Private hospitals are not showing commitment to the Kathmandu Metropolitan City (KMC) directive requiring them to run their own…

Private hospitals are not showing commitment to the Kathmandu Metropolitan City (KMC) directive requiring them to run their own…

The Nepal Stock Exchange (NEPSE) Index experienced a decline of 14.83 points, or 0.72%, closing at 2,037.09 points on the first trading day of the week,…

KATHMANDU: The government had announced its plans to complete Nepal's credit rating before the investment summit held in late…

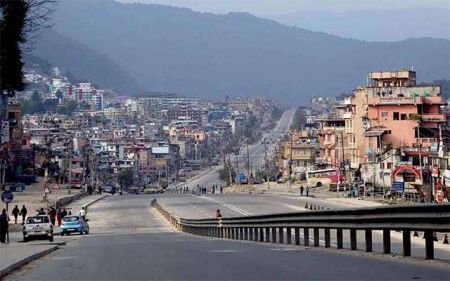

KATHMANDU: The Government of Nepal had signed a Memorandum of Understanding (MOU) in February 2018 with China for the expansion of the Kalanki-Maharajganj-Dhobikhola section of the Ring Road under the second phase of the Kathmandu Ring Road Improvement…

KATHMANDU: The recommendation committee formed for the appointment of the chairman of the Securities Board of Nepal (SEBON) has announced that a new process will be initiated following the cancellation of the previous appointment…

KATHMANDU: This year, the government celebrated the 21st National Paddy Day with the slogan 'Climate-Friendly Agriculture, Increase in Paddy Production.'…

KATHMANDU: The government’s arrears has climbed to over Rs 1183 billion till date, according to the 61st report of the Office of the Auditor General.…

KATHMANDU: Preparations for the 'New Business Women Summit and Awards 2024,' to be organized by New Business Age Pvt Ltd, have been completed.…

VIENNA: A United Nations (UN) report sounded alarm on the worsening world drug problem as the emergence of new synthetic opioids and a record supply and demand of other drugs lead to rising drug use disorders and other…

Every household in Lo-Ghekar Damodarkunda Rural Municipality, Mustang district, has received free e-stoves for cooking. The municipality, in collaboration with the Annapurna Conservation Area Project (ACAP), distributed the e-stoves to mitigate climate change impacts and promote environmental…

Citizens Bank International Limited has provided financial assistance to a school damaged by an earthquake in Bajhang. Under its corporate social responsibility initiative, the bank has donated one lakh rupees for the reconstruction of Bal Bikash Secondary School located in Golai,…

KATHMANDU: The government has been unable to sell foreign employment savings bonds as desired in the current fiscal year.…

KATHMANDU: Despite being part of the capital city, residents of some areas in Kirtipur Municipality are deprived of public transport services to and from the main city of…

KATHMANDU: Nepal Rastra Bank has made arrangement for international payment (cross-border payment) transactions between Nepal and India through the 'Retail Payment Switch'.…

KATHMANDU: Nepal Rastra Bank requires banks and financial institutions to provide loans to micro, cottage, small, and medium enterprises (SMEs).…

Notice (8): Undefined variable: file [APP/View/Elements/side_bar.ctp, line 60]Code Context// $file = 'http://aabhiyan:QUVLg8Wzs2F7G9N7@nepalstock.com.np/api/indexdata.xml';if(!$xml = simplexml_load_file($file)){$viewFile = '/var/www/html/newbusinessage.com/app/View/Elements/side_bar.ctp' $dataForView = array( 'articles' => array( (int) 0 => array( 'Article' => array( [maximum depth reached] ) ), (int) 1 => array( 'Article' => array( [maximum depth reached] ) ), (int) 2 => array( 'Article' => array( [maximum depth reached] ) ), (int) 3 => array( 'Article' => array( [maximum depth reached] ) ), (int) 4 => array( 'Article' => array( [maximum depth reached] ) ), (int) 5 => array( 'Article' => array( [maximum depth reached] ) ), (int) 6 => array( 'Article' => array( [maximum depth reached] ) ), (int) 7 => array( 'Article' => array( [maximum depth reached] ) ), (int) 8 => array( 'Article' => array( [maximum depth reached] ) ), (int) 9 => array( 'Article' => array( [maximum depth reached] ) ), (int) 10 => array( 'Article' => array( [maximum depth reached] ) ), (int) 11 => array( 'Article' => array( [maximum depth reached] ) ), (int) 12 => array( 'Article' => array( [maximum depth reached] ) ), (int) 13 => array( 'Article' => array( [maximum depth reached] ) ), (int) 14 => array( 'Article' => array( [maximum depth reached] ) ) ), 'current_user' => null, 'logged_in' => false ) $articles = array( (int) 0 => array( 'Article' => array( 'id' => '21398', 'article_category_id' => '1', 'title' => 'Private Hospitals Non-Committal About Operating Own Pharmacies: KMC', 'sub_title' => '', 'summary' => 'Private hospitals are not showing commitment to the Kathmandu Metropolitan City (KMC) directive requiring them to run their own pharmacies.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">June 30: Private hospitals are not showing commitment to the Kathmandu Metropolitan City (KMC) directive requiring them to run their own pharmacies.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">On June 5, KMC issued a directive to all 52 private hospitals within its jurisdiction to operate their own pharmacies. However, according to Sajina Maharjan, the Officiating Chief of the KMC Health Department, none of the hospitals have contacted the department to confirm their compliance with the directive.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Some private hospitals have indicated that they plan to start operating their own pharmacies from next Saun (mid-July to mid-August), arguing that the deadline given by KMC was too short.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">KMC believes that having hospitals run their own pharmacies will ensure patients receive appropriate medicines at reasonable prices. This initiative aims to make medicines more affordable for indigent citizens.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Currently, only 16 out of the 52 private hospitals are running their own pharmacies. Additionally, 28 hospitals operate the hospital and pharmacy under different names, while the remaining hospitals do not have an in-house pharmacy at all. </span></span><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">KMC had given a 15-day deadline for the private hospitals to implement the directive. (RSS) </span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21124', 'image' => '20240630052227_collage (21).jpg', 'article_date' => '2024-06-30 17:21:16', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 1 => array( 'Article' => array( 'id' => '21397', 'article_category_id' => '1', 'title' => ' NEPSE Drops by 14.83 Points', 'sub_title' => '', 'summary' => 'The Nepal Stock Exchange (NEPSE) Index experienced a decline of 14.83 points, or 0.72%, closing at 2,037.09 points on the first trading day of the week, Sunday.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">June 30: The Nepal Stock Exchange (NEPSE) Index experienced a decline of 14.83 points, or 0.72%, closing at 2,037.09 points on the first trading day of the week, Sunday. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">The trading day commenced with the index at 2,051.73 points, reaching an intraday high of 2,059.79 points. It then experienced a low of 2,034.50 points before settling at the closing value of 2,037.09 points.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">During today’s trading session, 320 stocks were traded through 50,952 transactions on the NEPSE. A total of 9,178,895 units of shares were exchanged with overall turnover standing at Rs3.60 billion. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Nepal Finance Ltd. (NFS) led the market in terms of turnover, achieving Rs. 12.88 Crores and closing at Rs. 970 per share. The highest gainer today was Muktinath Krishi Company Limited (MKCL), which saw an increase of 7.06%.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">Conversely, Manakamana Smart Laghubitta Bittiya Sanstha Limited (MKLB) faced a significant loss, dropping by 9.30%.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,sans-serif">In terms of sector performance, only two sector indices concluded the day in positive territory. The "Finance Index" recorded the highest sectoral gain of 0.34%, while the "Microfinance Index" saw the highest loss, declining by 1.37%.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21123', 'image' => '20240630034323_collage (20).jpg', 'article_date' => '2024-06-30 15:42:16', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 2 => array( 'Article' => array( 'id' => '21396', 'article_category_id' => '1', 'title' => 'Credit Rating Still Uncertain Two Months after Investment Summit', 'sub_title' => '', 'summary' => 'KATHMANDU: The government had announced its plans to complete Nepal's credit rating before the investment summit held in late April.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: The government had announced its plans to complete Nepal's credit rating before the investment summit held in late April. However, two months after the summit, no significant progress has been made in this regard. The government aims to undertake Nepal's credit rating through the American credit rating company Fitch Ratings, with a grant from the British government.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">A sovereign credit rating is a key indicator of a country's financial health and creditworthiness. It shows how secure a country's government-issued international bonds are, which helps attract international investors and depicts the investment environment. Good foreign investors often consider a sovereign credit rating a prerequisite for investment. However, Nepal has not yet obtained a country credit rating.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Six months ago, a task force led by the Joint Secretary of the Financial Division of the Ministry of Finance was given the responsibility to complete the necessary preparations for the country rating before the investment summit. Although the task force completed the necessary preparations, the rating company has not yet conducted a field visit.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">As the rating company did not visit by the third week of May, the task did not get priority due to the need to prepare the budget. A high-ranking official from the Ministry of Finance stated, "The company has said that they will visit in September."</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to the official, the Ministry of Finance is now working to update the indicators prepared in April. "We have collected the data according to the format requested by the rating company. It won’t be a problem for us to update it," said the official. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">However, since there has been no progress even after the investment summit, finance ministry officials cannot yet confirm when the credit rating process will conclude. "We have been trying for a long time, but the work has not been done," said the official. "However, there is a possibility that the rating work will be completed before Dashain."</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Finance ministry officials indicated that the rating work was delayed due to a lack of clarity on the scope of work between the British Cooperation Agency (Foreign, Commonwealth and Development Office), which provided the grant for this work, and Standard Chartered Bank, which provided technical support.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Once the credit rating is obtained, Nepal will be able to raise resources from the international market by issuing bonds. Nepal has not yet mobilized resources through international bonds. However, the Asian Development Bank and the International Finance Corporation have initiated issuing international bonds in Nepalese currency.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Due to limited domestic resources, there is a need to mobilize foreign resources for the country's infrastructure sector. The country's revenue is only sufficient to cover current expenses, making Nepal highly dependent on internal loans and foreign aid for development expenses.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The government first announced plans for a country rating in the budget of the fiscal year 2076/77. This has also been mentioned in the current year's budget. Due to the lack of a rating, banks have been unable to secure large loans directly, and Nepal has faced challenges in obtaining commercial loans for large infrastructure projects from international development partners.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The government issued a public notice to companies for the sovereign credit rating. Fitch, Moody's, and Standard & Poor's, the world's three major rating companies, applied. Among them, the government entered into an agreement with Fitch Ratings for the credit rating. Standard Chartered Bank has been appointed as a rating consultant for this process.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Previously, due to the COVID-19 pandemic, all economic indicators were negative, and the government halted the process to avoid sending a negative message to the international community. Despite assurances from former Finance Minister Dr. Prakash Sharan Mahat and current Finance Minister Barsha Man Pun that the sovereign credit rating would be completed before the investment summit, government officials claim the delay is due to Fitch Ratings not yet starting the work.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Additionally, the government has announced that the rating work could be included in next year's budget as well. The repeated inclusion in the budget without implementation has raised questions about the government's credibility.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Former Vice Chairman of the National Planning Commission Dr. Pushparaj Kandel commented, "It is unfortunate that the work to be done before the investment summit has not been completed yet. There should be no delay in this." He emphasized that the government should immediately direct Fitch Ratings to complete the work.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21122', 'image' => '20240630025925_20240610014837_20230313041732_1678585862.Clipboard28.jpg', 'article_date' => '2024-06-30 14:58:20', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 3 => array( 'Article' => array( 'id' => '21395', 'article_category_id' => '1', 'title' => 'Ring Road Expansion Stalled: No Progress in Six Years', 'sub_title' => '', 'summary' => 'KATHMANDU: The Government of Nepal had signed a Memorandum of Understanding (MOU) in February 2018 with China for the expansion of the Kalanki-Maharajganj-Dhobikhola section of the Ring Road under the second phase of the Kathmandu Ring Road Improvement Project.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">HIMA BK</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: The Government of Nepal had signed a Memorandum of Understanding (MOU) in February 2018 with China for the expansion of the Kalanki-Maharajganj-Dhobikhola section of the Ring Road under the second phase of the Kathmandu Ring Road Improvement Project. According to the agreement, the road section was supposed to be extended within two years. However, six years later, work on expanding the 11.6 km section of the ring road has not even begun. Meanwhile, the Chinese government has completed and handed over the remaining sections.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Initially, the road expansion was stalled due to obstructions in the Kalanki-Maharajganj-Dhobikhola area. Then, the COVID-19 pandemic further delayed the process. Even though the situation has normalized, the Chinese side has yet to submit the design and detailed project report (DPR) for the expansion of this section to the Government of Nepal.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Due to the prolonged delay, the local government (Kathmandu Metropolitan City) and Members of Parliament (MPs) have started to pressure the government. On May 25, Kathmandu Metropolitan City dumped dust in front of the Department of Roads and the Road Division Office in Kathmandu to protest the delay. The KMC argued that the unfinished road has become extremely dusty, and the dust pollution has severely affected public health.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">On June 12, Nepali Congress MP Pradeep Paudel, along with the support of 10 other MPs, registered a resolution proposal in Parliament for the expansion of the ring road. The proposal emphasized the urgent need to proceed with the construction to minimize the long-term health impacts on the citizens and reduce risks during the rainy season.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Following these incidents, the government sent a letter to the Chinese Embassy in Nepal regarding the expansion of the second section of the ring road. Ramhari Pokharel, Director General of the Department of Roads, informed that the Ministry of Finance had written to the Chinese Embassy, incorporating comments from the Finance Secretary to move forward with the Kalanki-Dhobikhola section expansion.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to Pokharel, both sides are currently revising the draft of the construction-related documents for the implementation of the agreement. The Chinese side was expected to design and create the DPR for the second section from Kalanki to Chabhil, Dhobikhola. However, they have yet to submit the final design and DPR to the government. Government officials have submitted recommendations on the design to the Chinese Embassy, but the DPR is still pending. Pokharel noted that work on the expansion could only begin after China responds with its opinion on the matter.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Despite the memorandum of understanding, the two sides are yet to sign the project implementation agreement' for the extension of this section. Government officials state that work will only start once such an agreement is reached. The Department of Roads has mentioned that most construction obstacles, such as trees and electric poles, have been removed in this section, but some houses near Narayan Gopal Chowk in Maharajganj still need to be cleared.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In the meantime, the department has contracted to build a service lane from Kalanki to Basundhara, keeping the main road built by China intact. Ram Bihari Chowdhury, information officer of the Kathmandu Ring Road Improvement Project, informed that the 3-kilometer service lane has already been completed. However, a house in Narayan Gopal Chowk, which is within the 'right of way,' has not been removed yet. The main road in this section will be expanded to eight lanes, with the rest being ten lanes by adding two lanes to the right and left. Work has started on the service lane.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Former Secretary Arjun Jung Thapa remarked that donor agencies and grant providers often proceed at their convenience. "If we had to build it ourselves, we don't have the resources," said Thapa. He noted that China is committed to providing the grant for the project. Thapa added that Nepal should diplomatically request the Chinese government to speed up the construction.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21121', 'image' => '20240630024801_20210526120707_20200601121121_lockdown.jpg', 'article_date' => '2024-06-30 14:47:21', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 4 => array( 'Article' => array( 'id' => '21394', 'article_category_id' => '1', 'title' => 'New Process to be Initiated for the Appointment of the Chairman of Securities Board', 'sub_title' => '', 'summary' => 'KATHMANDU: The recommendation committee formed for the appointment of the chairman of the Securities Board of Nepal (SEBON) has announced that a new process will be initiated following the cancellation of the previous appointment process.', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: The recommendation committee formed for the appointment of the chairman of the Securities Board of Nepal (SEBON) has announced that a new process will be initiated following the cancellation of the previous appointment process. According to the law, the committee must recommend at least three candidates for the position. However, the committee canceled the process after only two candidates attended the interview. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">A meeting of the committee on June 28 decided to cancel all the procedures that had been carried out since February 28. </span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">"A new process will now be started for the appointment of the SEBON chairman," said a source from the recommendation committee, "But it has not been decided when this process will begin."</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The four-month-long process for filling the vacant post of SEBON chairman, which started on January 5, has been canceled. It appears it will take some time to fill the post as the process will begin again with a call for applications.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The three-member recommendation committee, chaired by Dr Meen Bahadur Shrestha, vice chairman of the National Planning Commission, had collected 19 applications from February 28 to March 13. The committee shortlisted five eligible candidates and conducted interviews.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Out of the five shortlisted candidates, only two participated in the interview. As per the Securities Act and the committee's procedures, recommending only two candidates was not permissible. The first interview was conducted on June 16, with only Santosh Shrestha and Muktinath Shrestha appearing for the interview. The other candidates—Dr Navraj Adhikari, Krishna Bahadur Karki, and Chiranjeevi Chapagai—did not attend the interview. A second interview was scheduled for June 19, but the three absent candidates did not attend that session either.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Before canceling the appointment process, the committee sought legal advice from the Office of the Attorney General. Based on the Attorney General's opinion and the provisions of the Securities Act, the committee decided it was not possible to recommend only two candidates, leading to the cancellation of the process.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to the law, at least three candidates must be recommended for the appointment of the chairman, prompting the recommendation committee to cancel the process after only two candidates participated in the interview.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21120', 'image' => '20240630022020_20240617124545_Sebon-update.jpg', 'article_date' => '2024-06-30 14:19:44', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 5 => array( 'Article' => array( 'id' => '21393', 'article_category_id' => '1', 'title' => 'More-than-Average Rainfall Raises Hopes and Concerns for Increase in Paddy Production', 'sub_title' => '', 'summary' => 'KATHMANDU: This year, the government celebrated the 21st National Paddy Day with the slogan 'Climate-Friendly Agriculture, Increase in Paddy Production.' ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">PRASHANT KHADKA</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: This year, the government celebrated the 21st National Paddy Day with the slogan 'Climate-Friendly Agriculture, Increase in Paddy Production.' However, it seems the government has not made sufficient preparations to develop a climate-friendly agricultural system and minimize the impacts of climate fluctuations on crops.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The Department of Hydrology and Meteorology estimated that Nepal will receive 35 to 55 percent more rain than average this year due to the 'La Nina' system developing in the Pacific Ocean, which is associated with above-average rainfall. The South Asian Climate Outlook Forum, a government mechanism of South Asian countries, announced that not only Nepal but all of South Asia will receive more than average rainfall this year.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Government officials expect rice production to increase due to the additional rains. However, due to the lack of irrigation facilities, many paddy farmers still rely on annual rainfall for paddy plantation. Experts also warn that floods and landslides could damage rice crops if there is excessive rain.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Hydrologist Madhukar Upadhyay notes that the current monsoon system is likely to bring more rain to some areas and none to others. He opines that since there will be excessive rainfall for a short period in places where rains, the possibility of crop destruction will increase. He said, “Currently, it is flooding in the Koshi region, but there is not much rain in the Bagmati and Terai regions. This kind of rain helps in planting rice but destroys it later rather than increasing production.”</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The government has emphasized the production and import of seeds that are resilient to excessive rain. However, there is a lack of focus on controlling soil erosion, floods, and landslides caused by climate change. Upadhyay questioned, “What good is focusing only on seeds if our plantation is washed away by floods and landslides?”</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The government has repeatedly failed to manage disasters caused by climate change, resulting in significant losses for farmers. In October 2021, unseasonal rainfall destroyed paddy fields, causing farmers across the country to bear losses of more than Rs 7 billion. Similarly, in 2020, locusts entered Nepal from India due to southerly winds, causing extensive crop damage, a phenomenon experts attribute to climate change.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Agricultural expert Chabi Poudel also noted the potential increase in rice production due to higher rainfall this year. However, he cautioned that if it rains excessively during rice planting, it could cause significant losses. Poudel criticized the government for only emphasizing fertilizers, irrigation management, and advanced seed production to increase rice production. Experts have been identifying excessive rain, unseasonal rain, and severe drought as effects of climate change.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">According to the Country Climate and Development Report issued by the World Bank in 2022, Nepal's arable land is at risk of severe drought due to climate change. This will decrease production, increase food costs, and affect rural livelihoods. The report predicts that Nepal's GDP will decrease by 0.8 percent by 2030 due to the impact of climate change on crop production.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Rice is Nepal's most important crop, contributing 5 percent to the country's GDP. The agricultural sector's contribution to the total GDP is 15 percent. If rice cultivation is affected by climate change, the contribution of the entire agricultural sector to the GDP may decrease. According to the Ministry of Agriculture and Livestock Development, paddy cultivation is done on 1.3 million to 1.4 million hectares of land in Nepal. The ministry reports that over the last 42 years, per capita rice consumption in Nepal has nearly doubled from 74 kg to 138 kg per year.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">With the onset of the monsoon, paddy planting began across the country. As of June 26, data from the Centre for Crop Development and Agro Biodiversity Conservation shows that 9.8 percent of rice planting has been completed, compared to 8.75 percent by June 24 last year. The most paddy has been planted in Bagmati, Karnali, and Sudurpaschim provinces. In Sudurpaschim, 25 percent of paddy planting has been completed while the figure is 23.9 percent in Karnali, and 18.3 percent in Bagmati.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Paddy cultivation is done on 175,176 hectares in Sudurpaschim, with 43,634 hectares planted so far. In Karnali, paddy is cultivated on 41,904 hectares of land, with 10,000 hectares planted so far. In Bagmati, out of 112,273 hectares, 20,550 hectares have been planted this year.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">It is estimated that rice cultivation will be done on a total of 1,398,836 hectares in Nepal this year. So far, planting has been completed on 136,411 hectares. Deputy Director General of the Department of Agriculture Arun Kafle noted that the dry spell in Lumbini, Gandaki, and Madhesh provinces delayed planting. Despite the early onset of the monsoon in Koshi province, planting has been delayed there.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Last year, rice was cultivated on 1,438,989 hectares of land. Kafle stated that the area of paddy plantation might decrease this year due to current rain conditions and other factors. However, he added, “Since paddy planting will be done by July 14, the planting area might be somewhat different compared to the current estimates.”</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21119', 'image' => '20240630012648_20240126015111_paddyyy-transformed.jpeg', 'article_date' => '2024-06-30 13:26:09', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 6 => array( 'Article' => array( 'id' => '21392', 'article_category_id' => '1', 'title' => 'Government’s Arrears Rise to Rs 1183 Billion: OAG', 'sub_title' => 'Rising Arrears A Cause for Concern: Speaker Ghimire ', 'summary' => 'KATHMANDU: The government’s arrears has climbed to over Rs 1183 billion till date, according to the 61st report of the Office of the Auditor General. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">KATHMANDU: The government’s arrears has climbed to over Rs 1183 billion till date, according to the 61st report of the Office of the Auditor General. The report is based on the audit of all three-tier governments as of the fiscal year 2022/23.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif""> Speaker of the House of Representatives Devraj Ghimire said that increasing arrears in the public offices was a cause for concern. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Speaking at the 66th anniversary of the Office of the Auditor General on Saturday, Speaker Ghimire asserted that the responsible authorities in the public agencies should take seriously the issue of increasing arrears. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Calling for promptness to clear arrears, Ghimire urged the concerned authorities to implement the recommendations in the report of the Office of the Auditor General, thereby reducing the arrears and maintaining financial discipline and accountability. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He commented that the account committee's performance at local level was not satisfactory. He emphasized that the concerned authority and accounting heads at public offices should realize their responsibilities to prevent arrears from occurring at the first place and secondly, to expedite clearance of arrears persisting as of now. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">The Speaker also requested the Office of Auditor General to fulfill its responsibilities as stipulated in the constitution of our country. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">Similarly, Rishikesh Pokharel, chairman of the Public Accounts Committee under the federal parliament, urged that the Office of Attorney General to proceed with its work in maintaining fiscal discipline and good-governance more effectively. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He argued that we could achieve effective results by considering change in our working style. Pokharel advocated for the autonomy of the Office of Auditor General in accordance with the federal set-up. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He rued that deliberation on the report of the Office of the Auditor General could not be held in the parliamentary committees for a long time. According to Pokharel, at present deliberation is underway on the 60th report of the OAG in the Public Account Committee. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">He demanded punishment for those employees in the public offices who perpetuate arrears. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Likewise, Auditor General Toyam Raya pledged to make audit system more refined and effective. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">According to him, the parliamentary committees and parliaments could play significant role in addressing the problems pointed out by his office's report. The auditing was carried out in compliance with the law and considering factors such as competence, effectiveness and relevance among others, he shared. -- RSS </span></span></span></p> <p> </p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21118', 'image' => '20240630124152_20240130023638_oag-building.jpg', 'article_date' => '2024-06-30 12:40:51', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 7 => array( 'Article' => array( 'id' => '21390', 'article_category_id' => '1', 'title' => 'Preparations for the Newbiz Business Women Summit and Awards 2024 Completed', 'sub_title' => '', 'summary' => 'KATHMANDU: Preparations for the 'New Business Women Summit and Awards 2024,' to be organized by New Business Age Pvt Ltd, have been completed. ', 'content' => '<p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: Preparations for the 'New Business Women Summit and Awards 2024,' to be organized by New Business Age Pvt Ltd, have been completed. New Business Age has been organising this annual event since 2021 to encourage women entrepreneurs and recognize their contributions.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">In the run-up to the event scheduled to be held in Kathmandu this Friday, New Business Age conducted training sessions on financial literacy and women entrepreneurship in Butwal and Nepalgunj. The main theme of this year's event is "Empowering Business Leadership of Nepali Women". The event will feature interactions between stakeholders focusing on this topic.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">This year, 12 women entrepreneurs will be honored and awarded in six different categories. One woman entrepreneur from each of the seven provinces will receive a cash prize as an 'Emerging Entrepreneurial Woman.'</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">Additionally, awards will be given to the best social entrepreneur, best female entrepreneur, best businesswoman, and best woman in the technology sector. A Lifetime Achievement Award will also be presented to a woman entrepreneur who has significantly contributed to women's entrepreneurship over a long period.</span></span></p> <p><span style="font-size:12pt"><span style="font-family:"Times New Roman","serif"">The event is supported by Standard Chartered Bank Nepal, IME Life Insurance, Salt Trading Corporation, Dove, Kajaria, Citizen Life Insurance, Himalaya Airlines, NLG Insurance Company, Mahalakshmi Bikas Bank, Krishi Bikas Bank, Reliable Nepal Life Insurance, Muktinath Bikas Bank, and Space Four.</span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21116', 'image' => '20240630113248_Untitled.jpg', 'article_date' => '2024-06-30 11:32:17', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 8 => array( 'Article' => array( 'id' => '21389', 'article_category_id' => '1', 'title' => 'UN Report Warns of Worsening Global Drug Problem ', 'sub_title' => '', 'summary' => 'VIENNA: A United Nations (UN) report sounded alarm on the worsening world drug problem as the emergence of new synthetic opioids and a record supply and demand of other drugs lead to rising drug use disorders and other harms. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-family:"Arial Unicode MS","sans-serif"">VIENNA:</span> <span style="font-family:"Arial Unicode MS","sans-serif"">A United Nations (UN) report sounded alarm on the worsening world drug problem as the emergence of new synthetic opioids and a record supply and demand of other drugs lead to rising drug use disorders and other harms. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">A total of 292 million people worldwide used drugs in 2022, an increase of 20 percent over the previous decade, according to the World Drug Report 2024 published recently by the UN Office on Drugs and Crime (UNODC). </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif"">Cannabis remained the most widely used drug, with about 228 million users across the world in 2022, followed by opioids, amphetamines, cocaine, and ecstasy, the report said, adding that while an estimated 64 million people worldwide suffer from drug use disorders, only around 9 percent of them is in treatment. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> The report warned of a prolonged surge in cocaine supply and demand. A record-smashing 2,757 tons of cocaine was produced worldwide in 2022, up 20 percent over the previous year, while the global cultivation area of coca bush rose 12 percent year on year to reach 355,000 hectares in 2022. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> The report said the surging cocaine production and demand "has coincided with a rise in violence in states along the supply chain, notably in Ecuador and Caribbean countries, and an increase in health harms in countries of destination, including in Western and Central Europe." </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> Noting that Canada, Uruguay, and 27 jurisdictions in the United States had legalized the production and sale of cannabis for non-medical use as of January 2024, the UNODC annual report also sounded alarm on the adverse impacts of cannabis legalization. The process "appears to have accelerated harmful use of the drug and led to a diversification in cannabis products," the report said. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> In Canada and the United States, hospitalizations related to cannabis use disorders and the proportion of people with psychiatric disorders and attempted suicide associated with regular cannabis use have increased, especially among young adults, according to the report. </span><br /> <span style="font-family:"Arial Unicode MS","sans-serif""> "Drug production, trafficking, and use continue to exacerbate instability and inequality, while causing untold harm to people's health, safety and well-being," UNODC executive director Ghada Waly said in a statement, calling for providing evidence-based treatment and support to people affected by drug use, targeting the illicit drug market and investing more in prevention. – Xinhua/RSS</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21115', 'image' => '20240630104537_skynews-cannabis-germany_6466664.jpg', 'article_date' => '2024-06-30 10:45:02', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 9 => array( 'Article' => array( 'id' => '21388', 'article_category_id' => '1', 'title' => 'All Households in Lo-Ghekar Damodarkunda Receive Free E-Stoves', 'sub_title' => '', 'summary' => 'Every household in Lo-Ghekar Damodarkunda Rural Municipality, Mustang district, has received free e-stoves for cooking. The municipality, in collaboration with the Annapurna Conservation Area Project (ACAP), distributed the e-stoves to mitigate climate change impacts and promote environmental conservation.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">June 30: Every household in Lo-Ghekar Damodarkunda Rural Municipality, Mustang district, has received free e-stoves for cooking. </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The municipality, in collaboration with the Annapurna Conservation Area Project (ACAP), distributed the e-stoves to mitigate climate change impacts and promote environmental conservation.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif""> The initiative is aimed at reducing the consumption of firewood and LP gas. </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Rural Municipality Chairman Raju Bista handed over the e-stoves to all 454 households across the municipality's five wards. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Bista emphasized the environmental degradation caused by using firewood in the arid Upper Mustang region, highlighting the e-stoves as a sustainable alternative.</span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif""> </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">"The introduction of e-stoves is a step towards reducing carbon emissions and lowering the reliance on imported cooking gas," Bista said.</span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The rural municipality allocated Rs 800,000, while ACAP contributed Rs 900,000 for the e-stove distribution in the current fiscal year. People's representatives and ACAP officials visited all wards this week to distribute the stoves. (RSS) </span></span></p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21114', 'image' => '20240630080510_collage (45).jpg', 'article_date' => '2024-06-30 08:03:28', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 10 => array( 'Article' => array( 'id' => '21387', 'article_category_id' => '1', 'title' => 'Citizens Bank Funds School Reconstruction', 'sub_title' => '', 'summary' => 'Citizens Bank International Limited has provided financial assistance to a school damaged by an earthquake in Bajhang. Under its corporate social responsibility initiative, the bank has donated one lakh rupees for the reconstruction of Bal Bikash Secondary School located in Golai, Bajhang.', 'content' => '<p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">June 30: Citizens Bank International Limited has provided financial assistance to a school damaged by an earthquake in Bajhang. </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">Under its corporate social responsibility initiative, the bank has donated one lakh rupees for the reconstruction of Bal Bikash Secondary School located in Golai, Bajhang. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The earthquake that struck last October had damaged the school's classrooms, affecting the teaching and learning process. </span></span><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">In a statement, the bank stated that the assistance will make teaching and learning more convenient. Approximately 300 students currently studying at the school, which offers classes from grades 1 to 12. </span></span></p> <p><span style="font-size:20px"><span style="font-family:Calibri,"sans-serif"">The bank has been offering banking services to 1,759,000 customers through its 192 branches, 155 ATMs, and 98 branchless banking units spread across the country. </span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-30', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21113', 'image' => '20240630073910_collage (44).jpg', 'article_date' => '2024-06-30 07:37:50', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '42' ) ), (int) 11 => array( 'Article' => array( 'id' => '21386', 'article_category_id' => '1', 'title' => 'Sale of Foreign Employment Savings Bonds Remains Very Low', 'sub_title' => '', 'summary' => 'KATHMANDU: The government has been unable to sell foreign employment savings bonds as desired in the current fiscal year. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">KATHMANDU: The government has been unable to sell foreign employment savings bonds as desired in the current fiscal year. The Public Debt Management Office called for the purchase of savings bonds worth Rs 1 billion, but bonds worth only Rs 51.6 million have been purchased.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"Foreign employment savings bonds worth only 51.6 million were purchased," said Dilaram Giri, the information officer of the Public Debt Management Office. "The trend of selling such savings bonds below the target has persisted for a long time. We were hopeful that allowing online purchases would increase the sales, but that did not happen as expected." The deadline for buying savings bonds was extended until June 25. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The government has been issuing 'Foreign Employment Savings Bonds' for nearly a decade and a half with the plan to invest the income of Nepalese employed abroad in the productive sector. However, every year, the sales fall short of the target.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The Public Debt Management Office issued a notification on May 2, calling for the purchase of Rs 1 billion in savings bonds. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">The notice mentions that the target group can purchase a minimum savings bond worth Rs 10,000 from May 5 to June 4. The notice further mentions the annual interest rate on the savings bond with a maturity period of five years will be 9 percent. </span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Giri stated that Nepali people living in more than two dozen countries bought the latest foreign employment savings bonds. "The largest number of buyers are Nepalis in Qatar," he said. "Nepalese in countries like Uganda and the Czech Republic have also purchased the bond."</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">Due to previous underperformance, the government has been reducing the size of these savings bonds over the past few years. Last fiscal year, Nepali citizens working abroad bought only Rs 26.3 million worth of foreign employment savings bonds out of a targeted Rs 1.47 billion. Previously, the central bank used to raise internal debt for the government, but since last March, the Public Debt Management Office has taken on this role.</span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:14.0pt">"It is not clear why people are reluctant to buy these savings bonds, but it seems to be due to a lack of awareness," Giri said. The government started collecting loans through savings bonds from FY 2066/67. According to Nepal Rastra Bank’s data, only 4.9 percent (equivalent to Rs 762.3 million) of savings bonds were sold out of Rs 15.56 billion targeted through 25 schemes till last year.</span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-28', 'modified' => '2024-06-28', 'keywords' => '', 'description' => '', 'sortorder' => '21112', 'image' => '20240628021906_20240503021028_20240117124624_20210730071603_20200327032654_5003_finance-ministy.jpg', 'article_date' => '2024-06-28 14:18:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 12 => array( 'Article' => array( 'id' => '21385', 'article_category_id' => '1', 'title' => 'Capital’s Kirtipur Lacks Public Transport Service!', 'sub_title' => '', 'summary' => 'KATHMANDU: Despite being part of the capital city, residents of some areas in Kirtipur Municipality are deprived of public transport services to and from the main city of Kathmandu.', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: Despite being part of the capital city, residents of some areas in Kirtipur Municipality are deprived of public transport services to and from the main city of Kathmandu. Locals of Pandechap, Langol, Inchugaon, Jakha, and Rarahil of Kirtipur Municipality have faced transportation woes for three years due to the absence of public transport on the Kirtipur-Ratnapark route.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Up until three years ago, Baghbhairav Transport Pvt Ltd operated 10 buses on this route, making it easier for residents to travel. However, the company stopped the service about three years ago due to a low number of passengers and the poor condition of roads. When other companies did not step in to provide transport services on this route, local residents were forced to endure difficulty to commute.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Even in the capital, we have to walk for half an hour to 45 minutes to reach Kirtipur market or Panga bus park to board public vehicle. Not everyone has a personal vehicle," said Radhikadevi Basnet, a local resident.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Krishna Koju, president of Baghbhairav Transport, mentioned that the service was suspended due to damaged roads but now that the roads have improved, they are preparing to resume the bus service on that route.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">While some areas of Kirtipur lack public transport services, those areas that do have transport services suffer from poor quality. The trend of using small buses and microbuses has caused problems for regular public transport users. Bandana Bhandari, who lives on rent in Kirtipur, recounted her daily hardships and mistreatment while using public transport to commute to work.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Especially in small buses, it feels like the driver and co-driver punish passengers by overcrowding," she said. "Traveling on public transport is particularly difficult for women with children." Local residents complain that public transport on the Kirtipur-Ratnapark route is especially problematic.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Stakeholders argue that a syndicate of operators running small buses prevents larger buses from operating on the route. Until 2-3 years ago, 15 buses with 40 seats operated on route number 21 from Kirtipur via Balkhu to Ratnapark. Now, only three such buses remain in service. Organizers of Kipu Bus Service claim that larger buses are more comfortable and attract more passengers, but a syndicate led by Baghbhairav Transport blocks their operation.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">An anonymous operator of Kipu Bus Service stated, "Baghbhairav Transport Pvt. Ltd. does not allow big (40-seat capacity) vehicles to ply on route number 21 of Kirtipur." They allege that Baghbhairav creates obstacles due to fears that their business would be affected by the competition from larger buses. Despite the government's ban on transport syndicates in 2075, the practice persists.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Baghbhairav Transport operates 130 vehicles daily from Panga Dobato, Panga Bus Park, and Machhegaon Bus Park on the Kirtipur-Ratnapark route. This includes 80 microbuses with 15-seat capacity and 50 minibuses with 25-seat capacity. Only three 40-seat capacity buses are in service, forcing people to rely on Baghbhairav's smaller vehicles. Koju claims that while larger buses take longer to fill and depart, their microbuses offer quicker service.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Students in Kirtipur have their own complaints about the public transport service. They claim that the student ID card discount is not honored at night. Thousands of students in Kirtipur face trouble because public transport on Route No. 21 does not offer student discounts after 8 pm. Nirak Rawal, an MA student at Tribhuvan University, reported that drivers often refuse the discount after 8 pm, saying it isn't feasible to offer discounts when the buses run empty from Kirtipur to Ratnapark in the evening.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-28', 'modified' => '2024-06-30', 'keywords' => '', 'description' => '', 'sortorder' => '21111', 'image' => '20240630103311_e5067a37.jpg', 'article_date' => '2024-06-28 14:17:36', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => false, 'user_id' => '34' ) ), (int) 13 => array( 'Article' => array( 'id' => '21384', 'article_category_id' => '1', 'title' => 'Cross-Border Payments through 'Retail Payment Switch'', 'sub_title' => '', 'summary' => 'KATHMANDU: Nepal Rastra Bank has made arrangement for international payment (cross-border payment) transactions between Nepal and India through the 'Retail Payment Switch'. ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: Nepal Rastra Bank has made arrangement for international payment (cross-border payment) transactions between Nepal and India through the 'Retail Payment Switch'. By revising Integrated Circular 2080 on Thursday, the central bank has arranged that remittances can be sent from Nepal to India and vice versa online, and tourists can pay for goods and services in Nepal through QR code.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Last March, the central bank had issued a directive making the use of the National Payment Switch mandatory for international payments. Amending the directive, the central bank has now allowed the Retail Payment Switch to be used until the National Payment Switch is fully operational. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The National Payment Switch allows both card and cardless transactions while only cardless transactions can be conducted through the Retail Payment Switch. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Although the government's National Payment Switch was launched in November 2078, it has not been fully operational. Currently, only wallet companies are using it for business transactions.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the NRB’s instructions, Indian citizens working in Nepal can deposit money in accounts opened in Indian banks and financial institutions through e-banking, interbank payment, mobile banking, and QR codes. A limit of Rs 15,000 per day and Rs 100,000 per month has been set for such transactions. Additionally, there is a provision that remittances can be sent from India through QR codes to accounts opened in Nepali banks and financial institutions.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">During the visit of Prime Minister Pushpa Kamal Dahal to India in May last year, an agreement was reached between Nepal and India to start the cross-border payment service. An agreement was made between Nepal Clearing House Limited (NCHL) and NIPL, the international branch of the National Payments Corporation of India (NPCI).</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In August, NIPL also entered into an agreement with Nepal's private sector payment service provider, PhonePay, for the operation of the cross-border payment service. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">NIPL also signed agreements with other private companies at the Global Fintech Fest-2023, in the presence of Nepal Rastra Bank Governor Maha Prasad Adhikari. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">In February, an agreement was reached between the United Payment Interface (UPI), which operates as a payment switch in India, and the National Payment Interface (NPI), which operates as a payment switch in Nepal, to establish a bilateral regulatory mechanism. However, it has not yet started. The central bank has approved payment service providers NCHL and PhonePay to operate the cross-border payment service.</span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-28', 'modified' => '2024-06-28', 'keywords' => '', 'description' => '', 'sortorder' => '21110', 'image' => '20240628021600_1642611123.Electronic-Payment-1-1.jpg', 'article_date' => '2024-06-28 14:15:29', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ), (int) 14 => array( 'Article' => array( 'id' => '21383', 'article_category_id' => '1', 'title' => 'Banks Struggling to Invest in Small and Medium Enterprises', 'sub_title' => '', 'summary' => 'KATHMANDU: Nepal Rastra Bank requires banks and financial institutions to provide loans to micro, cottage, small, and medium enterprises (SMEs). ', 'content' => '<p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">KATHMANDU: Nepal Rastra Bank requires banks and financial institutions to provide loans to micro, cottage, small, and medium enterprises (SMEs). Although commercial banks have arranged to transfer 11 percent of their total loans to SMEs by the end of the current fiscal year (FY), more than a dozen banks are unable to meet the specified limit.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">According to the data of the central bank, commercial banks have invested an average of 9.43 percent of loans in SMEs as of mid-April 2024. While the average investment is higher due to government banks providing more loans in this area, 13 commercial banks have invested less than 10 percent in the segment. Government-owned Rastriya Banijya Bank, Agriculture Development Bank, and Nepal Bank Limited, as well as Kumari Bank, Citizens Bank, and NIC Asia Bank, have invested more than the stipulated amount in SMEs.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Nepal Rashtra Bank, through its monetary policy for the year </span></span><span style="font-size:13.5pt"><span style="font-family:"Arial","sans-serif"">2019/20</span></span><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">, mandated commercial banks to invest at least 15 percent of their total loans in SMEs. Even after five years of this mandatory regulation, the investment situation remains weak.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Sunil KC, president of the Nepal Bankers Association, stated that due to the COVID-19 pandemic and the resulting economic slowdown, banks have been unable to invest in micro, cottage, small, and medium enterprises as specified. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Small and medium industries have been affected the most by the COVID-19 pandemic and economic recession," he said. "Therefore, we have not been able to invest as prescribed by the central bank, and the deadline should be extended."</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">The central bank initially set a schedule to increase the investment rate to 11 percent by mid-July 2021, 12 percent by mid-July 2022, 14 percent by mid-July 2023, and 15 percent by mid-July 2024. As banks have been unable to meet these targets, the central bank has extended the deadline. According to the provisions of the Unified Directive 2080, banks must extend 11 percent loans to SMEs by mid-July 2024, 12 percent by June 2025, 14 percent by June 2026, and 15 percent by June 2027. Despite the extended deadlines, banks are still struggling to meet the investment targets.</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">There is a provision that banks can count loans up to ten million rupees and investments made directly to the underprivileged under this segment. Banks can set the interest rate by adding a maximum of 2 percent premium to their base rate for such loans. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Umesh Prasad Singh, president of the Nepal Cottage and Small Industries Federation, stated that banks are not interested in lending to small entrepreneurs. "Banks welcome big borrowers with a red carpet," he said. "Cottage and small entrepreneurs are not their priority."</span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">Officials from the central bank indicated that banks failing to invest as specified would be penalized according to the law. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"To ensure that the bank loans are invested in the productive sector, we have instructed them to prioritize these areas," said Nepal Rastra Bank’s spokesperson Dr Gunakar Bhatt. </span></span></span></span></p> <p><span style="font-size:11pt"><span style="font-family:Calibri,"sans-serif""><span style="font-size:12.0pt"><span style="font-family:"Times New Roman","serif"">"Banks that are unable to deliver the investment will be dealt with according to the rules." </span></span></span></span></p> <p> </p> ', 'published' => true, 'created' => '2024-06-28', 'modified' => '2024-06-28', 'keywords' => '', 'description' => '', 'sortorder' => '21109', 'image' => '20240628014215_20240109035705_Banks - Copy.jpg', 'article_date' => '2024-06-28 13:41:38', 'homepage' => false, 'breaking_news' => false, 'main_news' => true, 'in_scroller' => null, 'user_id' => '34' ) ) ) $current_user = null $logged_in = falseinclude - APP/View/Elements/side_bar.ctp, line 60 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::_renderElement() - CORE/Cake/View/View.php, line 1224 View::element() - CORE/Cake/View/View.php, line 418 include - APP/View/Articles/index.ctp, line 157 View::_evaluate() - CORE/Cake/View/View.php, line 971 View::_render() - CORE/Cake/View/View.php, line 933 View::render() - CORE/Cake/View/View.php, line 473 Controller::render() - CORE/Cake/Controller/Controller.php, line 968 Dispatcher::_invoke() - CORE/Cake/Routing/Dispatcher.php, line 200 Dispatcher::dispatch() - CORE/Cake/Routing/Dispatcher.php, line 167 [main] - APP/webroot/index.php, line 117