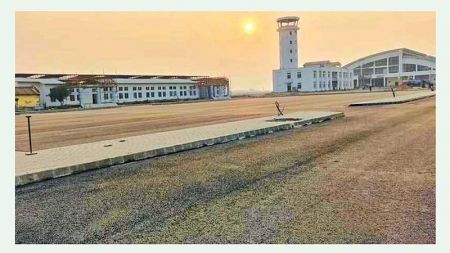

October 11: The construction work of Gautam Buddha International Airport in Bhairahawa has reached the final stage.…

October 11: The construction work of Gautam Buddha International Airport in Bhairahawa has reached the final stage.…

October 11: The government has decided to charge an additional fare for the payment of taxes through digital wallets of payment gateways associated with the Revenue Management Information…

October 11: Minister for Culture, Tourism and Civil Aviation Yogesh Bhattarai has confirmed himself testing positive for coronavirus.…

October 9: The debtors of microfinance companies have been facing difficulties in repaying the installments and loans due to the coronavirus…

October 9: The government has failed to regulate the shipping companies involved in transporting goods to Nepal from…

October 9: The Insurance Board is making preparations for a one-door-system for settling insurance claims for Covid-19 after facing severe backlash for the delay in making…

October 9: Brick industries of Nepal are looking for local workers for production for the upcoming season.…

October 8: Nepal Rastra Bank (NRB) will be clarifying about the fixed interest rates through the quarterly review of monetary policy even though it has allowed the Banks and Financial Institutions (BFIs) to determine the fixed interest rates on personal term loans, including home and auto loan by the end of Ashoj…

October 8: The Ministry of Physical Infrastructure and Transport has finalized the specifications required for the purchase 300 electric buses.…

October 8: It is estimated that it will take at least another two months for the government of Nepal to bring in 50,000 metric tons of urea from Bangladesh on loan.…

October 8: Nepal’s economy is projected to grow by only 0.6 percent in 2021, inching up from an estimated 0.2 percent in 2020 as lockdowns caused by COVID-19 disrupt economic activity, especially tourism, says the World Bank’s latest South Asia Economic Focus.…

October 8: The government has decided to increase the scope of small projects backed by India’s investment in coordination with the local…

October 7: The Civil Aviation Department (CAD) of Hong Kong has postponed the flight of Nepal Airlines Corporation (NAC) for two weeks after the airlines confirmed coronavirus infection among six passengers who traveled to Hong Kong from Nepal on a regular…

October 7: Nepal Rastra Bank has capped the maximum limit of cash dividend to be distributed by banks and financial institutions (BFIs) at 30 percent of their profit.…

October 7: Tatopani customs, which was reopened on Monday after 80 days, has been closed again from Tuesday (October 6).…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '12581', 'article_category_id' => '1', 'title' => 'Construction of Gautam Buddha International Airport in the Final Stage', 'sub_title' => 'Disputes over air entry routes remain unresolved', 'summary' => 'October 11: The construction work of Gautam Buddha International Airport in Bhairahawa has reached the final stage. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">October 11: The construction work of Gautam Buddha International Airport in Bhairahawa has reached the final stage. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">However, to make optimal use of this airport, international flights coming to Nepal need to use the air entry points of Mahendranagar and Nepalgunj via India, for which India has not yet given positive response. As these entry routes are uncertain, the prospect of flight operation at the under-construction airport has become uncertain and complicated.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Even if India does not approve flights to enter Nepal through its airspace from the routes requested by Nepal, it does not mean that there will be no flight. However, the Mahendranagar and Nepalgunj air entry routes via Indian airspace will save both time and fuel for the flights.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Meanwhile, the Ministry of Culture, Tourism and Civil Aviation has been informing that the Gautam Buddha Airport will be operational from the beginning of 2021 and everything is being done accordingly.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">During Prime Minister KP Oli's recent visit to India, the issue was discussed with his Indian counterpart Narendra Modi. However, no further progress has been made since then, according to tourism ministry officials. Aviation experts, officials of the ministry and officials of the Civil Aviation Authority of Nepal have been saying that the issue of airspace should be resolved by initiating a high level diplomatic discussion.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Indian authorities have so far disagreed to the air route citing security reasons, according to CAAN officials.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-11', 'modified' => '2020-10-11', 'keywords' => '', 'description' => '', 'sortorder' => '12328', 'image' => '20201011031237_1602374658.1594332606.Clipboard04.jpg', 'article_date' => '2020-10-11 15:11:55', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 1 => array( 'Article' => array( 'id' => '12580', 'article_category_id' => '1', 'title' => 'Government Planning to Collect Service Charge for Payment of Taxes through Digital Wallets', 'sub_title' => '', 'summary' => 'October 11: The government has decided to charge an additional fare for the payment of taxes through digital wallets of payment gateways associated with the Revenue Management Information System.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">October 11: The government has decided to charge an additional fare for the payment of taxes through digital wallets of payment gateways associated with the Revenue Management Information System.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">According to Nepal Rastra Bank, the service charge is free of cost for the time being due to Covid-19 crisis. However, service seekers will have to pay anything between Rs 5 to Rs 30 for the payment of taxes effective from mid-January. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The central bank amended the Unified Directive 2077 on Friday, adding a provision that makes transactions up to Rs 1000 free of cost for an indefinite period. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">However, it has fixed service charge of Rs 5 for transaction between Rs 1000 to Rs 3000. Likewise, the service charge for transaction between Rs 3001 to Rs 10,000 has been fixed at Rs 10 while the transactions above Rs 10,001 has been fixed at Rs 30.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The central bank has said that the payment of taxes through digital wallets will be free of cost until January 13 considering the crisis created by coronavirus.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Executive Director of the Payments Management Department of Nepal Rastra Bank Bhuvan Kandel confirmed that the taxpayers can enjoy waiver of service charge for payments made through digital wallets until mid-January.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-11', 'modified' => '2020-10-11', 'keywords' => '', 'description' => '', 'sortorder' => '12327', 'image' => '20201011123329_nrb.jpg', 'article_date' => '2020-10-11 12:32:56', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 2 => array( 'Article' => array( 'id' => '12579', 'article_category_id' => '1', 'title' => 'Tourism Minister Tests Positive for Covid-19', 'sub_title' => '', 'summary' => 'October 11: Minister for Culture, Tourism and Civil Aviation Yogesh Bhattarai has confirmed himself testing positive for coronavirus. ', 'content' => '<p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">October 11: Minister for Culture, Tourism and Civil Aviation Yogesh Bhattarai has confirmed himself testing positive for coronavirus. </span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">He posted on Facebook Saturday that his test report turned out positive.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">In the post, Minister Bhattarai said that he suffered from mild fever on Friday and got tested for coronavirus again for the second time on Saturday. The result came out positive.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">His PCR test taken last Monday had turned out negative, after which the minister attended a few programmes outside the valley.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">He further added that he is not facing any other problems besides mild fever.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS"">The minister also urged everyone who has come into contact with him to remain alert and undergo test if they develop any symptoms.</span></span></span></p> <p><span style="font-size:18px"><span style="font-family:Times"><span style="font-family:"Arial Unicode MS""><img alt="" src="/app/webroot/userfiles/images/yogesh%20bhattarai.jpg" style="height:464px; width:800px" /></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-10-11', 'modified' => '2020-10-11', 'keywords' => '', 'description' => '', 'sortorder' => '12326', 'image' => '20201011111501_yogesh_bhattarai.jpg', 'article_date' => '2020-10-11 11:13:39', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '12578', 'article_category_id' => '1', 'title' => 'Debtors of Microfinances Facing Difficulties in Loan Repayment', 'sub_title' => '', 'summary' => 'October 9: The debtors of microfinance companies have been facing difficulties in repaying the installments and loans due to the coronavirus pandemic.', 'content' => '<h1><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">October 9: The debtors of microfinance companies have been facing difficulties in repaying the installments and loans due to the coronavirus pandemic. A study by the Center for Microfinance Nepal (CMF) has shown that debtors from manufacturing and industrial sector are struggling more to repay their loans.</span></span></span></h1> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">CMF had conducted a study of 25 percent of the total microfinances in Nepal during the months of Chaitra and Baisakh (mid-March to mid-May). It released its study report on the impact of COVID-19 on microfinance on Thursday.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">According to the study done by CMF, the debtors from urban areas have more difficulties in repaying loans than the debtors in rural areas. The report shows that 63.82 percent of the borrowers in rural areas have difficulty in repaying their loans whereas 68.63 percent of urban borrowers have difficulty in repaying their loans.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">A total of 22.66 percent of the rural population have partial difficulty in repaying the loan while 13.53 percent of the debtors have no problem in repaying the loan. However, 21.47 percent of debtors from urban areas have partial difficulty in repaying their loans while 9.89 percent have no difficulty in repaying their loans.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Debtors of the urban areas are struggling to repay their loans more as the businesses in the urban areas have come to a standstill. Presenting the study report, CMF's Operations Manager Jagdish Tiwari stressed on the need to adopt collateral strategy to get rid of such problems. Prakash Kumar Shrestha, executive director of the Department of Supervision of Microfinance Financial Institutions of Nepal Rastra Bank, says that the 18 percent of the loan is based on collateral at present. He said, “Recently, the number of debtors who have exceeded the loan payment period has reached 1,256,000. Therefore, collateral loans need to be emphasized as they have less risks.”</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">About 79 percent of those who take loans from microfinance have said that their ability to repay loans has become weaker. Similarly, the study showed that the condition of 42 percent of agriculture, 68 percent of productive loans and 32 percent of consumer loans has become weak. The CMF has also suggested to increase investments in digitization for the technical development of microfinances. The study has also brought attention to changing the model of services as new methods and technologies are now needed in microfinance too.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The trend of saving in microfinance has increased since the beginning of the coronavirus pandemic. According to the study, deposits in MFIs have increased by 47 percent despite the decrease in the flow of credit. The trend of withdrawing money has also increased by 80 percent during this period. The study has also shown that e-transactions have increased by 10 percent during this period. According to the institutions that were part of the study, about 70 percent of the customers have psychosocial problems due to lack of income. Customers are worried because of their unfavorable household budgets.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The study points out that the recent 5 percent interest rebate given to revive businesses through relief packages is not enough for small businesses. Therefore, the study has suggested that the government should give income tax exemption for two years as an incentive. "As Nepal Rastra Bank regulates and supervises all banks and financial institutions in Nepal, a separate regulatory body is now needed for microfinance institutions," Tiwari said while presenting the report, adding, “There is a separate regulatory body for microfinances in countries like Bangladesh. Nepal also needs a separate regulator for microfinance institutions.”</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Rewat Bahadur Karki, executive chairman of CMF, says that the main objective of the study was to assess and analyze the overall, immediate, short-term and the long-term impacts of COVID-19 in the operation of microfinance institutions and their customers.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-09', 'modified' => '2020-10-09', 'keywords' => '', 'description' => '', 'sortorder' => '12325', 'image' => '20201009055110_microfinance.jpg', 'article_date' => '2020-10-09 17:50:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '12577', 'article_category_id' => '1', 'title' => 'Government Fails to Regulate Shipping Companies', 'sub_title' => 'Foreign Companies Ignore Government Directive to Conduct Business Only after Registration', 'summary' => 'October 9: The government has failed to regulate the shipping companies involved in transporting goods to Nepal from overseas.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">October 9: The government has failed to regulate the shipping companies involved in transporting goods to Nepal from overseas.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The government had announced to make the transport of goods cost-effective, transparent and economical by making a separate law, but the plan has not been able to move ahead as planned.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The private sector has been complaining that the shipping companies transporting containers to Nepal from third countries have been charging fare as per their will because they have not been registered in Nepal. In such condition, the government has not been able to regulate such companies. Such companies have been charging massive amounts to the importers in the name of freight and fines.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Since the government can only regulate companies registered in Nepal, the shipping companies are still out of the government's control. A few months ago, the Ministry of Industry, Commerce and Supplies took the initiative of bringing the shipping companies under the registration process. However, that effort has slowed down.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The Bilateral and Regional Trade Division under the ministry had instructed Nepal-based representative of foreign shipping companies to conduct business only after registering their company here. The representatives were asked to write to the concerned company immediately for the registration process. However, after three months, not a single shipping company has been registered.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-09', 'modified' => '2020-10-09', 'keywords' => '', 'description' => '', 'sortorder' => '12324', 'image' => '20201009043033_1602200812.Clipboard01.jpg', 'article_date' => '2020-10-09 16:29:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '12576', 'article_category_id' => '1', 'title' => 'Insurance Board to Introduce One-Door System for Covid-19 Insurance Settlement', 'sub_title' => '', 'summary' => 'October 9: The Insurance Board is making preparations for a one-door-system for settling insurance claims for Covid-19 after facing severe backlash for the delay in making payment.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">October 9: The Insurance Board is making preparations for a one-door-system for settling insurance claims for Covid-19 after facing severe backlash for the delay in making payment.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The board is preparing a one-door system to make the settlement easier and faster. The board informed that necessary preparations are being made in this regard. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Executive director of the Insurance Board Rajuraman Poudel informed that the one-door system will be implemented from the coming week. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">“The Insurance Board has been closed after an employee was diagnosed with coronavirus. The office is planning to open from next Sunday (October 11),” said Poudel, adding, “Probably, we will implement it from Sunday or Monday.” After the implementation of this provision, the previous claims and the new claims will be settled through one-door system. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The board says that the one-door system is being implemented as there are chances that the insurance claim can be repeated. Similarly, there is a possibility that the claim will be paid even if fake report is submitted. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The settlement issue has been lengthy because the insurance company has to seek approval from the insurers’ association after receiving an application for insurance claim.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman""> As a result, the settlement of insurance claims was delayed due to lengthy and bothersome process. Now, the board believes that the one-door system will speed up the process of insurance claim.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-09', 'modified' => '2020-10-09', 'keywords' => '', 'description' => '', 'sortorder' => '12323', 'image' => '20201009025121_1602200332.Clipboard06.jpg', 'article_date' => '2020-10-09 14:50:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '12575', 'article_category_id' => '1', 'title' => 'Brick Industries Looking for Local Workers to Fill the Void', 'sub_title' => '', 'summary' => 'October 9: Brick industries of Nepal are looking for local workers for production for the upcoming season. ', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">October 9: Brick industries of Nepal are looking for local workers for production for the upcoming season. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Indian workers used to constitute a large part of the workforce in brick kilns across the country. However, most of the workers have returned home in India due to the coronavirus crisis and there is lack of workers at the moment. In order to run the brick kilns efficiently, the Federation of Nepal Brick Industries is looking for local workers in the absence of skilled Indian workers. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">It is estimated that more than 70 percent of the workers in more than 1200 brick kilns of Nepal are Indian nationals. Normally, the peak season for production of bricks is during the winter. Since the production will start in massive scale after two months, the factory owners have started looking for local workers right from now, says Mahendra Bahadur Chitrakar, chairman of the federation.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">“We are making preparations to recruit Nepali migrant workers who have returned from abroad. We will be coordinating with the private sector to train the workers,” said Chitrakar.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The Ministry of Industry, Commerce and Supplies has also announced to collaborate with the private sector to provide employment-oriented training to those who have lost jobs due to coronavirus.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Chitrakar says they are in talks with the ministry as well as other stakeholders like FNCCI, CNI among others to train the workers.</span></span></span></span></p> ', 'published' => true, 'created' => '2020-10-09', 'modified' => '2020-10-09', 'keywords' => '', 'description' => '', 'sortorder' => '12322', 'image' => '20201009123504_1602200733.Clipboard07.jpg', 'article_date' => '2020-10-09 12:34:28', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '12574', 'article_category_id' => '1', 'title' => 'Fixed Interest Rate Not Practical: Bankers’ Association', 'sub_title' => '', 'summary' => 'October 8: Nepal Rastra Bank (NRB) will be clarifying about the fixed interest rates through the quarterly review of monetary policy even though it has allowed the Banks and Financial Institutions (BFIs) to determine the fixed interest rates on personal term loans, including home and auto loan by the end of Ashoj (mid-October).', 'content' => '<h1><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">October 8:<strong><span style="font-size:14.0pt"> </span></strong>Nepal Rastra Bank (NRB) will be clarifying about the fixed interest rates through the quarterly review of monetary policy even though it has allowed the Banks and Financial Institutions (BFIs) to determine the fixed interest rates on personal term loans, including home and auto loan by the end of Ashoj (mid-October).</span></span></span></h1> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">The central bank after adopting a fixed interest rate policy, had directed the BFIs to fix their interest rates on personal loans by mid-October due to the unstable fluctuations on the rates of interest. However, Nepal Bankers' Association had recently suggested Governor Maha Prasad Adhikari that this may not be practical. However, Nepal Rastra Bank has stated that the suggestions could be addressed through the monetary policy of the current fiscal year.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Since the maturity of home loans are up to 25-30 years, the Bankers’ Association believes that it will not be practical to fix the interest rates for such a long term. Anil Sharma, executive director of the Bankers' Association, suggests that it would be better to fix the interest rates on personal loans for only 5 years.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">“Rastra Bank’s directive on fixing the interest rates seems to have made things difficult for the banks. We suggest fixing the interest rates for 5 years at a time instead of fixing it for a very long term,” he told New Business Age, adding, “We are expecting clear arrangements to be made by the central bank in order to make the banks more comfortable.”</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">He firmly believes that fixing the interest rate for a long time may be turn out to be more expensive for the customers.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">According to a source from the Governor's Office, the suggestions received from the Association cannot be addressed immediately. However, it will be brought into discussion during the first quarterly review of the monetary policy. The source added that the complaints and feedbacks received so far will also be included and discussed on the basis of their importance. </span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">“However, the banks will have to continue implementing the directives given by the central bank so far. The central bank will take care of any problems that arises during the implementation,” the source said.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Dr Gunakar Bhatt, the spokesperson of Nepal Rastra Bank, stresses on the need to introduce the fixed interest rates from the month of Kartik (after mid-October). He says that decisions haven’t yet been made on the suggestions received from the association. The central bank came up with the fixed interest rates policy to protect the customers from repetitive increase in the interest rates. However, the implementation of this policy is likely to be weak since the bankers are dissatisfied with the system.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Nepal Rastra Bank had issued the Unified Directive, 2077 on September 8, directing the BFIs to maintain a fixed interest rate on personal term loans that have a repayment period of more than one year. Since the bankers had demanded more time to study the issue before fixing their interest rates, the central bank gave them an extension to implement the fixed interest rate policy till the end of Ashoj (mid-October). The Bankers' Association however, wants a clear arrangement on the policy despite the extension given by Nepal Rastra Bank.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Apart from the fixed interest rate, the association has also drawn the attention towards the central bank's directive on not charging interbank fee in ATMS, priority sector lending limit, liquidity and loan advance payment through their letter.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">According to the association's executive director Sharma, they have also suggested loosening the lending limits on priority sectors such as agriculture, energy, deprived group, and tourism because the banks are not in a position to reach the prescribed limits. The central bank has made it mandatory for banks to disburse 25 percent of their total credit to the priority sector by lending 10 percent to the agriculture sector, 15 percent to the energy and tourism sector and 5 percent to the deprived sector.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">"Banks have not been able to meet the limits set in some priority sectors. The effects of COVID-19 has made things more difficult. This is why we have requested to not make the priority sector lending mandatory," he said.</span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman""><span style="font-size:14.0pt">Similarly, suggestions have also been made to review the loan advance payment fees as this has led to an unhealthy competition between BFIs in the market.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12321', 'image' => '20201008054458_1602114379.Clipboard05.jpg', 'article_date' => '2020-10-08 17:44:18', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '12573', 'article_category_id' => '1', 'title' => 'Government Finalizes Specifications for Electric Buses ', 'sub_title' => '', 'summary' => 'October 8: The Ministry of Physical Infrastructure and Transport has finalized the specifications required for the purchase 300 electric buses. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">October 8: The Ministry of Physical Infrastructure and Transport has finalized the specifications required for the purchase 300 electric buses. Although the budget for the current fiscal year has not allocated any amount under this particular head, the ministry has decided to issue a tender for purchasing the buses.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The government had decided to purchase electric buses for operation in Kathmandu Valley on December 18, 2018. Prior to this, Prime Minister KP Sharma Oli had inaugurated five electric buses that were purchased by the Ministry of Tourism with the financial assistance of Asian Development Bank. The BYD buses that were inaugurated by KP Oli were later stalled due to a dispute. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The government had claimed to operate electric buses in Kathmandu Valley from April 14, 2019 and had allocated budget for this purpose the same year. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">A cabinet decision in June announced that the government-owned Sajha Yatayat would be given Rs 3 billion. However, after three months, a letter was written to Sajha to stop the procurement process, alleging that the bus could not be purchased on time. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The government had decided to hand over the responsibility of purchasing the bus to the ministry by withdrawing the amount given to Sajha in mid-January. However, even after eight months after the decision was made, the ministry has not been able to purchase the bus. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman""> The ministry had formed a committee to finalize the specifications under the leadership of Joint Secretary Pramila Bajracharya. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Shankar Singh Dhami, a member of the committee and chief of the transport management section of the ministry, said that the tender process has already started as the work of finalizing the specifications has been completed. The ministry had decided to open the tender before Dashain. However, the ministry said that the process was postponed after a staff of the ministry tested positive for coronavirus. </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12320', 'image' => '20201008040011_1602111677.Clipboard03.jpg', 'article_date' => '2020-10-08 15:59:39', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '12572', 'article_category_id' => '1', 'title' => 'Fertilizer from Bangladesh to Arrive after at least 2 Months ', 'sub_title' => '', 'summary' => 'October 8: It is estimated that it will take at least another two months for the government of Nepal to bring in 50,000 metric tons of urea from Bangladesh on loan. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">October 8: It is estimated that it will take at least another two months for the government of Nepal to bring in 50,000 metric tons of urea from Bangladesh on loan. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The obligation to complete the procurement process under the Public Procurement Act has been seen as the delaying factor for the arrival of the chemical fertilizer.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">The government-owned Agricultural Inputs Company Limited had announced a tender for the procurement process on September 20 for bringing in urea from Bangladesh. Although five companies had participated in the bidding process, Gentrade FZF, a UAE-based company was awarded the contract for making the lowest bid.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Gentrade has the deadline of next Friday for signing the agreement. The agreement is likely to be signed on Sunday, October 11, the Agricultural Inputs Company Limited informed.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">According to Bishnu Pokhrel, head of the company's procurement division, the Bangladesh government has given permission to bring the fretilizer to Nepal from Chittagong port in Bangladesh. He informed that the contractor company will start transporting the fertilizer to Nepal after the Bangladesh government transports them to Chittagong port and all the fertilizer will reach Nepal within 70 days.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">It is estimated that the first batch of urea will arrive in Nepal within 20 days after the Bangladesh government releases the fertilizer. So far, however, the Bangladesh government has not transported fertilizer to the port. The government of Nepal had sought the fertilizers from Bangladesh on loan after there was an acute shortage of urea in the country during paddy plantation. The government has made a commitment to return the same amount of urea to Bangladesh next year.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12319', 'image' => '20201008021535_1602114711.Clipboard16.jpg', 'article_date' => '2020-10-08 14:14:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 10 => array( 'Article' => array( 'id' => '12571', 'article_category_id' => '1', 'title' => 'World Bank Estimates Nepal's GDP to Grow by 0.2% in 2020', 'sub_title' => '', 'summary' => 'October 8: Nepal’s economy is projected to grow by only 0.6 percent in 2021, inching up from an estimated 0.2 percent in 2020 as lockdowns caused by COVID-19 disrupt economic activity, especially tourism, says the World Bank’s latest South Asia Economic Focus. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">October 8: Nepal’s economy is projected to grow by only 0.6 percent in 2021, inching up from an estimated 0.2 percent in 2020 as lockdowns caused by COVID-19 disrupt economic activity, especially tourism, says </span></span><span style="font-size:14.0pt"><span style="font-family:Arial">the World Bank’s latest South Asia Economic Focus. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"> <span style="font-size:14.0pt"><span style="font-family:Arial">Released on October 8, the twice-a-year-regional update notes that South Asia is set to plunge this year into its worst-ever recession as the devastating impacts of the pandemic on the region’s economies linger on, taking a disproportionate toll on informal workers and pushing millions of South Asians into extreme poverty. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"> <span style="font-size:14.0pt"><span style="font-family:Arial">The report forecasts a sharper than expected economic slump across the region, with regional growth expected to contract by 7.7 percent in 2020, after topping 6 percent annually in the past five years. Regional growth is projected to rebound to 4.5 percent in 2021. Factoring in population growth, however, income-per-capita in the region will remain 6 percent below 2019 estimates, indicating that the expected rebound will not offset the lasting economic damage caused by the pandemic.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"> <span style="font-size:14.0pt"><span style="font-family:Arial">In previous recessions, falling investment and exports led the downturn. This time is different as private consumption, traditionally the backbone of demand in South Asia and a core indicator of economic welfare, will decline by more than 10 percent, further spiking poverty rates. A decline in remittances is also expected to accelerate loss of livelihoods for the poorest in some countries. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial"><img alt="" src="/app/webroot/userfiles/images/faris-hadad-zervos-worldbank-new-director.jpg" style="height:240px; width:320px" /></span></span></span></span></p> <p><span style="font-size:12px"><em><span style="font-family:Cambria"><span style="font-family:Arial">Faris Hadad-Zervos, World Bank’s country director for the Maldives, Nepal and Sri Lanka.</span> </span></em></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">“The economic consequences of the pandemic and impact on livelihoods across Nepal is expected to be the most acute for informal workers or those without social security or assistance, who are more at risk of falling into extreme poverty,” stated Faris Hadad-Zervos, World Bank’s country director for the Maldives, Nepal and Sri Lanka. “Swift action is needed to provide incomes, social protection, and employment to support them. This includes key investment climate reforms to promote physical infrastructure and access to finance for the informal sector to shorten the transition to recovery.”</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt">I</span><span style="font-size:14.0pt"><span style="font-family:Arial">nformal businesses make up around 50 percent of enterprises in Nepal and are the main source of income for most of the labor force, the World Bank stated. Within this group, urban informal sector workers and self-employed households in urban areas are more vulnerable than rural households who can fall back on subsistence farming. Most informal firms operate with limited savings, and owners may face the difficult choice of staying home and facing starvation during the lockdown or running their business and risking infection. These scenarios accentuate financial difficulties as well as the spread of COVID-19.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"> </span></span><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">The report urges governments to design universal social protection as well as policies that support greater productivity, skills development, and human capital. In that effort, securing international and domestic financing will help governments fund crucial programs to speed up recovery. In the long-term, digital technologies can play an essential role in creating new opportunities for informal workers, making South Asia more competitive and better integrated into markets—if countries improve digital access and support workers to take advantage of online platforms. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"> </span></span><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Arial">“COVID-19 will profoundly transform Nepal and the rest of South Asia for years to come and leave lasting scars in its economies. But there is a silver lining toward resilient recovery: the pandemic could spur innovations that improve South Asia’s future participation in global value chains, as its comparative advantage in tech services and niche tourism will likely be in higher demand as the global economy becomes more digital,” said Hans Timmer, World Bank’s chief economist for the South Asia Region.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12318', 'image' => '20201008123642_20200920100437_WORLD-BANK-696x447.jpg', 'article_date' => '2020-10-08 12:34:52', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 11 => array( 'Article' => array( 'id' => '12570', 'article_category_id' => '1', 'title' => 'Government Expands Scope of Investment in Small Projects backed by India', 'sub_title' => '', 'summary' => 'October 8: The government has decided to increase the scope of small projects backed by India’s investment in coordination with the local units.', 'content' => '<p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">October 8: The government has decided to increase the scope of small projects backed by India’s investment in coordination with the local units.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The Indian government has been investing in various small development projects (SDPs) in Nepal ranging from waste management to construction of school buildings in villages.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The Ministry of Federal Affairs and General Administration is the handles all the matters related to SDPs. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">A ministerial-level decision taken by Minister for Federal Affairs and General Administration Hridayesh Tripathi last week decided to change the programmes and expand the scope of SDPs run on investment made by India.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">With the amendment, India can now invest on SDPs including construction of community school buildings, child development centres, libraries, hospitals, health posts, blood collection centres, maternity wards among others.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The scope of SDPs have been increased with the objective of bringing in more investment from India in projects like waste management, drinking water projects, agriculture among others.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">Prior to this, the government had not clearly specified the areas of investment due to which India had been investing in projects at its will, insist officials at the ministry. </span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">After the government clearly identified areas of investment by India, the Indian government will now have to invest in those specific projects in coordination with the local units. The local levels have been given the authority to select the projects and implementing them as well.</span></span></span></span></p> <p><span style="font-size:10pt"><span style="font-family:Times"><span style="font-size:14.0pt"><span style="font-family:"Arial Unicode MS"">The SDPs were initiated in 2003. Initially, the Indian Embassy in Nepal used to be directly involved in the projects. But after the promulgation of the new constitution of Nepal in 2015, a provision was included for the projects to be run in coordination with the local units.</span></span></span></span></p> ', 'published' => true, 'created' => '2020-10-08', 'modified' => '2020-10-08', 'keywords' => '', 'description' => '', 'sortorder' => '12317', 'image' => '20201008120230_1602113759.Clipboard11.jpg', 'article_date' => '2020-10-08 12:01:54', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '12566', 'article_category_id' => '1', 'title' => 'Hong Kong Bars NAC for Two Weeks', 'sub_title' => '', 'summary' => 'October 7: The Civil Aviation Department (CAD) of Hong Kong has postponed the flight of Nepal Airlines Corporation (NAC) for two weeks after the airlines confirmed coronavirus infection among six passengers who traveled to Hong Kong from Nepal on a regular flight.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">October 7: The Civil Aviation Department (CAD) of Hong Kong has postponed the flight of Nepal Airlines Corporation (NAC) for two weeks after the airlines confirmed coronavirus infection among six passengers who traveled to Hong Kong from Nepal on a regular flight. The Covid-19 cases were confirmed on Monday. The passengers arriving in Hong Kong from the NAC’s RA 4099 flight on October 3 from Nepal were infected with coronavirus, the NAC informed.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Archana Khadka, spokesperson of NAC, informed that the PCR report of the passengers was negative in Nepal while testing for Covid-19. However, the same passengers showed positive result during tests in Hong Kong. </span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">Passengers are allowed to enter Hong Kong if the present report taken 72 hours before arrival.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">"From here, we completed all the procedures and sent them as per the health protocol. Only the passengers with PCR negative report have left the country through this airlines. We have learnt that they their report turned out positive in Hong Kong. Therefore, the corporation's flight to Hong Kong has been postponed for two weeks,” informed Spokesperson Khadka.</span></span></span></span></p> <p><span style="font-size:12pt"><span style="font-family:Cambria"><span style="font-size:14.0pt"><span style="font-family:Calibri">According to her, the ban imposed by the Civil Aviation Department (CAD) of Hong Kong from October 4 will be lifted only on October 17. A total of 11 Covid-19 cases were reported in Hong Kong on Monday while six of them were passengers of NAC. One of the passengers is said to be a passenger from India.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2020-10-07', 'modified' => '2020-10-07', 'keywords' => '', 'description' => '', 'sortorder' => '12313', 'image' => '20201007043802_1602027461.Clipboard17.jpg', 'article_date' => '2020-10-07 16:37:26', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '12565', 'article_category_id' => '1', 'title' => 'Central Bank Caps Limit for Distribution of Cash Dividend by BFIs', 'sub_title' => 'BFI can now distribute Cash Dividend up to 30 Percent of Distributable Profit ', 'summary' => 'October 7: Nepal Rastra Bank has capped the maximum limit of cash dividend to be distributed by banks and financial institutions (BFIs) at 30 percent of their profit. ', 'content' => '<p><span style="font-size:18px">October 7: Nepal Rastra Bank has capped the maximum limit of cash dividend to be distributed by banks and financial institutions (BFIs) at 30 percent of their profit. </span></p> <p><span style="font-size:18px">The central bank has clearly stated that the BFIs can distribute cash dividend up to 30 percent of their distributable profit earned in fiscal year 2019/20 irrespective of the capacity to distribute the amount. The central bank made such arrangement by introducing a new work procedure. </span></p> <p><span style="font-size:18px">With the approval of the new work procedure, the earlier provision for distributing cash dividend issued five years ago has effectively come to an end. Meanwhile, the new work procedure has a provision than mandates BFIs with net distributable profit less than 5 percent of the paid-up capital not to distribute cash dividend except for paying taxes. </span></p> <p><span style="font-size:18px">As per the new provision, BFIs have to follow nearly half a dozen rules in order to distribute cash dividend and bonus shares. The central bank has also barred BFIs from distributing cash dividend unless they sell their shares in cross holding. However, this rule will not be applicable for microfinance companies.</span></p> ', 'published' => true, 'created' => '2020-10-07', 'modified' => '2020-10-07', 'keywords' => '', 'description' => '', 'sortorder' => '12312', 'image' => '20201007023010_1602027918.Clipboard03.jpg', 'article_date' => '2020-10-07 14:27:27', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '12564', 'article_category_id' => '1', 'title' => 'Tatopani Customs Closed Again after Workers Test Positive for Covid-19 ', 'sub_title' => '', 'summary' => 'October 7: Tatopani customs, which was reopened on Monday after 80 days, has been closed again from Tuesday (October 6). ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">October 7: Tatopani customs, which was reopened on Monday after 80 days, has been closed again from Tuesday (October 6). </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">According to the chief of Tatopani Customs Office Lal Bahadur Khatri, the Chinese side has been reluctant to send goods via the checkpoint after seven of the 33 workers who went to the border to load and unload the goods tested positive for coronavirus. China did not send the container after three of the infected workers tested positive on Tuesday. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">The report of the workers was negative when tested in Nepal. However, the import was halted on Monday after they tested positive in China. While testing all the drivers and workers in 5/5 days, four of them who were found positive are being treated in isolation at the district headquarters Chautara. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Twelve containers of goods have been imported from China from Sunday evening till Monday morning. In particular, the containers were loaded with clothes, garments materials and some ready-made items. Earlier, the customs office had expected goods to arrive in more than 15 containers daily. The officials were also expecting collection of average revenue of Rs 10 million. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">According to Khatri, 29 people, including drivers and laborers, used to reach the Friendship Bridge with 12 containers to collect the goods stored by China across the Bridge. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri"><span style="font-size:14.0pt"><span style="font-family:"Times New Roman"">Around 800 containers of ready-made garments, clothes, various electronic goods, apples, garlic, onions, cosmetics and toys are stuck in the middle of the road. Chief District Officer of Sindhupalchowk, Umesh Kumar Dhakal informed that discussions have been started on how to bring the closed Tatopani checkpoint into operation. </span></span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2020-10-07', 'modified' => '2020-10-07', 'keywords' => '', 'description' => '', 'sortorder' => '12311', 'image' => '20201007124800_1602028245.Clipboard04.jpg', 'article_date' => '2020-10-07 12:47:28', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117