economy and noted that social security obligations and recurrent spending are on the rise.The Finance Minister affirmed that the government is committed to resolving the issues with the support of all sides. </span></p> <p><span style="font-size:18px">Minister acknowledged that the problems are not caused by the current or previous governments alone, and that it would take time to find a solution. However, he pledged to work with honesty and utmost efforts for the greater good of the country and its people.</span></p> <p><span style="font-size:18px">Dr. Mahat said that the present economic problem is caused by loose monetary policy during the COVID pandemic, low capital spending due to elections, rising interest rates due to liquidity crunch, low absorbing capacity, and the tendency to spend capital expenditures at the end of the fiscal year.</span></p> <p><span style="font-size:18px">Minister stated that although it may take time, the government is dedicated to making the economy dynamic through collective efforts and reform measures with support from all sides. </span></p> ', 'published' => true, 'created' => '2023-04-27', 'modified' => '2023-04-27', 'keywords' => '', 'description' => '', 'sortorder' => '17414', 'image' => '20230427063049_.prakash sharan mahat.jpg', 'article_date' => '2023-04-27 06:27:40', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 10 => array( 'Article' => array( 'id' => '17587', 'article_category_id' => '274', 'title' => 'Minister Mahat Calls for Collaborative Efforts to Do Away With Economic Woes ', 'sub_title' => '', 'summary' => 'Minister for Finance Dr Prakash Sharan Mahat stressed that that the government and private sector should collaborate to remove difficulties facing the country’s economy.', 'content' => '<p><span style="font-size:20px"> April 18: Minister for Finance Dr Prakash Sharan Mahat stressed that that the government and private sector should collaborate to remove difficulties facing the country’s economy.</span></p> <p><span style="font-size:20px">Congratulating the newly elected office-bearers of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) in Kathmandu on Monday, Minister Mahat asserted that the government and private sector should support each other to overcome problems seen in the economy.</span></p> <p><span style="font-size:20px">"The entrepreneurs and businessmen feel uncomfortable, difficult and pressurized at present. I understand there are some obstacles and disturbances. The government and private sector should work together to remove these hardships," Mahat emphasized. </span></p> <p><span style="font-size:20px">Minister Dr Mahat admitted that the government has not been able to deliver as it should. "We, from political leadership to bureaucracy should admit it. I am ready to admit it. We must bring about good changes in the economy. There is a challenge to increase efficiency of the country," the Minister opined.</span></p> <p><span style="font-size:20px"> The Minister shared that he had held formal and informal discussions with the leadership of the Nepal Rastra Bank to revitalize the national economy. </span></p> <p><span style="font-size:20px">Dr Mahat said that the Nepal Bankers' Association(NBA) decision to lower the interest rates on deposits starting from Baisakh 1 of New Year 2080 would help ease the economic difficulties facing the country. </span></p> <p><span style="font-size:20px">"I request to the private sector to disclose the realities. I will try my best to solve your problems through monetary policy," Mahat held. </span></p> <p> </p> ', 'published' => true, 'created' => '2023-04-18', 'modified' => '2023-04-18', 'keywords' => '', 'description' => '', 'sortorder' => '17322', 'image' => '20230418062106_collage (77).jpg', 'article_date' => '2023-04-18 06:11:35', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 11 => array( 'Article' => array( 'id' => '17458', 'article_category_id' => '274', 'title' => 'NCC Urges Finance Minister to Expand Tax Scope', 'sub_title' => '', 'summary' => 'Nepal Chamber of Commerce (NCC) has urged Finance Minister Dr Prakash Sharan Mahat to expand the scope of tax. A delegation of NCC including its president Rajendra Malla called on the Finance Minister on Tuesday and suggested that the government fulfill the revenue collection target by expanding the tax net. ', 'content' => '<p><span style="font-size:18px">April 5: Nepal Chamber of Commerce (NCC) has urged Finance Minister Dr Prakash Sharan Mahat to expand the scope of tax. A delegation of NCC including its president Rajendra Malla called on the Finance Minister on Tuesday and suggested that the government fulfill the revenue collection target by expanding the tax net. </span></p> <p><span style="font-size:18px">"Rather than increasing the tax rate, the scope of tax should be increased. Arrangement of issuing PAN card should be made along with the citizenship certificate for this purpose," the NCC said. </span></p> <p><span style="font-size:18px">Malla said the illegal trade taking place at the bordering areas should also be discouraged and brought under the purview of tax while the provision of seeking and providing invoice should be made mandatory. </span></p> <p><span style="font-size:18px">The NCC president also called to fix interest rate at single digit at the earliest to stimulate the economy. He suggested preparing and implementing a time-bound action plan for the capital expenditure for managing the liquidity crunch. </span></p> <p><span style="font-size:18px">NCC urged the government to encourage the investment of the remittance money in productive sectors. During the meeting, Finance Minister Dr Mahat said the government has taken the latest economic situation seriously and coordination is being made for the successful implementation of the budget and monetary policy. </span></p> <p><span style="font-size:18px">Minister Mahat said he is in consultation with the Nepal Rastra Bank Governor and the secretaries of the bodies concerned for reinvigorating the economy and with the customs officials regarding the issue of unmet revenue collection target. The Finance Minister expressed hope that the economy will come on track from the next fiscal year. ----RSS</span></p> ', 'published' => true, 'created' => '2023-04-05', 'modified' => '2023-04-05', 'keywords' => '', 'description' => '', 'sortorder' => '17193', 'image' => '20230405063746_collage (60).jpg', 'article_date' => '2023-04-05 06:35:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 12 => array( 'Article' => array( 'id' => '17453', 'article_category_id' => '274', 'title' => 'Asian Development Bank Estimates 4.1% Economic Growth in Nepal in the Current Fiscal Year ', 'sub_title' => '', 'summary' => 'The Asian Development Bank (ADB) has estimated Nepal’s economic growth (gross domestic product growth) rate to be 4.1 per cent for the fiscal year 2023, down from an estimated growth of 5.8% in fiscal year 2022. ', 'content' => '<p> </p> <p><span style="font-size:18px">April 4: The Asian Development Bank (ADB) has estimated Nepal’s economic growth (gross domestic product growth) rate to be 4.1 per cent for the fiscal year 2023, down from an estimated growth of 5.8% in fiscal year 2022. </span></p> <p><span style="font-size:18px">“Nepal’s gross domestic product (GDP) growth is projected to slow largely due to tight monetary policy, slackened domestic demand, the unwinding Covid stimulus, and persistent global headwinds,” the bank says.</span></p> <p><span style="font-size:18px">“There are downside risks to the outlook such as a global downturn hitting Nepal’s tourism and remittance receipts,” said ADB Country Director for Nepal Arnaud Cauchois. </span></p> <p><span style="font-size:18px">“Accelerating capital budget spending through focused investment planning, financial management, and project readiness will help spur Nepal’s economic growth over the years,” the bank added. </span></p> <p><span style="font-size:18px">The bank estimates that the agriculture growth rate will likely be 2.0% in FY2023, down from 2.3% in FY2022. Despite the surge of paddy output, scanty rainfall in winter will affect winter crop yield and overall agricultural output. </span></p> <p><span style="font-size:18px">Similarly, industry growth is estimated to decrease due to higher interest rates, import restriction measures, slowdown in domestic consumption, and a dampened external demand.</span></p> <p><span style="font-size:18px">Services' growth is projected to be 4.4% from 5.9% in FY2022. Credit control measures and a hike in interest rates have slowed down real estate, wholesale, and retail trade activities. While tourism growth has been strong, international tourist arrivals are still at half of the pre-pandemic level, according to the ADB report. </span></p> <p><span style="font-size:18px">ADB forecasts that Nepal’s inflation will edge up to 7.4% in FY 2023 from 6.3% in FY2022, despite the tight monetary policy reigning in demand. Inflation is expected to decelerate to 6.2% in FY2024 assuming a normal harvest, subdued oil prices, and a decline in inflation in India.</span></p> ', 'published' => true, 'created' => '2023-04-04', 'modified' => '2023-04-04', 'keywords' => '', 'description' => '', 'sortorder' => '17188', 'image' => '20230404041905_collage - 2023-04-04T161658.068.jpg', 'article_date' => '2023-04-04 16:13:57', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 13 => array( 'Article' => array( 'id' => '17443', 'article_category_id' => '274', 'title' => 'NEPSE’s Fall Continues; Turnover Shrinks Below One Billion ', 'sub_title' => '', 'summary' => 'The NEPSE index fell 16.67 points and closed at 1,871.88 on the second trading Monday as well. The Sensitive Index plunged by 3.05 points. Likewise, Floated Index, and Sensitive Floated Index decreased by 1.16 and 1.04 points. ', 'content' => '<p><br /> <span style="font-size:18px">April 4: The NEPSE index fell 16.67 points and closed at 1,871.88 on the second trading day Monday as well.<br /> The Sensitive Index plunged by 3.05 points. Likewise, Floated Index, and Sensitive Floated Index decreased by 1.16 and 1.04 points respectively. </span></p> <p><span style="font-size:18px">A total of 2,829,426 shares of 260 companies listed on the NEPSE exchanged hands via 27,454 transactions. The total turnover amount stood at Rs. 92.02 crores. This is lower than the last trading day's turnover of Rs. 1.207 billion.</span></p> <p><span style="font-size:18px">Today the index opened at 1,888.61 and went intraday high of 1,891.76. In contrast, it went as low as 1,866.16 and ultimately closed at 1,871.88. Kalinchowk Darshan Limited (KDL) gained the highest 10% and hit the positive circuit for the day.</span></p> <p><span style="font-size:18px">Conversely, 8.5% Prabhu Bank Debenture 2087 (PBLD87) lost 10% today. Nabil Bank Ltd. (NABIL) had the highest turnover of Rs. 3.62 crores closing at a market price of Rs. 589.9 per share. </span></p> <p><span style="font-size:18px">The shares of GBIME traded the most. Only one sector closed green. "Trading" gained 1.21%, while "Hydropower" lost the highest 1.30% today.</span></p> ', 'published' => true, 'created' => '2023-04-03', 'modified' => '2023-04-03', 'keywords' => '', 'description' => '', 'sortorder' => '17178', 'image' => '20230403053029_collage - 2023-04-03T173010.811.jpg', 'article_date' => '2023-04-03 17:26:43', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '42' ) ), (int) 14 => array( 'Article' => array( 'id' => '17434', 'article_category_id' => '274', 'title' => 'Janakpur Customs Office Fails to Meet Revenue Collection Target ', 'sub_title' => '', 'summary' => 'Janakpur Customs Office Janakpurdham is finding it tough to meet its revenue collection target in the current fiscal year. ', 'content' => '<p><span style="font-size:18px"><br /> April 2: Janakpur Customs Office Janakpurdham is finding it tough to meet its revenue collection target in the current fiscal year. The customs office has collected only 45 percent revenue of its annual target in the eight months of the current fiscal year.</span></p> <p><span style="font-size:18px">If the rate of the revenue collection remains the same, the customs office will find it hard to meet its target in the next four months. </span></p> <p><span style="font-size:18px">Janakpur Customs Office has set the target to collect 495 million in revenue in the current fiscal year. “But, the customs office has collected only Rs 221 million in revenue in the eight months,” said Keshavraj Oli, Chief of the Customs Office. </span></p> <p><span style="font-size:18px">The customs office had collected Rs 227 million in revenue against its target of 485 million last fiscal year. Restrictions have been placed on border points to optimize revenue collection. However, goods and commodities are found to have been imported avoiding tax at night. </span></p> <p><span style="font-size:18px">Non-operation of the freight train has dealt a blow to the revenue collection, according to Oli. He estimated that revenue might increase if a freight train was operated. </span></p> ', 'published' => true, 'created' => '2023-04-02', 'modified' => '2023-04-02', 'keywords' => '', 'description' => '', 'sortorder' => '17169', 'image' => '20230402043929_collage - 2023-04-02T164022.134.jpg', 'article_date' => '2023-04-02 16:36:59', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117